Illinois Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

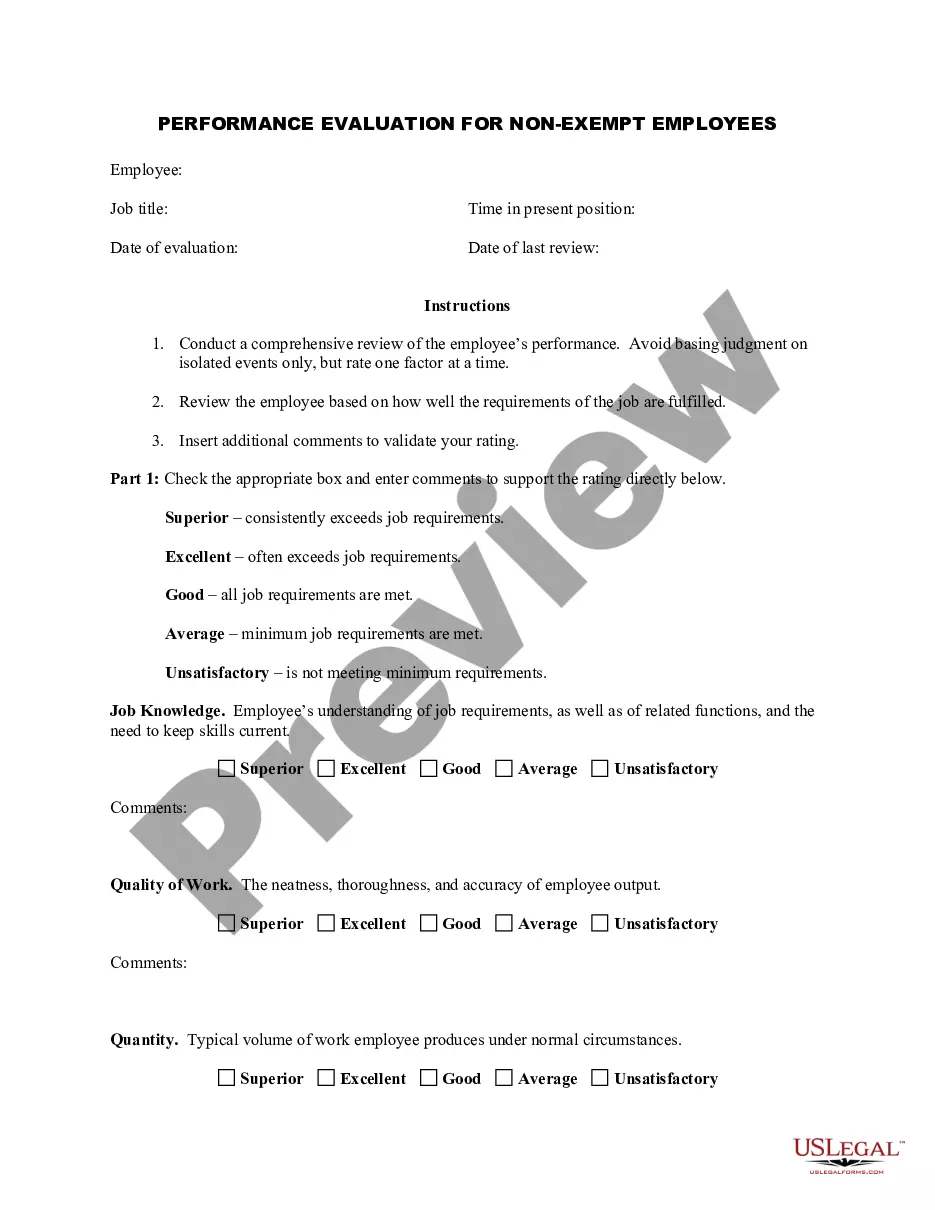

If you need to complete, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and convenient search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find other forms in the legal form template.

Step 4. After you've found the form you need, click the Get now button. Select your preferred payment plan and enter your information to register for an account.

- Use US Legal Forms to find the Illinois Qualified Written RESPA Request to Dispute or Validate Debt with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Illinois Qualified Written RESPA Request to Dispute or Validate Debt.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps mentioned below.

- Step 1. Ensure you have chosen the form for the correct city/state.

