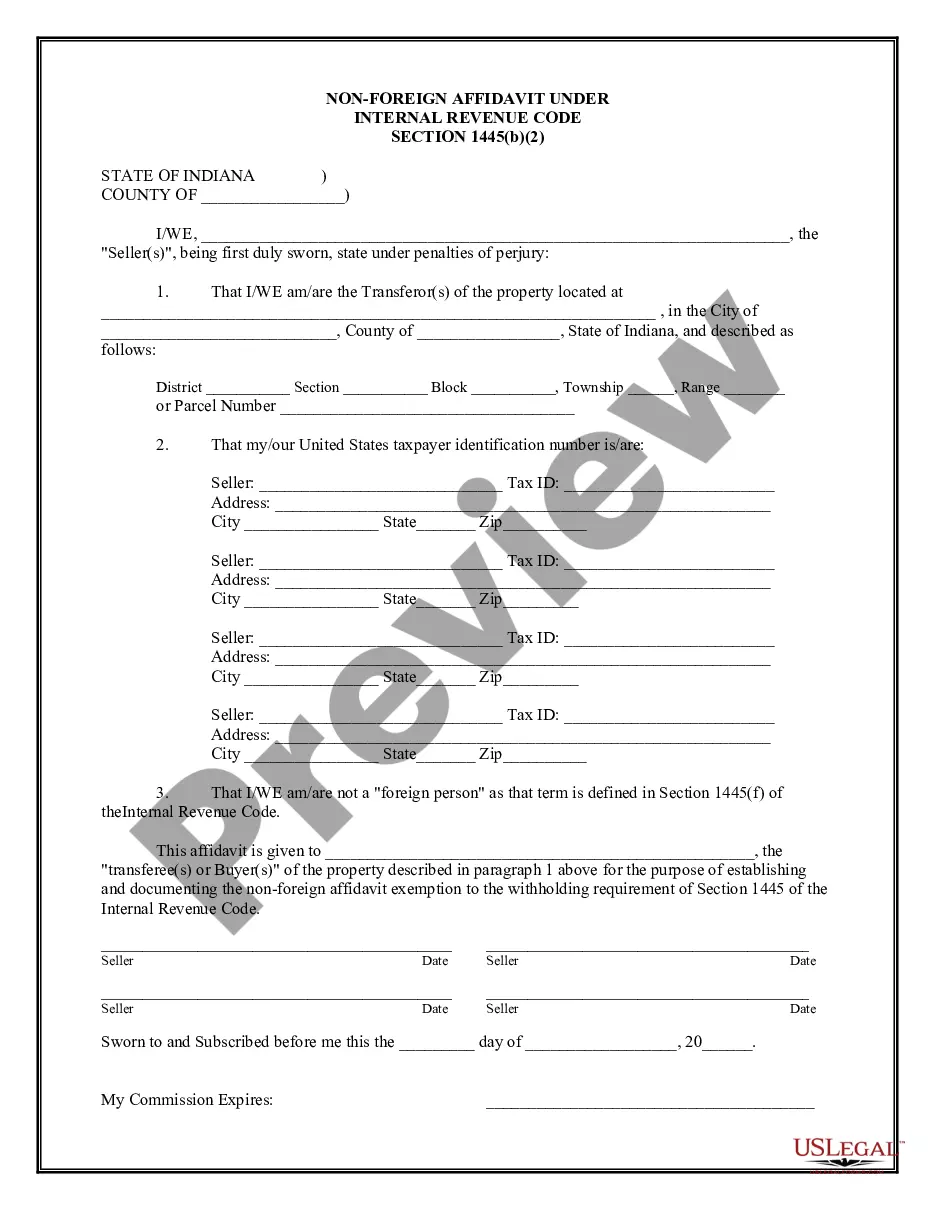

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Indiana Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Indiana Non-Foreign Affidavit Under IRC 1445?

Searching for Indiana Non-Foreign Affidavit Under IRC 1445 forms and completing them may pose a challenge. To minimize time, expenses, and effort, utilize US Legal Forms to locate the appropriate template tailored for your state with just a few clicks. Our legal experts prepare every document, so all you have to do is fill them in. It’s truly that simple.

Log in to your account, revisit the form's webpage, and download the sample. All your downloaded templates are stored in My documents and are available anytime for future use. If you haven’t subscribed yet, registration is required.

Review our comprehensive instructions on how to obtain your Indiana Non-Foreign Affidavit Under IRC 1445 form in just a few minutes.

You can print the Indiana Non-Foreign Affidavit Under IRC 1445 template or complete it using any online editor. There’s no need to be concerned about errors, as your template can be used and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To acquire an authentic example, verify its legitimacy for your state.

- Examine the form using the Preview option (if it’s available).

- If there is a description, read it to grasp the details.

- Click on the Buy Now button if you discover what you need.

- Select your plan on the pricing page and set up an account.

- Indicate whether you wish to pay by credit card or PayPal.

- Download the document in your preferred file format.

Form popularity

FAQ

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

FIRPTA Certificate: Certification of Non-Foreign Status - FIRPTA is the Foreign Investment in Real Property Act and Form 8288. It was developed to ensure that foreign sellers of U.S. property be subject to U.S. tax on the sale.

A withholding certificate is an application for a reduced withholding based on the gain of a sale instead of the selling price. If 15% of the selling price is more than the tax you will owe on this sale, then a withholding certificate may be ideal for you.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.