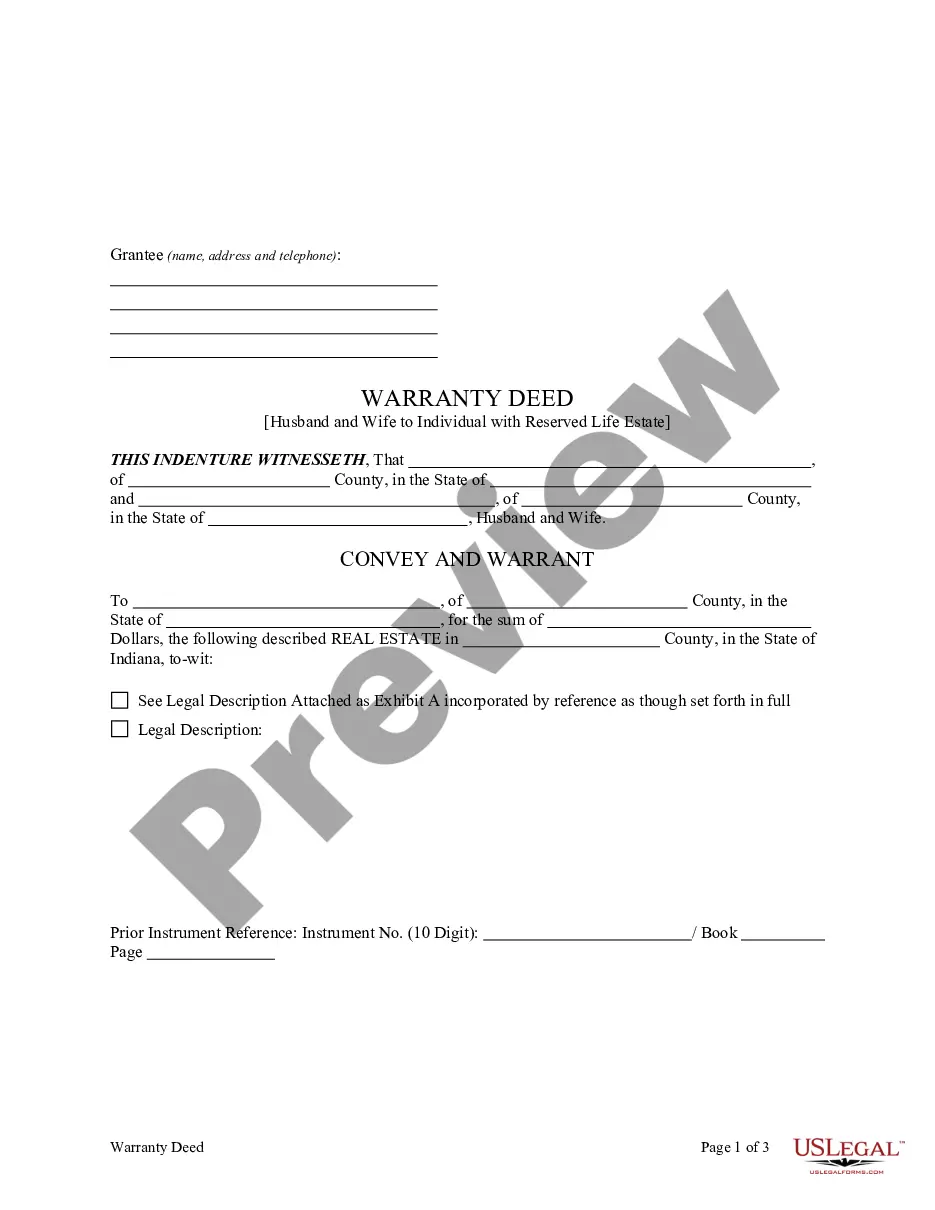

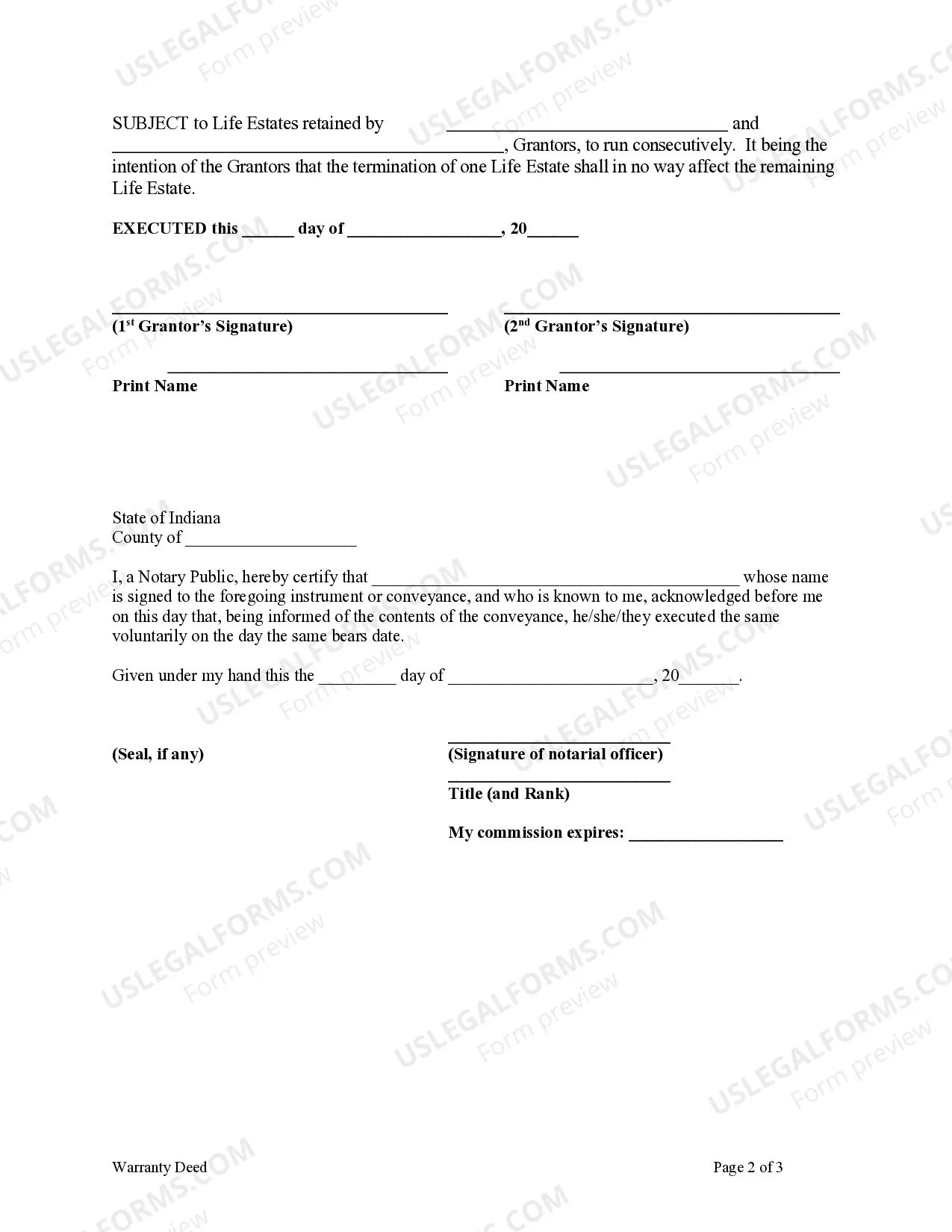

