Illinois Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests

Description

How to fill out Sample Proposed Amendment To Partnership Agreement To Provide For Issuance Of Preferred Partnership Interests?

Are you inside a situation where you need to have papers for possibly company or person purposes nearly every time? There are plenty of legitimate document web templates available on the Internet, but finding types you can rely on is not simple. US Legal Forms gives a large number of type web templates, such as the Illinois Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests, that are created to satisfy state and federal needs.

Should you be already knowledgeable about US Legal Forms website and also have your account, just log in. Next, you are able to down load the Illinois Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests design.

Unless you provide an accounts and want to start using US Legal Forms, adopt these measures:

- Find the type you require and make sure it is for the correct city/region.

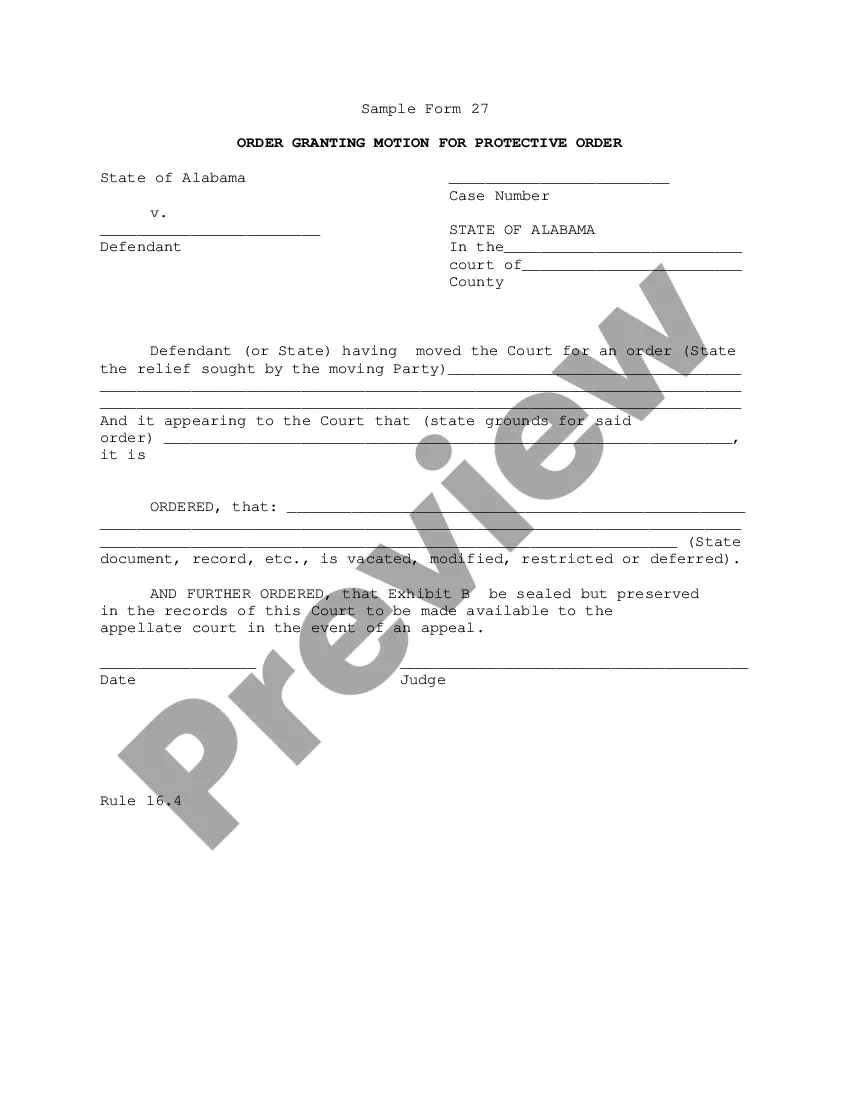

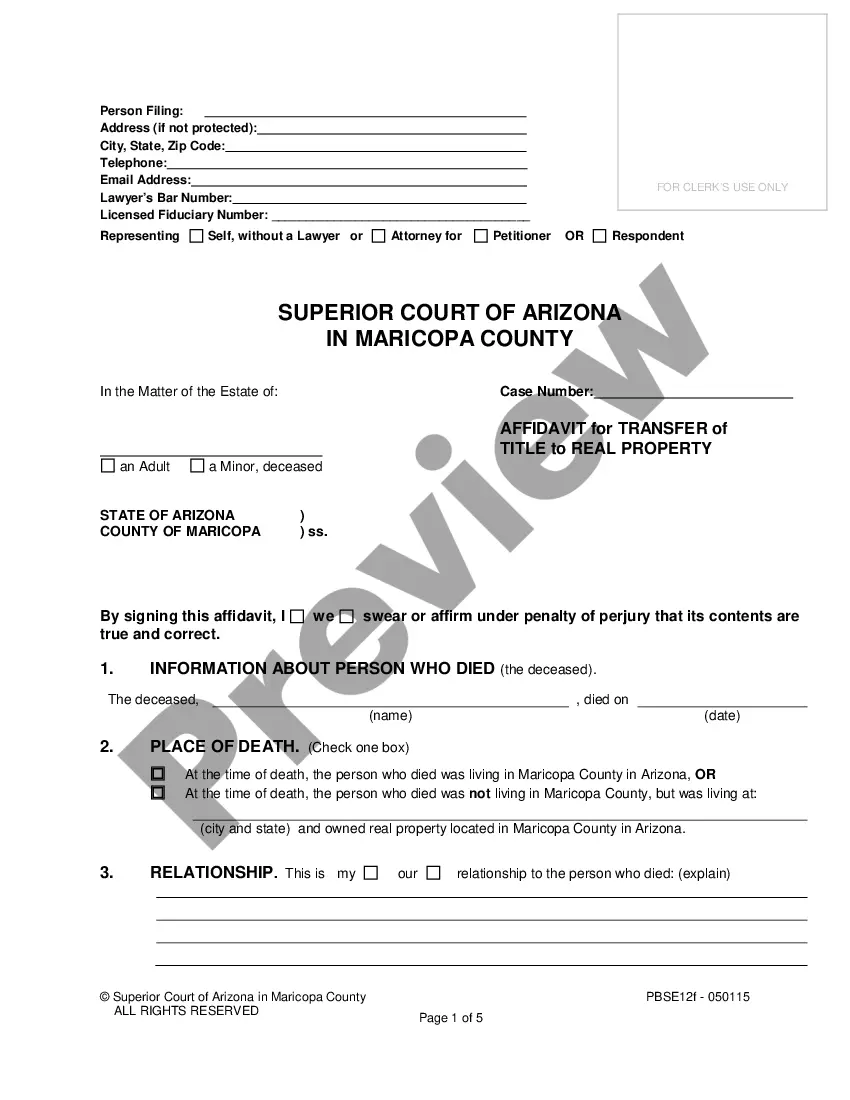

- Use the Review switch to check the form.

- See the outline to ensure that you have chosen the right type.

- When the type is not what you are trying to find, take advantage of the Look for industry to find the type that suits you and needs.

- Whenever you obtain the correct type, click on Acquire now.

- Choose the pricing program you need, fill out the required information to create your bank account, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Decide on a convenient file format and down load your copy.

Get all of the document web templates you may have purchased in the My Forms food list. You can aquire a further copy of Illinois Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests anytime, if possible. Just click the needed type to down load or print out the document design.

Use US Legal Forms, the most substantial variety of legitimate types, to conserve some time and avoid faults. The assistance gives skillfully made legitimate document web templates that can be used for a range of purposes. Create your account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

