Illinois Surety Agreement

Description

How to fill out Surety Agreement?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site’s simple and user-friendly search feature to locate the documents you need.

A variety of templates for business and personal purposes are organized by categories and keywords.

Every legal document template you acquire is yours permanently. You have access to all forms you saved in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download and print the Illinois Surety Agreement with US Legal Forms. There are thousands of professional and state-specific forms that you can use for your business or personal needs.

- Utilize US Legal Forms to find the Illinois Surety Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to obtain the Illinois Surety Agreement.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

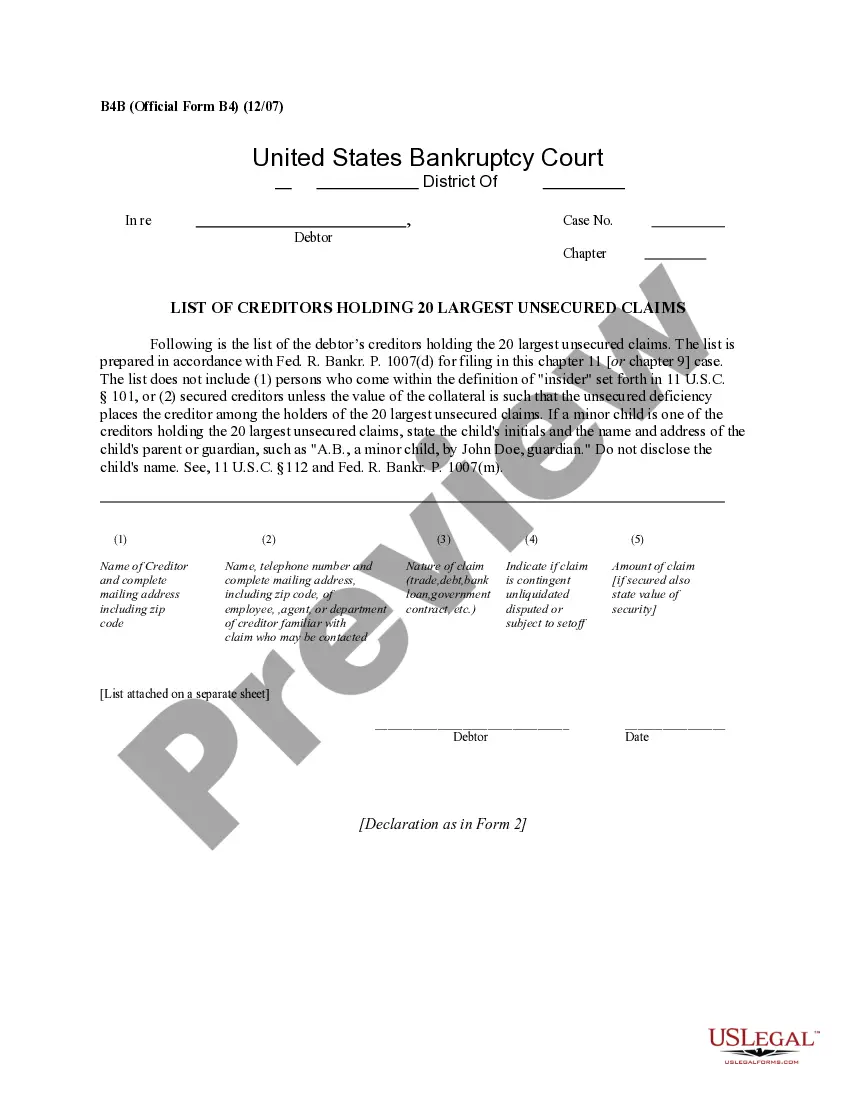

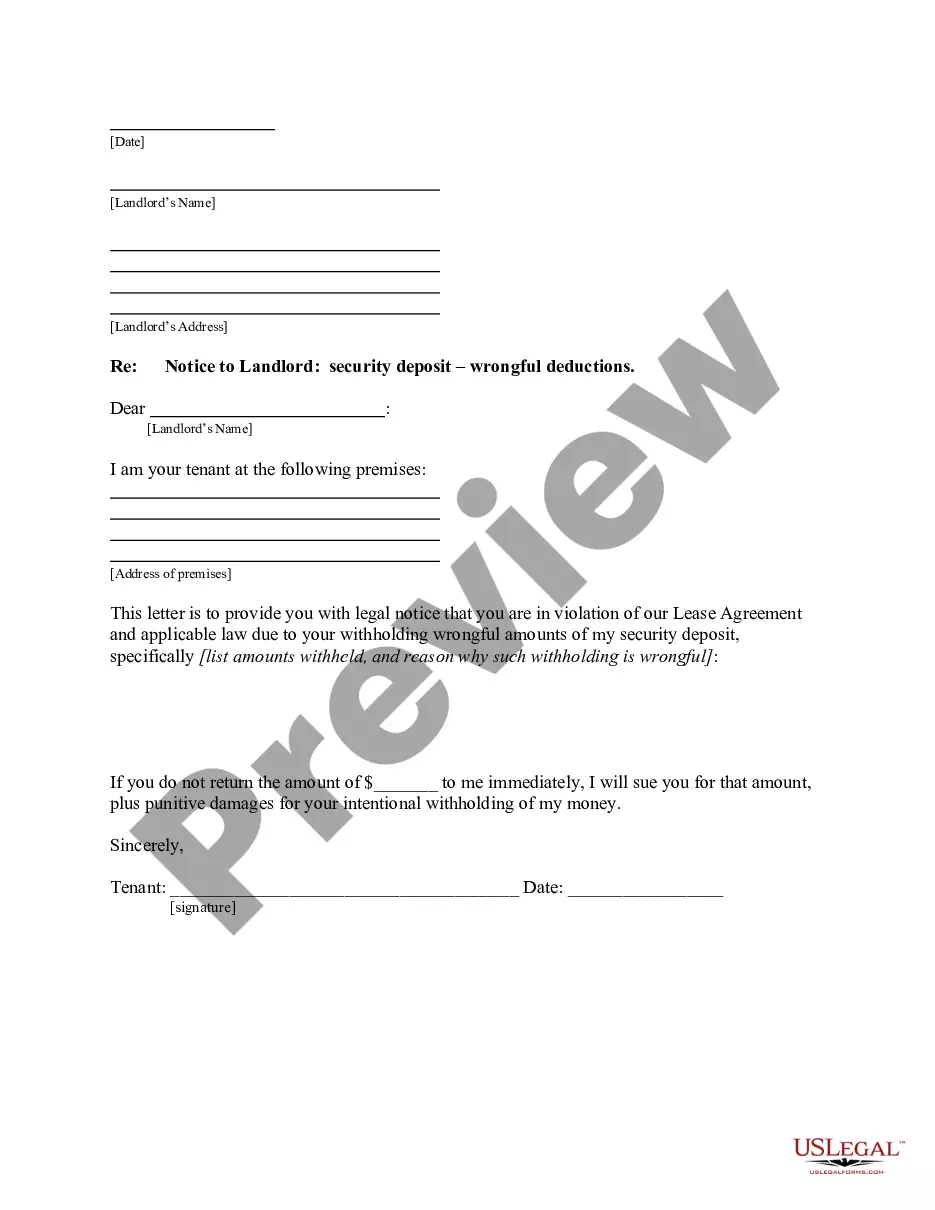

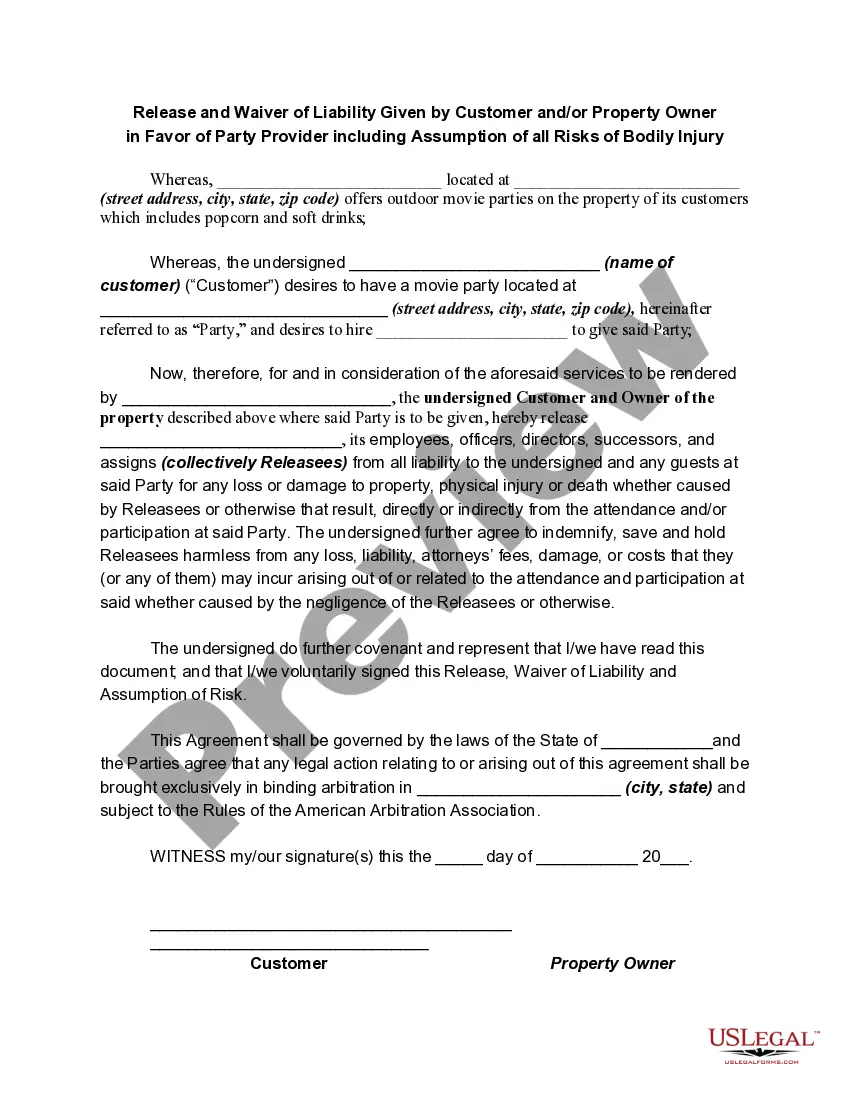

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. After you have located the form you need, click on the Buy now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois Surety Agreement.

