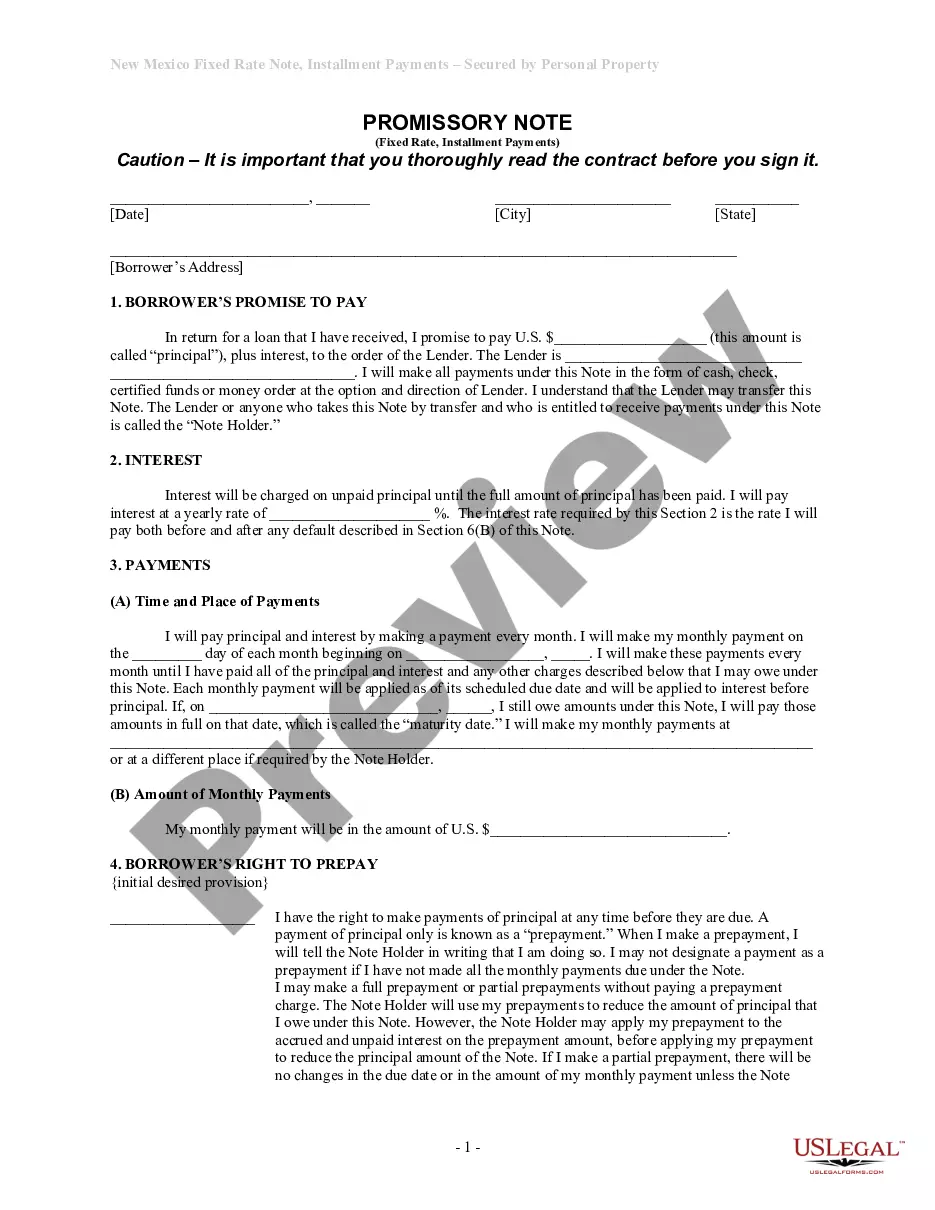

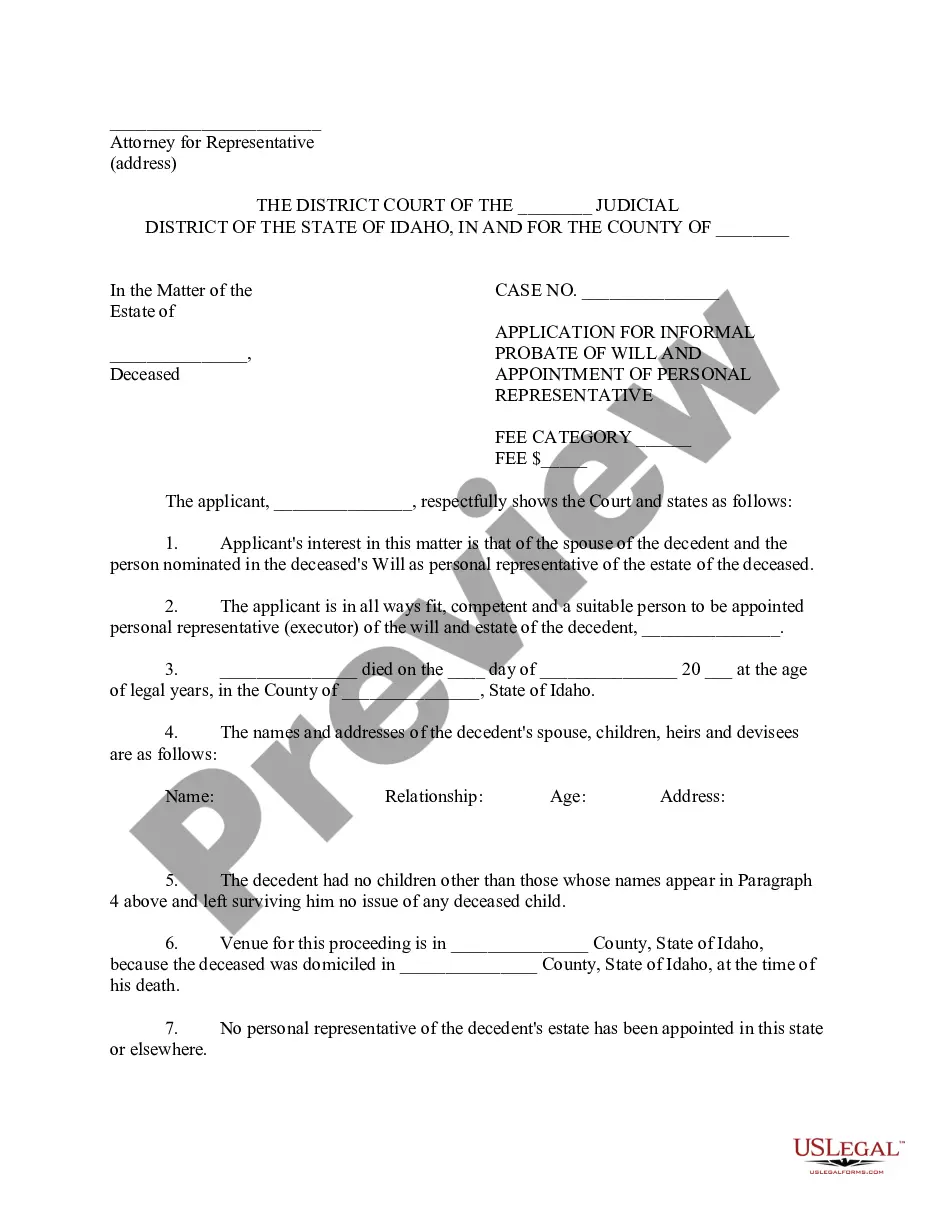

Illinois Borrower Security Agreement regarding the extension of credit facilities

Description

How to fill out Borrower Security Agreement Regarding The Extension Of Credit Facilities?

Are you presently within a position the place you will need files for sometimes organization or person reasons nearly every day time? There are a variety of legitimate document templates available on the Internet, but getting versions you can depend on is not effortless. US Legal Forms gives a huge number of kind templates, such as the Illinois Borrower Security Agreement regarding the extension of credit facilities, which are composed to satisfy federal and state specifications.

If you are already informed about US Legal Forms website and get your account, simply log in. Next, you are able to download the Illinois Borrower Security Agreement regarding the extension of credit facilities design.

Unless you offer an profile and want to start using US Legal Forms, follow these steps:

- Find the kind you need and make sure it is for your correct city/county.

- Use the Review option to review the shape.

- Read the description to actually have chosen the proper kind.

- In the event the kind is not what you`re looking for, make use of the Lookup area to obtain the kind that meets your requirements and specifications.

- If you obtain the correct kind, just click Purchase now.

- Choose the pricing plan you desire, complete the specified information and facts to make your money, and pay money for an order with your PayPal or charge card.

- Pick a practical data file format and download your backup.

Locate every one of the document templates you possess bought in the My Forms food list. You can obtain a extra backup of Illinois Borrower Security Agreement regarding the extension of credit facilities at any time, if needed. Just click the needed kind to download or print the document design.

