The following form is a Petition that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.

Illinois Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate

Description

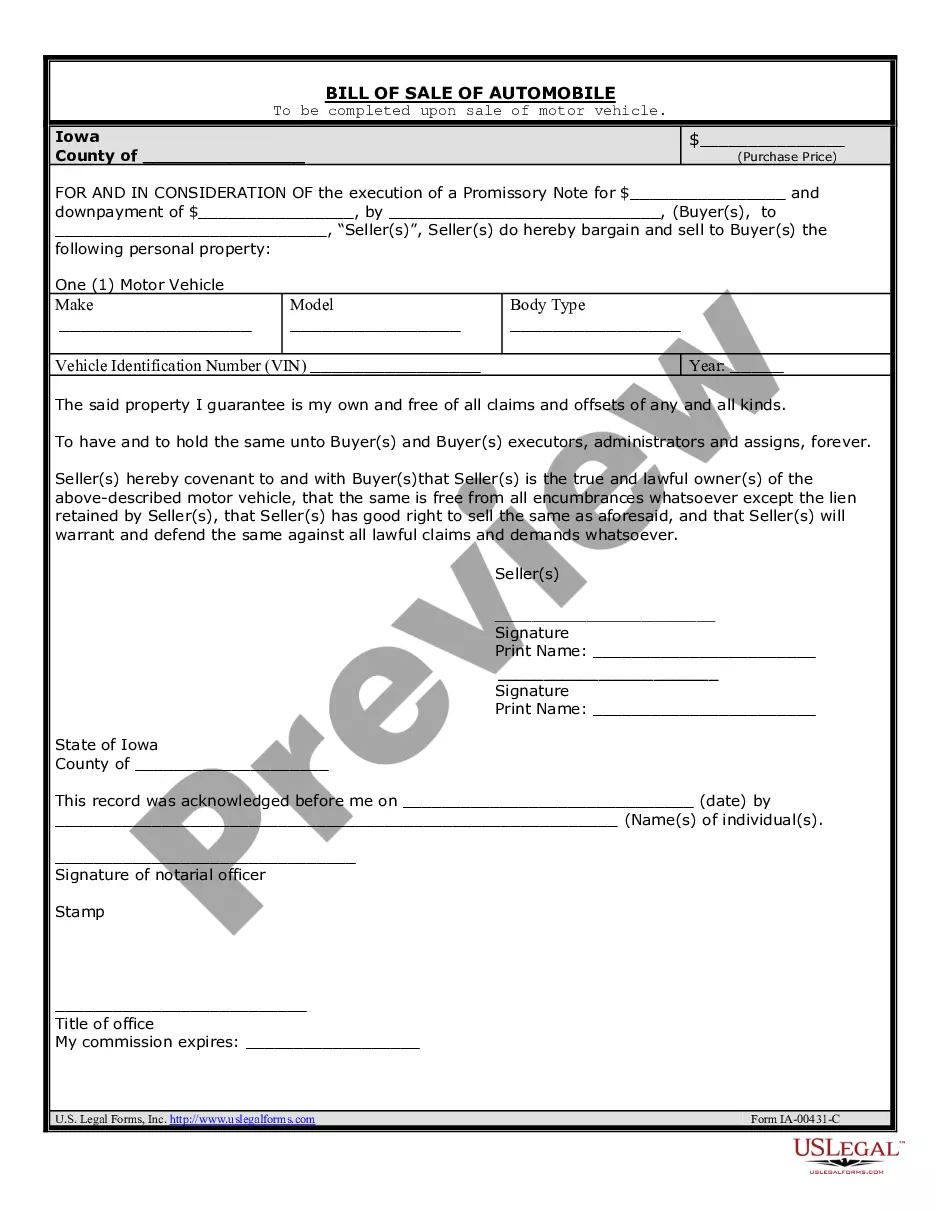

How to fill out Petition Of Creditor Of An Estate Of A Decedent For Distribution Of The Remaining Assets Of The Estate?

You may commit hrs on the web attempting to find the lawful papers design that meets the federal and state needs you require. US Legal Forms supplies a huge number of lawful varieties which are analyzed by professionals. It is possible to obtain or produce the Illinois Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate from your support.

If you currently have a US Legal Forms accounts, you may log in and click on the Obtain button. Following that, you may full, modify, produce, or sign the Illinois Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate. Each lawful papers design you buy is yours forever. To have one more copy for any acquired form, check out the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms site initially, adhere to the straightforward instructions beneath:

- Very first, make sure that you have chosen the proper papers design for your county/city that you pick. Browse the form description to make sure you have chosen the proper form. If available, make use of the Review button to appear from the papers design also.

- If you would like locate one more variation from the form, make use of the Search area to discover the design that suits you and needs.

- Once you have found the design you desire, simply click Buy now to carry on.

- Select the pricing program you desire, type in your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal accounts to pay for the lawful form.

- Select the formatting from the papers and obtain it in your device.

- Make adjustments in your papers if needed. You may full, modify and sign and produce Illinois Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate.

Obtain and produce a huge number of papers templates utilizing the US Legal Forms site, which provides the greatest assortment of lawful varieties. Use specialist and condition-certain templates to deal with your organization or personal requires.

Form popularity

FAQ

A will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children. If you die without a will, those wishes may not be carried out.

After someone dies, someone (called the deceased person's 'executor' or 'administrator') must deal with their money and property (the deceased person's 'estate'). They need to pay the deceased person's taxes and debts, and distribute his or her money and property to the people entitled to it.

Statute of Limitations and Claims Deadlines Typically, these time limits range from 2 to 6 years for unsecured debts (such as credit cards), and sometimes even longer for contract debts.

Probate is the court supervised process of identifying and gathering a person's assets after their death, paying all of their debts, and distributing the balance to the rightful heirs or beneficiaries.

Probate is the process completed when a decedent leaves assets to distribute, such as bank accounts, real estate, and financial investments. Probate is the general administration of a deceased person's will or the estate of a deceased person without a will.

Secured debts will get paid first, as they are connected to the assets themselves. Unsecured debts, like credit cards or personal loans, are generally paid last. As executor, it is your legal obligation to put off payment of unsecured debts until funeral costs, estate expenses, taxes, and medical expenses are paid off.

If someone dies without a will, the bank account still passes to the named beneficiary for the account. If someone dies without a will and without naming a beneficiary, it gets more complicated. In general, the executor of the estate handles any assets the deceased owned, including money in bank accounts.