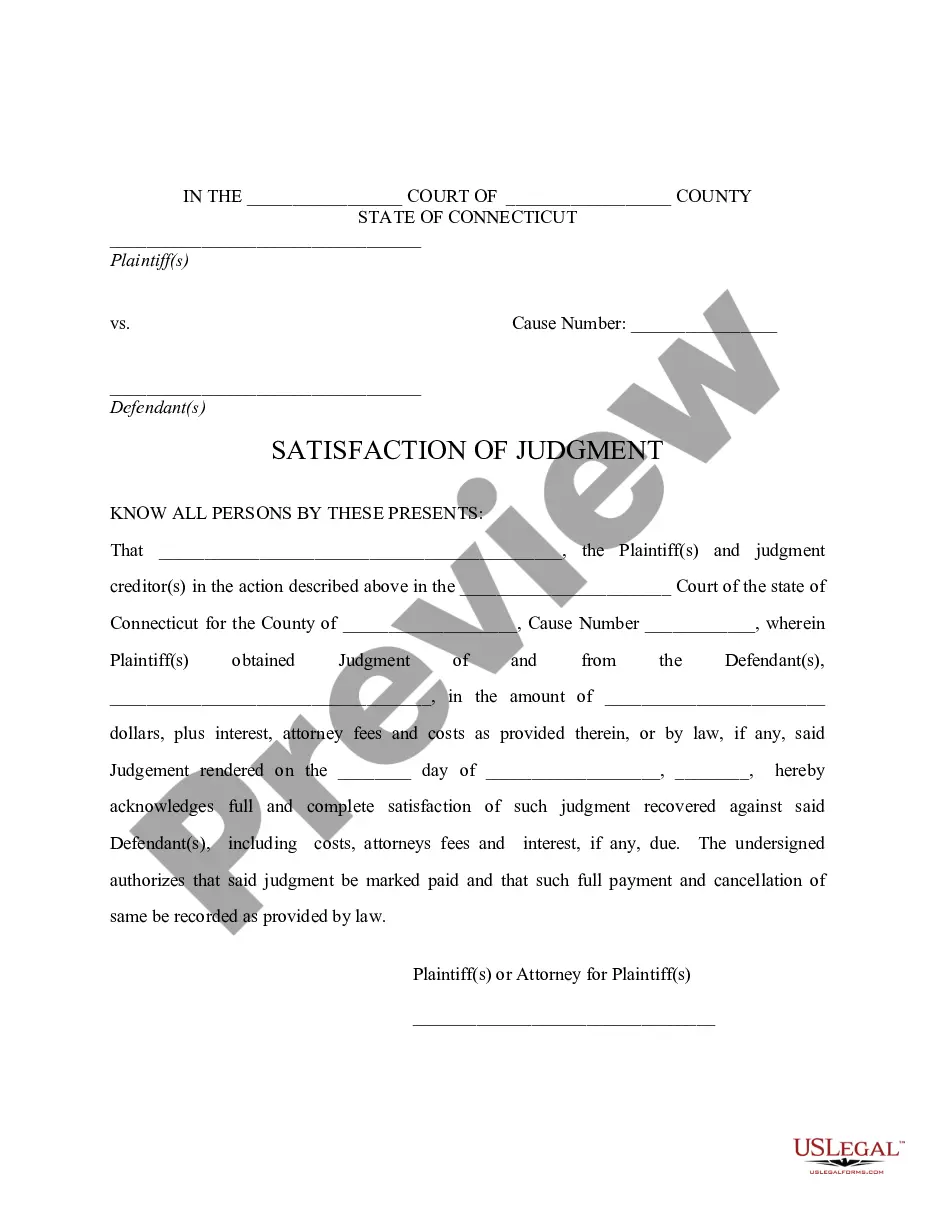

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Connecticut Satisfaction of Judgment

Description

How to fill out Connecticut Satisfaction Of Judgment?

The greater the quantity of documents you need to create, the more anxious you become.

You can find a vast array of Connecticut Satisfaction of Judgment forms online, yet you remain uncertain about which ones to rely on.

Eliminate the inconvenience of acquiring samples through US Legal Forms, simplifying the process substantially.

Enter the necessary information to create your account and complete your order via PayPal or credit card. Choose a user-friendly document format and obtain your sample. Access all documents you acquire in the My documents section. Simply navigate there to fill out a new copy of your Connecticut Satisfaction of Judgment. Even when utilizing professionally created templates, it remains crucial to consult with your local legal expert to verify that your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you have an active subscription to US Legal Forms, Log In to your account to access the Download button on the Connecticut Satisfaction of Judgment’s webpage.

- If you are new to our service, complete the registration process by following these steps.