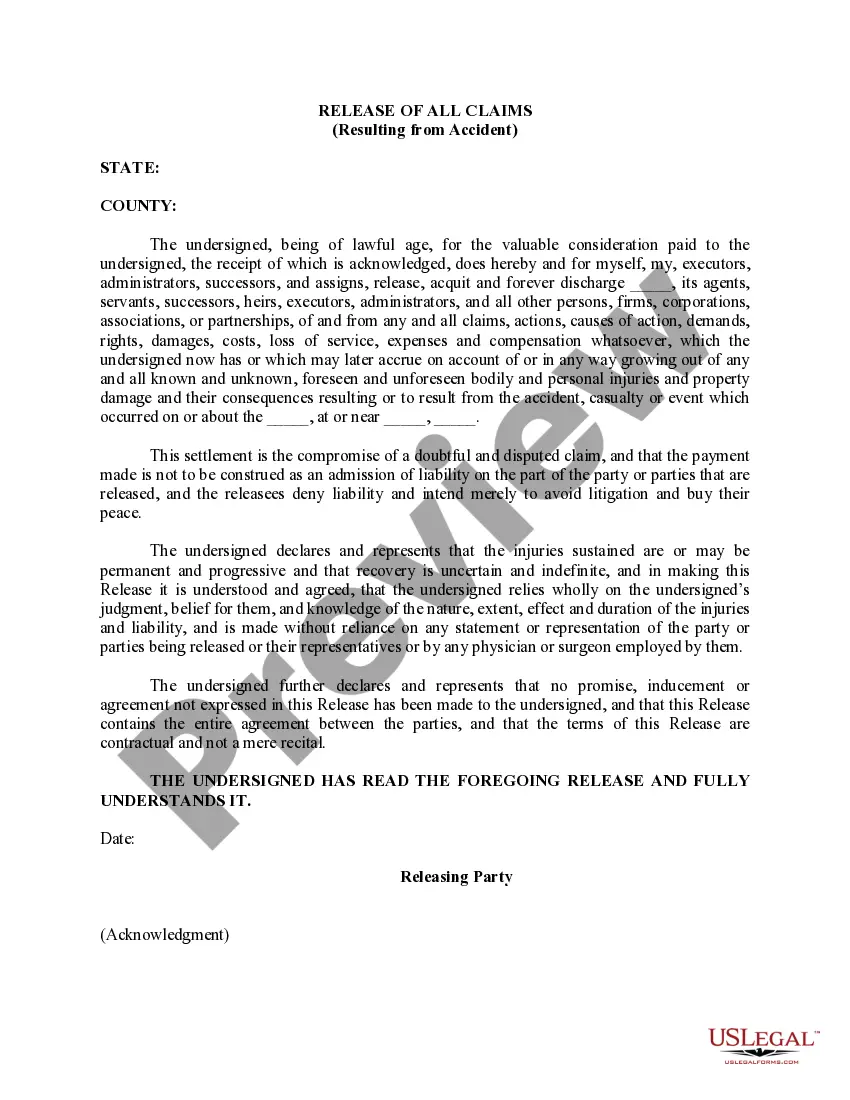

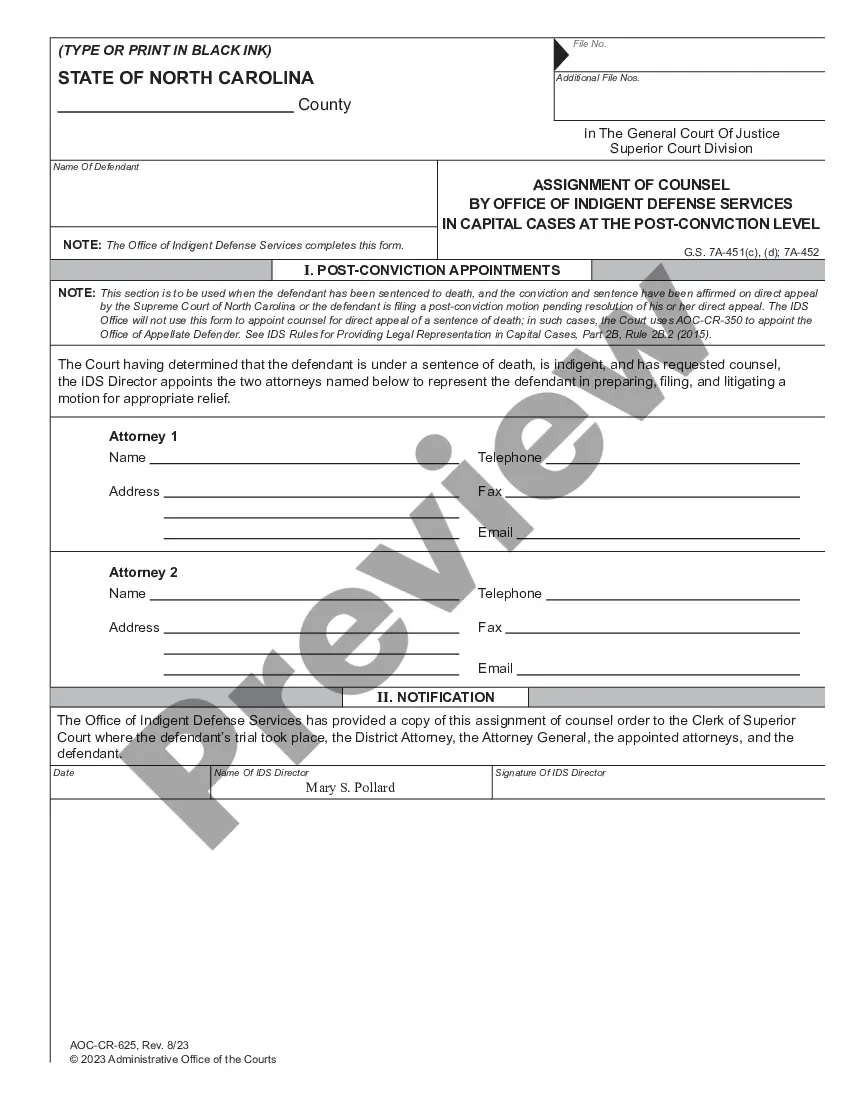

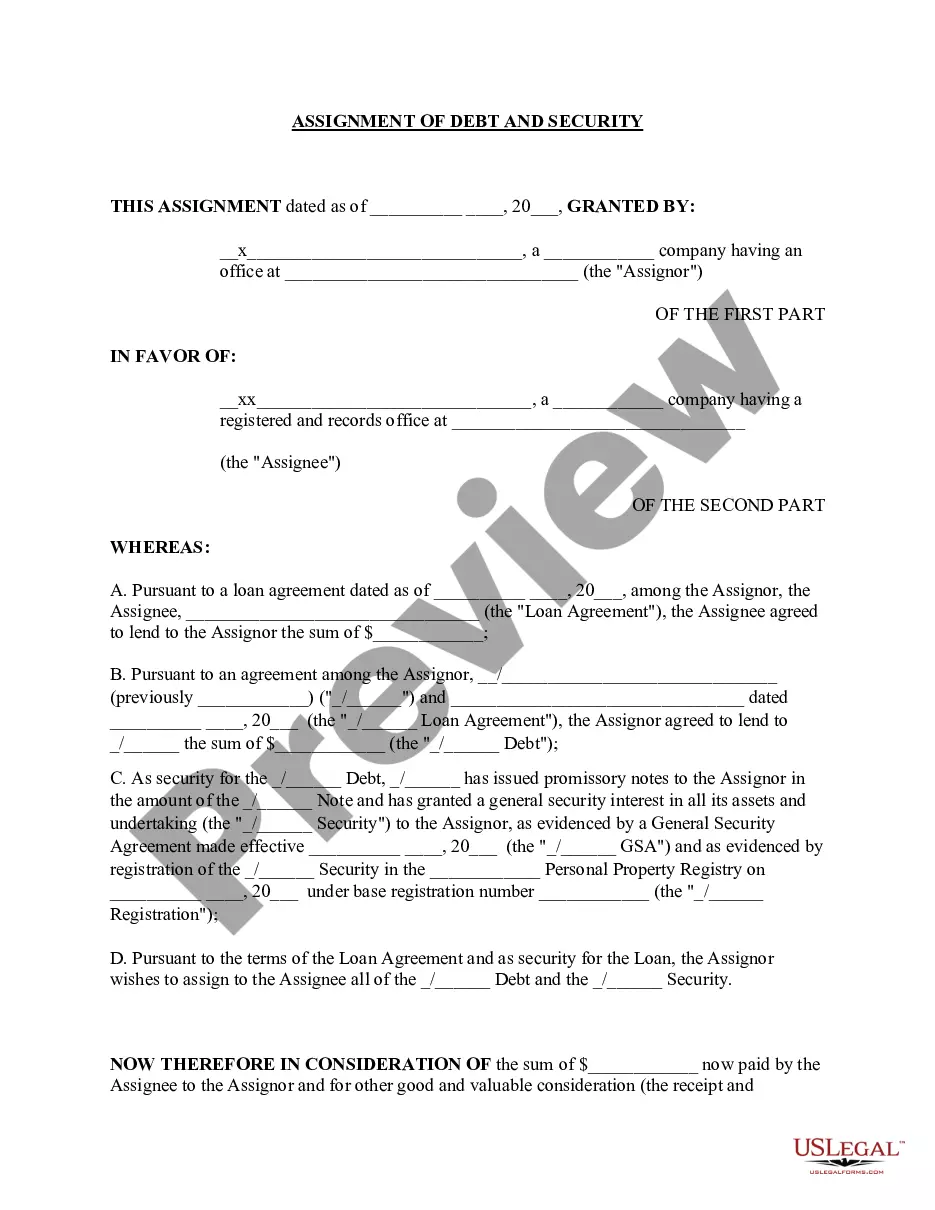

- Step 2. Use the Review option to examine the form's details. Don't forget to check the summary.

Form popularity

FAQ

In your dispute letter to a mortgage company, begin by stating your account details and the specific errors you are challenging. Include references to the relevant Illinois Qualified Written RESPA Request to Dispute or Validate Debt, and clearly express the resolution you seek. It's vital to maintain a professional tone and attach any supporting documents. Using our platform at uslegalforms, you can access templates and guidance to create an effective dispute letter.

Writing a qualified written request involves being clear and concise. Start with your contact information, include a statement that identifies the request pertains to the Illinois Qualified Written RESPA Request to Dispute or Validate Debt, and outline the issues or concerns clearly. Make sure to send the request via certified mail, track its delivery, and keep copies for your records. This approach ensures the lender treats your request seriously.

