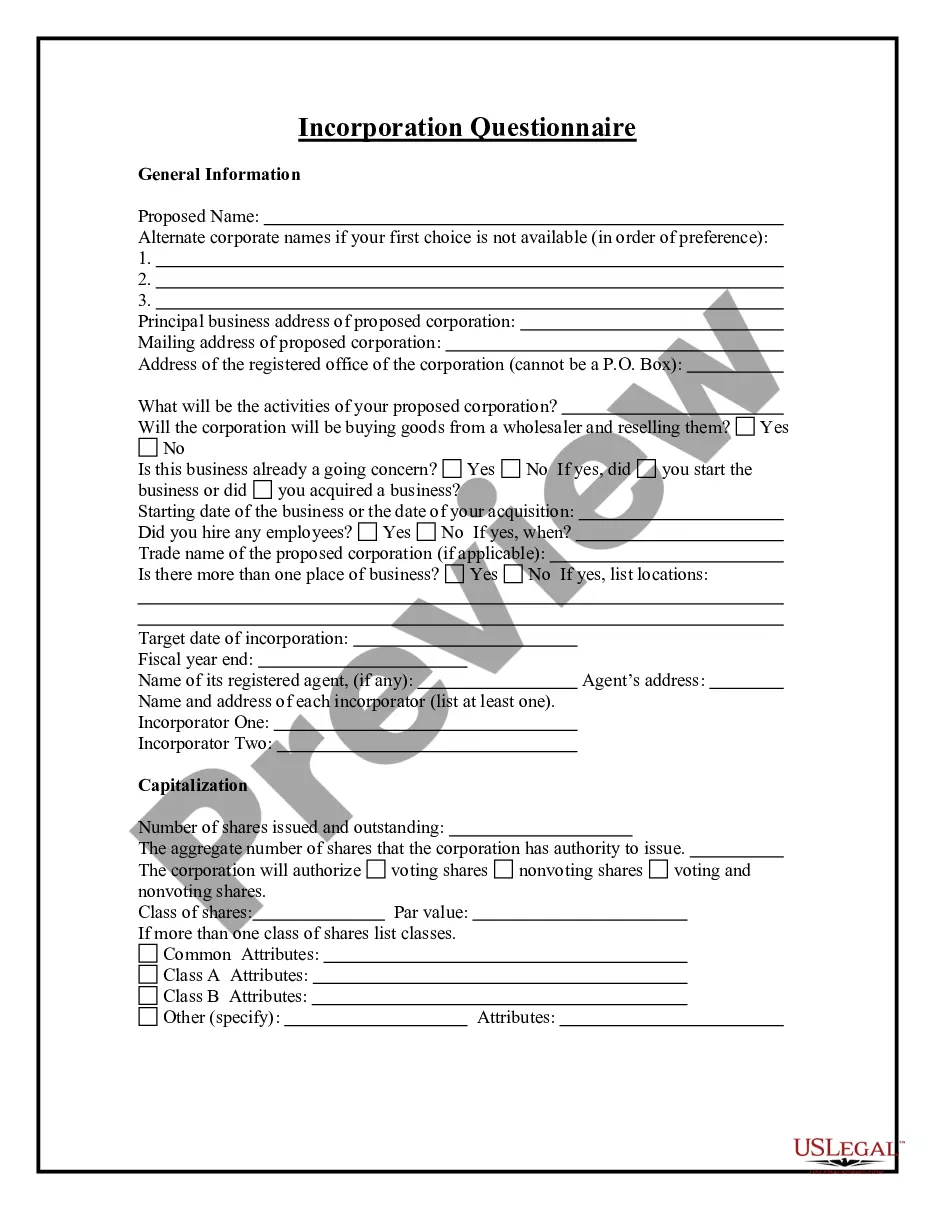

Illinois Incorporation Questionnaire

Description

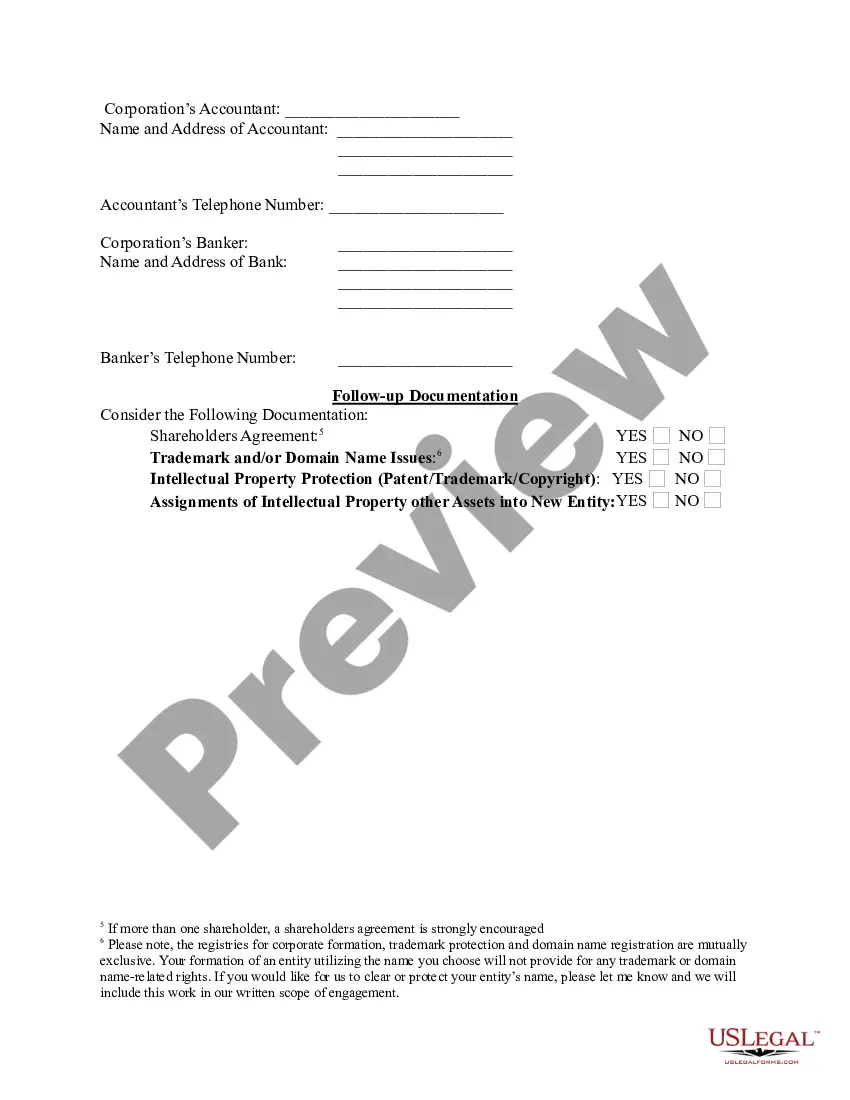

