Illinois Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

If you aim to finish, acquire, or create authentic legal document templates, utilize US Legal Forms, the primary repository of legal forms, accessible online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for professional and personal use are organized by categories and claims, or keywords.

Every legal document template you purchase is yours indefinitely.

You have access to every form you've saved in your account. Click the My documents section and choose a form to print or download again. Stay competitive and download, print, and obtain the Illinois Executive Employee Stock Incentive Plan with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Illinois Executive Employee Stock Incentive Plan in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and select the Obtain option to get the Illinois Executive Employee Stock Incentive Plan.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

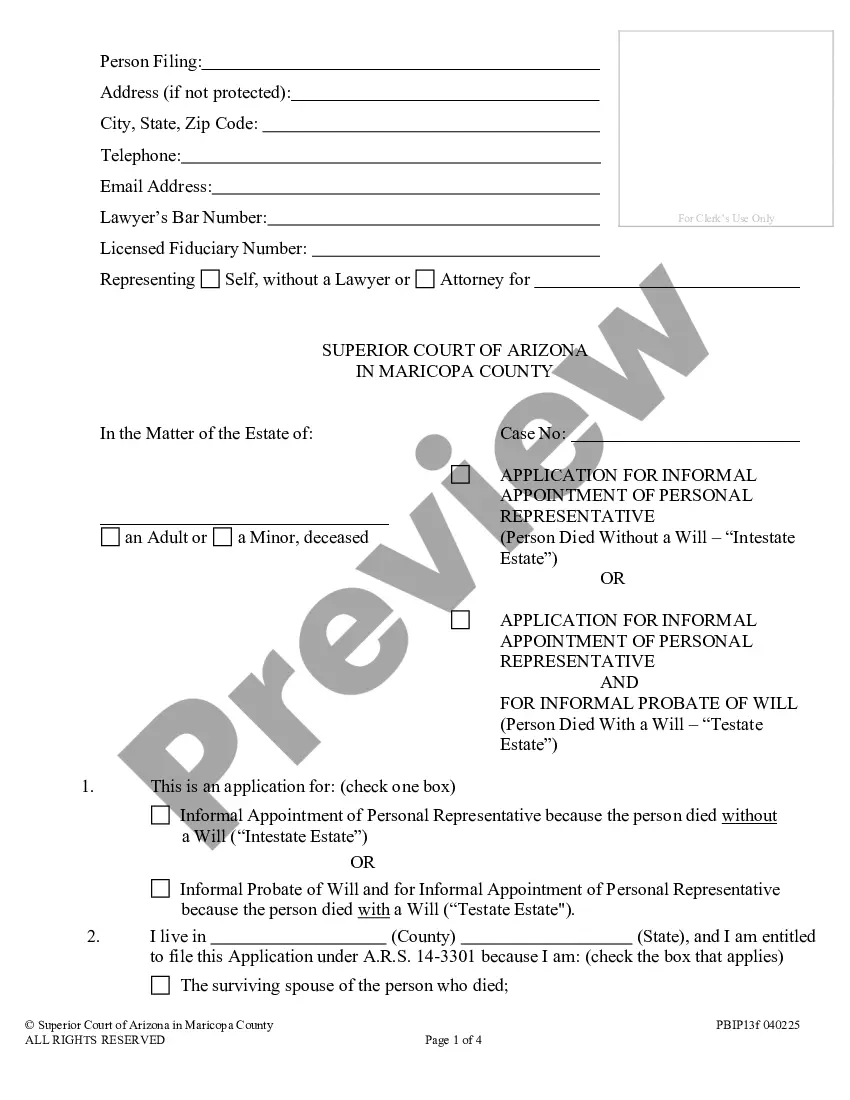

- Step 2. Utilize the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the desired form, click on the Get now option. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Illinois Executive Employee Stock Incentive Plan.

Form popularity

FAQ

LTI stock, or Long-Term Incentive stock, is part of an Illinois Executive Employee Stock Incentive Plan designed to reward employees over a period of time. Typically, employees receive stock options or share grants that vest after meeting specific performance goals or tenure requirements. This structure encourages employees to contribute positively to the company’s long-term success, aligning their interests with those of the organization. By participating in such a plan, employees can benefit from potential stock appreciation, making it a valuable addition to their overall compensation.

The Illinois Executive Employee Stock Incentive Plan is a program designed to align the interests of employees and executives with the goals of the company. This plan provides employees the opportunity to acquire stock options, giving them a stake in the company's success. By participating in this plan, employees can enjoy financial benefits as the company's performance improves. For those looking to implement or understand such plans, US Legal Forms offers a range of resources and documents that can simplify the process.

Generally, incentive stock options (ISOs) are granted to employees, including executives and key personnel, who meet certain criteria established by the company. This typically includes a requirement that the employee must work a minimum number of hours or have specific responsibilities. If you are interested in incorporating ISOs within your Illinois Executive Employee Stock Incentive Plan, consulting with legal experts can provide clarity on qualifications and benefits.

An annual incentive plan for executives is a compensation plan that rewards executives based on the achievement of specific performance goals over a year. These benchmarks often include financial and operational targets that benefit both the company and its shareholders. Such plans play a crucial role in the Illinois Executive Employee Stock Incentive Plan by aligning executive efforts with the company’s strategic objectives.

Yes, Employee Stock Ownership Plans (ESOPs) are taxable in Illinois. However, the tax treatment may depend on various factors, including the structure of the plan and the specific transactions involved. For clearer guidance on the tax implications related to the Illinois Executive Employee Stock Incentive Plan, consulting a tax professional or using resources like US Legal Forms can be beneficial.

The IL 4644 form is used by taxpayers to declare their eligibility for the Illinois exemption from the replacement tax. This form assists in ensuring compliance with state taxation rules. If your company utilizes an Illinois Executive Employee Stock Incentive Plan, it’s beneficial to understand the role of this form in your overall tax strategy.

The Illinois replacement tax is imposed on corporations and partnerships that do business or generate income in Illinois. It serves as a substitute for property tax and is calculated based on business income. If your company is engaged in an Illinois Executive Employee Stock Incentive Plan, understanding this tax can help you navigate financial responsibilities.

Equity incentive plans, including those that fall under Illinois regulations, are taxed based on the type of plan and when you realize the gain. For example, options may be taxed upon exercising, while restricted stock is taxed when it vests. Familiarizing yourself with these tax implications is critical if you're taking part in an Illinois Executive Employee Stock Incentive Plan.

Yes, stock compensation is generally taxed as income when it is vested or exercised. For individuals participating in an Illinois Executive Employee Stock Incentive Plan, understanding this tax treatment is essential for financial planning. Proper reporting ensures you comply with Illinois tax regulations and avoid unexpected tax liabilities.

The inheritance tax waiver in Illinois allows for the exemption from inheritance taxes under certain conditions. Beneficiaries may receive this waiver based on the value of the inheritance and the relationship to the deceased. It's beneficial to be aware of how this may impact the value of equity received through an Illinois Executive Employee Stock Incentive Plan.