This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Petition to Determine Distribution Rights of the Assets of a Decedent

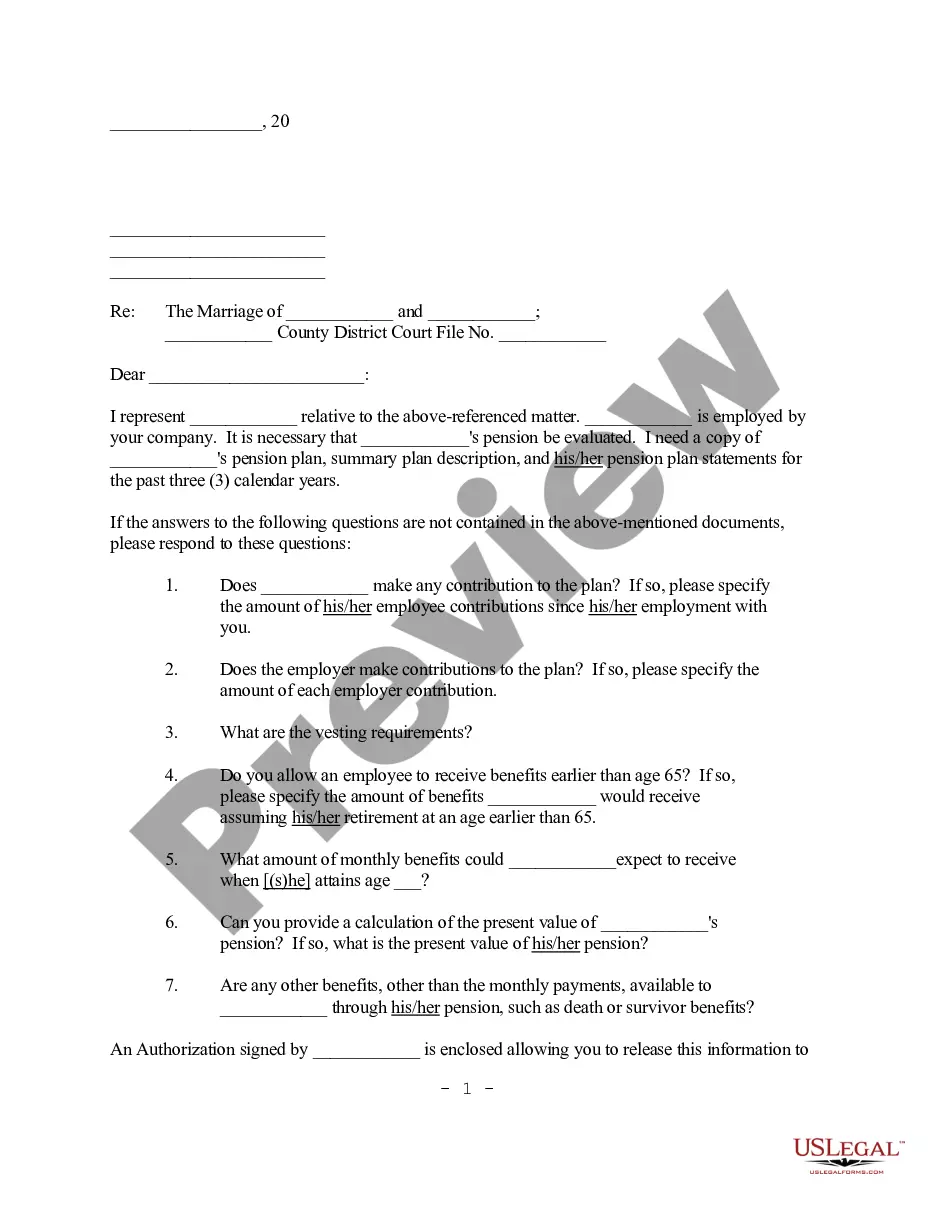

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

If you wish to complete, obtain, or printing legitimate record web templates, use US Legal Forms, the most important variety of legitimate types, which can be found on-line. Make use of the site`s simple and handy look for to find the papers you will need. A variety of web templates for organization and specific purposes are categorized by categories and states, or key phrases. Use US Legal Forms to find the Illinois Petition to Determine Distribution Rights of the Assets of a Decedent within a few clicks.

In case you are presently a US Legal Forms client, log in for your account and then click the Down load option to have the Illinois Petition to Determine Distribution Rights of the Assets of a Decedent . You may also accessibility types you formerly saved within the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for your proper metropolis/region.

- Step 2. Make use of the Review solution to examine the form`s articles. Don`t overlook to learn the explanation.

- Step 3. In case you are not satisfied with the kind, utilize the Look for area near the top of the display to find other versions from the legitimate kind template.

- Step 4. Upon having identified the shape you will need, click the Buy now option. Opt for the pricing program you choose and include your accreditations to sign up for the account.

- Step 5. Method the deal. You should use your Мisa or Ьastercard or PayPal account to finish the deal.

- Step 6. Find the file format from the legitimate kind and obtain it in your device.

- Step 7. Full, modify and printing or indicator the Illinois Petition to Determine Distribution Rights of the Assets of a Decedent .

Every legitimate record template you get is your own property forever. You might have acces to every kind you saved inside your acccount. Click on the My Forms section and pick a kind to printing or obtain once again.

Compete and obtain, and printing the Illinois Petition to Determine Distribution Rights of the Assets of a Decedent with US Legal Forms. There are many specialist and condition-certain types you may use for your personal organization or specific needs.

Form popularity

FAQ

A Will, also known as a Last Will and Testament, is a legally prepared and bound document that states your intentions for the distribution of your assets and wealth after your death. In the event you have children, a valid Will also allows you to designate who will care for them.

Probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Depending on the amount and type of property the deceased person owned, you may or may not need to go to court to transfer or inherit the property.

The executor first uses the funds in the account to pay any of the estate's creditors and then distributes the money ing to local inheritance laws. In most states, most or all of the money goes to the deceased's spouse and children.

Through the probate process, the probate court oversees the orderly distribution of an estate. If the deceased had a will, the court will confirm the validity of the will and ultimately govern the distribution of assets in ance with the wishes expressed in the will.

Probate is when the court supervises the processes that transfer legal title of property from the estate of the person who has died (the "decedent") to his or her beneficiaries.

A will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children. If you die without a will, those wishes may not be carried out.

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.