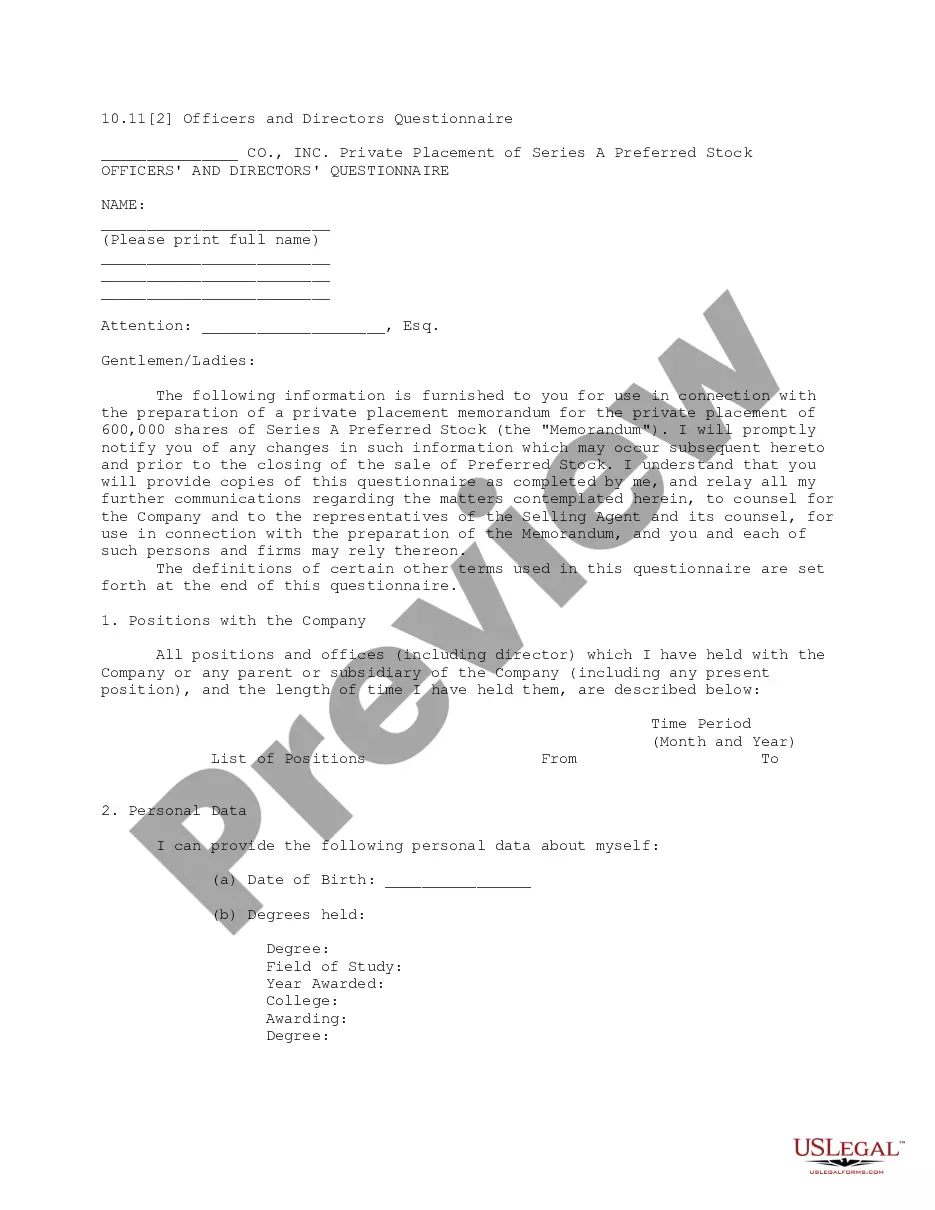

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews."

