Illinois General Form of Receipt

Description

How to fill out General Form Of Receipt?

Finding the appropriate legal document template can be challenging. Obviously, there are many templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers a wide array of templates, such as the Illinois General Form of Receipt, that you can apply for both business and personal purposes. All forms are reviewed by professionals and adhere to state and federal regulations.

If you are already registered, Log In to your account and then click the Download button to access the Illinois General Form of Receipt. Use your account to search through the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the documents you need.

Finally, complete, revise, print, and sign the acquired Illinois General Form of Receipt. US Legal Forms is the largest repository of legal documents from which you can find various template layouts. Utilize the service to download professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are straightforward instructions you can follow.

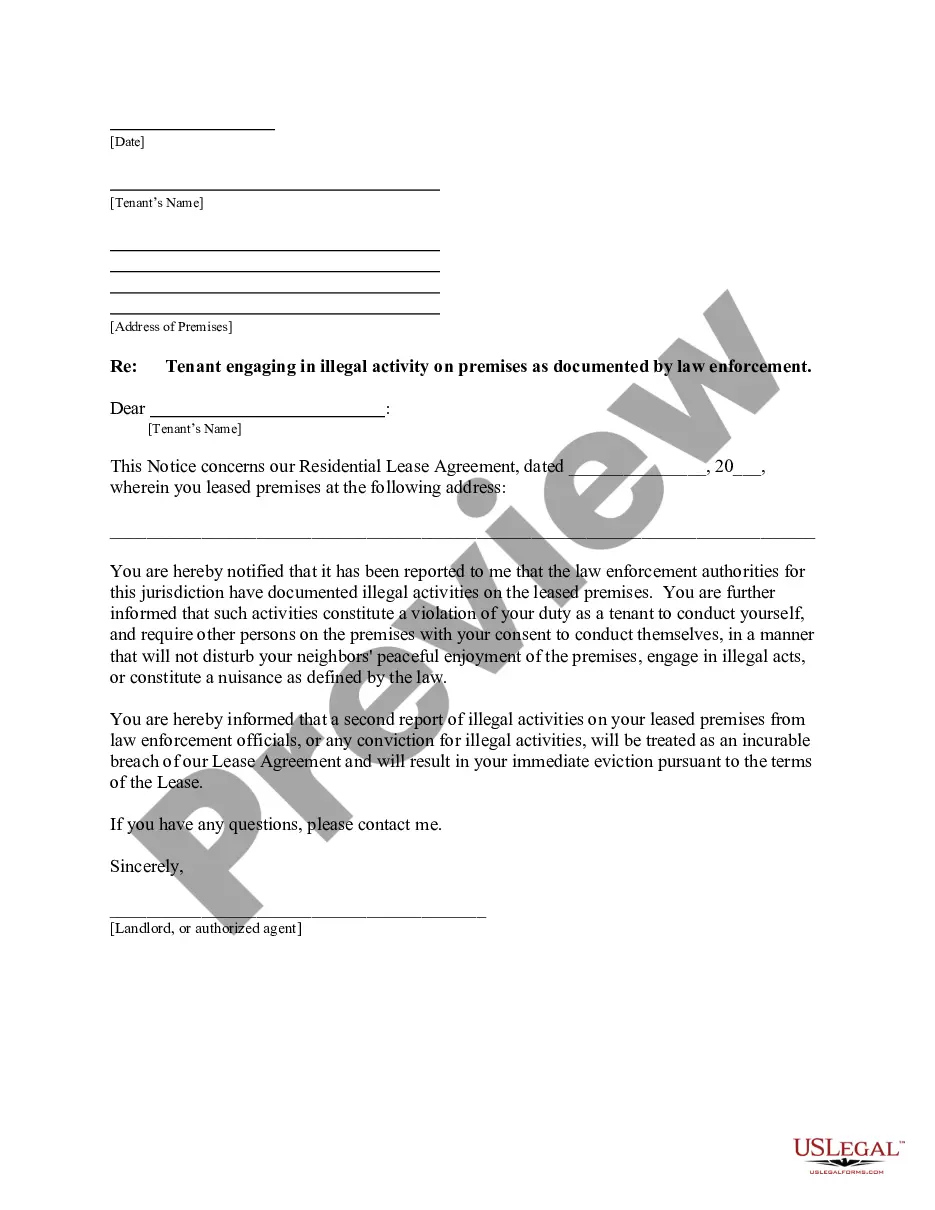

- First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm it’s suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate template.

- Once you are confident that the form is suitable, click on the Get now button to retrieve the form.

- Choose the pricing plan you want and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the format and download the legal document template to your device.

Form popularity

FAQ

You can order Illinois tax forms online through the Illinois Department of Revenue’s website. This site allows you to easily download and print forms you may need, such as the Illinois General Form of Receipt. Alternatively, you can call their office to request physical copies. Accessing the correct forms promptly is crucial for timely filing.

The Illinois ST 556 form is a Sales Tax Transaction Return used for reporting sales tax collected from customers. This form is vital for businesses that sell taxable goods or services within the state. Completing it accurately ensures compliance with Illinois tax regulations. Remember, the Illinois General Form of Receipt can assist you in understanding transactions that may require this form.

Filing your Illinois state taxes for the first time involves several steps, beginning with gathering your income documentation. You can then choose to file electronically or by mail. If you are unsure about the forms or process, consider using resources or services that guide you through the filing process. The Illinois General Form of Receipt serves as an essential resource for understanding your filing steps.

MyTax is available for businesses and individuals seeking to manage their tax accounts online in Illinois. This platform allows users to file returns, make payments, and review their tax status conveniently. Anyone who has an Illinois tax obligation, including those needing to utilize the Illinois General Form of Receipt, can benefit from MyTax.

Receiving a letter from the Illinois Comptroller usually indicates that there is important information regarding your tax account or a potential issue. This letter might address your tax debt, missing documents, or updates about your tax filings. It is crucial to respond promptly to any correspondence to avoid complications. If you have questions about your receipt or correspondence, the Illinois General Form of Receipt can provide clarity.

Yes, Illinois has begun accepting tax returns for the current tax year. You can file your taxes electronically for a quicker process, or submit paper returns if you prefer the traditional method. Always check the Illinois Department of Revenue website for the latest updates on tax return acceptance. Utilizing tools like the Illinois General Form of Receipt can facilitate your filing.

Whether you need to file an Illinois tax return depends on various factors, such as your income level and residency status. In general, if you have earned income in Illinois, you likely need to complete and submit an Illinois tax return. Additionally, filing requirements may change annually, so it’s beneficial to stay informed. The Illinois General Form of Receipt can help confirm your tax obligations.

Yes, if you engage in selling goods or services subject to sales tax in Illinois, you must register for a sales tax permit. This registration allows you to collect sales tax from customers and remit it to the state. Obtaining your Illinois General Form of Receipt during this process is vital, as it documents your sales, making tax reporting easier. Utilize platforms like uslegalforms to simplify registration and compliance.

Illinois Form ST 556 is the Certificate of Exemption, which allows certain purchases to be exempt from sales tax. This form is crucial for businesses and individuals who qualify for exemptions under Illinois law. Utilizing this form helps maintain proper records, alongside your Illinois General Form of Receipt, to track exempt transactions. It's important to understand the eligibility criteria to avoid issues.

The ST1 form in Illinois refers to the Sales Tax Registration Application. This form allows businesses to register to collect sales tax, ensuring compliance with state regulations. By completing the ST1 form, you can obtain your Illinois General Form of Receipt, which is necessary for reporting sales tax accurately. This process helps streamline your business operations.