Illinois Management Long Term Incentive Compensation Plan of of SCEcorp

Description

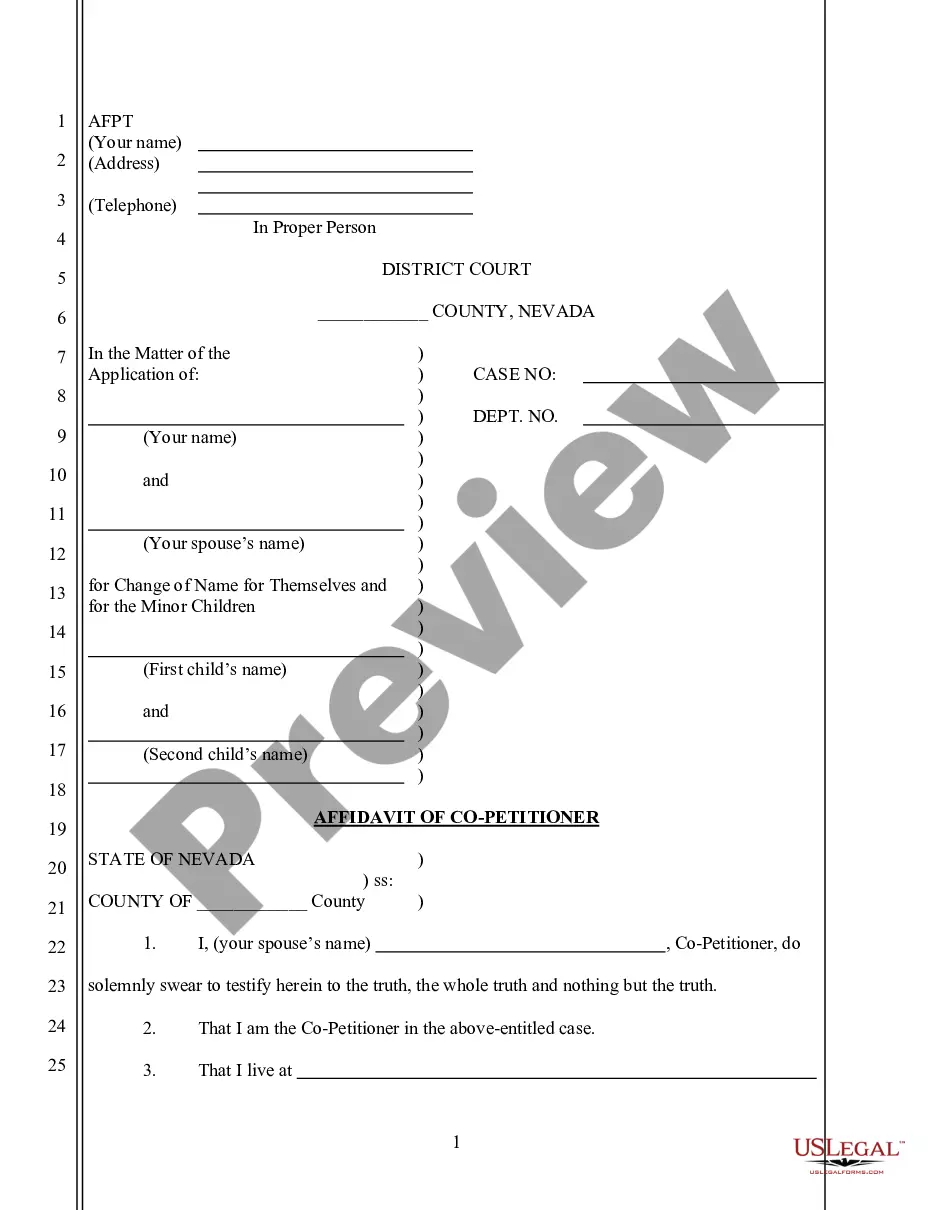

How to fill out Management Long Term Incentive Compensation Plan Of Of SCEcorp?

If you have to complete, acquire, or print out authorized file themes, use US Legal Forms, the biggest assortment of authorized kinds, which can be found online. Make use of the site`s basic and hassle-free research to get the files you will need. Numerous themes for business and individual uses are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to get the Illinois Management Long Term Incentive Compensation Plan of of SCEcorp in a couple of mouse clicks.

If you are previously a US Legal Forms client, log in for your account and click the Acquire option to find the Illinois Management Long Term Incentive Compensation Plan of of SCEcorp. You may also gain access to kinds you formerly downloaded in the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for your proper area/land.

- Step 2. Make use of the Preview option to check out the form`s articles. Don`t forget to see the explanation.

- Step 3. If you are not satisfied with the form, take advantage of the Look for area near the top of the monitor to discover other models of your authorized form format.

- Step 4. Once you have found the form you will need, click on the Purchase now option. Pick the rates plan you prefer and include your credentials to sign up on an account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Pick the formatting of your authorized form and acquire it on your own gadget.

- Step 7. Total, modify and print out or sign the Illinois Management Long Term Incentive Compensation Plan of of SCEcorp.

Each authorized file format you buy is your own property eternally. You possess acces to every form you downloaded within your acccount. Click the My Forms segment and pick a form to print out or acquire once more.

Compete and acquire, and print out the Illinois Management Long Term Incentive Compensation Plan of of SCEcorp with US Legal Forms. There are thousands of skilled and state-particular kinds you can utilize for your personal business or individual requires.

Form popularity

FAQ

term incentive plan (LTIP or LTI plan) is a deferred compensation strategy to attract, reward and motivate your employees, while also helping your company to retain valued talent and grow. LTIP prevalence: 98% of public companies provide LTIPs while 63% of private companies offer LTIPs. ( Source: SHRM)

LTI Bonus Compensation means all amounts awarded to a Participant under the Company LTI (Long Term Incentive) Plan that the Company determines to be eligible as compensation for purposes of the Plan.

LTIP Payout means any long-term incentive award paid to a Participant under the LTIP relating to services performed during any performance period, whether paid or not paid during such performance period or included on the Federal Income Tax Form W-2 during such performance period.

For Senior Executives, MTIP pools are based fully on relative total shareholder return. Long-Term Incentive Plan Encourages executives to generate Stock Options LTIP targets are based on the median for the comparable (LTIP) sustained share price growth over the market and the compensation mix.

Incentive compensation programs are primarily used to promote efficiency and productivity of the workforce, but organizations can also use them to enhance employee recruitment, engagement, retention and employer branding. Incentive compensation programs stem from the theory that rewards drive behavior.

A MIP can be either an equity incentive plan or a cash incentive plan. It doesn't always have to result in a company giving away equity, as certain factors may preclude them from doing so. Cash-based plans usually involve either a cash bonus, pension contribution or shadow equity.

Incentive compensation management is the strategic use of incentives to drive better business outcomes and more closely align sales rep behavior with the organization's goals. Incentives can be structured in multiple ways, including straight commissions, bonuses, prizes, ?spiffs,? awards, and recognition.

Incentives like restricted stock-based packages and cash bonuses ? awarded to employees after reaching certain long-term goals or staying on at the company for specified time frames ? are examples of long-term incentive compensation.