Illinois Independent Contractor Agreement - For Programming Services

Description

How to fill out Independent Contractor Agreement - For Programming Services?

US Legal Forms - a prominent repository of legal documents in the USA - offers a wide variety of legal form templates that you can download or print. By utilizing the website, you will access thousands of forms for business and personal purposes, classified by categories, states, or keywords.

You can find the most recent versions of forms such as the Illinois Independent Contractor Agreement - For Programming Services in just seconds.

If you have a subscription, Log In and download the Illinois Independent Contractor Agreement - For Programming Services from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Illinois Independent Contractor Agreement - For Programming Services.

Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- If this is your first time using US Legal Forms, here are some simple instructions to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to review the form’s details.

- Check the form summary to confirm you've chosen the right document.

- If the form doesn’t meet your requirements, use the Search box at the top of the screen to find one that does.

- Once satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select your preferred payment option and provide your information to create an account.

Form popularity

FAQ

Writing a contract agreement for services starts with clearly defining the project scope, payment terms, and timeline. You should incorporate clauses for confidentiality and dispute resolution to safeguard both parties. An Illinois Independent Contractor Agreement - For Programming Services will serve as a valuable template to guide you through the essential components and legal requirements, ensuring clarity and mutual understanding.

Independent contractors in Illinois need to fill out an Illinois Independent Contractor Agreement - For Programming Services, which outlines the terms of their work. They also may need to complete a W-9 form for tax purposes to provide their taxpayer identification number. Keeping accurate records of work performed and payments received is also crucial to manage taxes and compliance effectively.

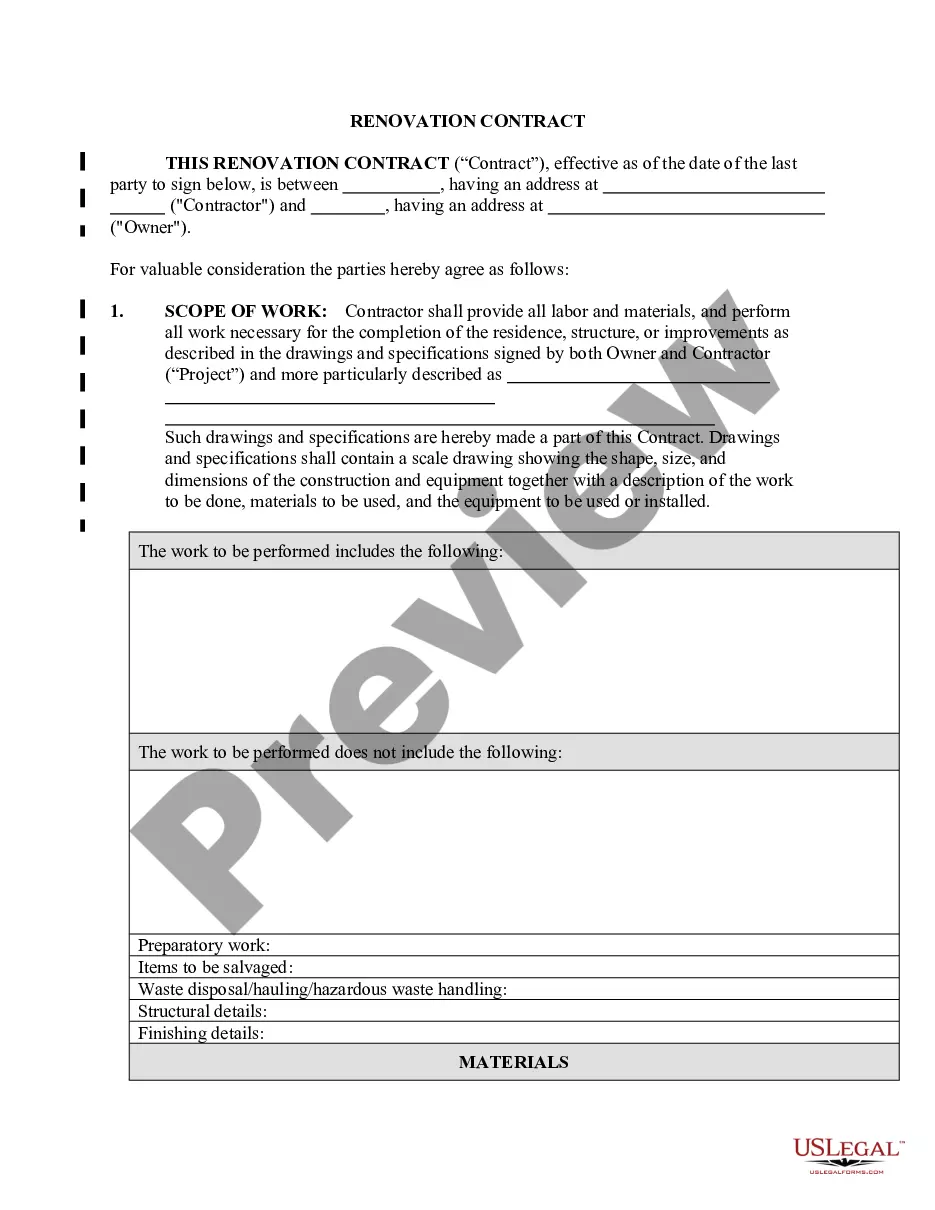

To fill out an Illinois Independent Contractor Agreement - For Programming Services, start by entering the parties' names and contact information. Next, specify the scope of work, payment details, and deadlines. It's essential to clarify confidentiality and intellectual property rights to protect both parties. Finally, ensure both parties sign and date the agreement to make it legally binding.

The 2 year contract rule relates to how long a contract is enforceable before it must be renewed or renegotiated. This rule is particularly relevant for determining ongoing project terms and maintaining good relationships between contractors and clients. Defining this timeframe in your Illinois Independent Contractor Agreement - For Programming Services is crucial for ensuring mutual understanding.

Independent contractors must report all income, but certain thresholds may apply before tax obligations arise. Generally, if you earn more than $600 in a tax year from a client, you will need to report it. Therefore, having a well-structured Illinois Independent Contractor Agreement - For Programming Services can help you manage your earnings and tax responsibilities effectively.

The new federal rule for independent contractors focuses on the criteria that determine whether a worker is truly an independent contractor or an employee. This rule aims to provide clarity for businesses and workers alike. As you draft your Illinois Independent Contractor Agreement - For Programming Services, it is essential to stay updated on these changes to ensure compliance.

The 2 year contractor law typically pertains to the duration a contractor can work continuously without being classified as an employee. This law helps prevent misclassification and ensures both parties understand their rights and obligations. Incorporating this into your Illinois Independent Contractor Agreement - For Programming Services can offer clarity and security.

Writing an independent contractor agreement involves clearly outlining the roles and responsibilities of both parties. Include sections on payment, project milestones, and termination clauses. Utilizing an Illinois Independent Contractor Agreement - For Programming Services template can simplify this process and ensure you cover all necessary legal bases.

The independent contractor rule in Illinois defines the criteria under which an individual can be considered an independent contractor rather than an employee. This distinction is vital for tax implications and benefits eligibility. To comply, ensure that your Illinois Independent Contractor Agreement - For Programming Services outlines the specific terms that adhere to this rule.

The 2 year contractor rule generally refers to how long a contractor can work on a particular project without needing to establish an official employee status. In Illinois, this rule helps maintain a clear distinction between independent contractors and employees, protecting both parties involved. It is essential to address this aspect within your Illinois Independent Contractor Agreement - For Programming Services.