A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

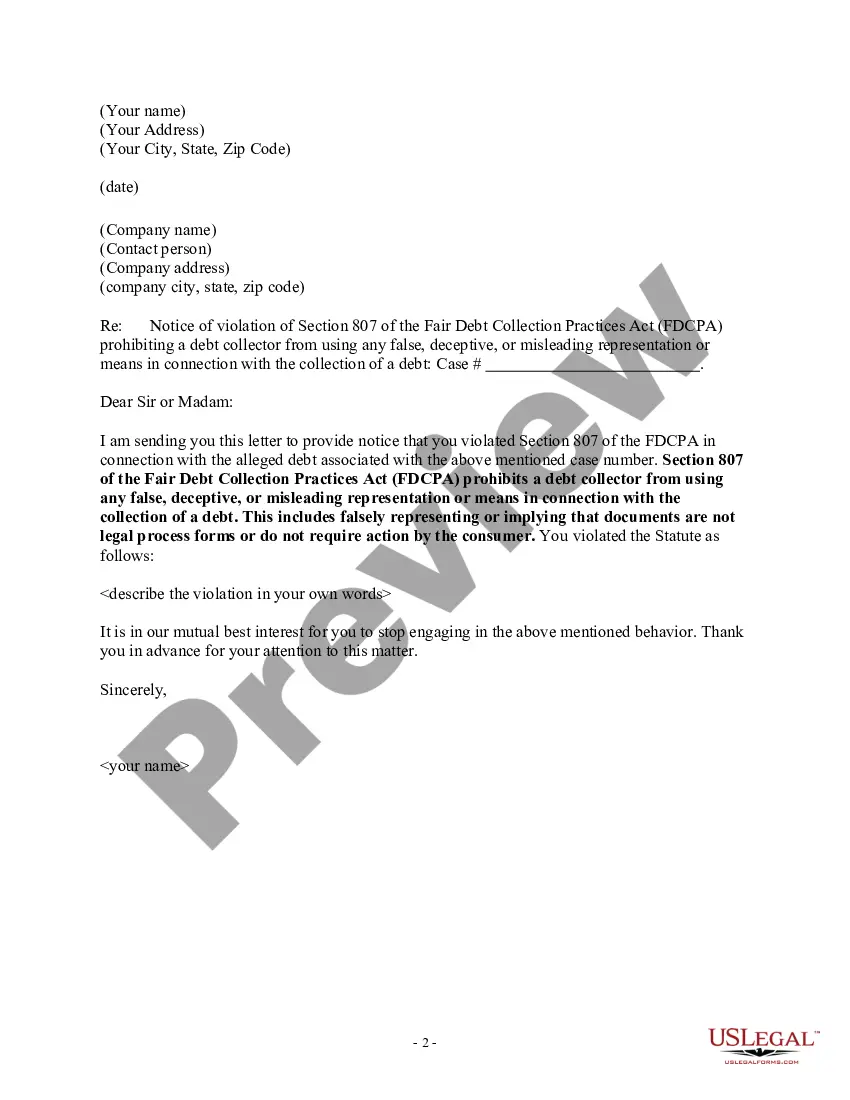

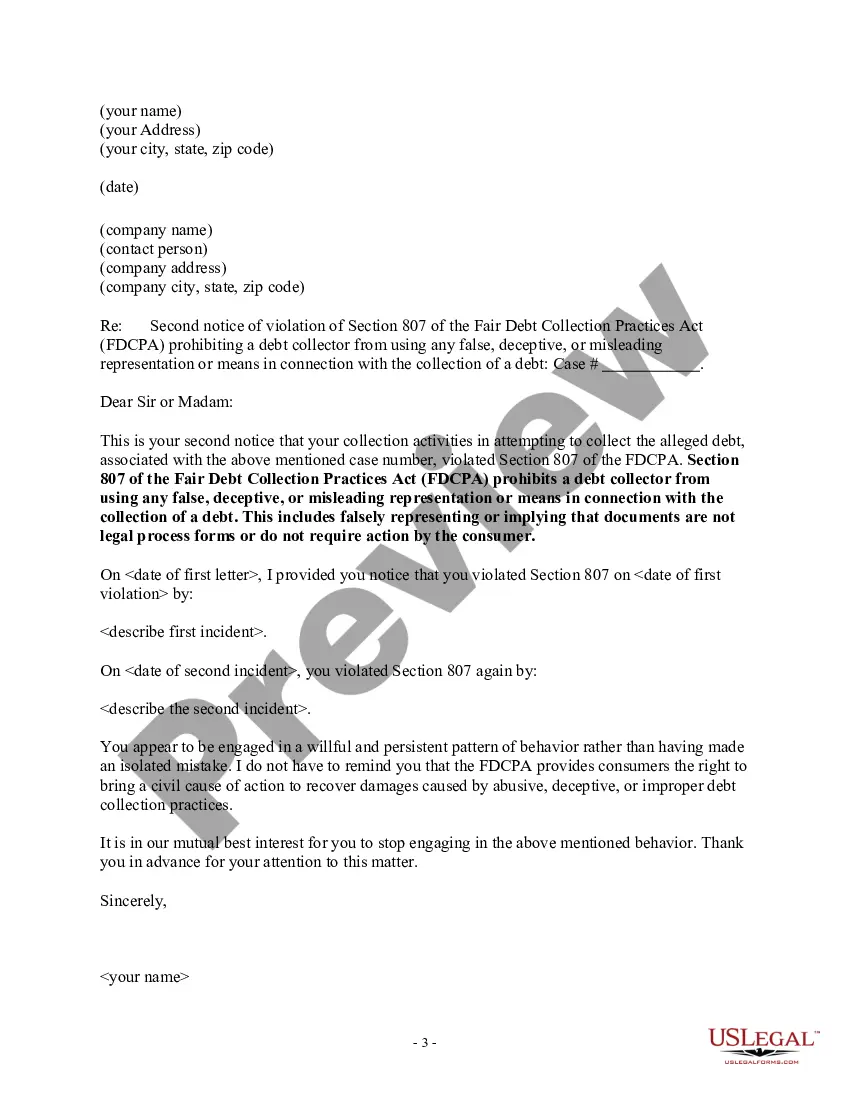

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Locating the appropriate legal document template can be challenging.

Naturally, there exists a range of templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, which can be used for both business and personal purposes.

You can browse the form using the Review option and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to retrieve the Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Use your account to search through the legal forms you have purchased previously.

- Go to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

Unfair debt collection practices include harassment, misleading representations, and threats of violence or legal action that are unfounded. These actions violate federal regulations and can leave you feeling overwhelmed. The Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action can help protect your rights. Utilizing resources like USLegalForms ensures you are properly informed and supported.

To fight a false debt collection, start by documenting all interactions and gathering evidence. You can then formally dispute the debt by sending a debt validation letter to the collector. The Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action serves as a vital resource in these situations. Engaging with services like USLegalForms can provide clarity and assistance throughout the process.

False and misleading practices occur when debt collectors provide inaccurate information or make threats that misrepresent your obligations. For instance, suggesting that you must take immediate legal action when no such process exists fits this definition. Understanding the Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action can empower you to recognize these tactics. Always keep your rights in mind when communicating with debt collectors.

To successfully dispute a debt, it's essential to collect evidence that supports your case. This may include correspondence from the debt collector, payment receipts, or any relevant financial documents. The Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action can help clarify the legitimacy of the claim against you. Consider using resources from USLegalForms to assist you in gathering proper documentation.

One common violation involves debt collectors falsely representing the truth about a debt. This can include making claims that documents are part of a legal process when they are not. Illinois Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action highlights this issue. If you encounter this situation, it is important to document the communication and seek guidance.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.