Illinois Determining Self-Employed Contractor Status

Description

How to fill out Determining Self-Employed Contractor Status?

If you need to compile, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Get now button. Choose your preferred pricing option and enter your details to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Illinois Determining Self-Employed Contractor Status in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Illinois Determining Self-Employed Contractor Status.

- You can also access forms you have previously saved within the My documents tab of your account.

- If this is your first time using US Legal Forms, follow these instructions.

- Step 1. Confirm you have chosen the form for the correct city/state.

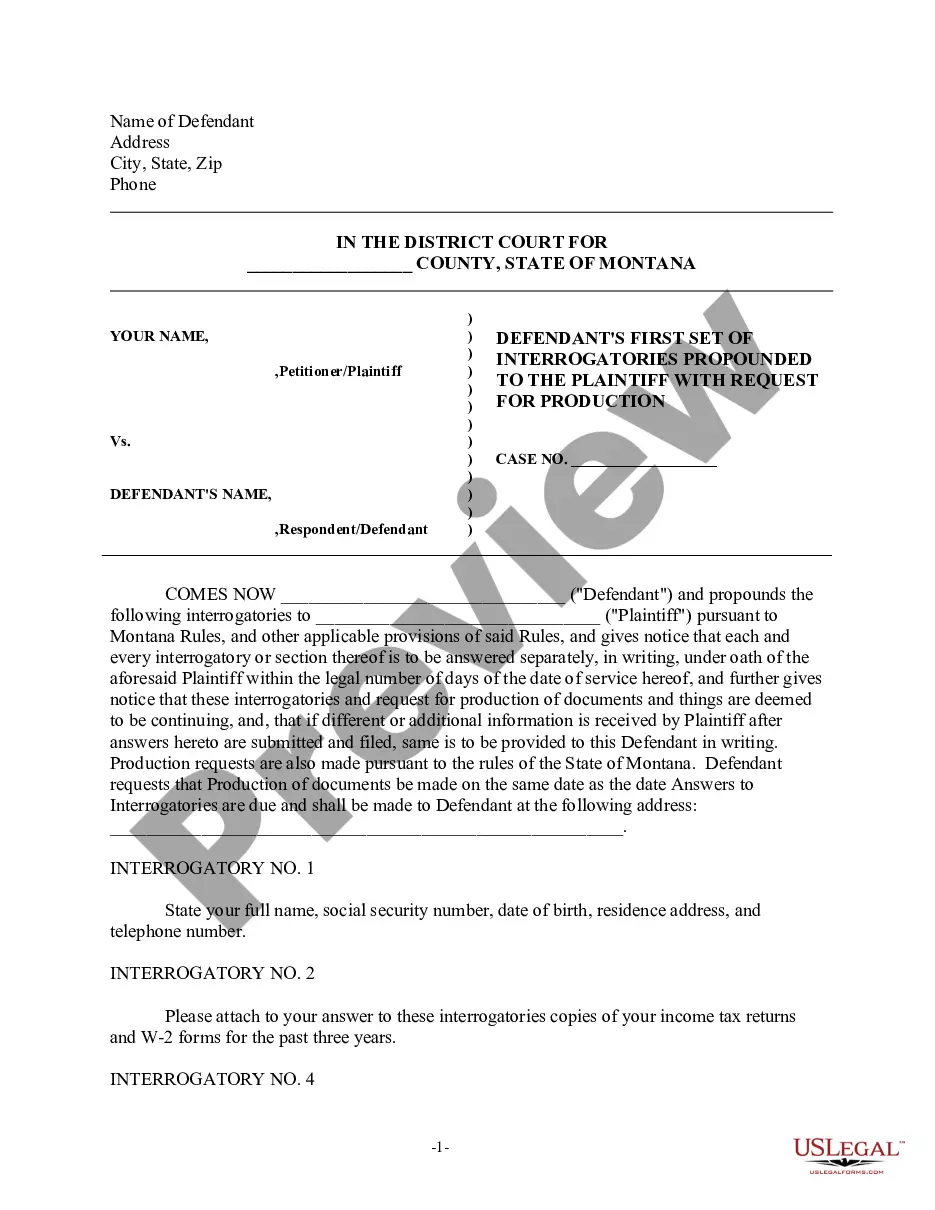

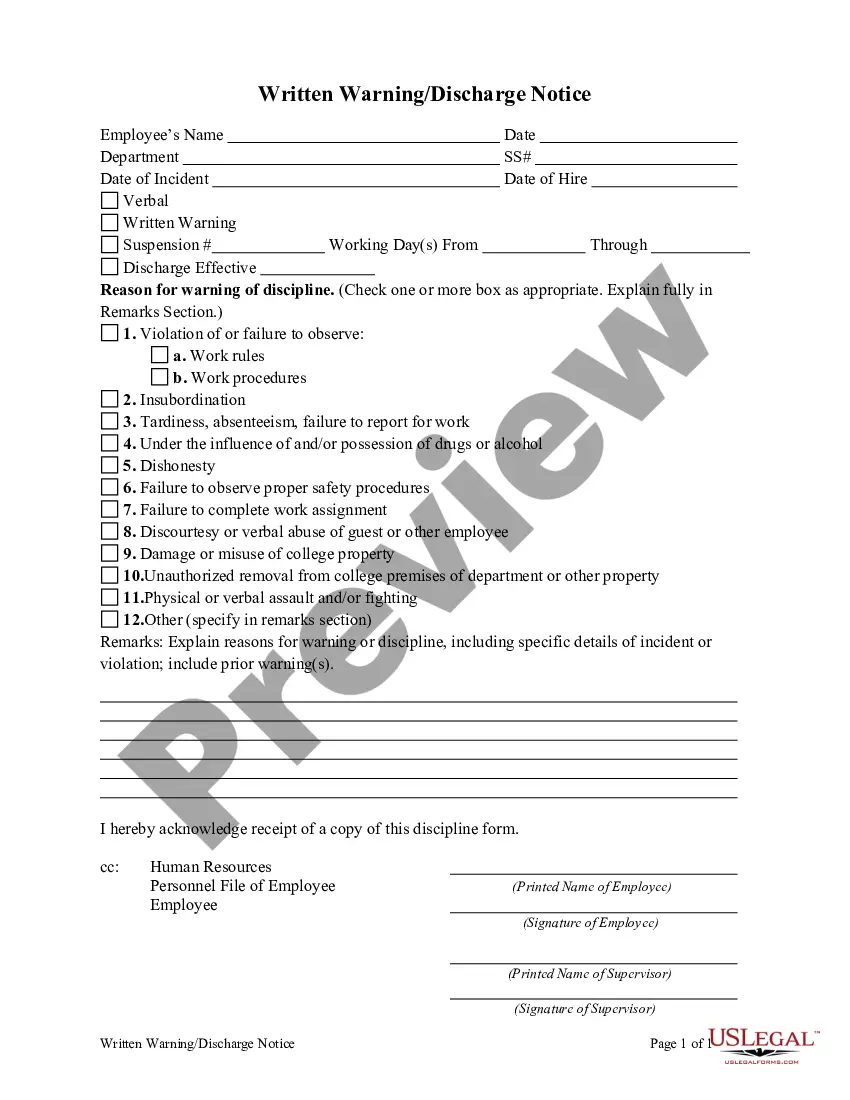

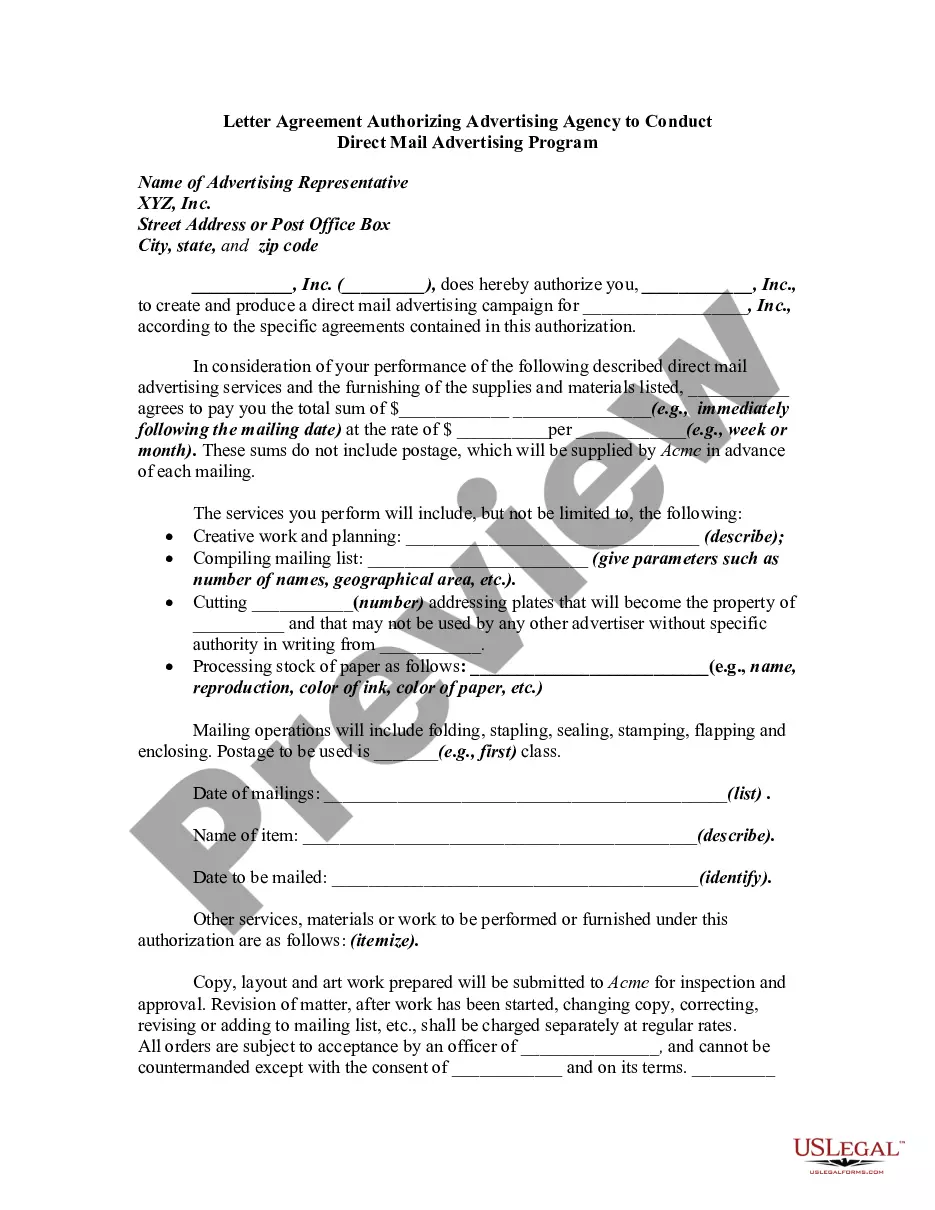

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search bar at the top of the screen to discover other forms in the legal form category.

Form popularity

FAQ

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

You are probably an independent contractor if:You are paid by the job.You set your own working hours.You provide the tools and equipment needed to do your job.You work for more than one company at a time.You pay your own business and traveling expenses.You hire and pay your own assistants.More items...

The independent contractor is responsible for paying his own income taxes, Social Security and Medicare taxes. If the person is determined to be an employee but you have treated him or her as an independent contractor, it can be a costly mistake for your business.

1099 Worker DefinedA 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors. To determine whether a person is an employee or an independent contractor, the company weighs factors to identify the degree of control it has in the relationship with the person.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

As an independent contractor, you may have more freedom to choose how you complete your work, but you are responsible for paying your own taxes, getting your own health insurance, and paying into unemployment and workers comp funds if you wish to access those benefits.