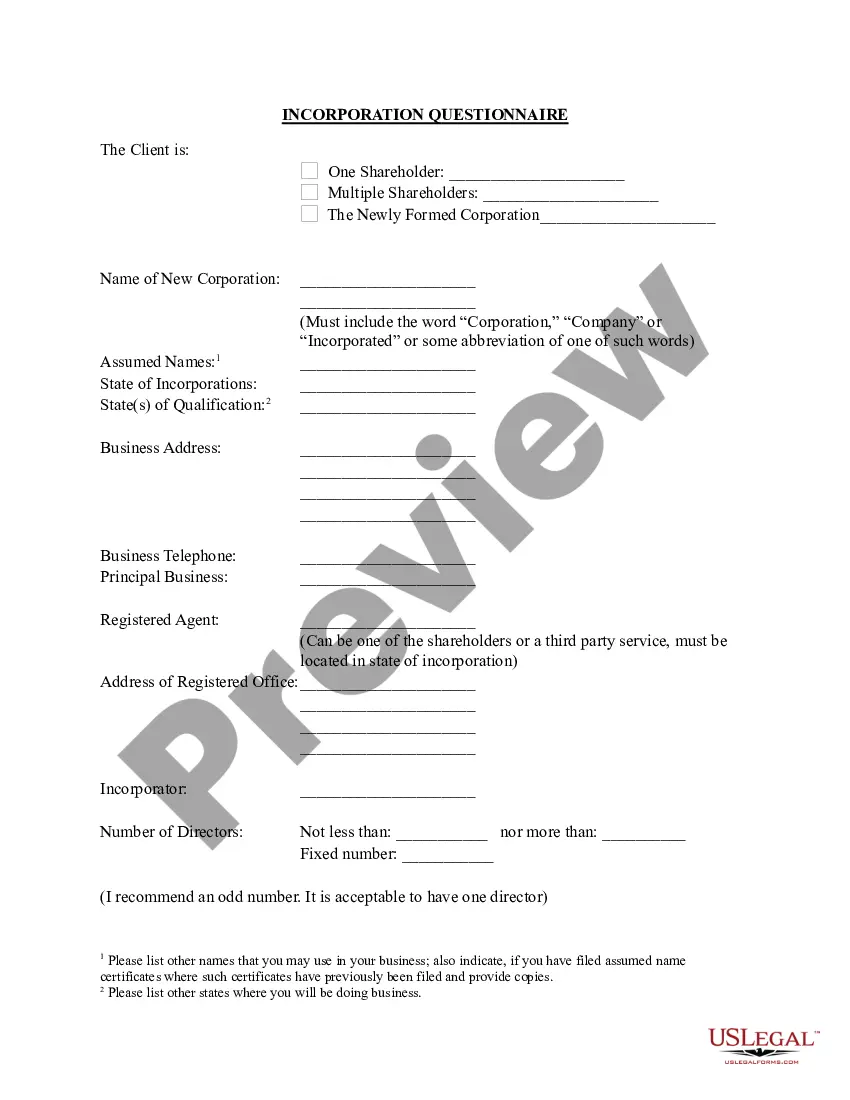

How to fill out Incorporation Questionnaire?

US Legal Forms - one of several largest libraries of legal types in America - offers a wide array of legal document themes it is possible to acquire or print out. Making use of the web site, you may get thousands of types for enterprise and specific reasons, sorted by categories, says, or search phrases.You can find the latest versions of types just like the Illinois Incorporation Questionnaire within minutes.

If you already possess a monthly subscription, log in and acquire Illinois Incorporation Questionnaire from the US Legal Forms local library. The Down load option can look on each and every form you view. You have accessibility to all in the past saved types within the My Forms tab of your respective account.

If you would like use US Legal Forms the first time, allow me to share straightforward recommendations to help you started off:

- Ensure you have chosen the correct form for the town/area. Click on the Review option to check the form`s information. See the form explanation to actually have selected the proper form.

- If the form does not match your needs, take advantage of the Look for industry at the top of the screen to discover the one which does.

- When you are content with the form, confirm your option by visiting the Acquire now option. Then, pick the pricing prepare you want and give your references to register for the account.

- Method the financial transaction. Use your Visa or Mastercard or PayPal account to accomplish the financial transaction.

- Pick the format and acquire the form on your own gadget.

- Make changes. Fill out, revise and print out and indication the saved Illinois Incorporation Questionnaire.

Each web template you put into your money does not have an expiration date which is yours permanently. So, if you want to acquire or print out one more backup, just visit the My Forms section and then click in the form you require.

Gain access to the Illinois Incorporation Questionnaire with US Legal Forms, one of the most substantial local library of legal document themes. Use thousands of expert and condition-distinct themes that meet your company or specific requirements and needs.

