Illinois Community Property Agreement

Description

How to fill out Community Property Agreement?

Finding the appropriate legal document template can be quite challenging.

Of course, there are many templates accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This service offers numerous templates, including the Illinois Community Property Agreement, suitable for both business and personal use.

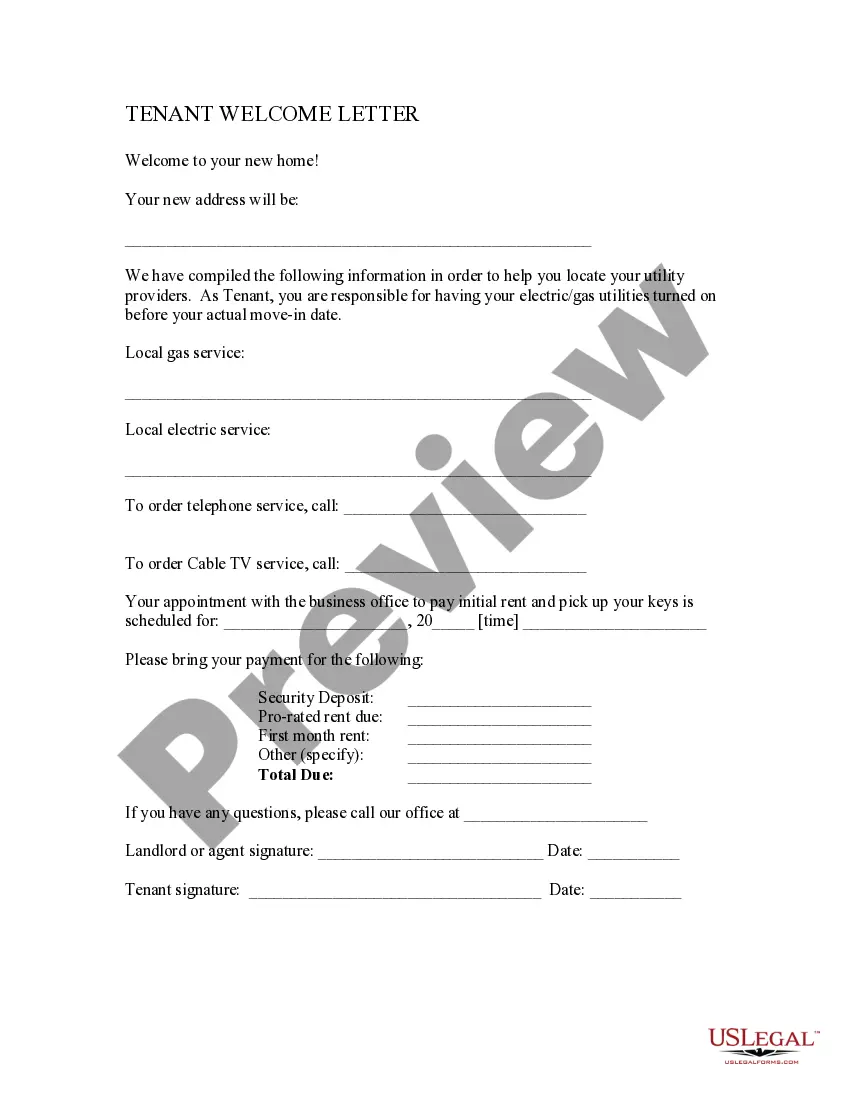

You can review the form using the Preview button and read the form description to confirm it is indeed suitable for you.

- All forms are reviewed by experts and meet both state and federal standards.

- If you are already registered, Log In to your account and click the Obtain button to access the Illinois Community Property Agreement.

- Use your account to search through the legal forms you have purchased in the past.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you should follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

The IRS recognizes community property as any property owned jointly by a married couple in certain states, including Illinois. This means that income earned by either spouse during the marriage is considered community property. It is advisable to consult a tax professional to understand the implications for your taxes. An Illinois Community Property Agreement can serve as a framework for managing tax responsibilities linked to shared assets.

Another example of community property would be income earned during the marriage by either spouse. This income becomes shared property, regardless of who earned it. For couples looking to manage their finances effectively, understanding these rules can prevent conflicts. An Illinois Community Property Agreement can help outline how income and assets will be handled.

A common example of community property in Illinois includes any real estate purchased during the marriage. Both spouses hold equal ownership rights to the property, making it subject to division during a divorce. It's crucial to document all transactions properly to avoid disputes later. Utilizing an Illinois Community Property Agreement can ensure that both parties understand their rights regarding shared assets.

Not every asset acquired during a marriage qualifies as community property. For instance, assets received as gifts or inheritance during the marriage are generally not considered community property in Illinois. Understanding this distinction can be vital during divorce or asset distribution. The Illinois Community Property Agreement provides clarity about what constitutes community property.

In Illinois, separate bank accounts are typically not considered marital property if they are maintained individually and were established before marriage. However, if marital funds are deposited into these accounts, they may become part of the marital estate under the Illinois Community Property Agreement. It is essential to understand how your finances are structured. Using a legal service can help clarify the distinction between separate and marital assets.

Filing separately while married can complicate your financial situation. In Illinois, the Illinois Community Property Agreement can help clarify how assets are divided and managed when filing separately. Each spouse is responsible for their own tax liabilities, which can lead to different outcomes based on your financial agreement. It’s beneficial to have a well-defined understanding through your community property agreement.

Reporting community property is essential if it falls under certain tax laws. In Illinois, both partners should detail their community property in their tax filings to avoid complications. When you establish an Illinois Community Property Agreement, you create a clear outline of what is considered shared property, which simplifies the reporting process. Always consult a tax professional for guidance.

Yes, tax refunds can be considered marital property in Illinois. Under the Illinois Community Property Agreement, both spouses may share ownership of tax refunds if they filed jointly. This shared ownership means that each spouse potentially has a claim to the refund, depending on the circumstances. It’s wise to discuss how to handle these funds within your agreement.

You don’t have to file community property separately in Illinois. The Illinois Community Property Agreement simplifies the process by allowing couples to outline their property rights without additional filings. This agreement serves as a legal document that can help clarify ownership and prevent disputes in the future. Consider this option to protect your interests.

In Illinois, marital property is generally divided equally between spouses during a divorce, regardless of the length of the marriage. This means that you do not need to be married for a specific period to claim half of the assets under an Illinois Community Property Agreement. Instead, any property acquired during the marriage is usually considered joint property and is subject to division. It is essential to establish a comprehensive community property agreement to clarify ownership rights and ensure fair distribution.