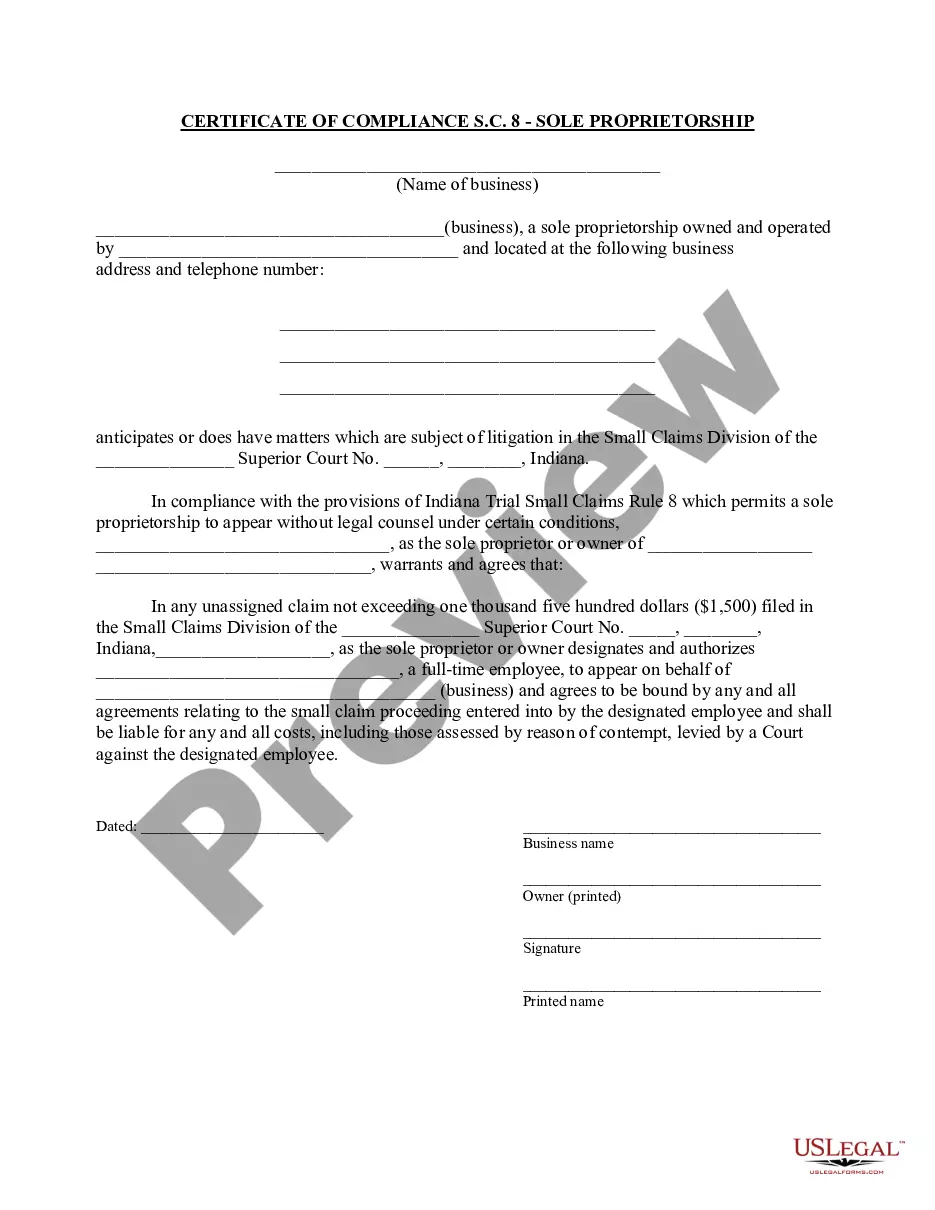

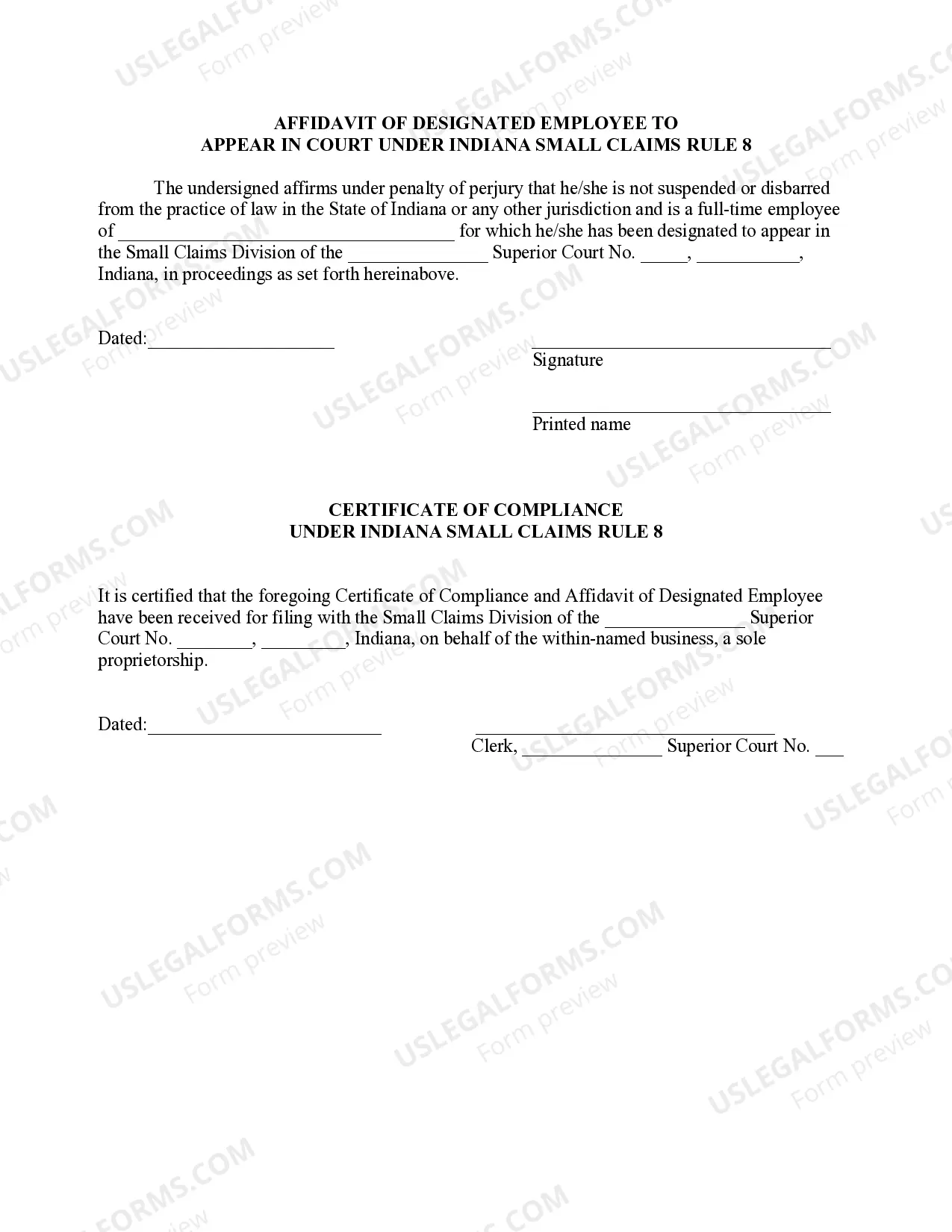

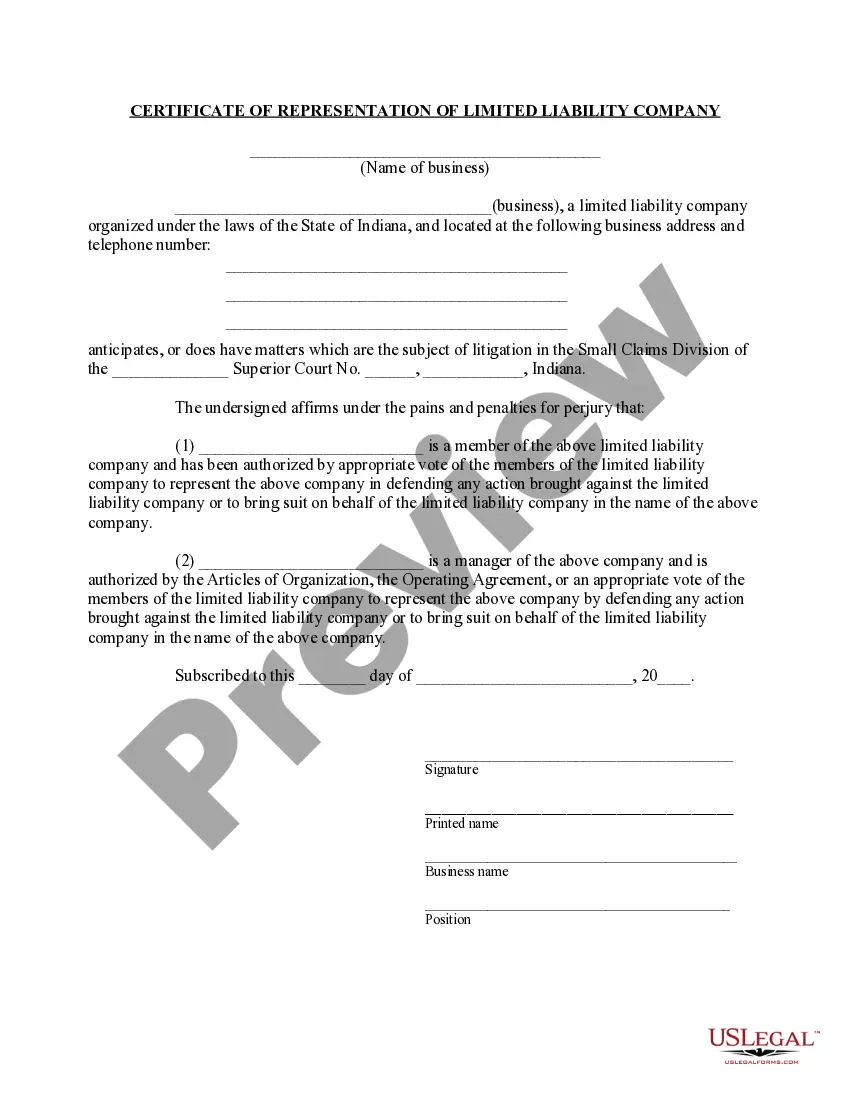

This is a Certificate of Compliance for a Sole Propietorship. A Sole Proprietor certifies that his/her claim is in compliance with the Indiana Trial Small Claims Rule 8.

Indiana Certificate of Compliance - Sole Proprietorship

Description

How to fill out Indiana Certificate Of Compliance - Sole Proprietorship?

Searching for Indiana Certificate of Compliance - Sole Proprietorship documents and completing them may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the correct template designated for your state with just a few clicks.

Our attorneys prepare every single document, so you merely need to complete them.

Review our comprehensive instructions on how to obtain your Indiana Certificate of Compliance - Sole Proprietorship template in a few minutes.

- Log in.

- to your account and revisit the form's webpage to save the document.

- Your downloaded templates are kept in.

- My documents.

- and can be accessed at any time for future reference.

- If you haven’t signed up yet, you’ll need to register.

Form popularity

FAQ

To obtain a certificate of clearance in Indiana, you need to ensure that your business has fulfilled all tax obligations and compliance requirements. Generally, you will need to contact the Indiana Department of Revenue for specific steps. Once you meet all conditions, you can request the certificate, which serves as proof of good standing. For sole proprietors, this supports your efforts to secure the Indiana Certificate of Compliance - Sole Proprietorship.

1Choose a business name.2File an assumed business name with the county recorder.3Obtain licenses, permits, and zoning clearance.4Obtain an Employer Identification Number.