Form popularity

FAQ

Surety Explained in Detail A surety bond is a legal binding agreement signed between three partiesthe lender, the trustee, and the guarantor. The obligee, generally a government agency, allows the principal to receive a security bond as a protection against future work output, normally a business owner or contractor.

Someone who assumes direct liability for another's obligation. Financial creditors may require the debtor to find a surety, who then signs the loan agreement along with the debtor.

These bond types are also referred to as commercial bonds" or business bonds." Examples of license and permit surety bonds include auto dealer bonds, mortgage broker bonds, and collection agency bonds.

Illinois Surety Bond Costs Standard market premiums are typically calculated at 1-3% of the bond amount. For example, a $20,000 designated agent dealer bond typically costs just $200-$600 for applicants who qualify for the standard market.

The cost of an Illinois certificate of title bond starts at $100, although the exact cost depends on the amount of the bond. Bonds up to $5,000 are issued instantly for $100 and the cost of bonds between $5,001 and $25,000 is calculated at a rate of $20 for every $1,000 of coverage.

A surety bond is a contract that promises you will follow through on your duties. You might need a surety bond to get licensed depending on your profession. If you follow through on your duties and perform your work ethically and honestly, nothing will happen with your bond.

Illinois law requires all Notaries to purchase and maintain a $5,000 Notary surety bond for the duration of their 4-year commission. The Notary bond protects the public of Illinois against any financial loss due to improper conduct by an Illinois Notary.

The first step to getting an Illinois surety bond is to apply for your bond. Not everyone can get approved for a bond, so this is the first step to getting bonded. Most companies all you to apply for your bond online. You can apply for a bond at your local insurance agency, or a specialized surety bond company.

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.