Illinois Startup Costs Worksheet

Description

How to fill out Startup Costs Worksheet?

Are you currently in a situation where you require documents for both business or personal purposes every day.

There are numerous authentic document templates accessible online, but locating ones you can rely on is challenging.

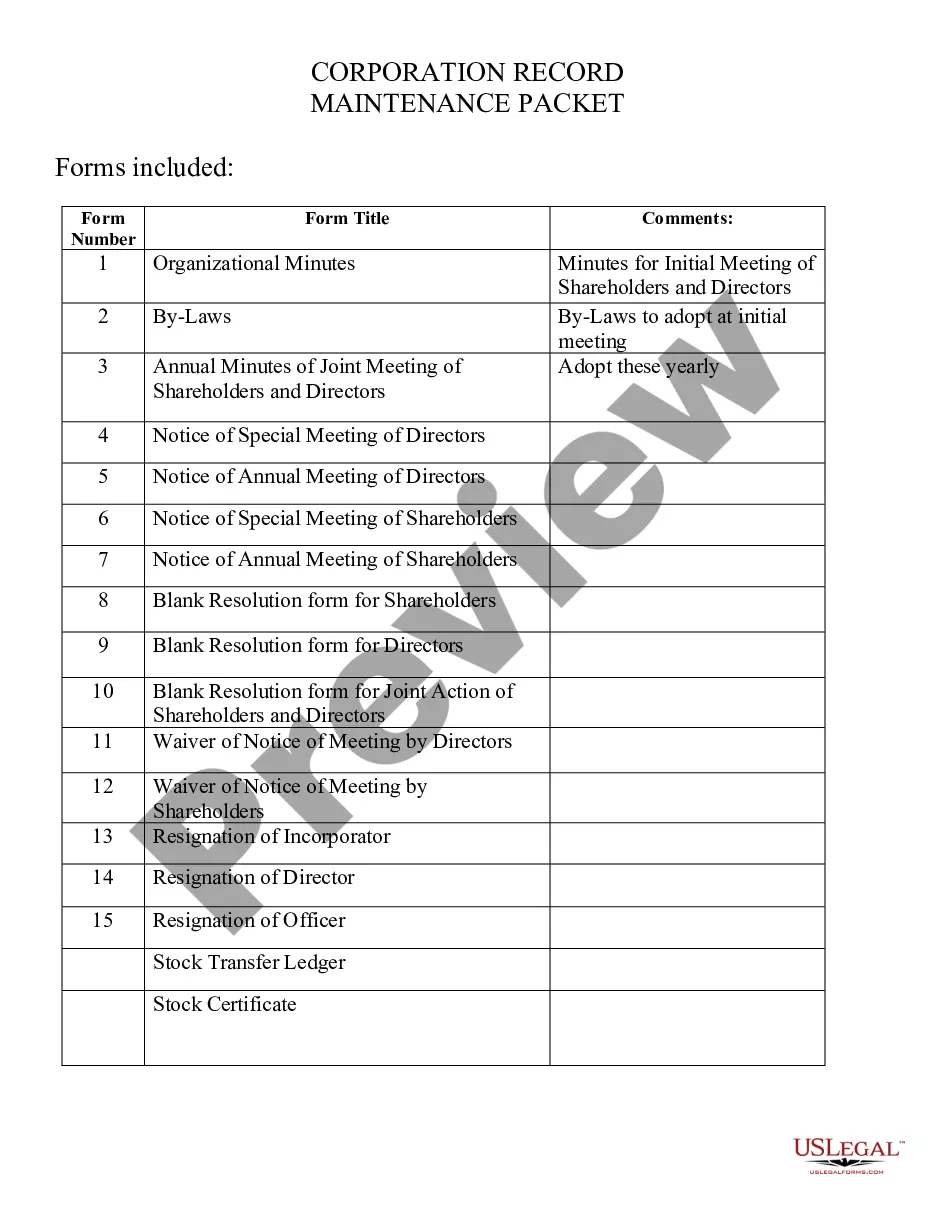

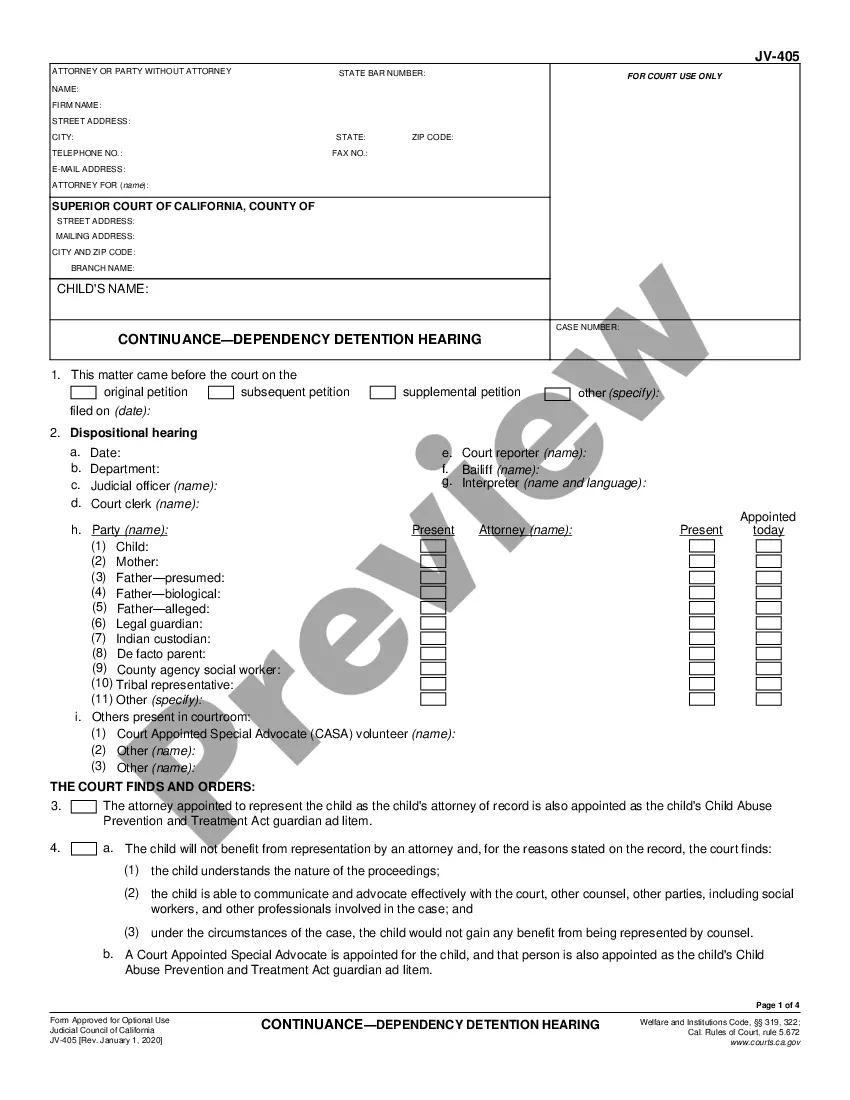

US Legal Forms offers thousands of form templates, such as the Illinois Startup Costs Worksheet, that are designed to comply with federal and state regulations.

If you find the suitable form, simply click Purchase now.

Choose the pricing plan you desire, fill in the required information to set up your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Illinois Startup Costs Worksheet template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct area/region.

- Use the Review button to examine the form.

- Check the details to make sure you have selected the right form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that meets you and your requirements.

Form popularity

FAQ

To expense startup costs, you should first categorize your expenses into operational and capital costs. The Illinois Startup Costs Worksheet can assist you in organizing these costs. Depending on the nature of the expenses, you may be able to deduct them as business expenses in the year they occurred or amortize them over time.

Section 195 of the Internal Revenue Code allows you to deduct certain startup costs incurred before the business begins. These can include expenses like market research, employee training, and some legal fees. Utilizing the Illinois Startup Costs Worksheet can help you categorize and calculate these expenses correctly, ensuring you maximize your deductions when filing taxes.

When calculating your startup costs, it is crucial to include both fixed and variable expenses. Fixed costs, such as rent and salaries, remain constant regardless of your sales volume. In contrast, variable costs, like inventory and utilities, fluctuate based on your operations. Utilizing the Illinois Startup Costs Worksheet will help you capture these essential components accurately, ensuring your financial plan reflects the true costs of starting your business.

The IRS allows you to deduct $5,000 in business startup costs and $5,000 in organizational costs, but only if your total startup costs are $50,000 or less. If your startup costs in either area exceed $50,000, the amount of your allowable deduction will be reduced by the overage.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

For those companies reporting under US GAAP, Financial Accounting Standards Codification 720 states that start up/organization costs should be expensed as incurred.

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

Startup costs will include equipment, incorporation fees, insurance, taxes, and payroll. Although startup costs will vary by your business type and industry an expense for one company may not apply to another.

Yes, getting a business off the ground takes time, and the IRS recognizes this. In your first few months or year of operation you may not bring in any income. Even without income, you may be able to deduct your expenses, as long as you meet certain IRS guidelines.

You can either deduct or amortize start-up expenses once your business begins rather than filing business taxes with no income. If you were actively engaged in your trade or business but didn't receive income, then you should file and claim your expenses.