Illinois Sample FCRA Letter to Applicant

Description

How to fill out Sample FCRA Letter To Applicant?

Finding the appropriate legal document format can be challenging. Naturally, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Illinois Sample FCRA Letter to Applicant, suitable for both business and personal needs.

All of the forms are vetted by professionals and comply with federal and state regulations.

Once you are certain that the form is suitable, click the Acquire now button to obtain the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete your payment via your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Illinois Sample FCRA Letter to Applicant. US Legal Forms is the largest repository of legal documents where you can find various document templates. Use the service to obtain properly crafted files that adhere to state regulations.

- If you are currently registered, Log In to your account and click the Download button to access the Illinois Sample FCRA Letter to Applicant.

- Use your account to view the legal documents you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new customer of US Legal Forms, follow these simple steps.

- First, ensure that you have selected the correct form for your state/region. You can browse the form using the Preview button and read the form summary to confirm it is the right one for you.

- If the form does not suit your requirements, utilize the Search field to find the appropriate form.

Form popularity

FAQ

Proof of adverse action generally involves documentation that shows a decision was made based on an applicant's background information or credit report. This could be a copy of the adverse action letter sent to the applicant or records from the consumer reporting agency. By utilizing the Illinois Sample FCRA Letter to Applicant, you can establish your proof effectively and uphold transparency.

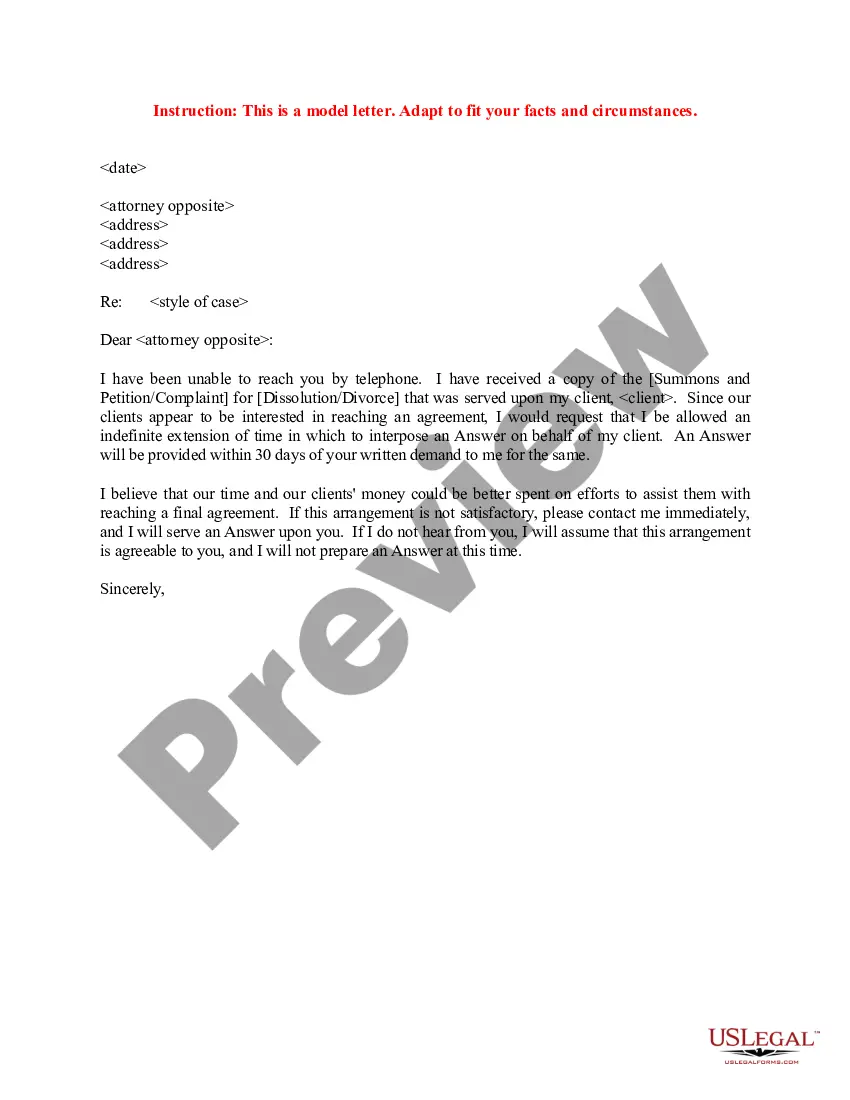

Before you take adverse action, you will provide the applicant or employee a notice that includes a copy of the background check/consumer report you used to make your decision and provide them with a summary of their rights under the FCRA. This is commonly referred to as a Pre-Adverse Action Notice.

FACTA (Fair and Accurate Credit Transactions Act) is an amendment to FCRA (Fair Credit Reporting Act ) that was added, primarily, to protect consumers from identity theft. The Act stipulates requirements for information privacy, accuracy and disposal and limits the ways consumer information can be shared.

Four Basic Steps to FCRA ComplianceStep 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

The Fair and Accurate Credit Transaction Act (FACT Act) of 2003 that amended the Fair Credit Reporting Act (FCRA), provides the ability for consumers to obtain a free copy of his or her consumer file from certain consumer reporting agencies once during a 12 month period.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

The Process of Handling Adverse ActionStep 1: Provide Disclosure and Send a Notice for Pre-Adverse Action.Step 2: The Waiting Period.Step 3: Review the Report Results Again.Step 4: Provide the Notice of Adverse Action.Step 5: Properly Dispose of Sensitive Information.06-May-2020

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application.

Properly inform the applicant of adverse action: In your final adverse action letter, you must explain your choice and tell the applicant that they have the right to dispute your decision. Provide the necessary information for them to get another copy of their report.