Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

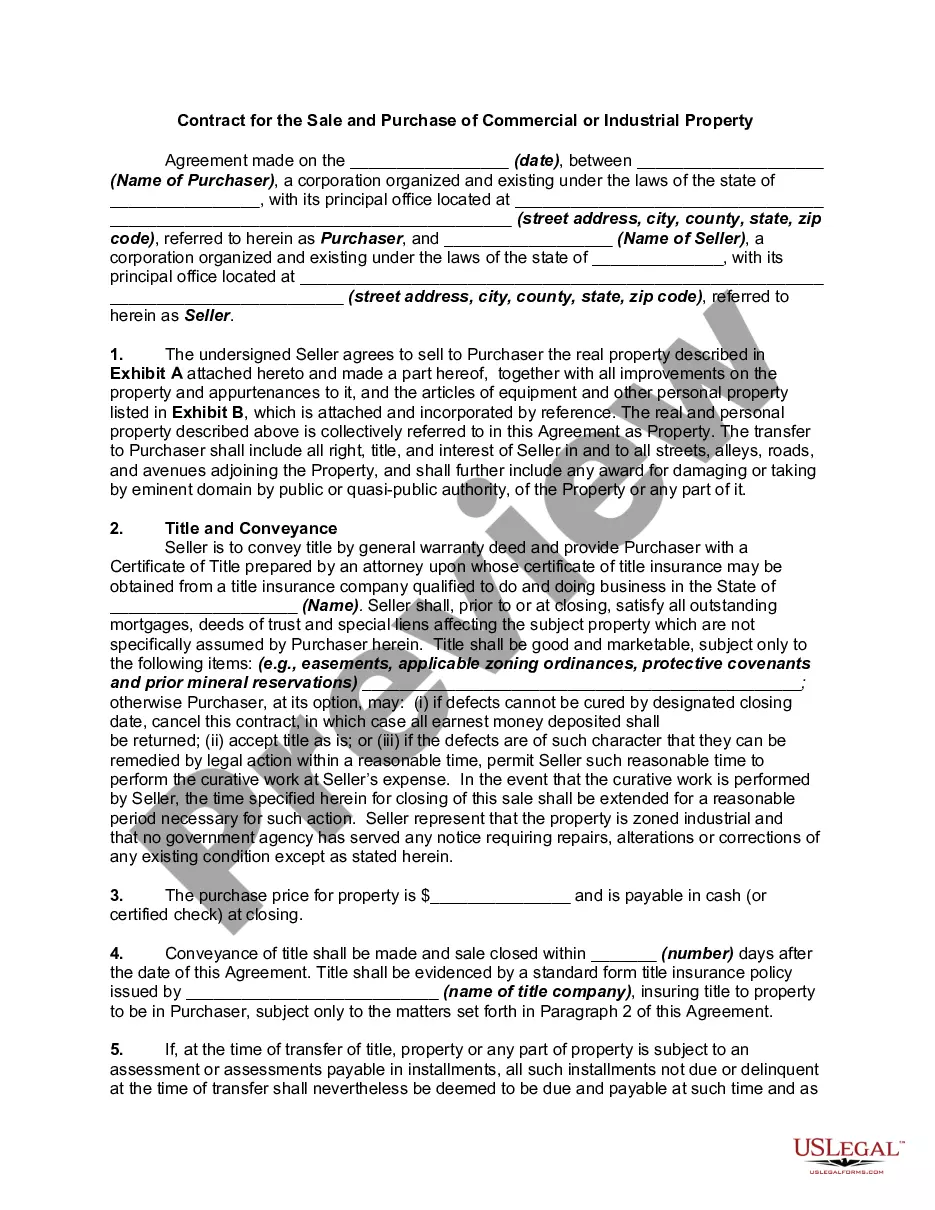

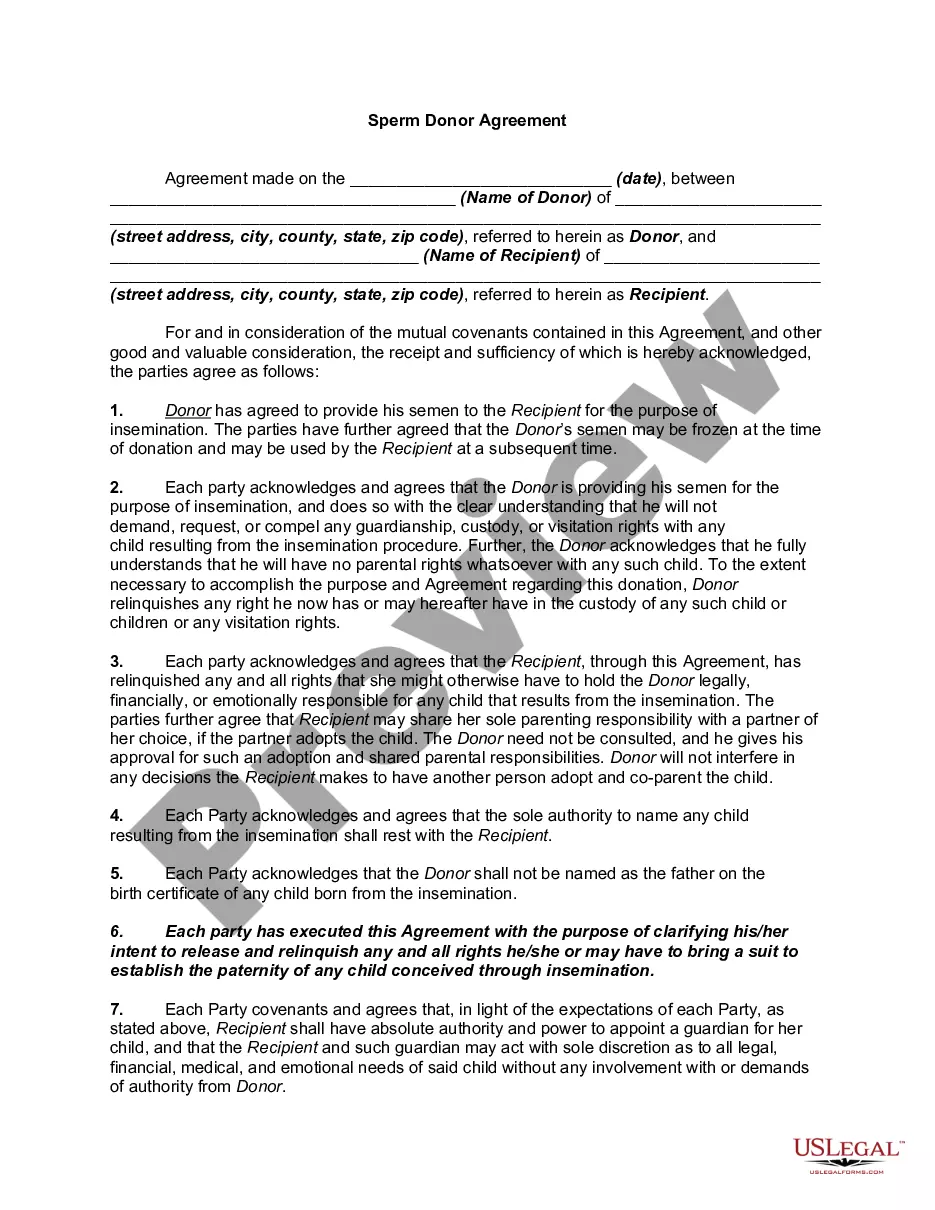

US Legal Forms - one of the top collections of legal documents in the United States - offers a broad selection of legal document templates that you can obtain or print.

By utilizing the website, you can discover thousands of forms for business and individual purposes, organized by categories, states, or keywords. You can find the latest versions of forms, such as the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in just a few minutes.

If you hold a subscription, Log In to access the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP from the US Legal Forms repository. The Download feature will appear on every form you view. You can access all previously acquired forms in the My documents section of your profile.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill in, modify, print, and sign the downloaded Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Each template you save in your account does not expire and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a variety of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your city/county.

- Click the Review option to evaluate the content of the form.

- Check the form details to ensure you have picked the right template.

- If the form does not fit your requirements, use the Search box at the top of the screen to find a suitable one.

