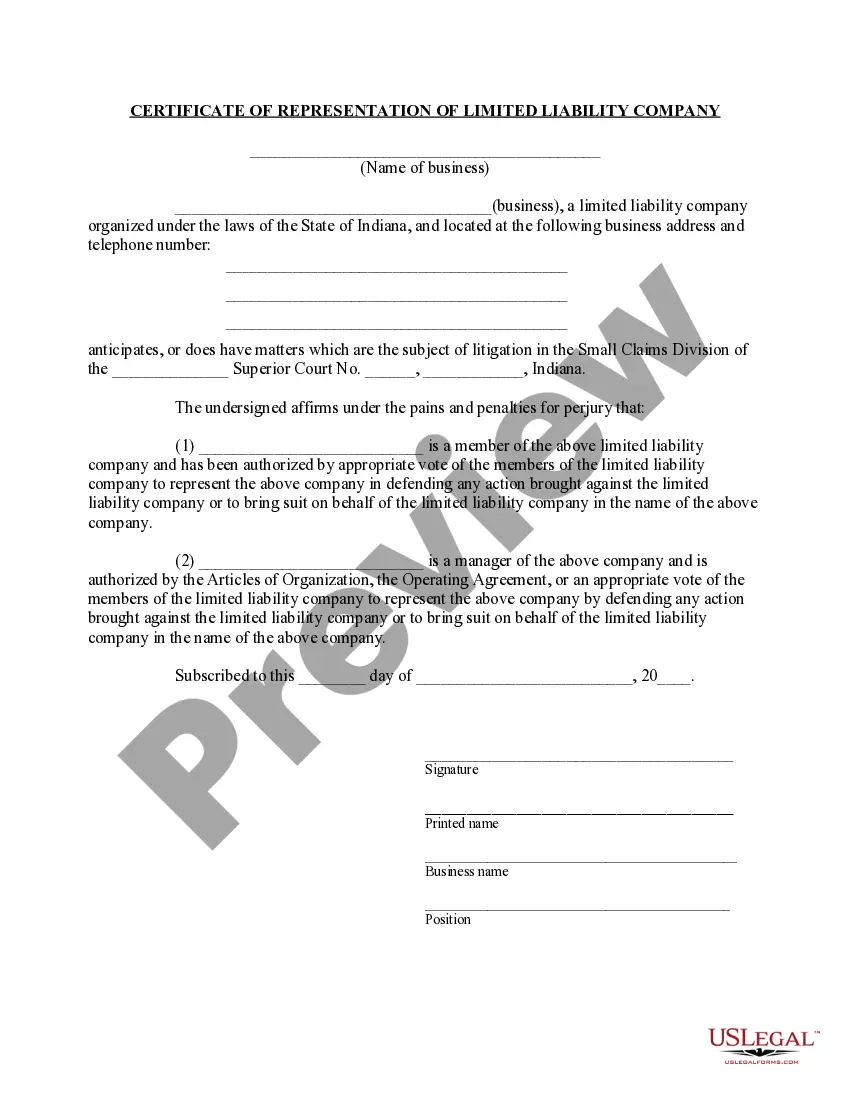

This is a Certificate of Representation of a Limited Liability Company to be used in the Small Claims Court of Indiana. A Certificate of Representation is needed because a manager of a LLC is authorized to defend the company against any pending actions.

Indiana Certificate of Representation of Limited Liability Company LLC

Description

How to fill out Indiana Certificate Of Representation Of Limited Liability Company LLC?

Searching for a sample Indiana Certificate of Representation of Limited Liability Company LLC and completing it could pose a challenge.

To save a significant amount of time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically designed for your state with just a few clicks.

Our legal experts prepare each document, so you only need to complete them. It truly is that easy.

Select your plan on the pricing page and create your account. Choose your payment method via credit card or PayPal. Save the template in your preferred file format. Now you can print the Indiana Certificate of Representation of Limited Liability Company LLC template or complete it using any online editor. There's no need to worry about making mistakes since your form can be used, submitted, and printed as many times as you need. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your stored templates are located in My documents and are available at any time for later use.

- If you haven't subscribed yet, you must register.

- Review our comprehensive guidelines on how to obtain the Indiana Certificate of Representation of Limited Liability Company LLC template in just a few minutes.

- Ensure you verify its validity for your state to get an eligible form.

- Examine the sample using the Preview option (if available).

- If there's a description, read it to grasp the details.

- Click Buy Now if you've found what you're looking for.

Form popularity

FAQ

To form an Indiana LLC, you must file the Articles of Organization with the Indiana Secretary of State. This step includes selecting a unique name for your LLC and designating a registered agent. Once approved, you will receive an Indiana Certificate of Representation of Limited Liability Company LLC, formally recognizing your business. You might also consider using platforms like uslegalforms to simplify the process and ensure all forms are accurately completed.

The LLC provides protection to the LLC owners by limiting the owner's personal liability. Generally, this means that business debts owed by the business, and other claims on the business, including liens and lawsuits, are limited to the assets of the business itself.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

A certificate of organization is a type of document filed with the secretary of state in some states to form an LLC. An LLC certificate is also sometimes called a certificate of formation. Each state will have different requirements to file and fill out the form.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

A limited liability company, commonly referred to as an LLC, is a type of business structure commonly used in the United States. LLCs can be seen as a hybrid structure that combines features of both a corporation and a partnership.

Although LLCs in Indiana are not required to have a limited liability company operating agreement, it is wise to have one in place with other members should your LLC have more than one member. The State of Indiana recognizes limited liability company operating agreements as governing documents. 5.