Illinois Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

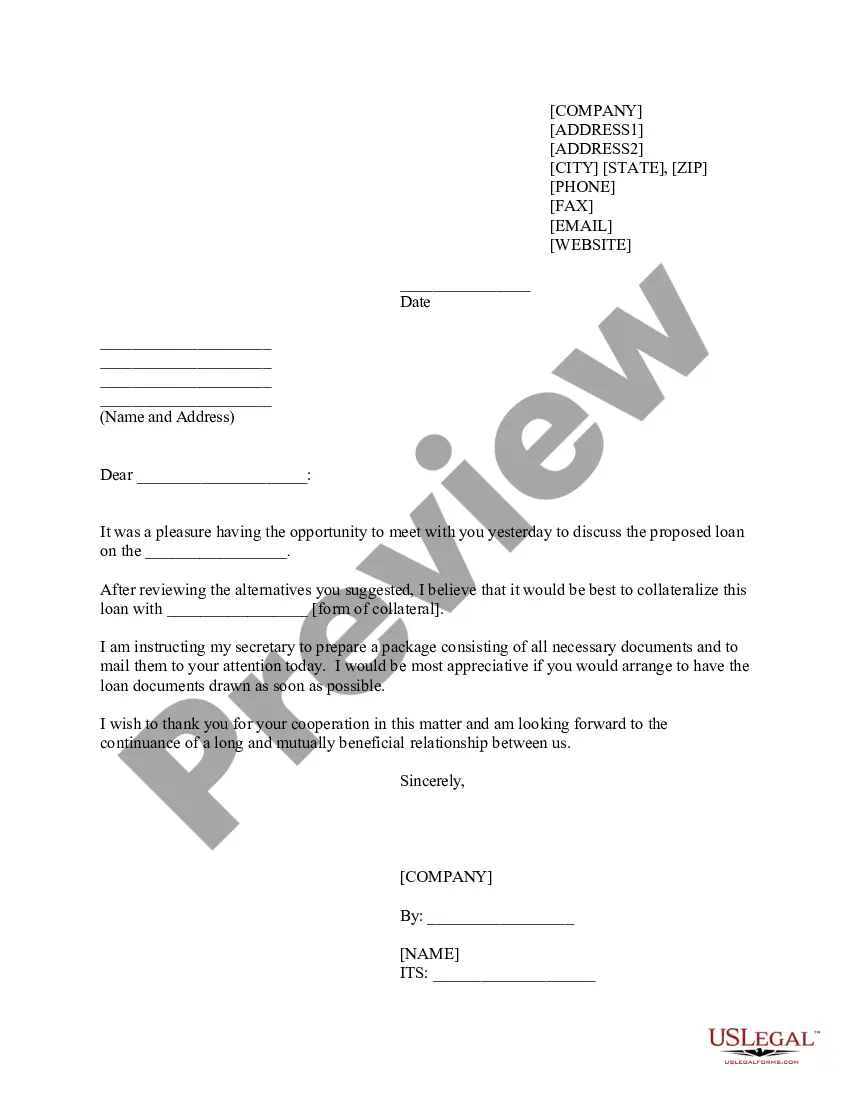

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

US Legal Forms - among the most significant libraries of legitimate forms in America - delivers an array of legitimate record layouts you may download or printing. Utilizing the web site, you will get a huge number of forms for enterprise and individual functions, sorted by groups, states, or key phrases.You can find the latest models of forms like the Illinois Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 in seconds.

If you currently have a membership, log in and download Illinois Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 from your US Legal Forms local library. The Obtain option will appear on each and every develop you perspective. You have access to all in the past acquired forms in the My Forms tab of your own accounts.

If you would like use US Legal Forms the very first time, here are basic recommendations to obtain began:

- Make sure you have selected the right develop to your metropolis/state. Go through the Review option to analyze the form`s information. Browse the develop explanation to actually have selected the right develop.

- In case the develop does not satisfy your specifications, utilize the Search discipline on top of the screen to discover the one which does.

- Should you be happy with the shape, validate your choice by clicking the Acquire now option. Then, choose the rates plan you favor and give your qualifications to register for the accounts.

- Method the deal. Use your bank card or PayPal accounts to complete the deal.

- Select the format and download the shape on your own gadget.

- Make alterations. Complete, revise and printing and signal the acquired Illinois Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Every single template you included with your money lacks an expiration particular date and it is your own for a long time. So, in order to download or printing one more version, just check out the My Forms segment and click on in the develop you want.

Obtain access to the Illinois Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms, one of the most considerable local library of legitimate record layouts. Use a huge number of professional and state-particular layouts that meet up with your company or individual requires and specifications.

Form popularity

FAQ

?Is the claim subject to Offset?? Asks if you have to pay back the whole debt. For example, if you owe the creditor $1,000 but the creditor owes you $200, then the claim can be ?offset?.

Types of Liabilities That Can Be Subject to Offset Past due federal student loans. Federal agency non-taxes owed. Unpaid child support or spousal support obligations. Certain unemployment compensation liabilities you owe to a state.

Offset is the general right of one party to recover a debt owed by another through a deduction from monies owed by the first party to the second.

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.

Set-off is a common law right allowing parties (each of which being both a creditor and a debtor) that have debts owing to each other to set them off. Where the right of set-off is applicable, the parties can net their payment obligations, and, as a result, will be liable to pay the remaining balance only.

Setoff is an equitable right of a creditor to deduct a debt it owes to the debtor from a claim it has against the debtor arising out of a separate transaction. Recoupment differs in that the opposing claims must arise from the same transaction.

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.