- Once you are content with the form, confirm your selection by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

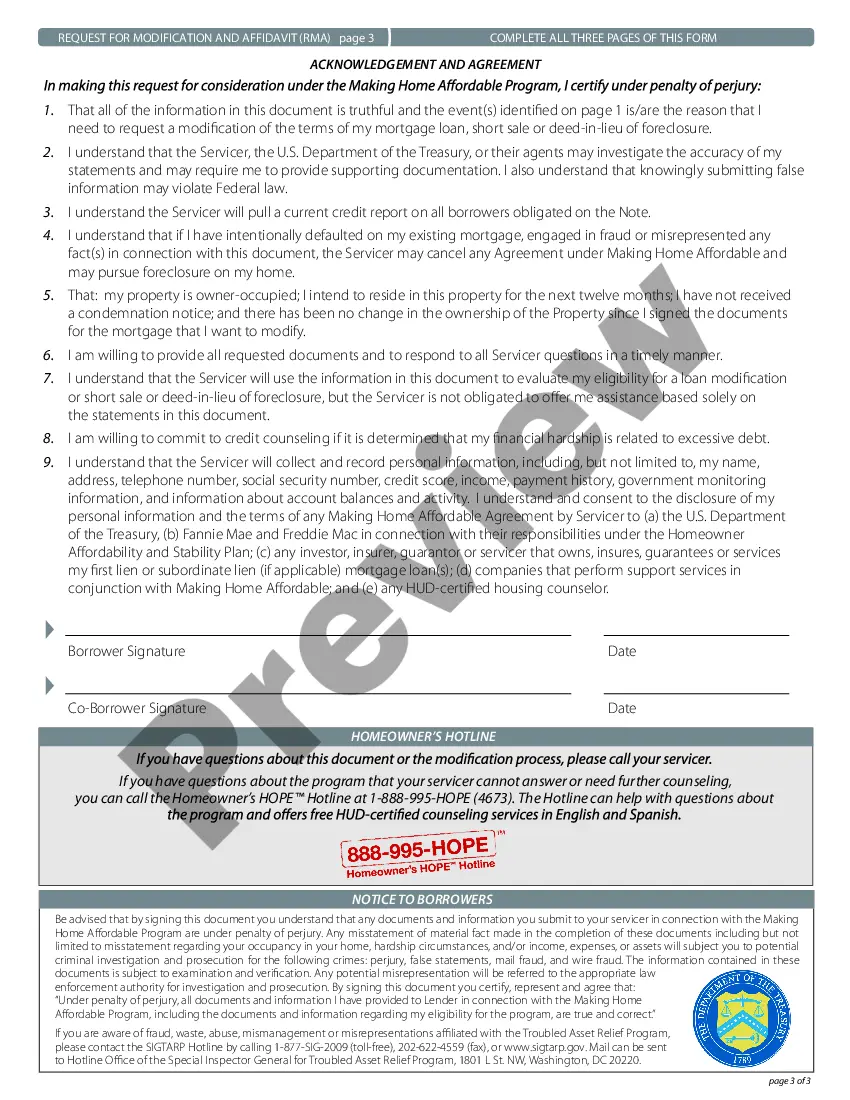

A mortgage loan modification can be a beneficial option for homeowners facing financial difficulties. It offers the potential to reduce monthly payments and prevent foreclosure, making it an attractive solution. For those considering this route, completing an Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can be an essential step toward regaining financial control.

As of 2025, the Home Affordable Modification Program HAMP is no longer available, as it was phased out after its initial rollout. However, many options still exist for homeowners seeking assistance with their mortgage payments. Exploring alternatives aligned with the Illinois Request for Loan Modification RMA can help borrowers navigate their options effectively through available resources and support.

A HAMP loan modification specifically refers to the restructuring of a mortgage loan through the Home Affordable Modification Program. This process aims to reduce monthly payments to an affordable level, helping borrowers avoid foreclosure. For homeowners interested in this solution, filing an Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can initiate the modification process.

A HAMP modification refers to the alteration of your mortgage terms to make payments more manageable. This can include reducing the interest rate, extending the loan term, or even reducing the principal balance. Homeowners who utilize the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can benefit from these changes, ultimately leading to improved financial stability.

HAMP stands for Home Affordable Modification Program. This program was established to help homeowners who are struggling with mortgage payments by providing various options to modify their loans. Utilizing the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can significantly ease the financial burden on those in need of assistance.

