Illinois Quitclaim Deed (Short Form)

Description

How to fill out Quitclaim Deed (Short Form)?

Choosing the best legal record format can be a have difficulties. Needless to say, there are plenty of web templates available on the Internet, but how do you find the legal type you require? Use the US Legal Forms site. The support offers a huge number of web templates, including the Illinois Quitclaim Deed (Short Form), which you can use for business and personal requirements. Each of the forms are checked by specialists and fulfill federal and state specifications.

In case you are presently registered, log in to the account and click on the Obtain key to get the Illinois Quitclaim Deed (Short Form). Use your account to look through the legal forms you may have ordered previously. Check out the My Forms tab of your account and have one more backup of the record you require.

In case you are a new customer of US Legal Forms, here are simple recommendations so that you can adhere to:

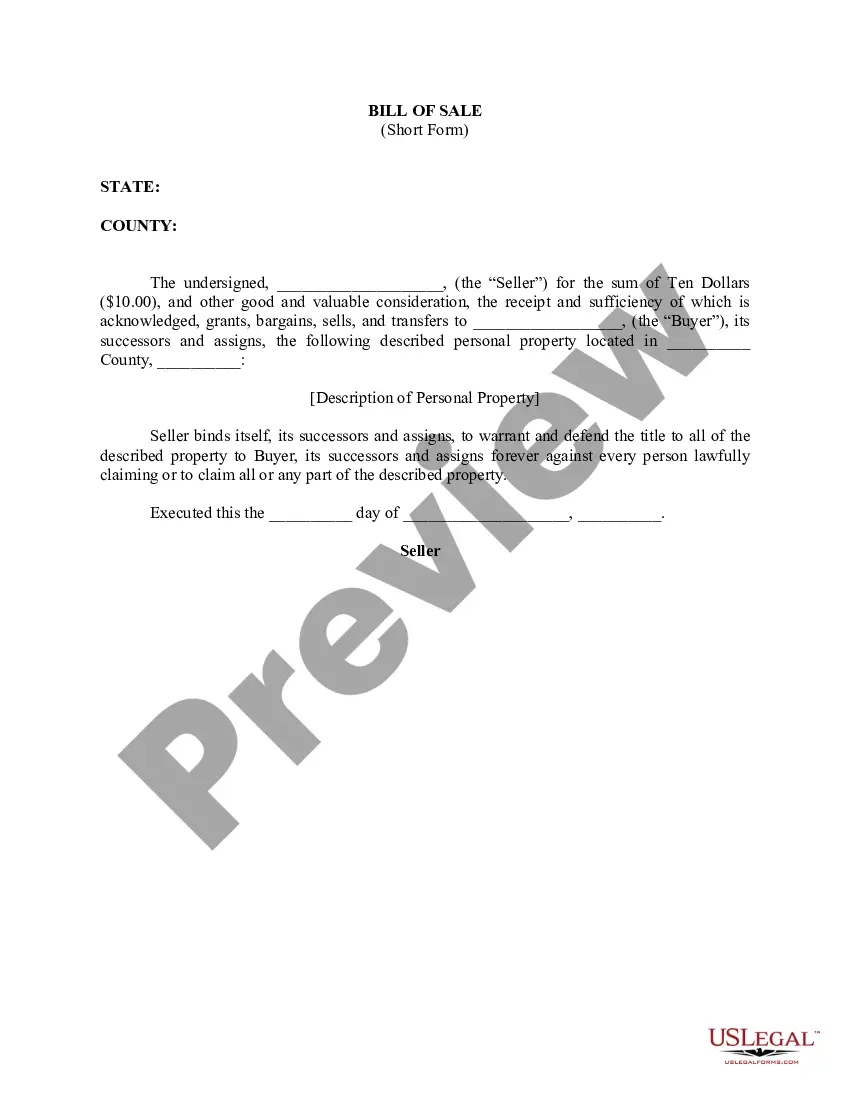

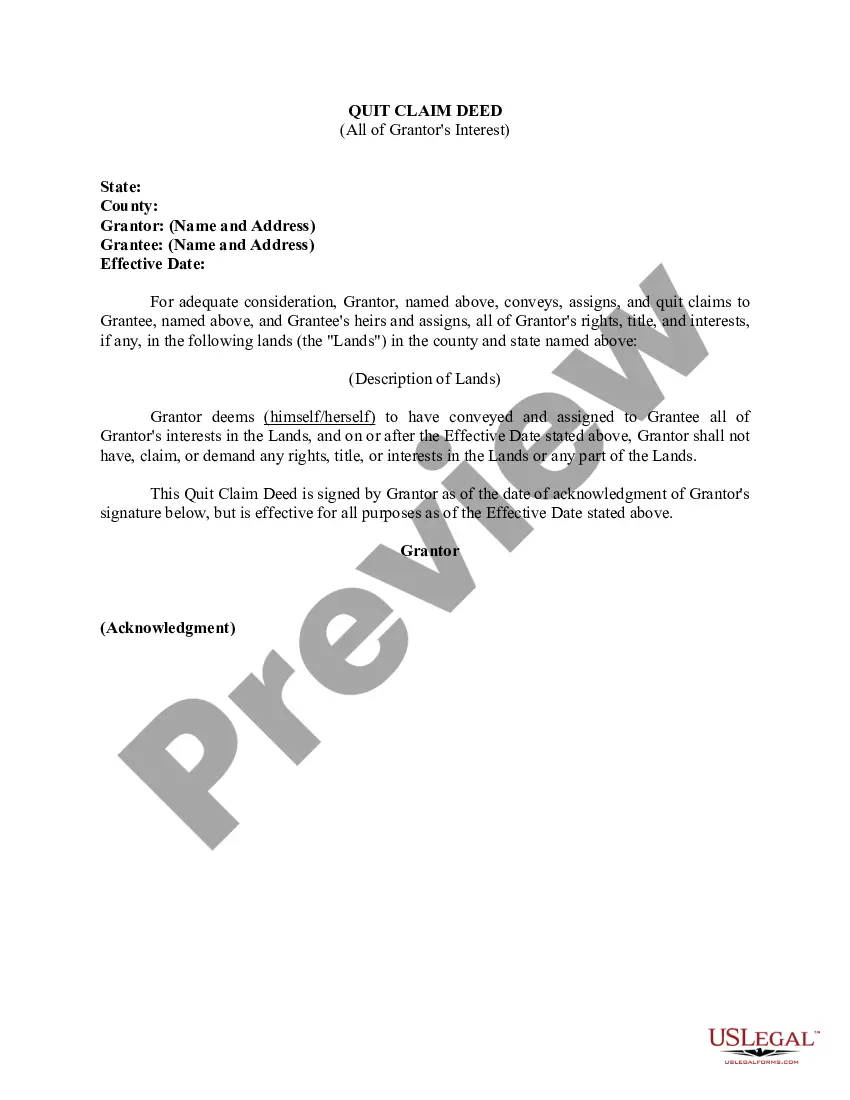

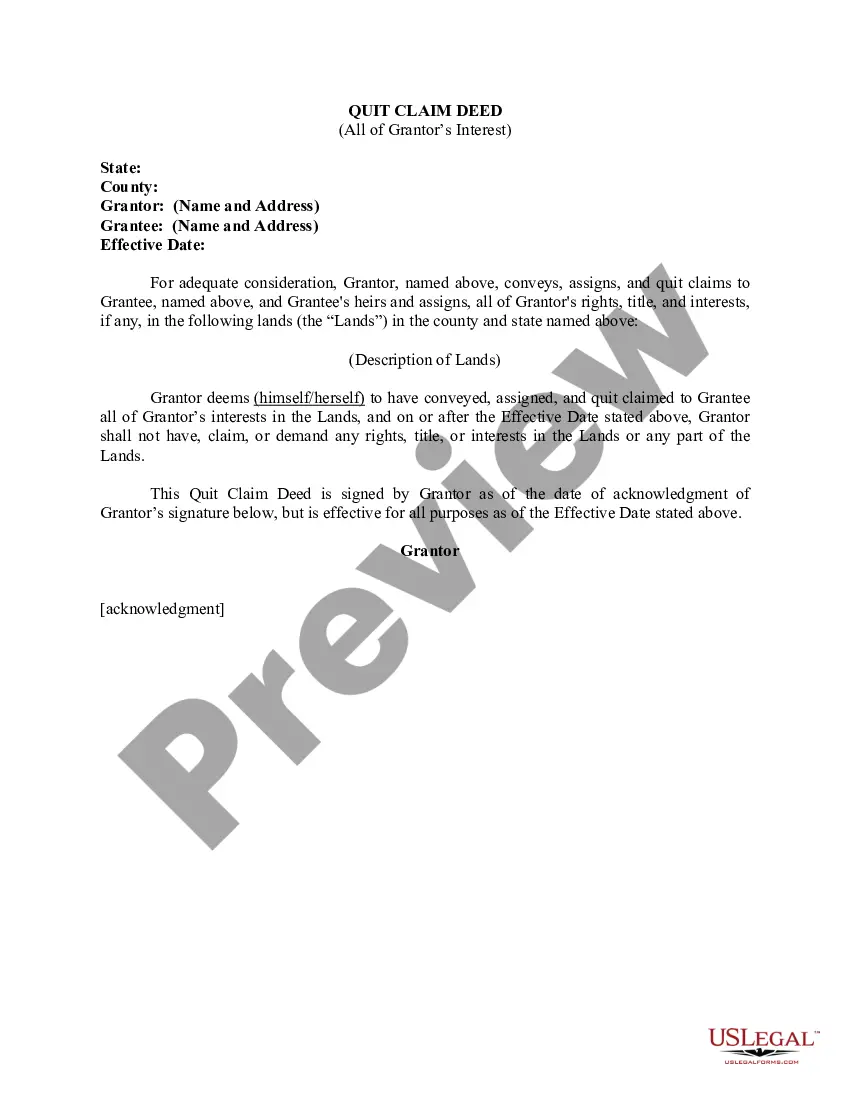

- Very first, be sure you have selected the right type for the city/area. You may look through the shape using the Review key and look at the shape outline to make certain this is basically the right one for you.