Form popularity

FAQ

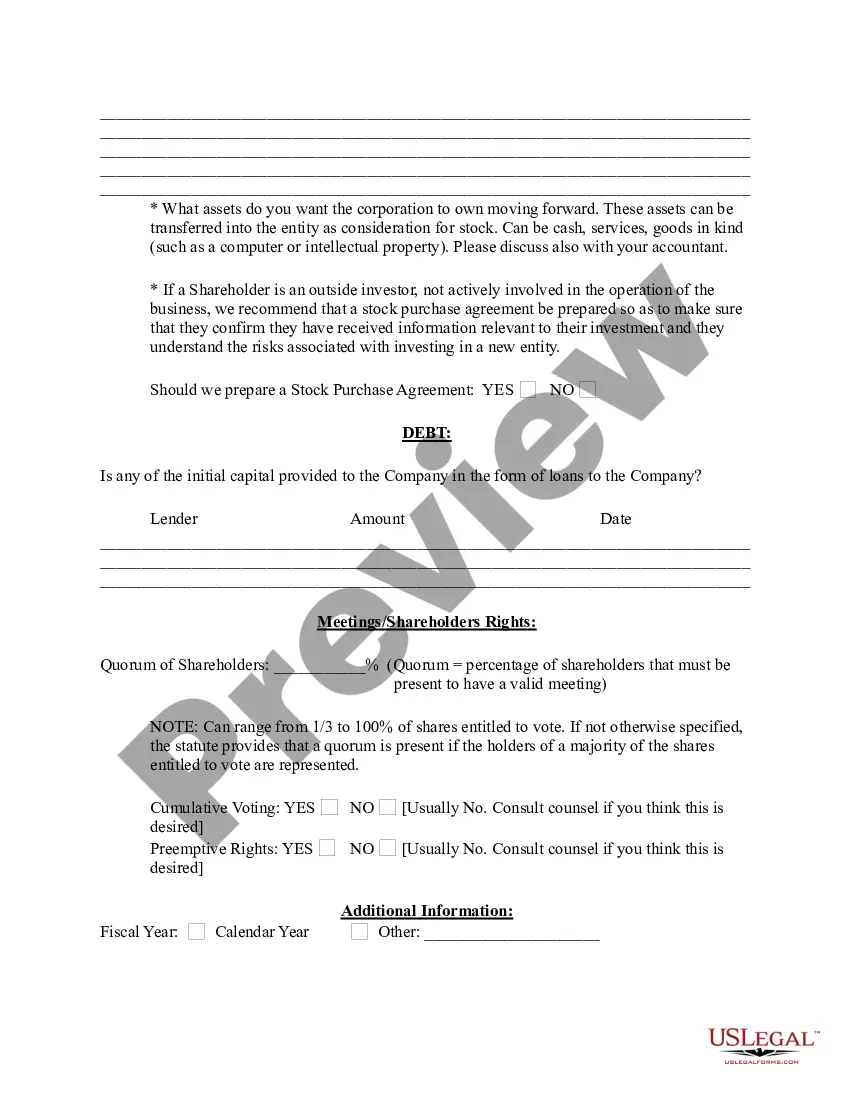

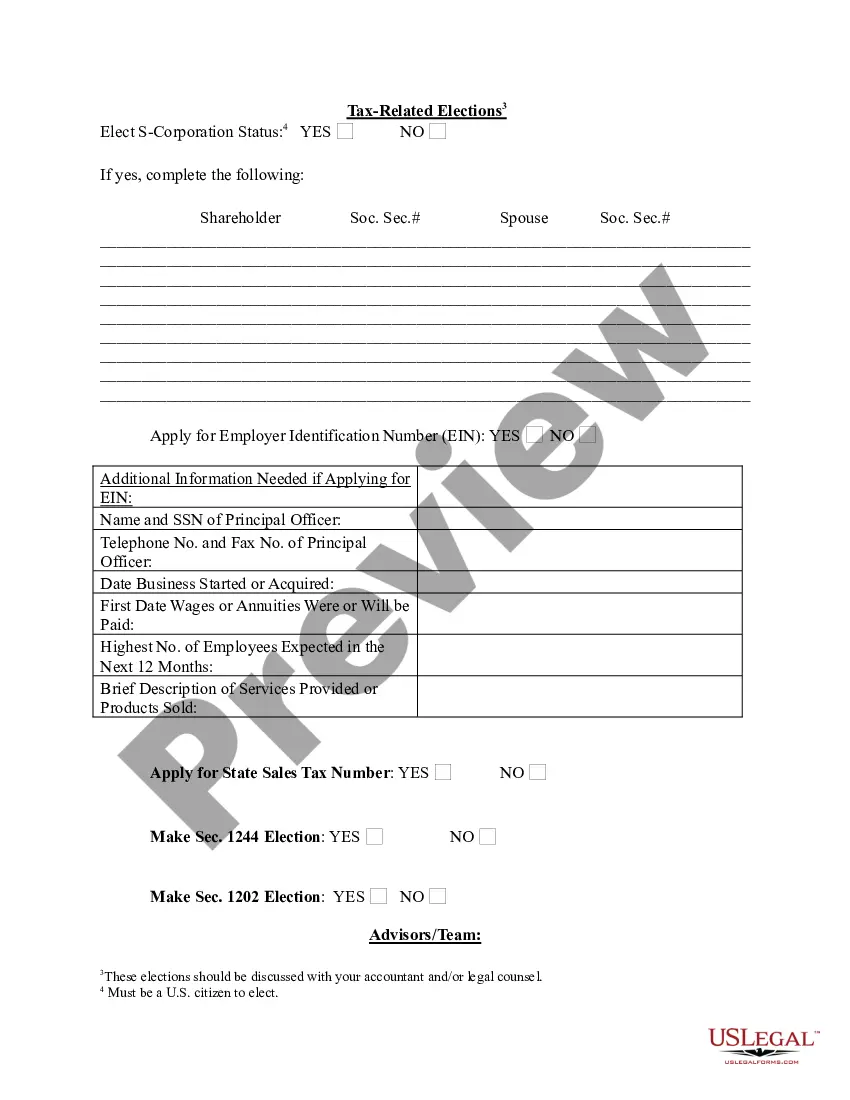

To form an Illinois S corp, you'll need to ensure your company has an Illinois formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

How long does it take to incorporate in Illinois? Regular processing of articles of incorporation takes about four weeks, plus an additional two or three days to mail the final documents. Regular filing time for an LLC (limited liability company) is between seven and ten business days.