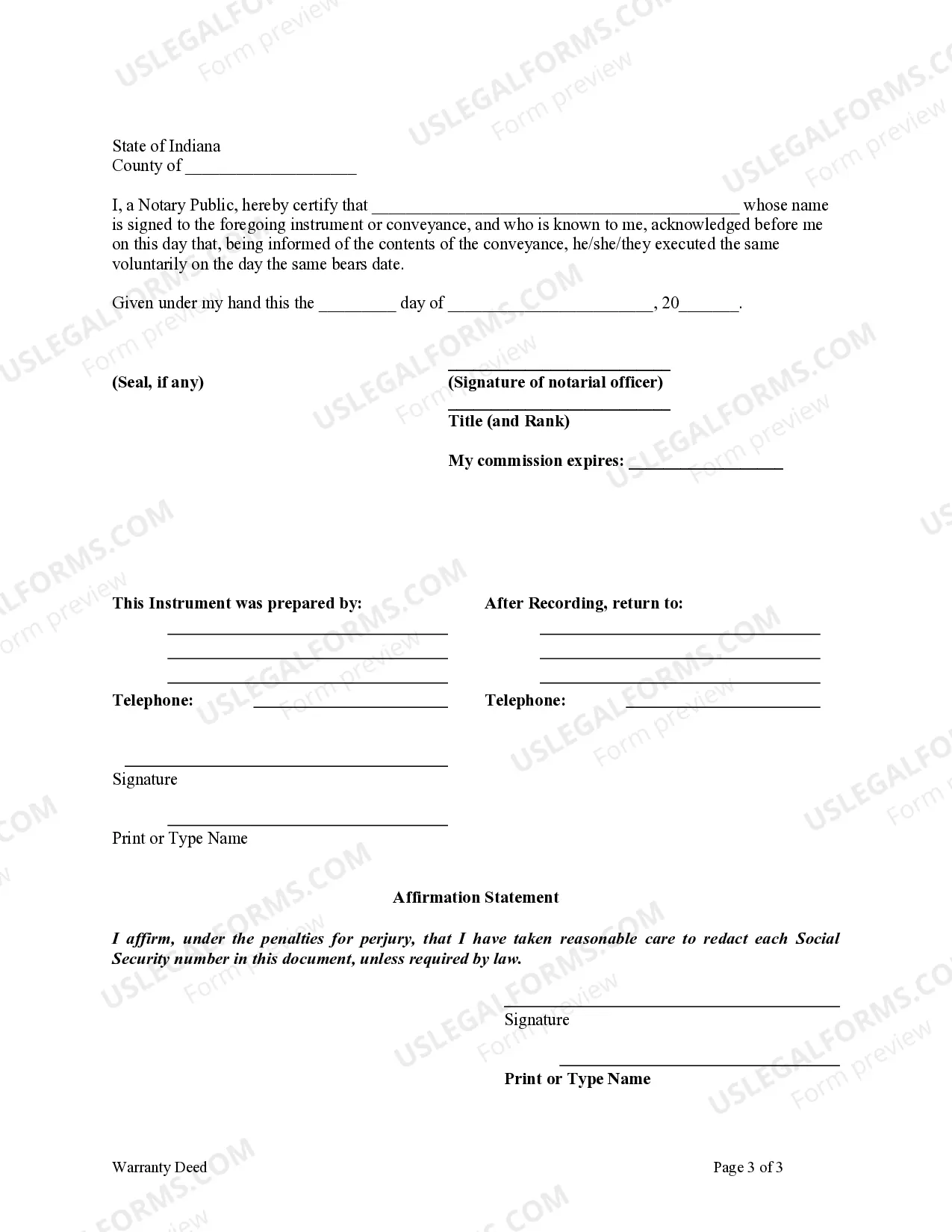

