Illinois Metal Works Services Contract - Self-Employed

Description

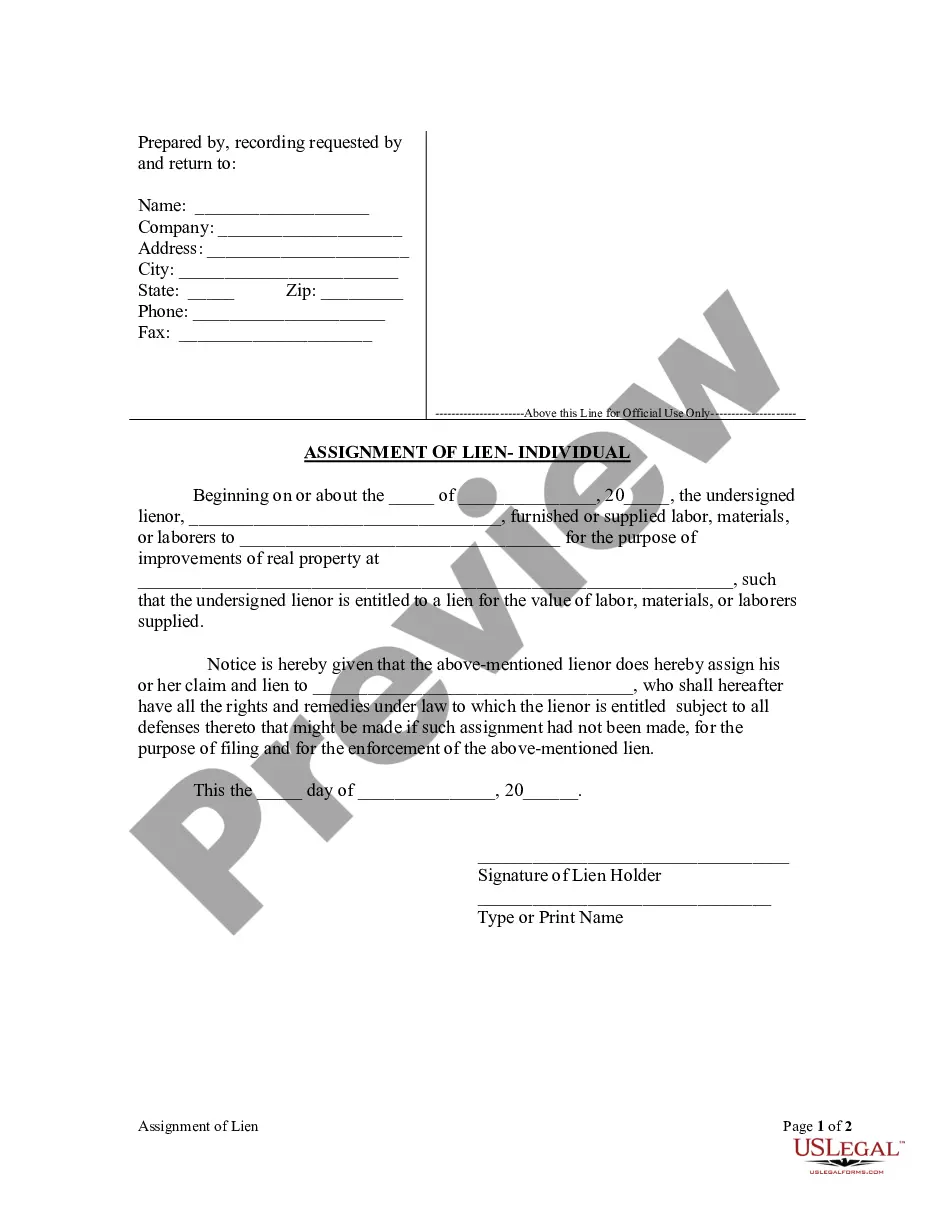

How to fill out Metal Works Services Contract - Self-Employed?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service provides a vast array of templates, including the Illinois Metal Works Services Contract - Self-Employed, which can be utilized for both business and personal needs. All documents are reviewed by professionals and comply with federal and state regulations.

