Illinois Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

Are you in a position where you occasionally require documents for organizational or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't always simple.

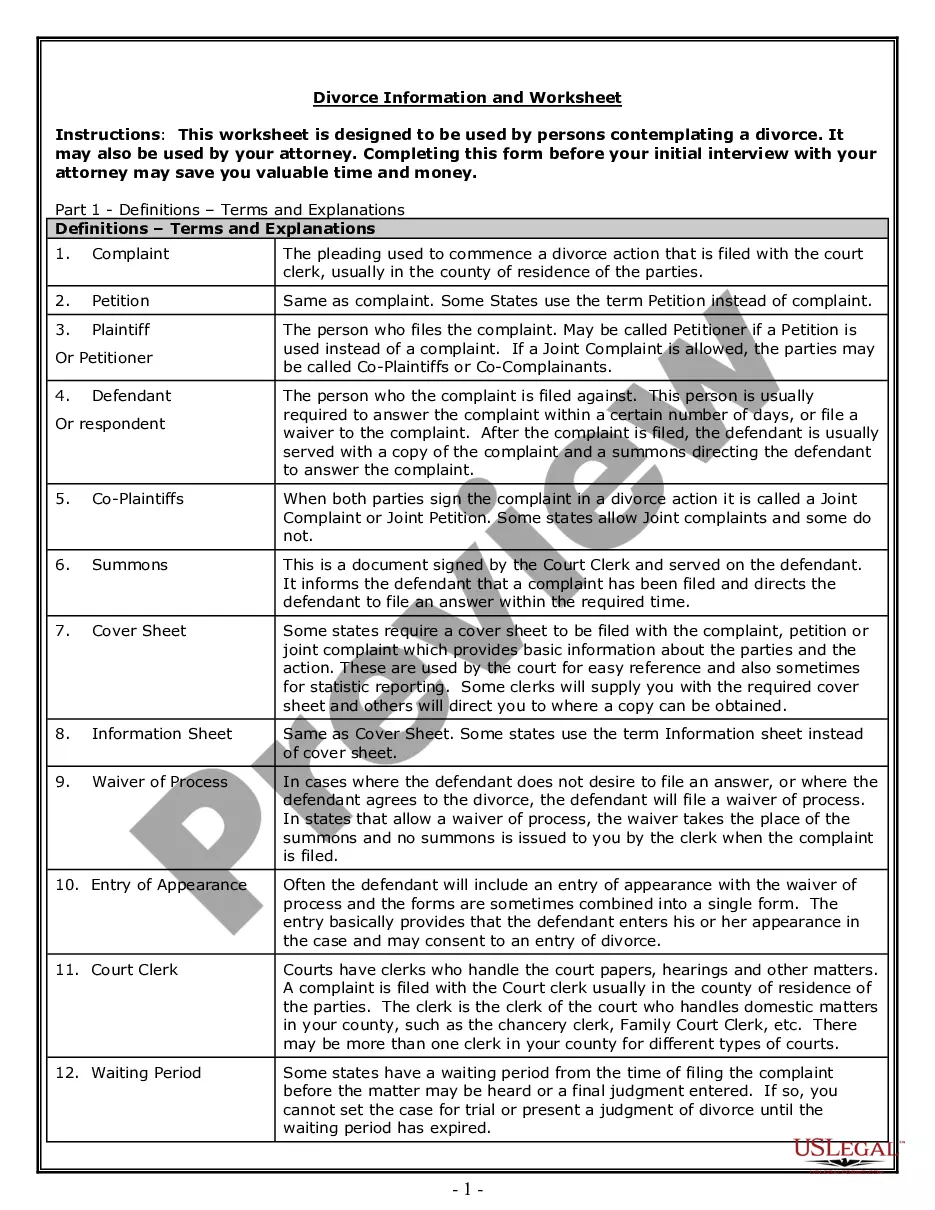

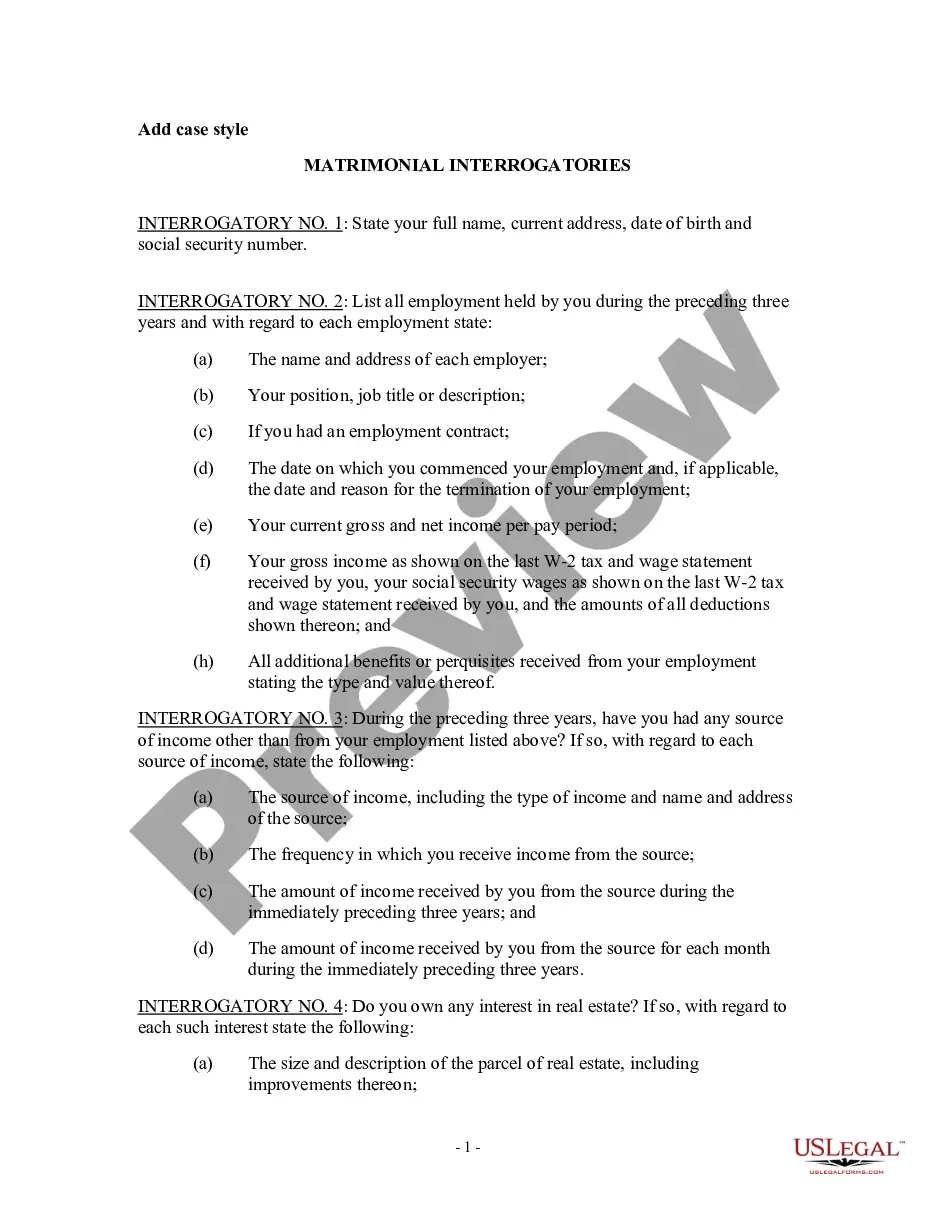

US Legal Forms offers a vast array of template documents, such as the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee, designed to comply with state and federal regulations.

Once you locate the appropriate form, simply click Get now.

Select the pricing plan you prefer, fill in the required details to create your account, and complete the payment using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Review button to evaluate the document.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Lookup section to find the document that fits your needs.

Form popularity

FAQ

An optional deduction is a choice an employee makes to have a set amount deducted from their paycheck for various purposes. Examples include health benefits, retirement contributions, and union dues. Utilizing the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee allows employees to clearly outline their desired deductions and maintain their financial strategy. This clarity helps employees feel more confident in their choices regarding their compensation.

An optional payroll deduction refers to deductions taken from an employee's paycheck that are not mandated by law. These deductions can include contributions to health insurance, charitable donations, or retirement savings plans. By using the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee, individuals can select which deductions they prefer, making their payroll process more personalized. This flexibility can enhance employee satisfaction and financial planning.

An example of an optional payroll deduction is a contribution to a retirement savings plan. Employees can choose to allocate a portion of their salary towards retirement accounts, such as 401(k) plans or IRAs. The Illinois Payroll Deduction Authorization Form for Optional Matters - Employee makes it easier for employees to specify their contribution amounts. This form helps streamline the process and ensures that employees can conveniently manage their payroll deductions.

A wage authorization form is a legal document that allows an employee to authorize deductions from their paycheck for various purposes. The Illinois Payroll Deduction Authorization Form for Optional Matters - Employee specifically covers optional deductions such as union dues, insurance premiums, or retirement contributions. Completing this form ensures that the employee agrees to the specified deductions and understands their implications. Utilizing the US Legal platform, you can easily access and complete this form to manage your payroll deductions effectively.