- When the type will not fulfill your needs, utilize the Seach discipline to obtain the proper type.

- Once you are positive that the shape would work, click on the Purchase now key to get the type.

- Opt for the prices program you desire and enter the required details. Make your account and buy the transaction utilizing your PayPal account or bank card.

- Opt for the submit structure and download the legal record format to the gadget.

- Full, change and printing and signal the received Illinois Quitclaim Deed (Short Form).

US Legal Forms may be the largest collection of legal forms for which you can discover numerous record web templates. Use the company to download skillfully-manufactured files that adhere to express specifications.

Form popularity

FAQ

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

In order to file a deed in Cook County, the necessary documents are as follows: (1) Tax Declaration (MyDec); (2) Tax Stamps (or ?Zero Stamps? if an exempt transfer); (3) A Grantor/Grantee Affidavit (exempt transfers); (4) The Deed to be Filed (which must contain PIN number, complete legal description, commonly known ...

Although a deed does not have to be recorded to be a valid conveyance, there are practical reasons for recording a deed. Deeds do not take effect as to creditors and subsequent purchasers without notice until the instrument is recorded.

5 Steps to Prepare and Record an Illinois Quitclaim Deed Prepare the Quitclaim Deed. There are multiple types of tenancies. ... Prepare the Grantor / Grantee Statement. ... Acquire Local Municipal Transfer Stamps. ... Prepare the County & State Transfer Declaration. ... Recording the Quitclaim Deed with the County.

The fee for recording the vast majority of documents in Cook County is a flat $98.00. ing to the Cook County Recorder of Deed's Office, ?this ordinance will promote efficiency in the real estate markets as it will permit full and accurate disclosure of the fees associated with real estate transactions.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

You simply download a free form directly from your county clerk's website and submit it on your own. It can offer a property tax benefit. When you quitclaim a deed to another individual, you are no longer responsible for paying property taxes for that particular property.

To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees.