Illinois Shareholder Agreements - An Overview

Description

How to fill out Shareholder Agreements - An Overview?

Are you presently in the position that you require papers for both company or individual purposes almost every working day? There are a lot of authorized document web templates available on the Internet, but locating ones you can depend on is not easy. US Legal Forms gives a huge number of develop web templates, much like the Illinois Shareholder Agreements - An Overview, that are written to meet state and federal demands.

If you are currently informed about US Legal Forms web site and possess a merchant account, merely log in. Following that, you may obtain the Illinois Shareholder Agreements - An Overview web template.

Unless you offer an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is for your right city/county.

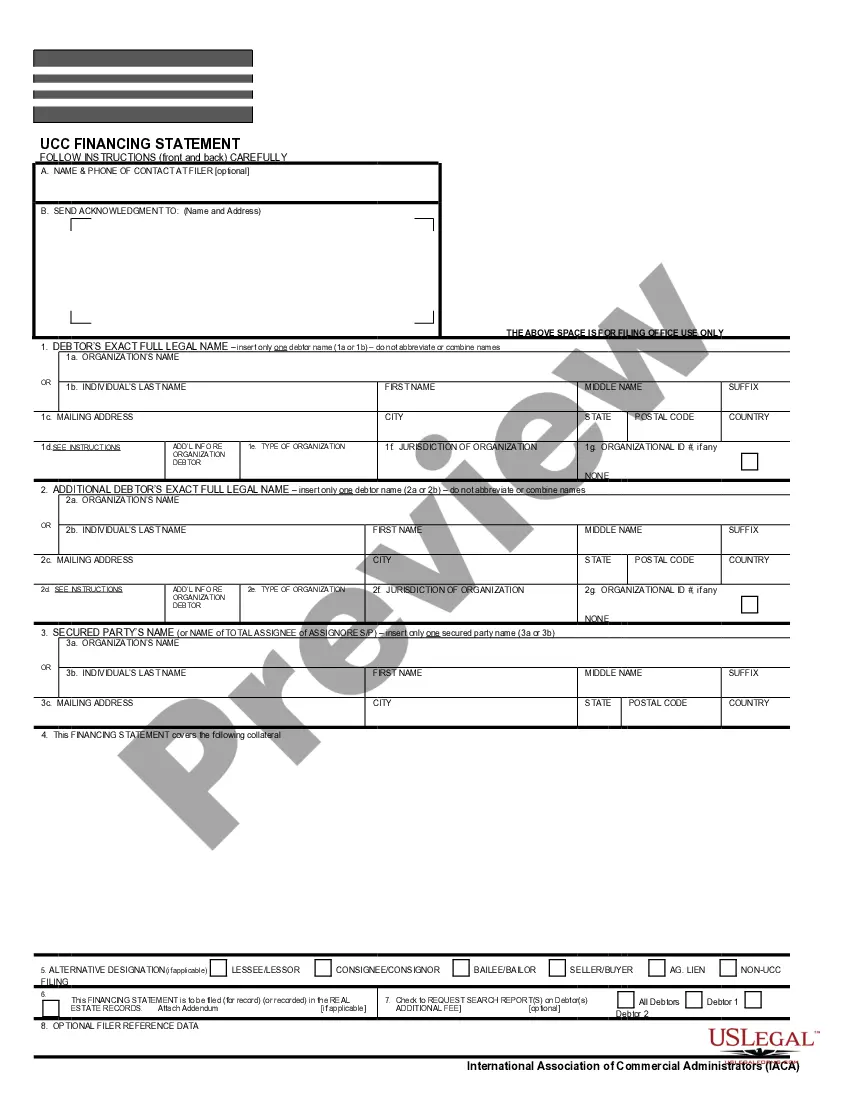

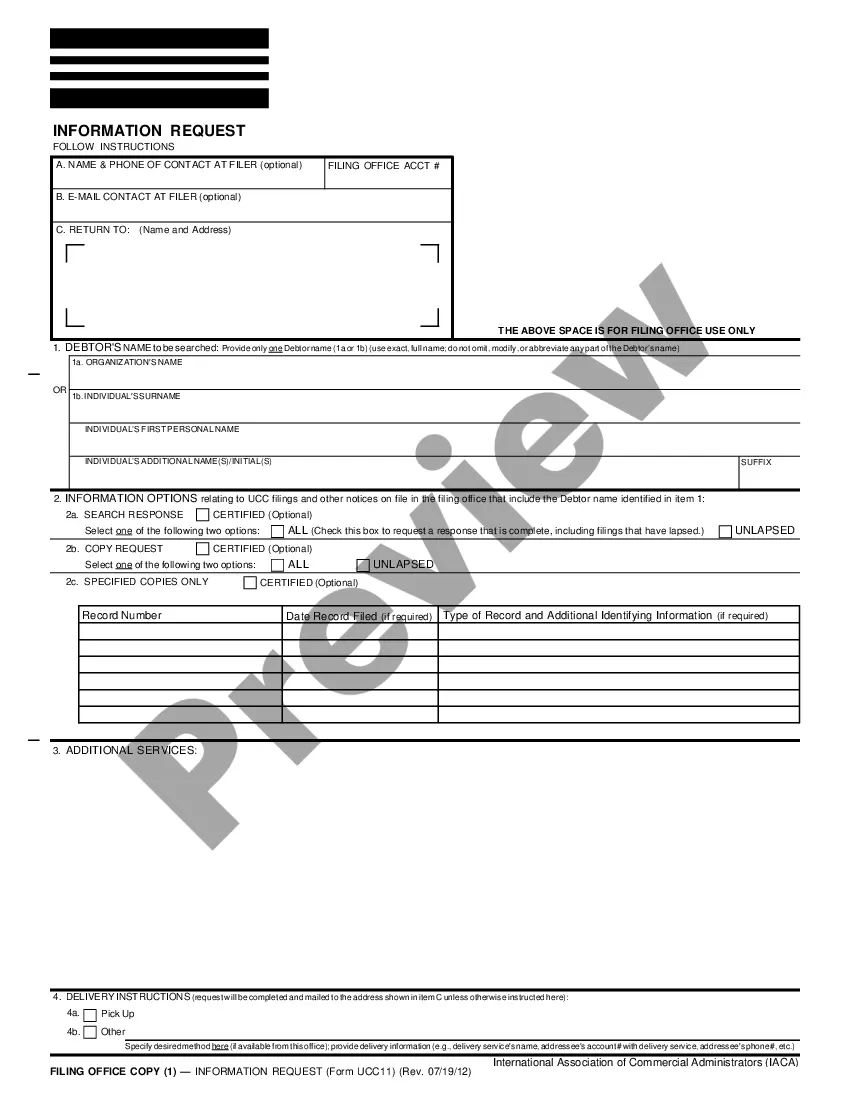

- Utilize the Preview button to examine the form.

- Read the description to ensure that you have chosen the right develop.

- In case the develop is not what you are looking for, use the Look for area to obtain the develop that suits you and demands.

- Once you discover the right develop, simply click Get now.

- Opt for the prices plan you desire, fill out the necessary information to produce your bank account, and buy an order utilizing your PayPal or bank card.

- Select a convenient paper structure and obtain your duplicate.

Locate all of the document web templates you might have bought in the My Forms menus. You can get a extra duplicate of Illinois Shareholder Agreements - An Overview whenever, if possible. Just go through the essential develop to obtain or produce the document web template.

Use US Legal Forms, probably the most comprehensive assortment of authorized types, to save lots of time and avoid errors. The service gives appropriately created authorized document web templates which you can use for an array of purposes. Make a merchant account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

A shareholders' agreement is an arrangement among a company's shareholders that describes how the company should be operated and outlines shareholders' rights and obligations. The shareholders' agreement is intended to make sure that shareholders are treated fairly and that their rights are protected.

Shareholders agreements should contain clauses which protect the business interests of the company. For example, shareholders may be required to disclose conflicts of interest, restrained from being involved with competing businesses and have restrictions imposed on them in dealing with customers of the company.

Set out below are the most common types of clauses we see in shareholders agreements. Director and Management Structure. ... Buy-Sell Provisions. ... Financing. ... Share Transfer Restrictions. ... Dispute Resolution. ... Confidentiality. ... Company Contracts. ... Meetings of Directors and/or Shareholders.

Pre-emptive rights and right of first refusal clause These clauses protect existing shareholders from the involuntary dilution of their stake in the company. Pre-emption rights provide the company's existing shareholders first offer on an issue of new shares; or first refusal over the sale of existing shares.

Bylaws ensure the corporation adheres to a certain standard and that everyone knows their role in the company. A shareholders' agreement differs from bylaws because it is an optional arrangement that only regulates the shareholders' relationship among themselves.

They typically consist of provisions on: notices and how they are to be sent; severability as to illegal or unenforceable terms and rectification; how the SHA may be amended (unanimity, majority or supermajority); governing law; dispute resolution; merger and integration that makes the SHA the final manifestation of ...

Summary. A shareholder agreement is an arrangement that defines the relationship between shareholders and the company. The agreement safeguards the rights and obligations of the majority and minority shareholders, and it ensures all shareholders are treated fairly.

Operation and management of the company. ... The Board of Directors and rights to appoint another Director. ... Share transfers (Pre-emptive rights and drag along / tag along) ... Protection of the business' interests (restraint provisions) ... Deadlocks and disputes. ... Meetings of the Board and Shareholders. ... Decision making.

However, drafting a shareholder agreement requires careful consideration of a range of critical issues, such as ownership structure, transferability of shares, voting rights, management structure, decision-making procedures, dividend distribution, dispute resolution mechanisms, confidentiality, termination provisions, ...

Not Including Privacy and Confidentiality Provisions Shareholders may receive information about the business. In the case of conflicts between shareholders, a shareholder may have the power to misuse such information.