A lender must provide the required RESPA information to a buyer within a specified timeframe after receiving a qualified written request. Under the Real Estate Settlement Procedures Act (RESPA), this information must be sent to the borrower within 20 business days. It is crucial for buyers to understand these timelines to ensure their rights are protected. Utilizing an Illinois Qualified Written RESPA Request to Dispute or Validate Debt can facilitate this communication.

A debt collector is required to provide a written validation notice within five days of their initial contact with you. This notice must include crucial details about the debt, such as the amount owed and your rights as a consumer. If you feel the notice is insufficient, you can file an Illinois Qualified Written RESPA Request to Dispute or Validate Debt to demand more information.

To write a letter disputing the validity of a debt, clearly state the debt you are challenging and request validation from the creditor. Include your account details and any relevant facts, ensuring your tone is professional and direct. An Illinois Qualified Written RESPA Request to Dispute or Validate Debt can serve as a template for this communication, helping you achieve a structured and effective dispute.

A debt validation dispute occurs when a borrower contests the validity of a debt that a collector claims is owed. This process requires the collector to provide evidence that you are liable for the debt. By filing an Illinois Qualified Written RESPA Request to Dispute or Validate Debt, you initiate a formal request for this proof, which can protect you from wrongful collection practices.

Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days.

If you believe you do not owe the debt or that it's not even your debt, send a written request to the debt collector and dispute the debt. You can also send a written request to the debt collector to receive more information about the debt.

A qualified written request, or QWR, is a written letter sent to the servicer that: requests information about the loan (called a "request for information" under RESPA), and/or. asks that the servicer correct an error (a "notice of error").

Keep in mind that disputing the validity of a debt does not mean you are refusing to pay. Rather, the collection agency must provide proof that you are legally obligated to pay the money to it. If the collection agency cannot provide this information, you are under no legal obligation to pay them.