Use US Legal Forms, probably the most comprehensive variety of legitimate forms, to save efforts and stay away from faults. The services gives professionally produced legitimate document templates which can be used for an array of reasons. Make your account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

A credit facility agreement refers to an agreement or letter in which a lender, usually a bank or other financial institution, sets out the terms and conditions under which it is prepared to make a loan facility available to a borrower. It is sometimes called a loan facility agreement or a facility letter.

What can be used as loan security? Your home, vehicle or another asset of value, such as jewellery, could all possibly be used as security against a loan. Property is the asset that is most commonly used as loan security.

Credit cards that allow you to take out money, pay it back, and take it out again are known as revolving credit lines. Term loans typically require borrowers to take out a single sum of money and agree to pay a fixed sum of money back over a set period of time.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

What is a Facility Agreement? A facility agreement is a contract between a borrower and a lender. The agreement sets out the terms and conditions of the agreement. It's often simply called a loan, credit facility agreement, or facility letter.

About credit agreements The credit agreement must state certain things that the lender and borrower agree to, such as the interest rate and any charges that may apply to the loan. A credit agreement is important since it states up-front what it will cost to borrow money and what terms and conditions apply to the loan.

Credit facilities are a type of pre-approved loan which allows the borrower to borrow money on an ongoing basis over an extended period of time, rather than applying for a new loan each time the borrower needs more money.