- Verify that the Connecticut Satisfaction of Judgment is applicable in your state.

- Confirm your choice by reviewing the description or using the Preview feature if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that suits your requirements.

Form popularity

FAQ

In Connecticut, a judgment generally remains valid for 20 years. However, if not enforced, it can expire after this period. Knowing this duration is important for managing your financial obligations effectively. For a clear understanding of Connecticut Satisfaction of Judgment and your legal rights, consider using US Legal Forms to find relevant guidance and resources.

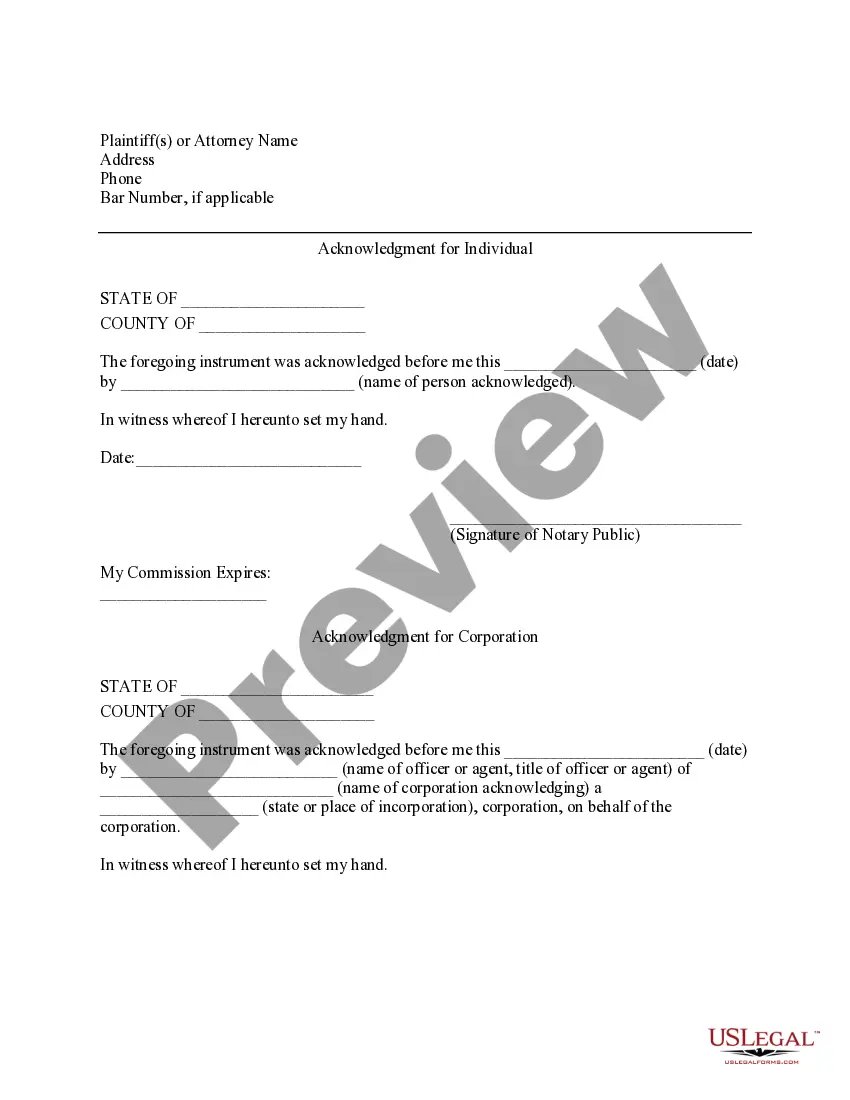

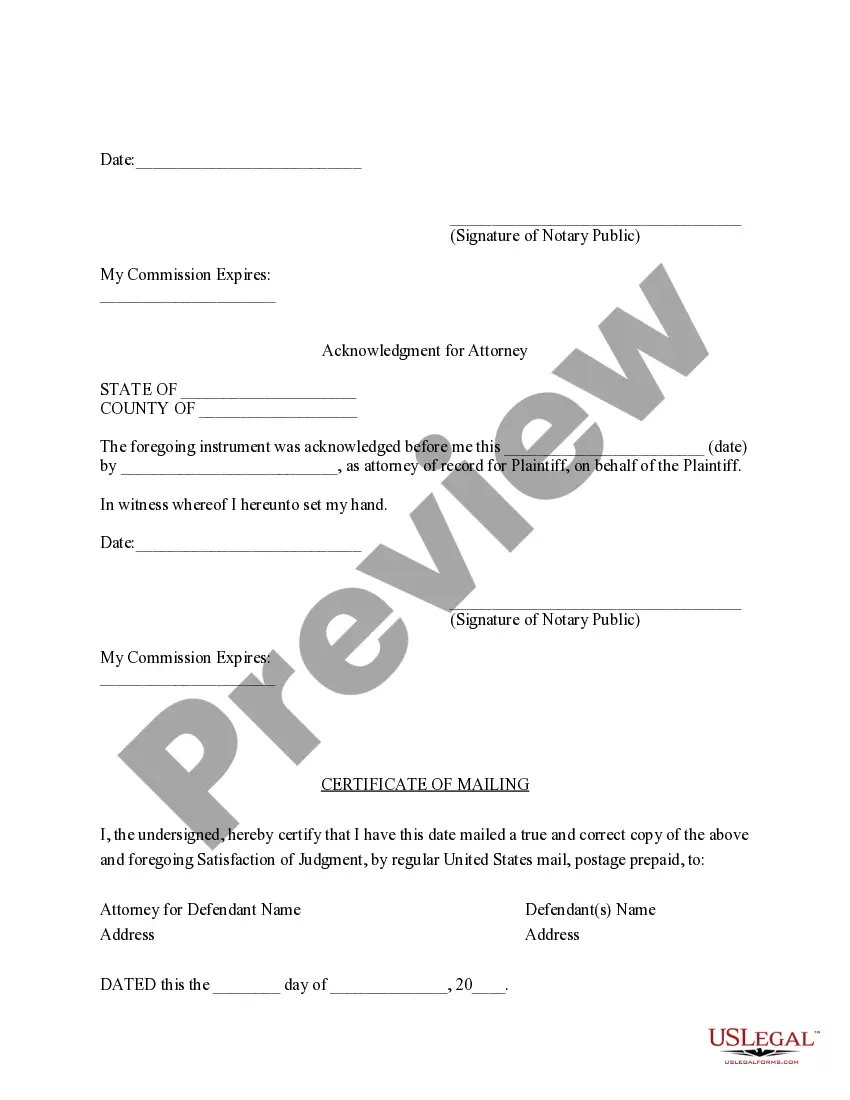

Filing an acknowledgment of satisfaction of judgment involves submitting a specific form to the court where the judgment was originally filed. Begin by completing the form with accurate information about the judgment and the payment made. Once done, file it with the court clerk and keep a copy for your records. For added convenience, consider using the UsLegalForms platform, where you can find templates and guidance tailored to help you manage your Connecticut Satisfaction of Judgment effectively.

To remove a satisfied judgment from your credit report, you should first obtain a copy of your credit report. After confirming that the judgment has been satisfied, contact the credit reporting agencies and request a review. You may need to provide proof of the satisfaction, such as a court order. Understand that this process helps ensure that your credit report accurately reflects your financial standing, especially in relation to your Connecticut Satisfaction of Judgment.

In Connecticut, the statute of limitations on a judgment is 20 years. This period is essential for creditors, as it defines how long they can enforce their claims. After this time, if no action is taken, creditors lose their right to collect. For debtors, knowing this timeframe can guide your financial decisions, as managing debt wisely can lead to a Connecticut Satisfaction of Judgment.

