Illinois Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Locating the appropriate certified document format can be a challenge.

Of course, there are countless templates accessible online, but how do you find the certified form you need.

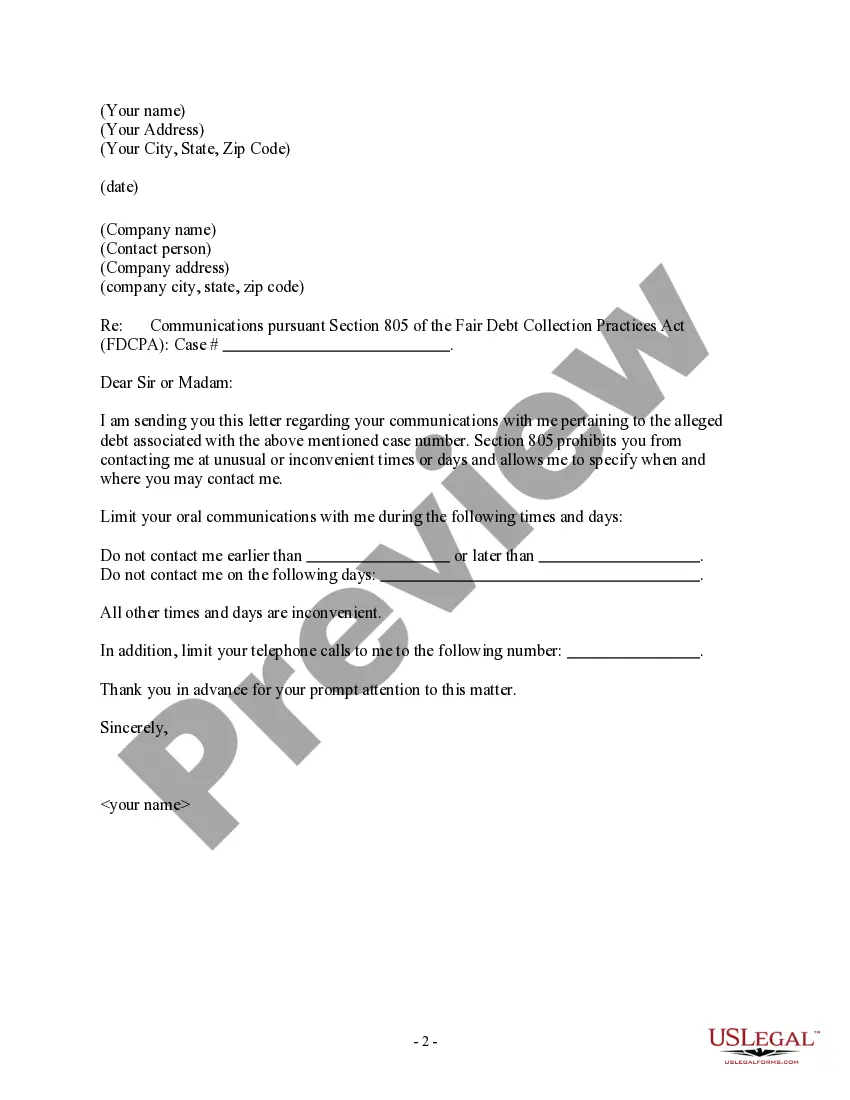

Utilize the US Legal Forms website. The service provides a vast array of templates, including the Illinois Letter to Debt Collector - Only contact me on the following days and times, that can be utilized for both business and personal purposes.

You can review the form using the Preview button and read the form details to confirm it is suitable for you. If the form does not satisfy your needs, use the Search box to find the appropriate form. Once you are confident that the form is suitable, click the Get now button to retrieve the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for the order using your PayPal account or Visa or MasterCard. Select the file format and download the certified document format to your system. Complete, modify, and print the received Illinois Letter to Debt Collector - Only contact me on the following days and times. US Legal Forms is indeed the largest collection of legal forms where you can find numerous document templates. Use the service to obtain accurately crafted documents that comply with state regulations.

- All of the forms are verified by experts and comply with state and federal regulations.

- If you are already a registered user, Log Into your account and click the Obtain button to retrieve the Illinois Letter to Debt Collector - Only call me on the following days and times.

- Use your account to search through the legal forms you have acquired previously.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

