Illinois Check Requisition Report

Description

How to fill out Check Requisition Report?

Are you presently situated in a location where you will require documents for potential business or particular tasks nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones is challenging.

US Legal Forms provides thousands of template options, including the Illinois Check Requisition Report, which can be completed to meet state and federal requirements.

Once you find the correct template, click on Purchase now.

Select the payment plan you prefer, input the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Illinois Check Requisition Report template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Obtain the template you want and ensure it is for the correct city/region.

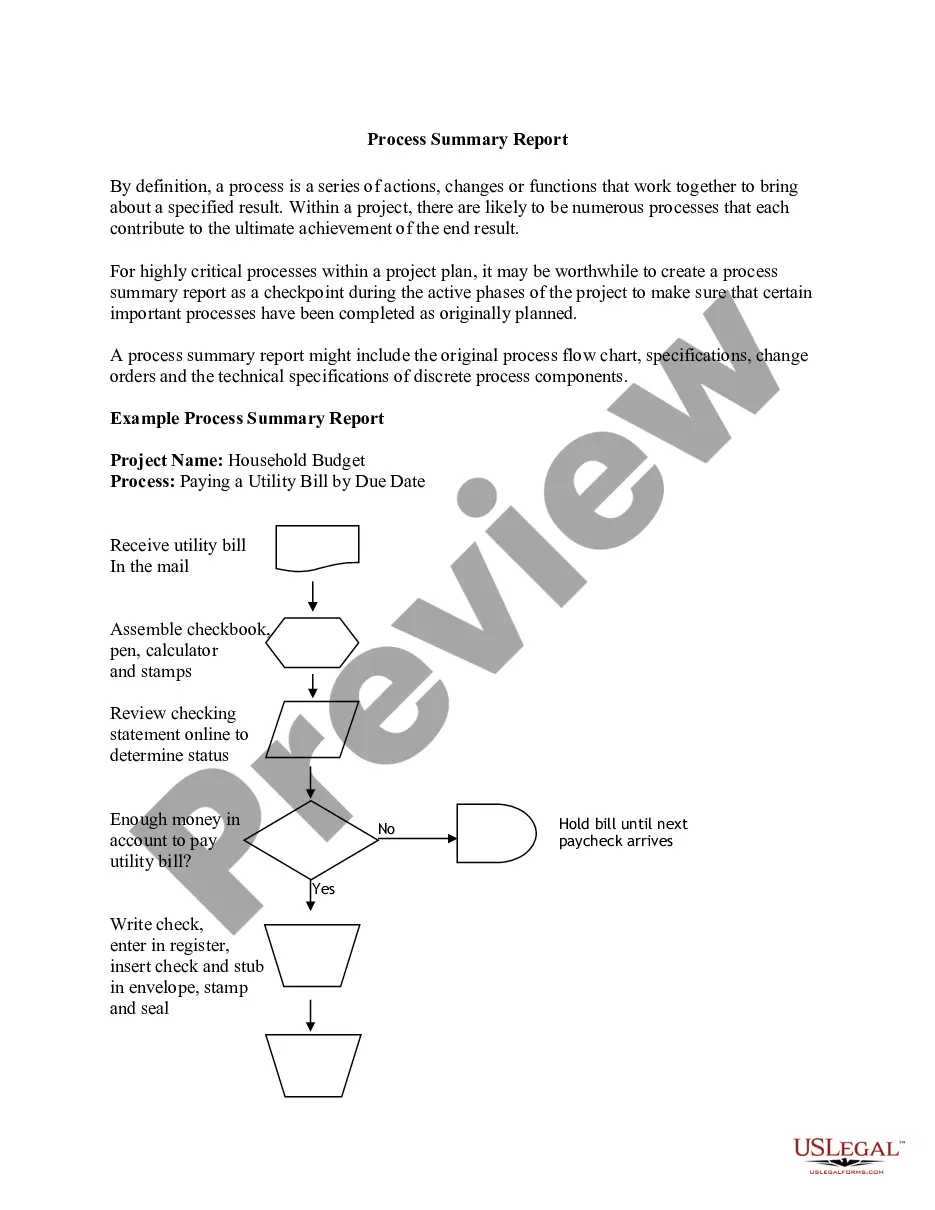

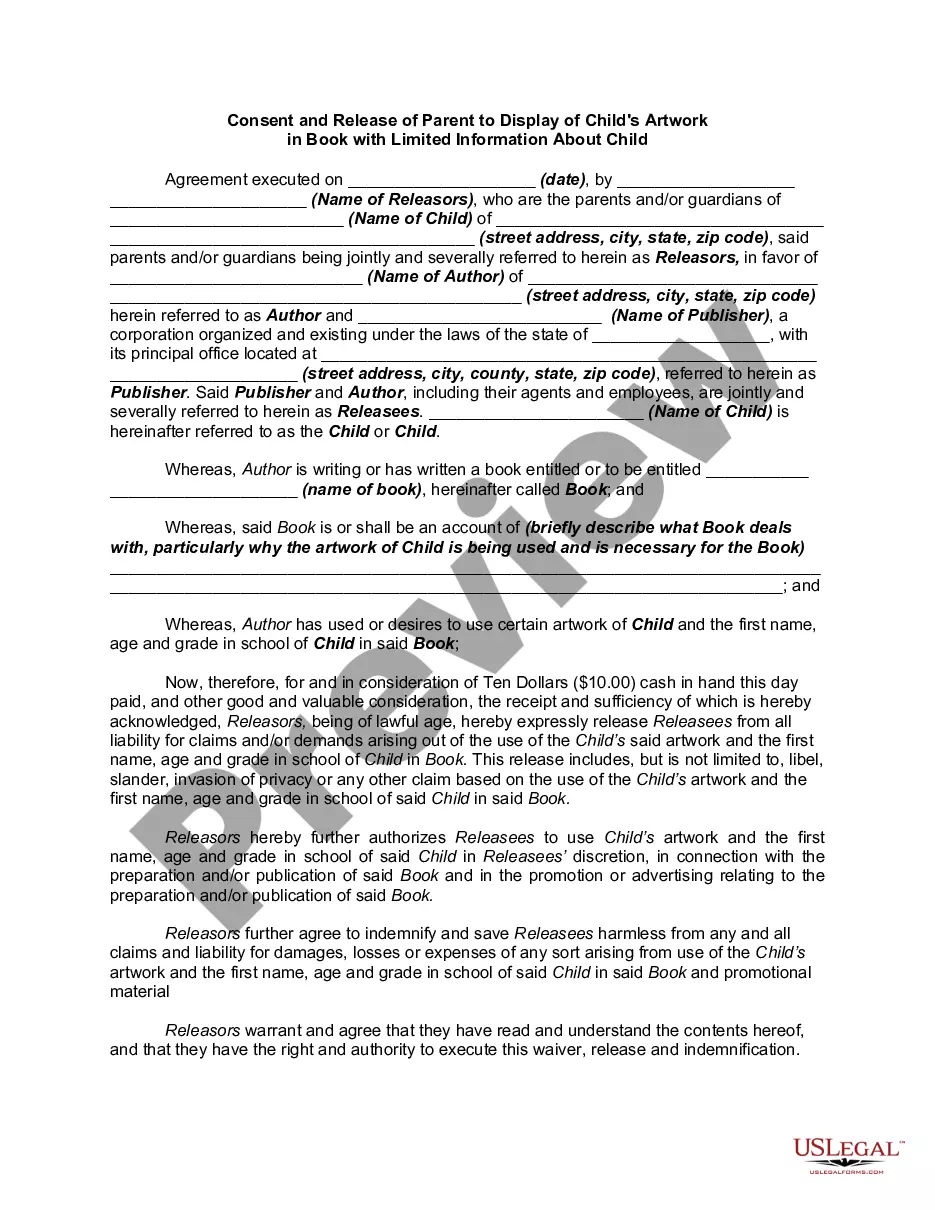

- Utilize the Review option to verify the template.

- Look over the description to confirm that you have chosen the correct template.

- If the template is not what you are looking for, utilize the Research field to find the template that fits your needs and requirements.

Form popularity

FAQ

The Illinois state withholding form requires basic information such as your name, address, and Social Security number. You will also indicate your marital status and the number of allowances claimed to calculate the proper withholding amount. This information is crucial for maintaining clear records in your Illinois Check Requisition Report.

To activate your MyTax Illinois account, you must go to mytax.illinois.gov, click "Sign Up," and complete specific information about yourself and your company.

Setting up access to your MyTax Illinois account is easy!Go to MyTax Illinois. Individuals will need to obtain a Letter ID.Click on the "Sign up" link.Enter all required fields. The information required during the MyTax Illinois activation varies based on the tax types for which you sign up.