How to Make Change in Partnership Deed? Draft another Partnership Deed ing to the adjustments in the constitution of the Firm. Fill Form in Capital Letters in Form No. Pay the Challan Fees with the particular Bank and Submit the application with the concerned Registrar of Firms of the State.

Partnership deed is a partnership agreement between the partners of the firm which outlines the terms and conditions of the partnership between the partners. The purpose of a partnership deed is to provide clear understanding of the roles of each partner, which ensures smooth running of the operations of the firm.

To change information of record for your LP, fill out this form, and submit for filing along with: ? A $30 filing fee. ? A separate, non-refundable $15 service fee also must be included, if you drop off the completed form. pages if you need more space or need to include any other matters.

Step 1: Select a business name. Any Illinois partnership must operate with a unique name. ... Step 2: Register the business name. ... Step 3: Complete required paperwork. ... Step 4: Determine if you need an EIN, additional licenses, or tax IDs. ... Step 5: Get your day-to-day business affairs in order.

A Partnership Amendment is used when two or more partners want to make changes to their Partnership Agreement. Partners can be individuals, corporations, Limited Liability Companies (LLCs), or other general partnerships.

Name and address of the partnership: The first clause in a partnership deed should be the name and address of the partnership. This clause should clearly identify the name of the partnership and the physical address of its principal place of business.

The changes in Partnership deed are made by execution of a supplementary deed which is an addendum to the original partnership deed. Payment of appropriate stamp duty is a must for said deed. The registration of the supplementary deed would be compulsory if the firm is already registered with Registrar of Firm.

How to Make Change in Partnership Deed? Draft another Partnership Deed ing to the adjustments in the constitution of the Firm. Fill Form in Capital Letters in Form No. Pay the Challan Fees with the particular Bank and Submit the application with the concerned Registrar of Firms of the State.