Form 2159 is used to outline specific payroll deductions and to authorize employers to make those deductions from an employee's paycheck. This form is often required for various optional deductions, ensuring that all parties are aware of and agree to the terms. By utilizing the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee, you can simplify the process of managing these important deductions effectively.

A payroll deduction authorization form is an essential tool that employees use to grant permission for their employers to deduct certain amounts from their wages. This form can cover various optional matters such as health insurance premiums or retirement contributions. Using the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee ensures that deductions are processed correctly and in compliance with Illinois laws.

The form for payroll deduction permission is typically a standardized document that employees complete to authorize their employer to deduct specific amounts from their paychecks. This form ensures that both parties agree on the terms and conditions of the deductions. The Illinois Payroll Deduction Authorization Form for Optional Matters - Employee serves this purpose effectively, providing clarity and legal backing for the deductions.

A payroll deduction agreement is a formal arrangement between an employer and an employee that allows specific amounts to be withheld from the employee's paycheck. This withholding can be for various purposes, such as benefits or charitable contributions. Understanding the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee can streamline this process and ensure compliance with state regulations.

Payroll deduction is the process by which an employer withholds a portion of an employee's earnings, often for taxes or benefits. This process helps manage a variety of expenses, from taxes to retirement plans. Understanding how to correctly implement this through the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee can greatly benefit both you and your employers.

Illinois tax forms should typically be sent to the appropriate department based on the type of form you are submitting. For forms related to payroll deductions, ensure you are sending them to the Illinois Department of Revenue. Using the Illinois Payroll Deduction Authorization Form for Optional Matters - Employee simplifies your submissions and keeps your documentation in order.