Illinois Instructions to Clients - Short

Description

How to fill out Instructions To Clients - Short?

Are you currently in a situation where you require documents for either business or personal reasons on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Illinois Instructions to Clients - Short, which are crafted to meet state and federal requirements.

Once you find the correct form, click Get now.

Select the pricing plan you desire, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Illinois Instructions to Clients - Short template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

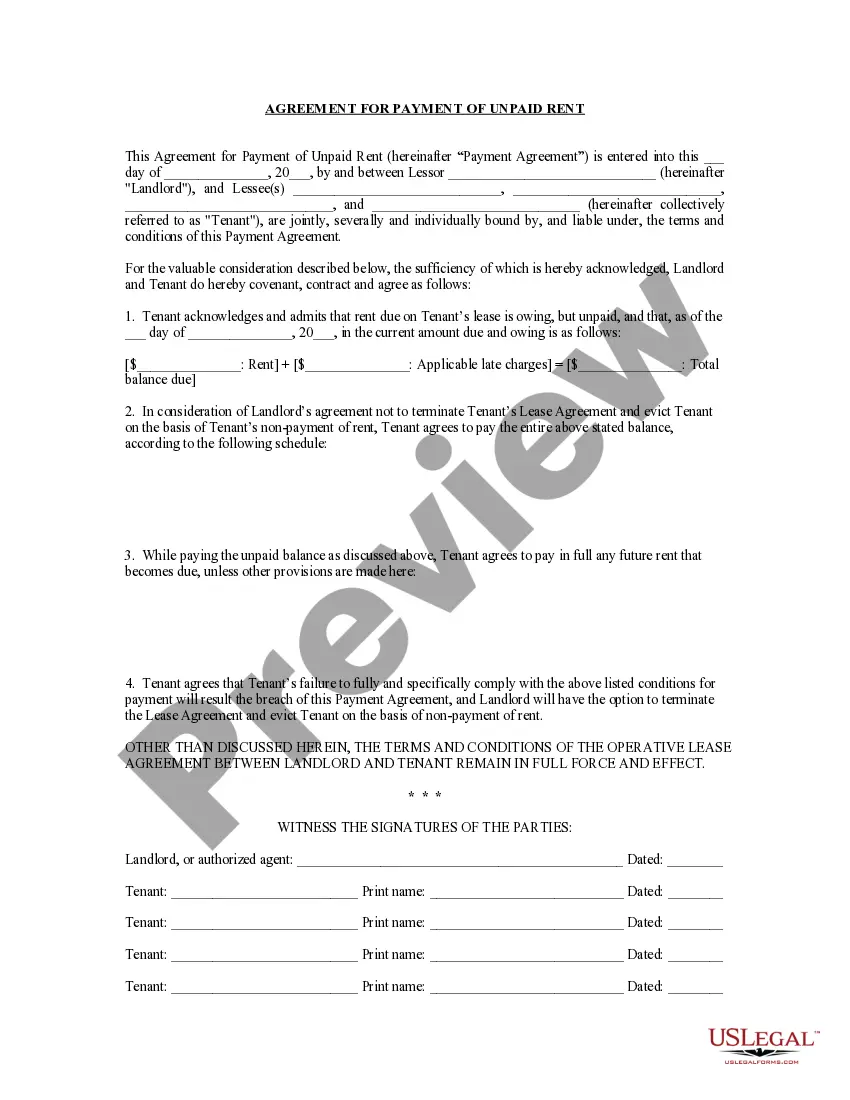

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

Subtracting the deductions on lines 12 and 13 from your AGI give you your taxable income, which is shown on Line 15. Your taxable income is the amount used to calculate your tax liability.

Line 26 asks you to write in the total of any estimated tax payments you made for the tax year, plus the value of any tax payments you made in the previous tax year that carry over to this return's tax year. Line 27 is where you write in the value of your earned income tax credit, if you qualify.

Who must file the Schedule M-3? Corporations and S corporations with assets of $10 million or greater. Partnerships must file Schedule M-3 if any of the following are true: The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more.

Line 26 asks you to write in the total of any estimated tax payments you made for the tax year, plus the value of any tax payments you made in the previous tax year that carry over to this return's tax year. Line 27 is where you write in the value of your earned income tax credit, if you qualify.

Line 28. If you're eligible for the child tax credit and there is an amount on line 27 of Schedule 8812, enter that amount here. Line 29. If you qualify for the American Opportunity Credit, which can help offset the cost of higher-education, enter the amount here.

Line 20 allows you to deduct contributions you made to a traditional IRA, as long as you made it with money you already paid income tax on.

The purpose of Schedule K-1-P, Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture, is for you to supply each individual or entity who was a partner or shareholder at any time during your tax year with that individual's or entity's share of the amounts you reported on your federal income tax ...

Farming profits or losses are transferred to Form 1040 to calculate your total tax liability for the year. Essentially, Schedule F is to farmers what Schedule C is to sole proprietors in other industries.