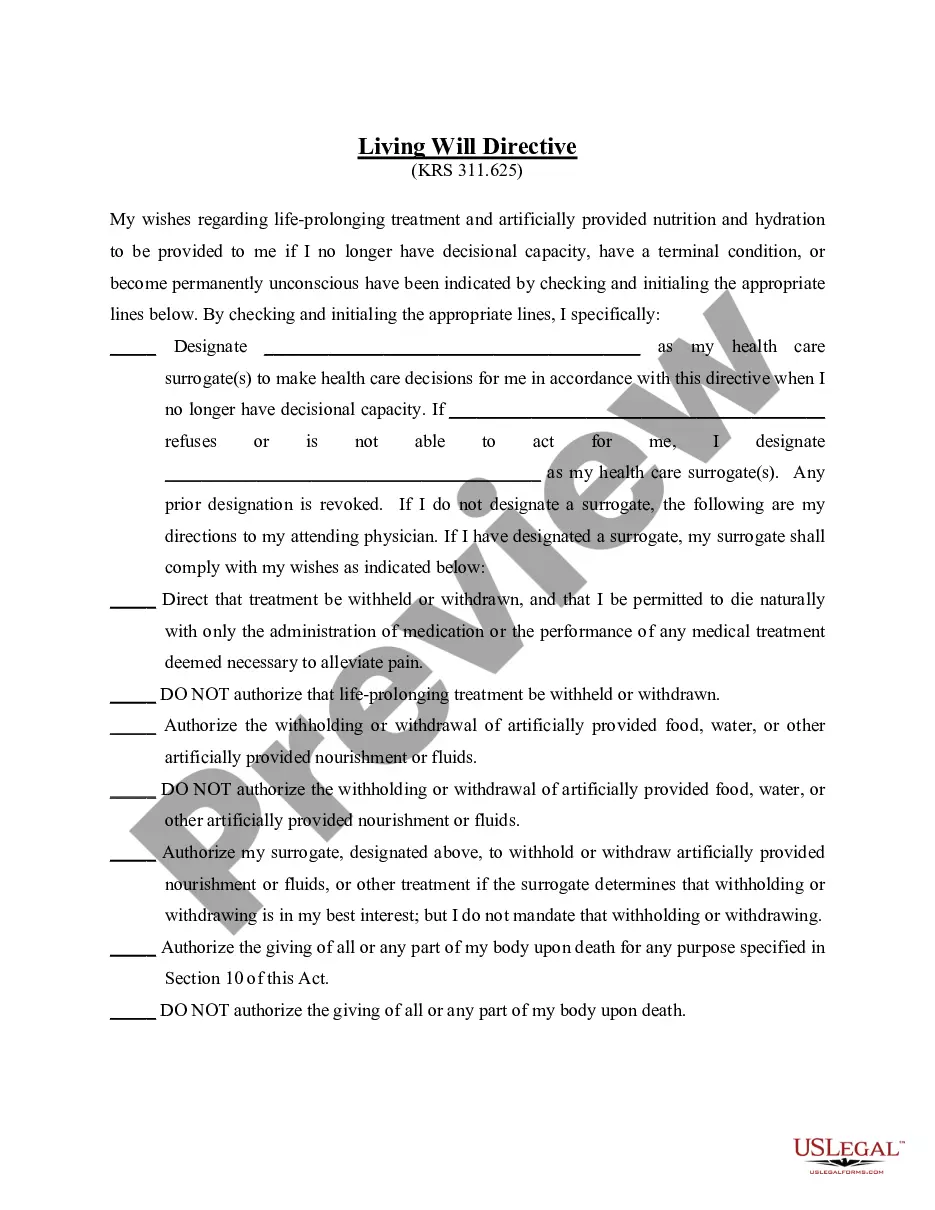

Indiana Individual Chapter 11 Discharge is a court order that releases a debtor from all of their dischargeable debts they owe. It is a form of bankruptcy that allows individuals to reorganize their finances and come up with a plan to pay off their creditors. There are three types of Indiana Individual Chapter 11 Discharge: full discharge, limited discharge, and conditional discharge. A full discharge releases the debtor from all of their debt, including any secured debt. A limited discharge releases the debtor from some of their debt, but not all. A conditional discharge releases the debtor from some of their debt, but only if they meet certain conditions. All three types of discharge require the debtor to complete all of their required payments and obligations in order to be discharged.

Indiana Individual Chapter 11 Discharge

Description

How to fill out Indiana Individual Chapter 11 Discharge?

Drafting legal documents can be quite a hassle unless you have ready-made fillable templates at your disposal.

With the US Legal Forms online repository of official paperwork, you can be assured of the fields you acquire, as all of them align with federal and state statutes and are validated by our specialists.

Haven’t you yet experienced US Legal Forms? Register for our service now to acquire any official document swiftly and effortlessly whenever you require, and maintain your documents organized!

- Obtaining your Indiana Individual Chapter 11 Discharge from our collection is as straightforward as ABC.

- Previously registered users with a valid subscription merely need to Log In and hit the Download button after locating the appropriate template.

- Subsequently, if necessary, users can select the same document from the My documents section of their account.

- However, even if you are new to our platform, creating an account with a valid subscription will take just a few minutes.

Form popularity

FAQ

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.

The Disadvantages of Chapter 11 Bankruptcy Loss of Privacy.Financial Record-Keeping & Reporting Requirements.Profitability Requirements.Some Loss of Control Over Business Operations.Restrictions on Compensation of Debtor's Insiders.Possible Loss of Shareholder Control.The Cost.

In individual chapter 11 cases, and in cases under chapter 12 (adjustment of debts of a family farmer or fisherman) and 13 (adjustment of debts of an individual with regular income), the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan.

Like all negative information reported to the credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if they're not directly notified by the bankruptcy court.

Business owners and individuals struggling under the weight of debt may find new life under Chapter 11 bankruptcy. Commonly called reorganization bankruptcy, Chapter 11 allows businesses to continue operating while the business owner and creditors reorganize the debts so the business can be profitable once again.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

In a Chapter 11 bankruptcy proceeding, if a company or individual filer (the ?debtor?) is unable to pay its creditors in full, the absolute priority rule bars owners from retaining their interests unless the owners contribute ?new value? to the business.

In a Chapter 11 case filed by an individual (i.e., a natural person), a discharge is granted by the court separately, after the completion of payments under the plan. A discharge is a court order relieving the debtor from liability for certain debts.