Illinois Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

It is feasible to devote numerous hours online attempting to locate the legal document format that satisfies the state and federal criteria you will require.

US Legal Forms provides an extensive collection of legal documents that are reviewed by experts.

It is easy to download or print the Illinois Pipeline Service Contract - Self-Employed from my service.

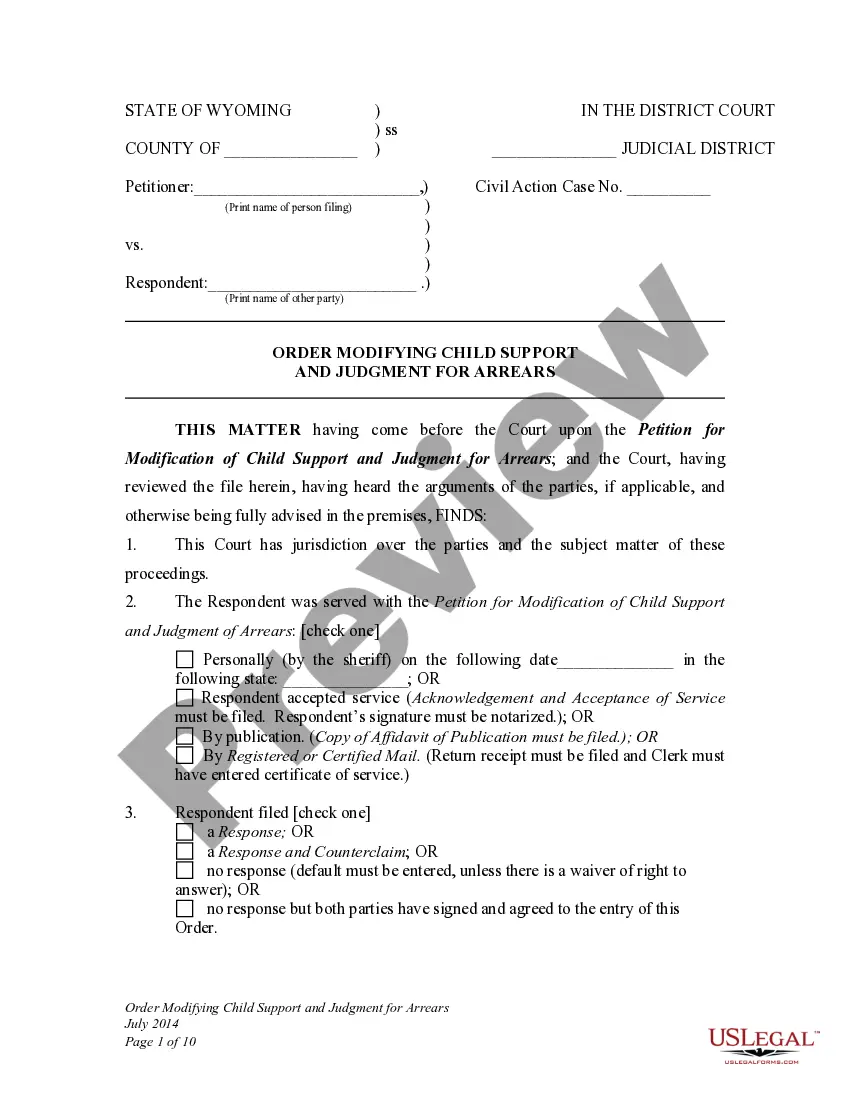

If available, use the Preview button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Illinois Pipeline Service Contract - Self-Employed.

- Every legal document format you obtain is yours indefinitely.

- To retrieve another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- Firstly, ensure that you have chosen the correct document format for the area/town of your choice.

- Review the form details to confirm that you have selected the appropriate form.

Form popularity

FAQ

Writing a contract as an independent contractor involves outlining the scope of work, payment terms, and deadlines clearly. Include clauses that specify your status as a self-employed individual, such as an Illinois Pipeline Service Contract - Self-Employed template from uslegalforms can provide structure and legality to your agreement. Make sure to cover essential details like confidentiality, liability, and dispute resolution. This approach ensures that both parties understand their responsibilities and protects your rights.

To prove you are an independent contractor, gather relevant documents like your business registration, tax filings, and client contracts. Your Illinois Pipeline Service Contract - Self-Employed can also serve as evidence of your independent status. Consider maintaining detailed records of your work, invoices, and communications with clients. These documents will help you demonstrate your self-employed status if needed.

The Illinois Freedom to Work Act primarily focuses on non-compete agreements for employees, not independent contractors. However, independent contractors should review their contracts to ensure there are no restrictive clauses that could limit their work opportunities. It’s essential to understand your rights as a self-employed individual under Illinois law. Consulting with legal experts can help clarify how these laws affect your Illinois Pipeline Service Contract - Self-Employed.

While the terms 'contract' and 'self-employed' are related, they are not identical. A contract, such as the Illinois Pipeline Service Contract - Self-Employed, defines the working relationship, while self-employment refers to the status of the worker. Under a contract, a self-employed individual has specific obligations and rights spelled out. It's essential to understand both concepts to effectively manage your work and business relations.

Yes, contract workers are generally considered self-employed. They typically establish their terms through agreements like the Illinois Pipeline Service Contract - Self-Employed, highlighting their independent status. This classification allows for more freedom and control over their work, though it also means taking on the responsibility for taxes and benefits. Understanding this distinction is key to navigating your rights and obligations.

The independent contractor law in Illinois outlines the relationship and rights between contractors and clients. Under the Illinois Pipeline Service Contract - Self-Employed, this law clarifies that independent contractors are not entitled to the same benefits as employees. Familiarizing yourself with these regulations helps you maintain compliance and understand your rights as a self-employed individual. Consider consulting legal resources for in-depth guidance.

employed contract should include essential elements such as scope of work, payment terms, duration of the contract, and any responsibilities of both parties. For those working on projects like the Illinois Pipeline Service Contract SelfEmployed, clarity on deliverables and deadlines is crucial. Ensure to specify any confidentiality and intellectual property considerations as well. This detailed approach protects both you and your client.

Most 1099 employees are classified as self-employed. When you work under an agreement such as the Illinois Pipeline Service Contract - Self-Employed, you receive a 1099 form for tax purposes, indicating your independent status. However, it's essential to confirm that your working conditions meet the criteria for self-employment. This understanding aids in navigating taxes and responsibilities effectively.

Contract work does not fall under traditional employment, but it is still a form of work engagement. When you enter into an agreement like the Illinois Pipeline Service Contract - Self-Employed, you establish a working relationship that defines the terms. While you may not have the same benefits as full-time employment, the contract clearly outlines your responsibilities and compensation. This clarity can be beneficial for managing work expectations.

Yes, contract employees are typically considered self-employed. They work under a specific agreement, such as the Illinois Pipeline Service Contract - Self-Employed, which highlights their independent status. As self-employed individuals, they are responsible for their own taxes and benefits. This classification allows for greater flexibility in their work arrangements.