Illinois MHA Request for Short Sale

Description

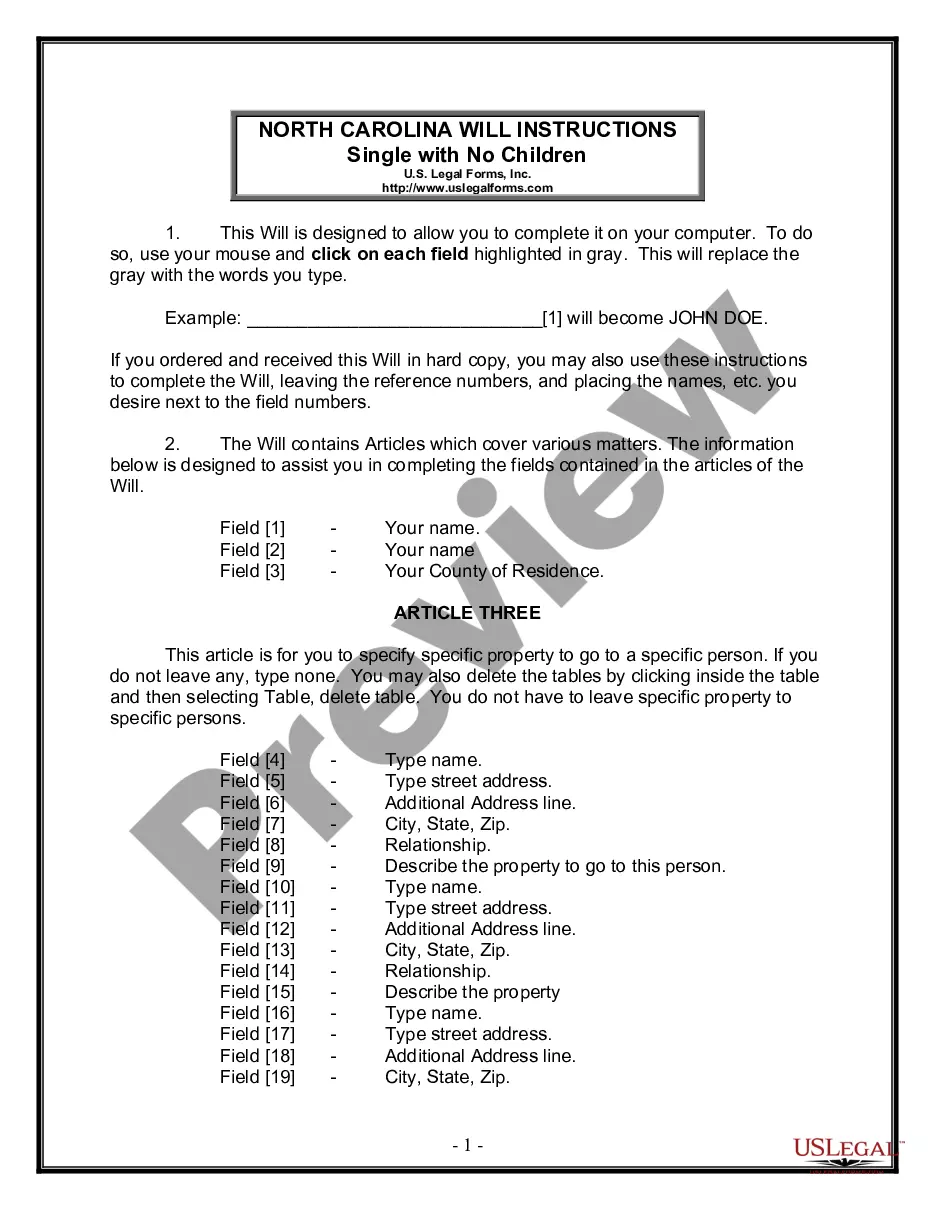

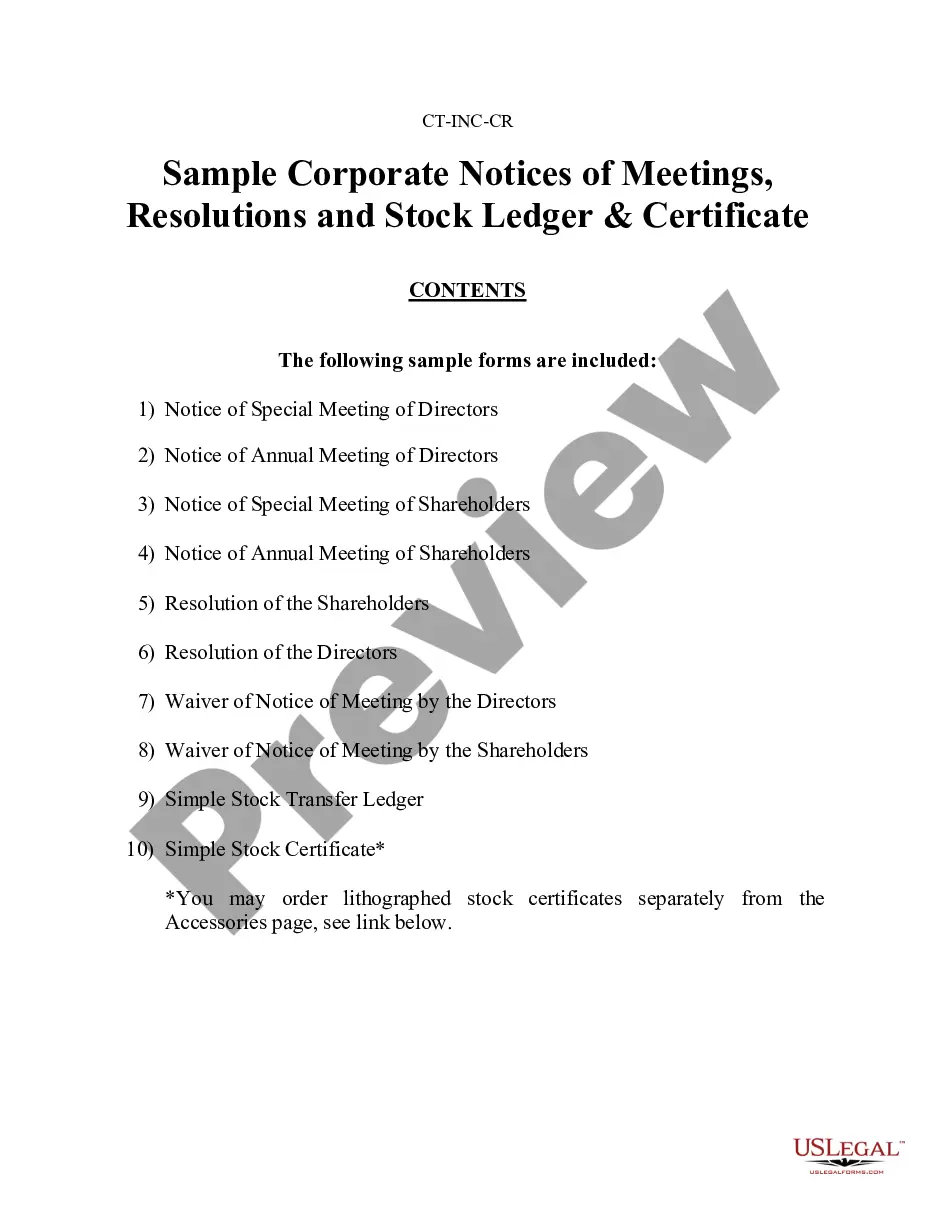

How to fill out MHA Request For Short Sale?

US Legal Forms - one of the largest collections of authentic forms in the United States - offers a variety of official document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Illinois MHA Request for Short Sale in just seconds.

Study the form description to confirm that you have selected the right document.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you already have an account, Log In to download the Illinois MHA Request for Short Sale from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to evaluate the contents of the form.

Form popularity

FAQ

To qualify for a short sale, you must demonstrate a financial hardship preventing you from continuing mortgage payments. The Illinois MHA Request for Short Sale requires proof of this hardship, such as job loss, medical emergencies, or divorce. It is also important that the property’s market value is less than the total outstanding mortgage balance. Ensure your situation aligns with your lender's guidelines to enhance the chances of approval.

To finalize a short sale, gather necessary documents and submit the Illinois MHA Request for Short Sale to your lender. Be prepared to provide a hardship letter, financial statements, and possibly an offer from a potential buyer. Working closely with a real estate professional can simplify this process and ensure your submissions meet the lender’s requirements. Once everything is submitted, maintain communication with your lender to receive updates.

The steps in a short sale begin with the seller listing their property and obtaining approval from the lender. After that, interested buyers will submit offers while the seller submits the Illinois MHA Request for Short Sale to the lender. The lender reviews the documents and decides whether to approve the sale, paving the way for closing the deal. Lastly, ensure all paperwork is completed accurately to expedite the process.

A reasonable offer on a short sale typically factors in the home's current market value and the seller's financial situation. It is essential to present a competitive offer, as the lender will review this when considering the Illinois MHA Request for Short Sale. Collaborating with a knowledgeable real estate agent can help you determine an appropriate offer that balances both your needs and the seller's circumstances.