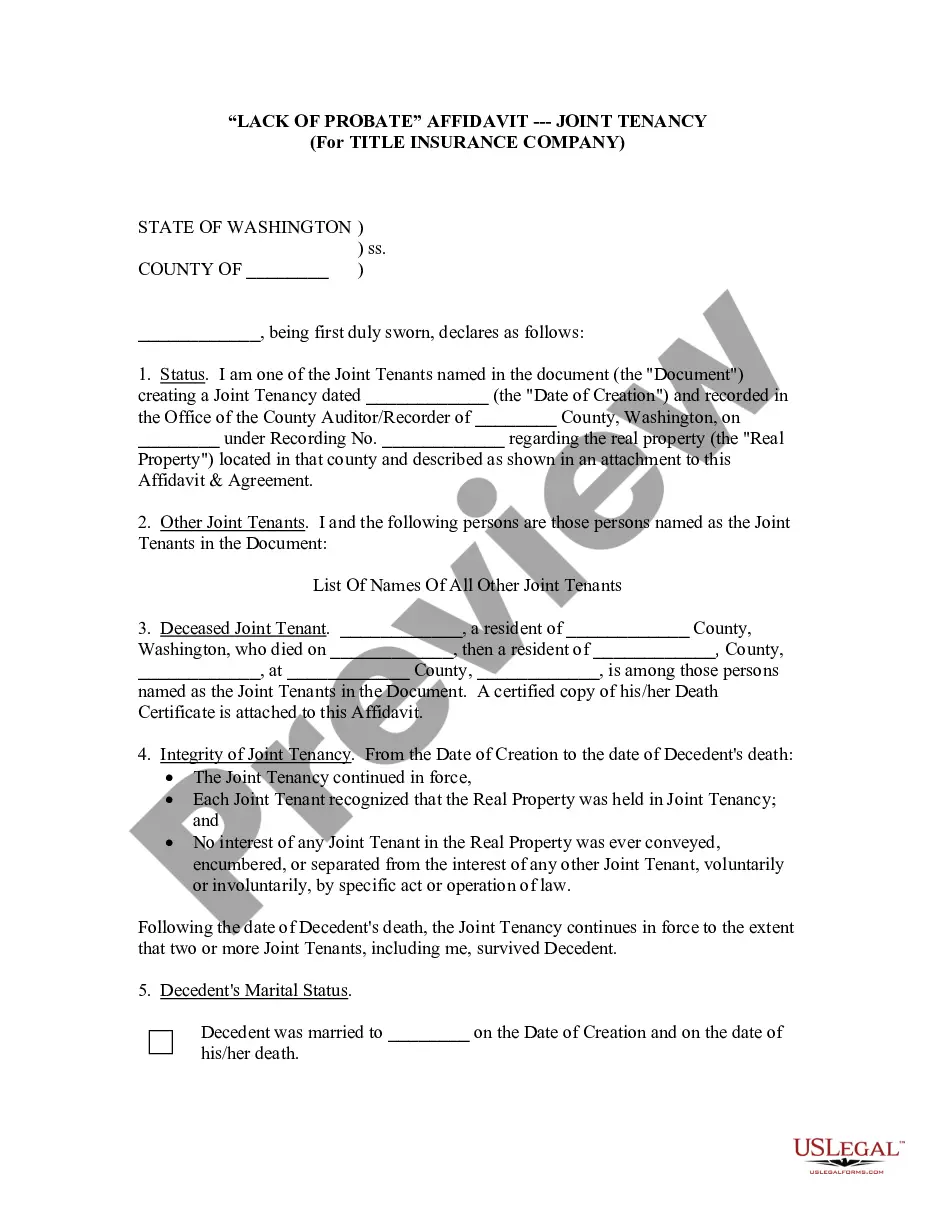

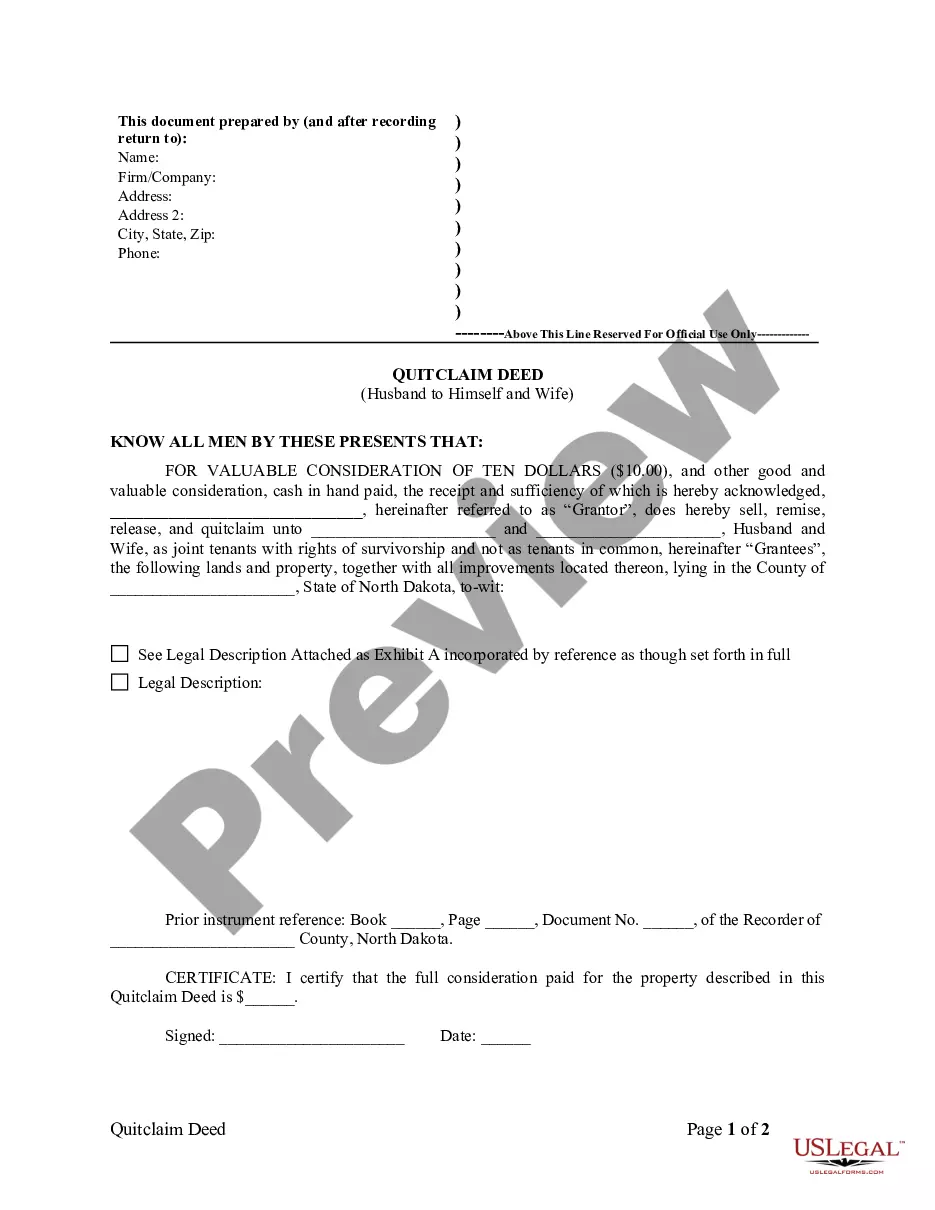

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Indiana Warranty Deed to Child Reserving a Life Estate in the Parents

