Illinois Letter of Intent to Form a Limited Partnership

Description

How to fill out Letter Of Intent To Form A Limited Partnership?

Are you currently in a situation that requires documentation for either business or personal reasons almost every day.

There are countless legal document templates available online, but finding reliable ones is challenging.

US Legal Forms provides a vast array of form templates, including the Illinois Letter of Intent to Establish a Limited Partnership, which are designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Illinois Letter of Intent to Establish a Limited Partnership at any time, if needed. Just follow the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. This service features professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Illinois Letter of Intent to Establish a Limited Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct region/state.

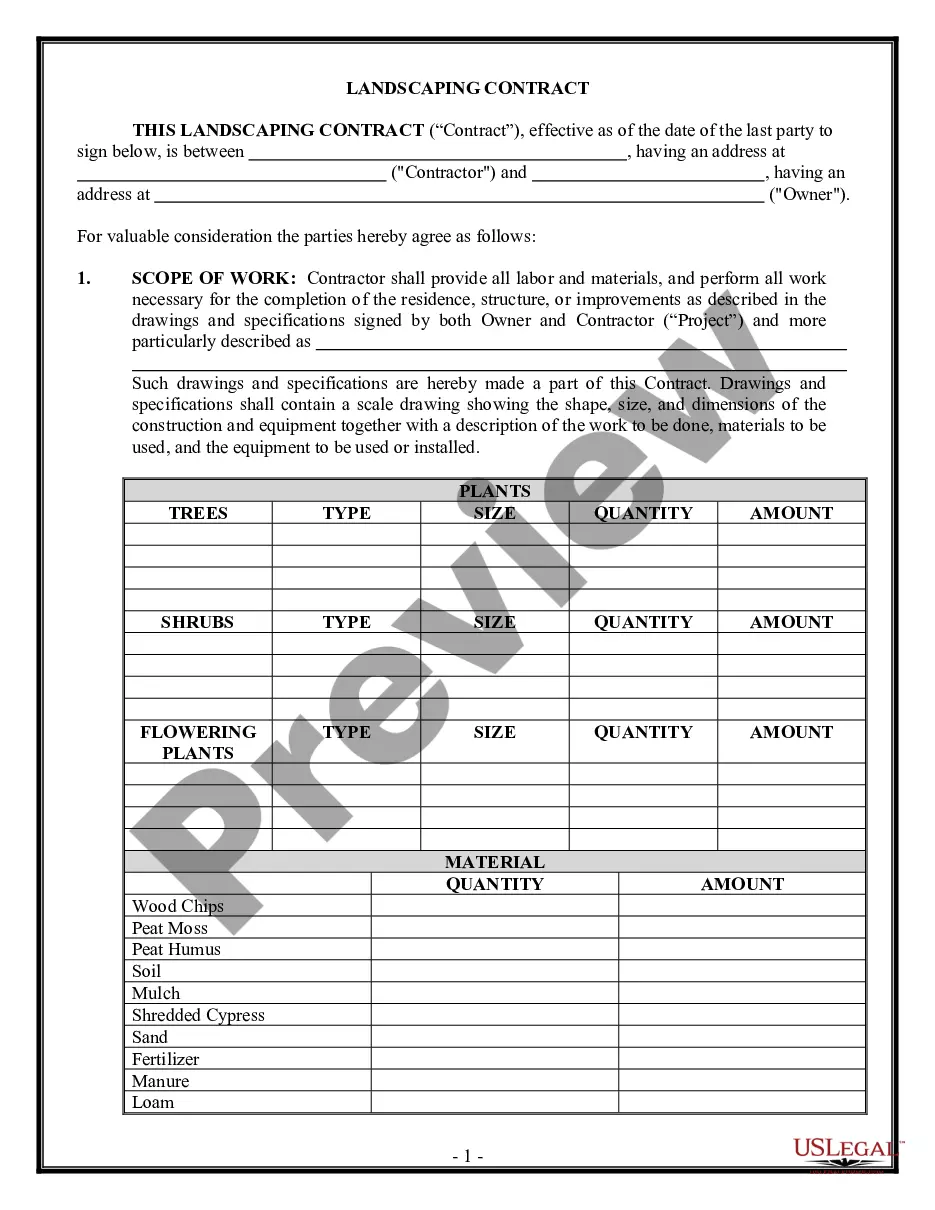

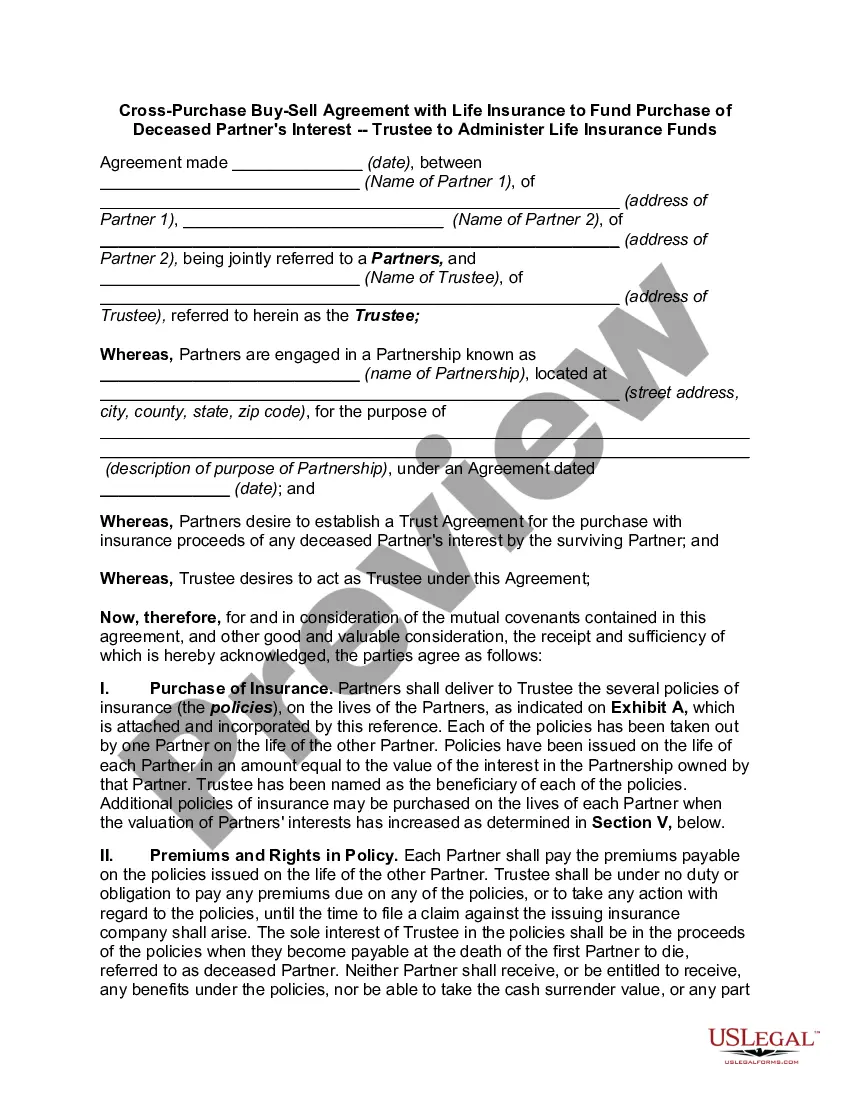

- Use the Preview button to inspect the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, take advantage of the Search section to find the form that suits your needs and requirements.

- If you locate the correct form, click Get now.

- Choose the pricing plan you want, complete the necessary details to create your account, and make a purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

A limited partnership is required to have both general partners and limited partners. General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

Your Limited Partnership Agreement can include details like: the name, address, and purpose of forming the partnership; whether limited partners have any voting rights regarding the day-to-day business decisions; how decisions will be made (by unanimous vote, majority vote, or majority vote based on percent ownership);

To form a partnership in Illinois, you should take the following steps:Choose a business name.File an Assumed Business Name Certificate.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

To form a limited partnership, you have to register in your state, pay a filing fee and create a limited partnership agreement, which defines how much ownership each limited partner has in your company, and other terms of the partnership.

An LP must have two or more owners. At least one must be a general partner who has unlimited, personal liability, and one must be a limited partner who has limited liability but is prohibited from participating in business management.

Trade Name Certificate. Fictitious Name Certificate. Certificate of Trade Name. Certificate of Assumed Business Name....The title of the organizing document will vary by state and may be called:Partnership Agreement.Certificate of Limited Partnership.Certificate of Limited Liability Partnership.Certificate of Good Standing.

How to Form an Illinois Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

How to Form an Illinois Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.