To complete a short sale, start by contacting your lender to discuss their requirements. You will need to submit the Illinois MHA Request for Short Sale form along with pertinent financial documents. This information helps the lender evaluate your situation and decide if they will approve the short sale. Finally, ensure that you work with a real estate agent experienced in short sales to streamline the process.

The time it takes for an Illinois MHA Request for Short Sale to be approved can vary, often ranging from a few weeks to several months. Factors that influence this timeline include your lender’s processing speed and the completeness of your application. Keep in mind that providing the necessary information right away can help expedite the process. For assistance, consider using USLegalForms to ensure your short sale request meets all requirements.

To get approved for an Illinois MHA Request for Short Sale, you need to show your lender that you cannot afford your mortgage payments. Start by gathering your financial documents, including income statements and expenses. Submit a complete short sale package that clearly outlines your situation, along with the necessary forms from the Illinois MHA program. Using USLegalForms can help streamline this process by providing the required documentation and guidance.

Short sales can indeed affect your credit score, but typically not as severely as a foreclosure. The impact on your credit report generally results in a negative entry, which can stay on your report for up to seven years. When navigating the Illinois MHA Request for Short Sale, understanding the credit implications can help you make informed decisions about rebuilding your financial health afterward.

Yes, in Illinois, lenders may pursue a deficiency judgment after a short sale if they do not explicitly waive this right. It is crucial to negotiate this aspect with your lender before finalizing the agreement. Engaging in the Illinois MHA Request for Short Sale helps clarify any potential liabilities, providing you with a better understanding of your financial standing post-sale.

Key requirements for a short sale typically include proof of financial hardship and a completed short sale application from your lender. Most lenders will require a market analysis to confirm that the home value is less than the mortgage balance. By understanding the Illinois MHA Request for Short Sale, you can better meet these requirements and submit a strong application.