Description

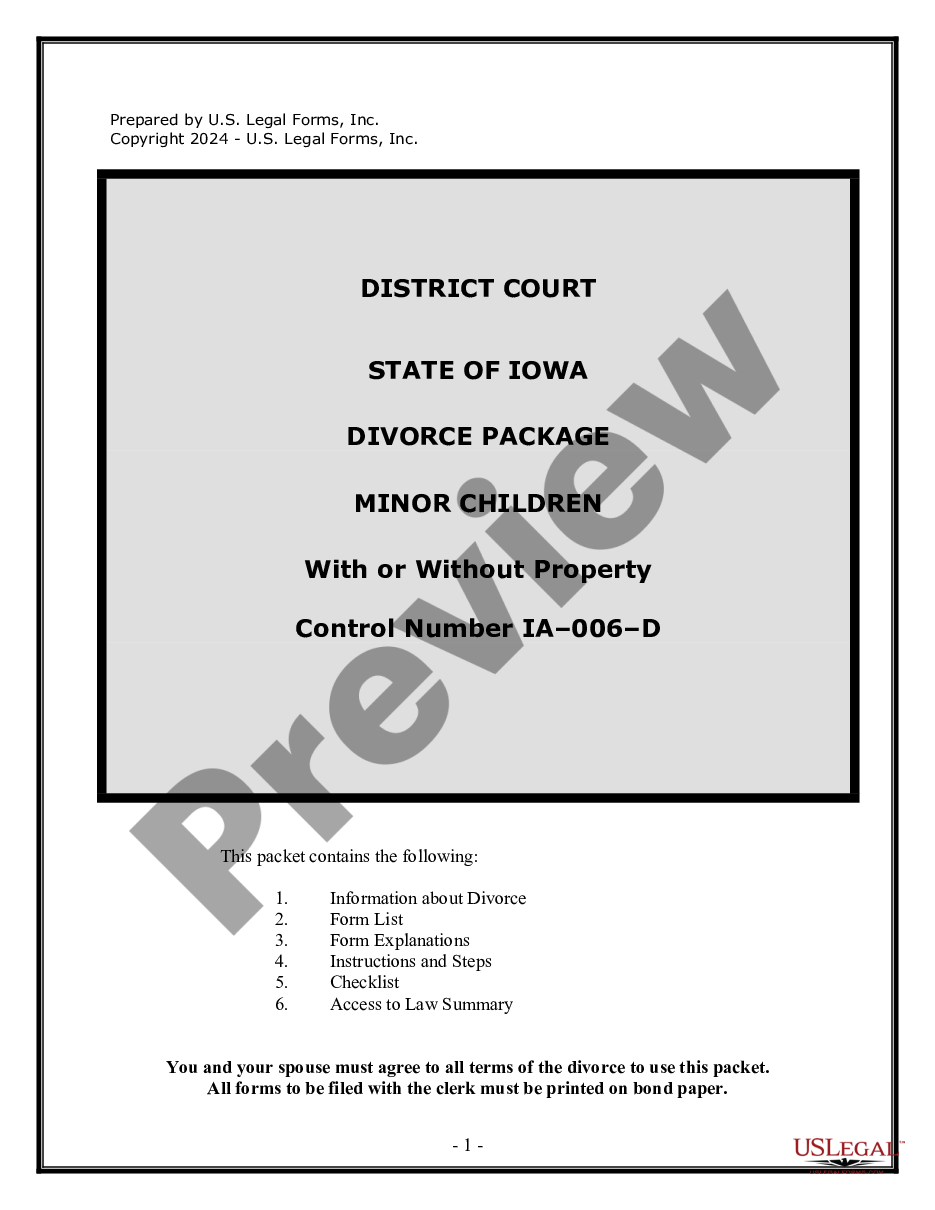

How to fill out Indiana Warranty Deed To Child Reserving A Life Estate In The Parents?

Attempting to locate the Indiana Warranty Deed to Child Retaining a Life Estate in the Parents templates and completing them could pose a challenge.

To conserve significant time, expenses, and effort, utilize US Legal Forms to discover the appropriate example specifically for your jurisdiction with just a few clicks.

Our attorneys prepare all documents, so you only need to complete them. It truly is that simple.

Select your plan on the pricing page and establish your account. Choose to pay via a credit card or PayPal. Download the sample in your desired file format. You can print the Indiana Warranty Deed to Child Retaining a Life Estate in the Parents template or fill it out using any online editor. There’s no need to be concerned about making mistakes, as your template can be utilized and submitted, and printed repeatedly. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Login to your account and return to the form's page to download the document.

- All of your saved templates are stored in My documents and are accessible at any time for future use.

- If you haven’t signed up yet, you will need to register.

- Review our comprehensive guidelines on how to acquire the Indiana Warranty Deed to Child Retaining a Life Estate in the Parents template in minutes.

- To obtain a valid sample, verify its relevance for your state.

- Examine the example using the Preview option (if available).

- If a description exists, read through it to understand the particulars.

- Press the Buy Now button if you found what you are seeking.

Form popularity

FAQ

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Can a life estate deed be changed? It is challenging to modify or change a life estate deed. The grantor cannot change the life estate as he or she has no power to do so after creating the life estate deed unless all of the future tenants agree. It requires the permission or consent of every one of the beneficiaries.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate is usually property that has been acquired during the lifetime of a person with his or her ownership only lasting through the time he or she lives.This also means he or she cannot sell it, rent it or alter it until the life tenant passes on or leaves permanently.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.