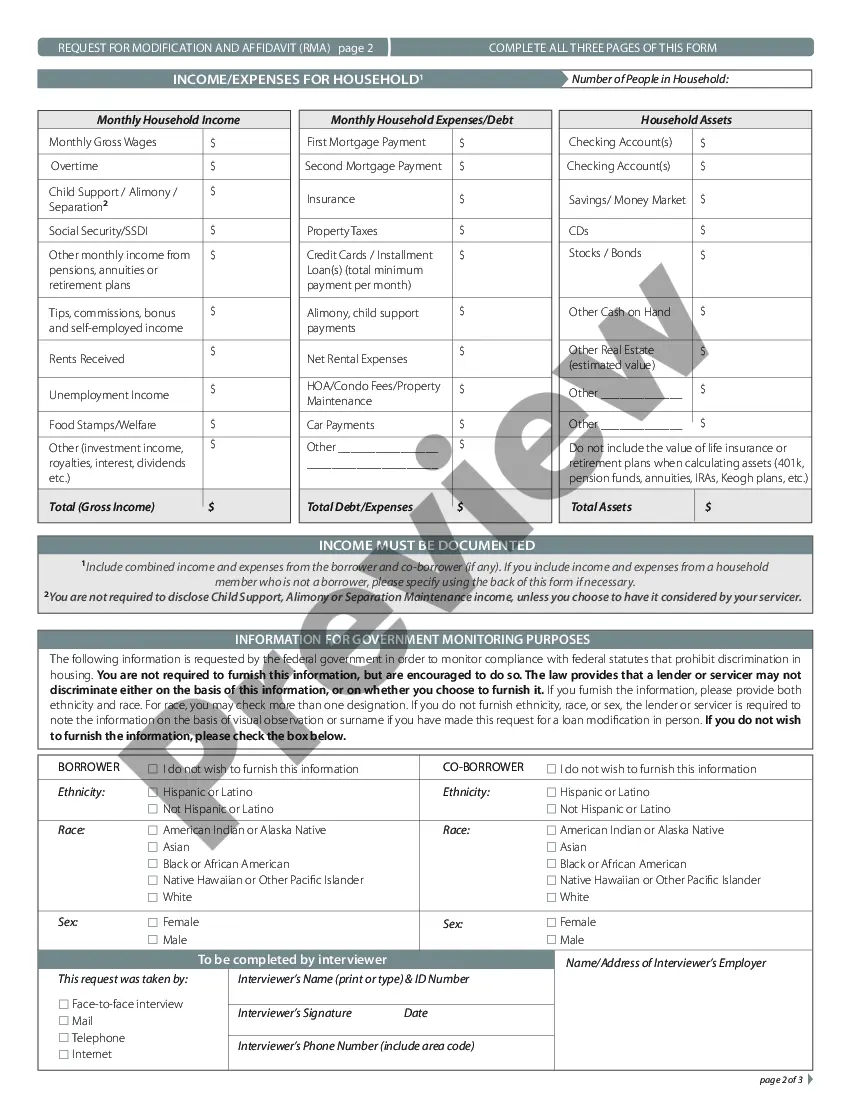

In mortgage terms, RMA stands for Request for Mortgage Assistance. This is a crucial document used by borrowers seeking help with their mortgage payments. By submitting an RMA, homeowners can formally request a modification of their loan under the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, which aims to make loans more affordable.

Yes, HAMP modifications are still available for eligible homeowners who seek assistance with their mortgage payments. While the program has evolved, various local initiatives continue to offer support under similar guidelines. The Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP remains an essential resource for those looking to secure a more manageable mortgage payment.

Requesting a mature modification on your loan involves submitting a formal request to your loan servicer, along with supporting documents that outline your current financial situation. It is important to clearly state the reasons you are seeking a modification. The Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP provides a framework for these types of requests, helping borrowers find feasible solutions.

To apply for a loan modification, you typically need to contact your loan servicer and ask for the necessary forms. Gather your financial documents, as they will be crucial for the review process. Programs like the Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP offer specific guidelines to follow, making the process smoother for applicants.

Yes, Congress passed several mortgage relief programs over the years, including HAMP. This initiative aims to provide relief to struggling homeowners through modifications that make mortgages more affordable. The Illinois Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is one of the key options available that helps eligible individuals reduce their monthly mortgage payments.