If you are already a member, Log Into your account and click the Download button to access the Illinois Metal Works Services Contract - Self-Employed. Use your account to browse through the legal documents you have previously acquired. Go to the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/county. You can review the form using the Preview button and read the form description to confirm it is the appropriate one for you. If the form does not meet your expectations, utilize the Search field to find the correct form. Once you are confident that the form is suitable, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Illinois Metal Works Services Contract - Self-Employed.

- US Legal Forms is the largest collection of legal documents where you can find a variety of paper templates.

- Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- Ensure compliance with necessary legal standards.

- Access a wide range of templates for various legal needs.

- Simplify the process of finding the right legal forms.

- Easily manage and retrieve your purchased documents.

Form popularity

FAQ

The 48 hour rule in Illinois pertains to the payment of wages and requires that employees receive their final paycheck within 48 hours of leaving a job. While this rule primarily affects employees, independent contractors should also ensure timely payment through their contracts. Incorporating the 48 hour rule in an Illinois Metal Works Services Contract - Self-Employed can promote transparency and foster trust between you and your clients.

Yes, employment contracts are generally enforceable in Illinois, provided they meet specific legal criteria. These contracts must be clear, mutually agreed upon, and supported by consideration. When working as an independent contractor, having an Illinois Metal Works Services Contract - Self-Employed can serve as a solid foundation, making your agreement legally binding and protecting both parties.

The Independent Contractor Act in Illinois provides guidelines that define the relationships between independent contractors and businesses. It clarifies the criteria for determining whether someone is an independent contractor or an employee, emphasizing the individual's control over their work. Understanding this Act is essential when drafting an Illinois Metal Works Services Contract - Self-Employed, as it ensures compliance with state regulations.

The primary difference between an independent contractor and an employee lies in the level of control and independence. Independent contractors have greater autonomy over their work schedules and methods, while employees follow the employer's directives. However, both parties can benefit from an Illinois Metal Works Services Contract - Self-Employed, as it ensures both are aware of their roles and responsibilities.

Yes, having a contract is crucial for independent contractors. A solid contract outlines the scope of work, payment terms, and responsibilities for both parties. When you enter into an Illinois Metal Works Services Contract - Self-Employed, it creates a legal framework that protects your rights and clarifies expectations. This clarity can prevent disputes and ensure smooth project execution.

In Illinois, independent contractors must meet specific legal requirements to operate effectively. First, they should register their business and obtain any necessary licenses. Additionally, they need to understand their tax obligations, as they are responsible for their own taxes. For those entering into an Illinois Metal Works Services Contract - Self-Employed, having a clear understanding of these requirements is essential.

To write a contract for a 1099 employee, clearly define the services provided, compensation details, and terms of the agreement. Focus on the independent nature of the work and include clauses that outline confidentiality and dispute resolution. An adaptable option to consider is the Illinois Metal Works Services Contract - Self-Employed, which helps set these terms effectively.

In Illinois, an independent contractor is an individual who provides services to another party under a contract while retaining control over how those services are performed. They are not employees and typically work on a project basis. Understanding this classification is important for creating an accurate Illinois Metal Works Services Contract - Self-Employed.

Writing a self-employment contract involves outlining your services, payment specifics, and the responsibilities expected from both parties. Make sure to include a termination clause that explains how either party can end the agreement. You can refer to the Illinois Metal Works Services Contract - Self-Employed for a clear example to guide your writing.

Yes, you can write your own legally binding contract, as long as it meets the necessary legal requirements. Include essential information, like the purpose of the agreement and signatures from both parties. By using a structured format like the Illinois Metal Works Services Contract - Self-Employed, you can make sure it covers all critical elements.