Mail to Illinois Department of Revenue, P.O. Box 19045, Springfield, IL 62794-9045. Enter your payment amount on this line. Return this voucher with check or money order payable to Illinois Department of Revenue.

How do I access MyTax Illinois to activate a MyTax Illinois account?Go to MyTax Illinois. Individuals will need to obtain a Letter ID.Click on the "Sign up" link.Enter all required fields. The information required during the MyTax Illinois activation varies based on the tax types for which you sign up.

MyTax Illinois is a free online account management program that offers a centralized location, provided by the Illinois Department of Revenue, for businesses to register for taxes, file returns, make payments, and manage their tax accounts. Most of these features require the taxpayer to create a MyTax Illinois account.

After you log in to your MyTax Illinois account, take the following actions.Select "View more account options" in your "Business Income Tax" account.Select "View Account Periods" in "Periods and Submissions"Choose the appropriate period (tax year ending date) for your payment.Select "Make a Payment"More items...

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

Click Import and select the file on your computer. Click Import to upload your file. Review your records in MyTax Illinois. You can edit or manually add other records prior to submitting your request.

IndividualsInclude a copy of your notice, bill, or payment voucher.Make your check, money order, or cashier's check payable to Franchise Tax Board.Write either your FTB ID, SSN, or ITIN, and tax year on your payment.Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.23-Sept-2021