Forming an Illinois Corporation is Easy Step 1: Create a Name For Your Illinois Corporation. ... Step 2: Choose an Illinois Registered Agent. ... Step 3: Choose Your Illinois Corporation's Initial Directors. ... Step 4: File the State of Illinois Articles of Incorporation. ... Step 5: Get an EIN.

Form an Illinois Corporation: Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account. File State Reports & Taxes.

Form NumberForm NameFeeBCA 2.10Articles of Incorporation$150BCA 2.10(MCA)Articles of Incorporation (Medical Corporation)$150BCA 2.10(2A)Articles of Incorporation (Close Corporation)$150BCA 2.10(PSCA)Articles of Incorporation (Professional Service Corporation)$15042 more rows

Illinois Corporation Incorporation: $150 filing fee + franchise tax ($25 minimum) + optional $100 expedite fee. The expedite fee is required if you file online. Franchise tax is calculated as $1.50 per $1,000 on the paid-in capital represented in this state.

Specific Rules for Illinois Business Names The name of a corporation or foreign corporation must contain: Shall contain, separate and apart from any other word or abbreviation in such name, the word "corporation", "company", "incorporated", or "limited", or an abbreviation of one of such words.

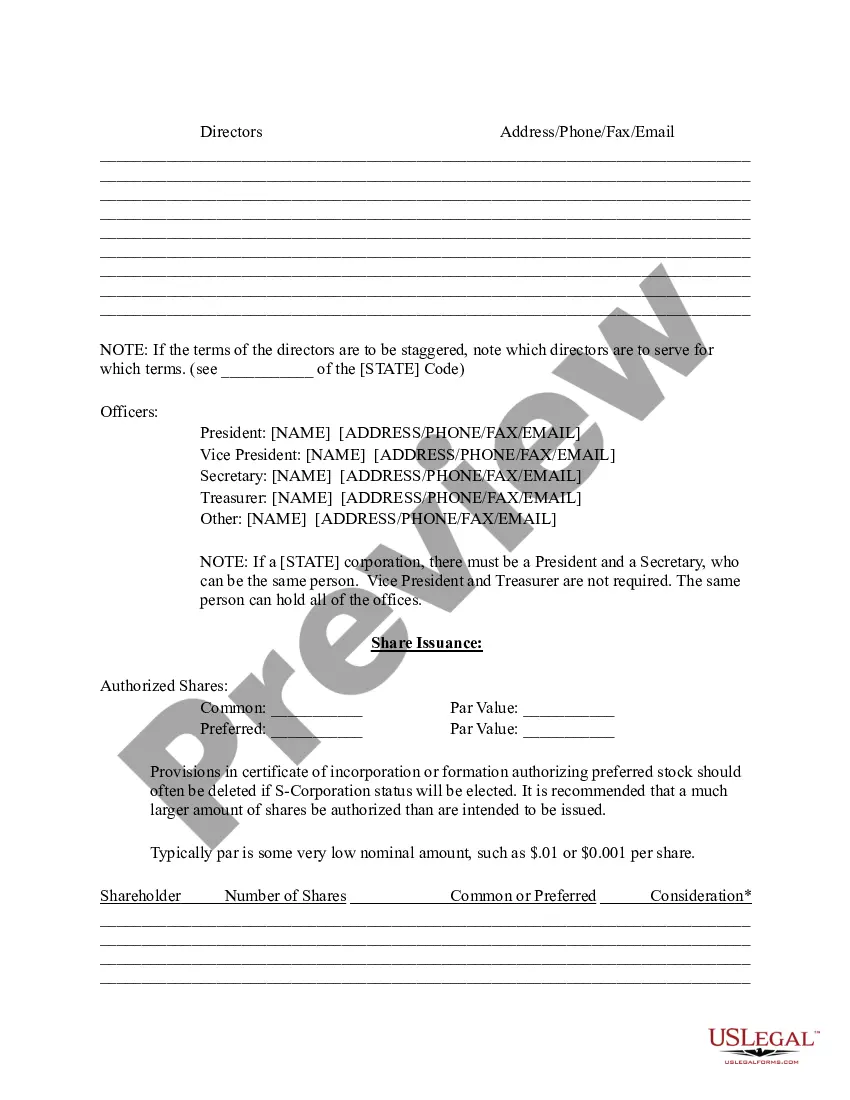

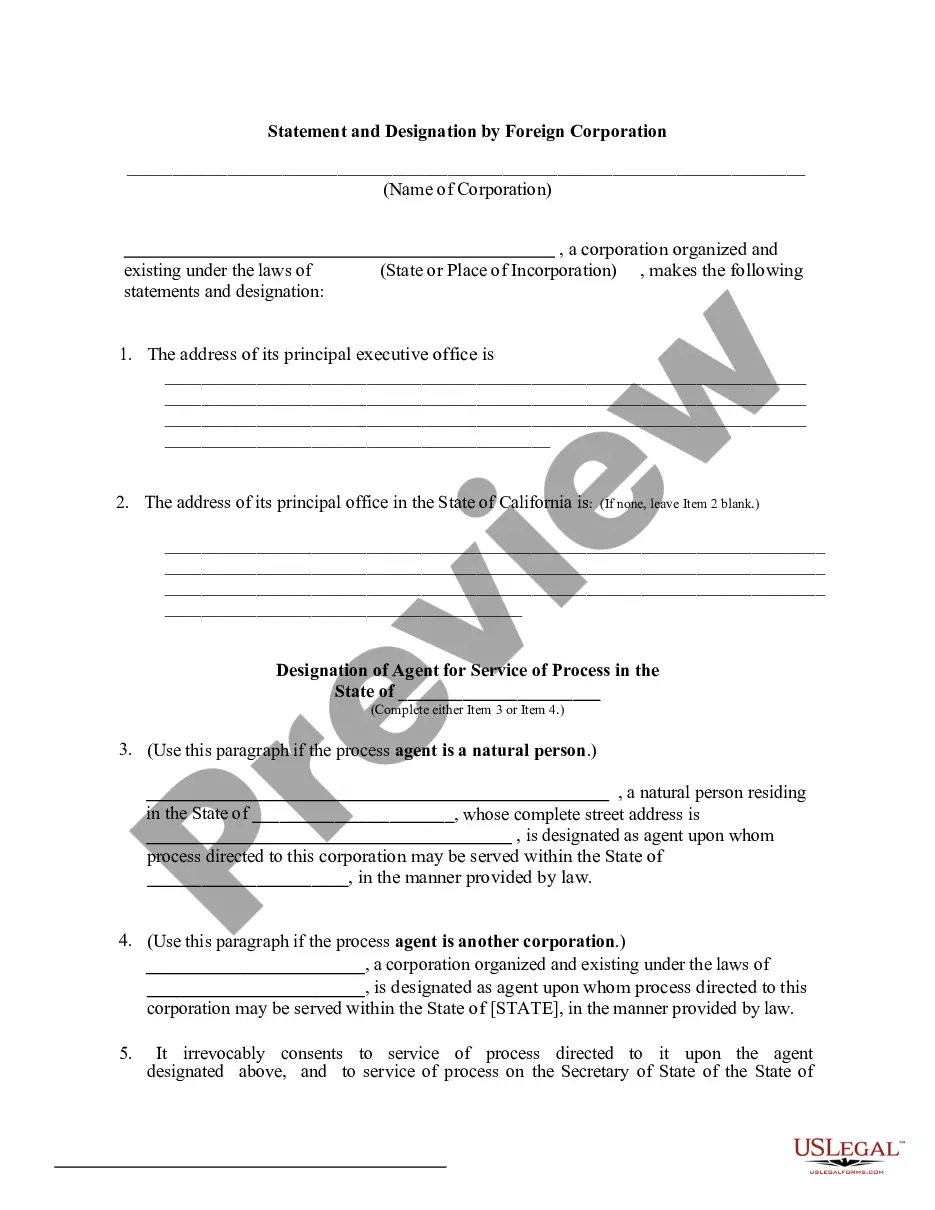

Articles of Incorporation in Illinois ask for: Name. ... Initial Registered Agent's Name, Address, and Mailing Address. ... Purpose (optional) ... Authorized shares. ... Directors (optional) ... Estimated Values (optional) ... Other Provisions (optional) ... Name and address of incorporator(s)