A judgment typically falls off your credit report after seven years from the date it was entered. However, if a Connecticut Satisfaction of Judgment is filed, it can have a positive impact sooner. This filing indicates to future creditors that the debt has been resolved. Keeping your credit report clear can help facilitate future financial opportunities.

In Connecticut, a debt generally becomes uncollectible after six years, as per the statute of limitations. This means creditors may lose the right to sue for the debt after this period. However, taking action sooner can lead to a Connecticut Satisfaction of Judgment. By addressing debts promptly, you can potentially avoid long-term financial repercussions.

In Connecticut, a judgment remains valid for 20 years. This period allows the creditor to collect the owed amount. If a Connecticut Satisfaction of Judgment is not filed, the debtor may face ongoing consequences. However, with timely action, individuals can resolve their debts and clear their records.

To satisfy a judgment means to fulfill the court's decision by paying the amount owed, which clears your debt. Once you satisfy a judgment in Connecticut, this means creditors can no longer pursue the debt. Obtaining documentation of satisfaction is important, as it serves as proof that you have met your obligations. Knowing about the process of Connecticut Satisfaction of Judgment can simplify your journey to financial freedom.

A person is considered judgment proof when they do not have sufficient income or assets that a creditor can collect on. For instance, if your income is below a certain level or protected by law, creditors may find it difficult to enforce a judgment against you. In Connecticut, understanding your rights and options regarding judgment proof status can be crucial. Exploring solutions like the Connecticut Satisfaction of Judgment can help clarify your situation.