Illinois Self-Employed Mechanic Services Contract

Description

How to fill out Self-Employed Mechanic Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast array of legal form templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can retrieve the latest editions of forms like the Illinois Self-Employed Mechanic Services Contract within moments.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your details to register for an account.

- If you already hold a subscription, Log In and download the Illinois Self-Employed Mechanic Services Contract from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You have access to all previously acquired forms from the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are straightforward instructions to get started.

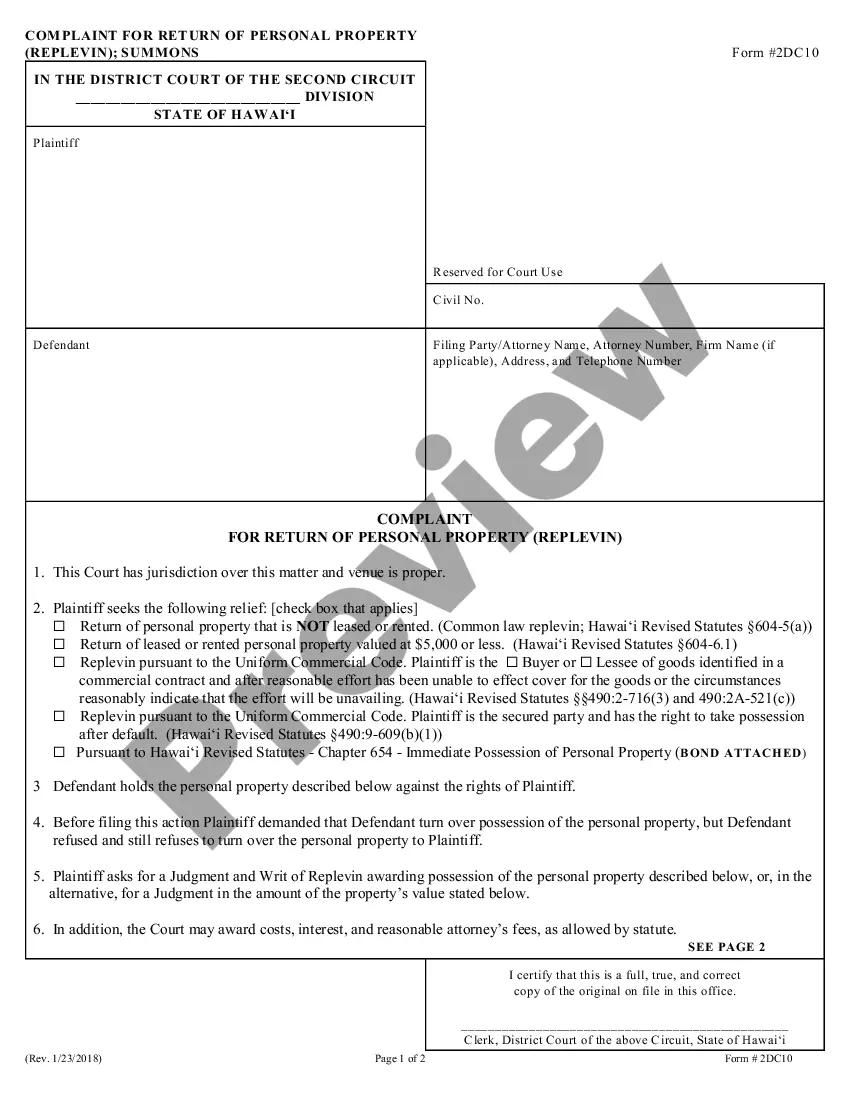

- Ensure you have chosen the correct form for your location. Click the Review button to examine the form’s content.

- Read the form summary to confirm you have selected the appropriate document.

Form popularity

FAQ

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

Contract for service. A contract of service is an agreement between an employer and an employee. In a contract for service, an independent contractor, such as a self-employed person or vendor, is engaged for a fee to carry out an assignment or project.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.