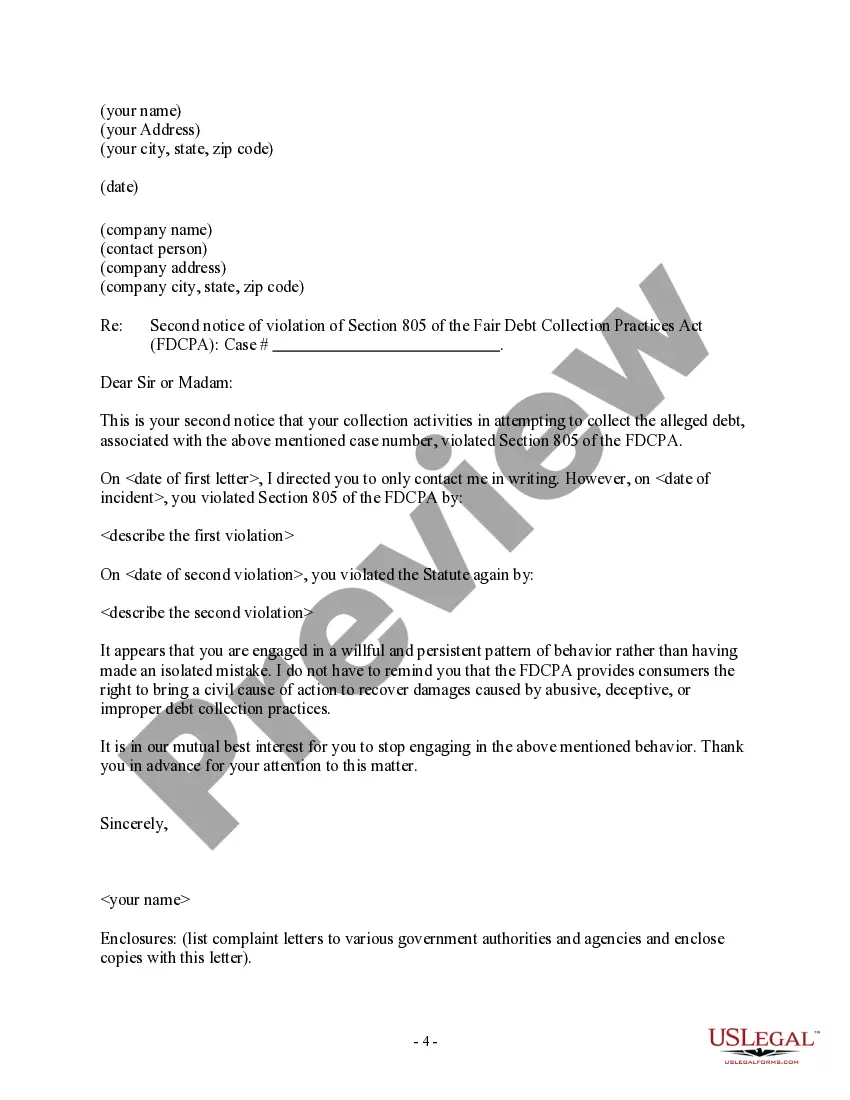

If you get a summons notifying you that a debt collector is suing you, don't ignore it. If you do, the collector may be able to get a default judgment against you (that is, the court enters judgment in the collector's favor because you didn't respond to defend yourself) and garnish your wages and bank account.

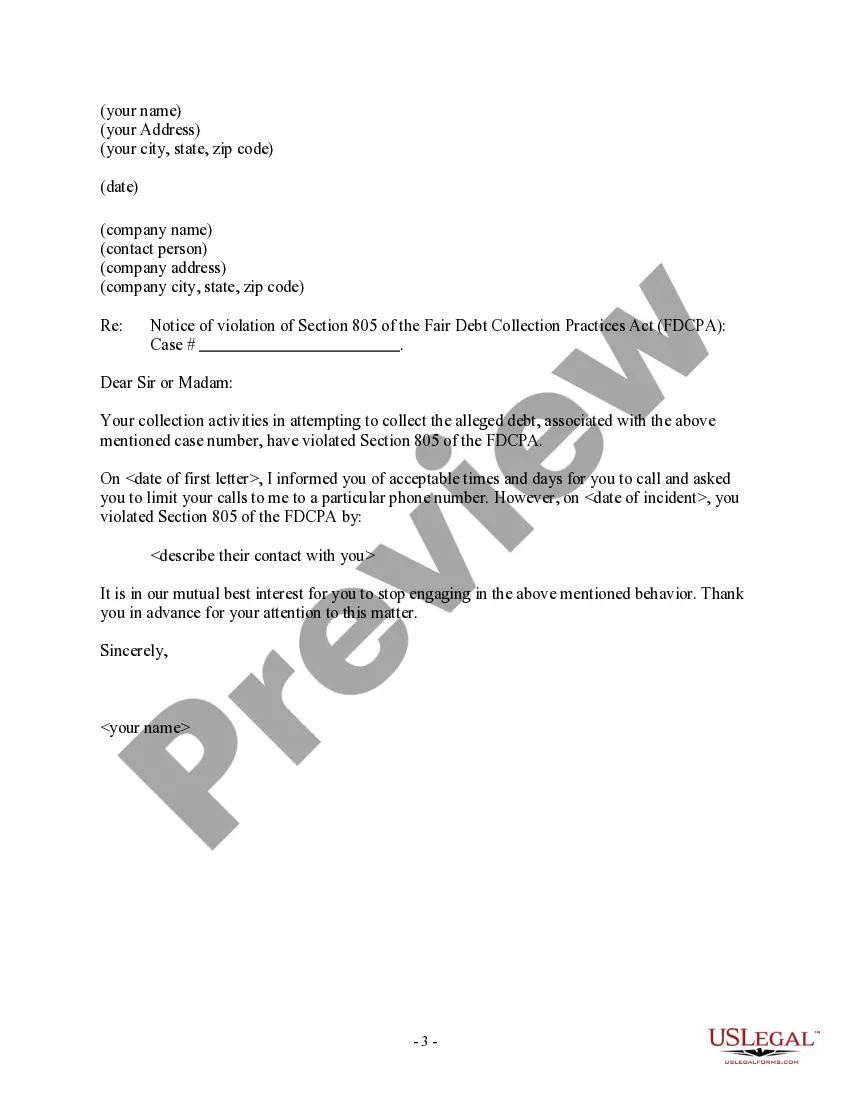

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Federal law says that after receiving written notice of a debt, consumers have a 30-day window to respond with a debt dispute letter.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC. You may also file a counterclaim against the debt collector for up to $1,000 for each violation.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

You have 30 days to dispute a debt or part of a debt within 30 days from when you first receive the required information from the debt collector.