Illinois Agreement with Sales and Marketing Representative

Description

Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors. In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.

Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no magic or set number of factors that makes the worker an employee or an independent contractor, and no one factor stands alone in making this determination. Also, factors which are relevant in one situation may not be relevant in another.

How to fill out Agreement With Sales And Marketing Representative?

If you require extensive, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find other types of your legal form format.

Step 4. After locating the form you require, click the Purchase now button. Choose your payment plan and provide your details to register for an account.

- Utilize US Legal Forms to obtain the Illinois Agreement with Sales and Marketing Representative in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Illinois Agreement with Sales and Marketing Representative.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you’re using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you’ve selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the details.

Form popularity

FAQ

Commission paid as direct remuneration In some companies, the sales commissions earned by salesmen who make or close a sale constitute part of the compensation or remuneration paid to them for serving as salesmen, and hence part of their wage or salary.

When you are a paid a set amount per year, regardless of how many hours you work, that's a salary. When you're paid hourly, that money is wages. A commission is a form of payment that's tied to sales performance, according to the U.S. Department of Labor.

The Fair Labor Standards Act (FLSA) does not require the payment of commissions, so employees cannot enforce their right to receive a commission by going to the federal agency that enforces the FLSA or going to court under the FLSA.

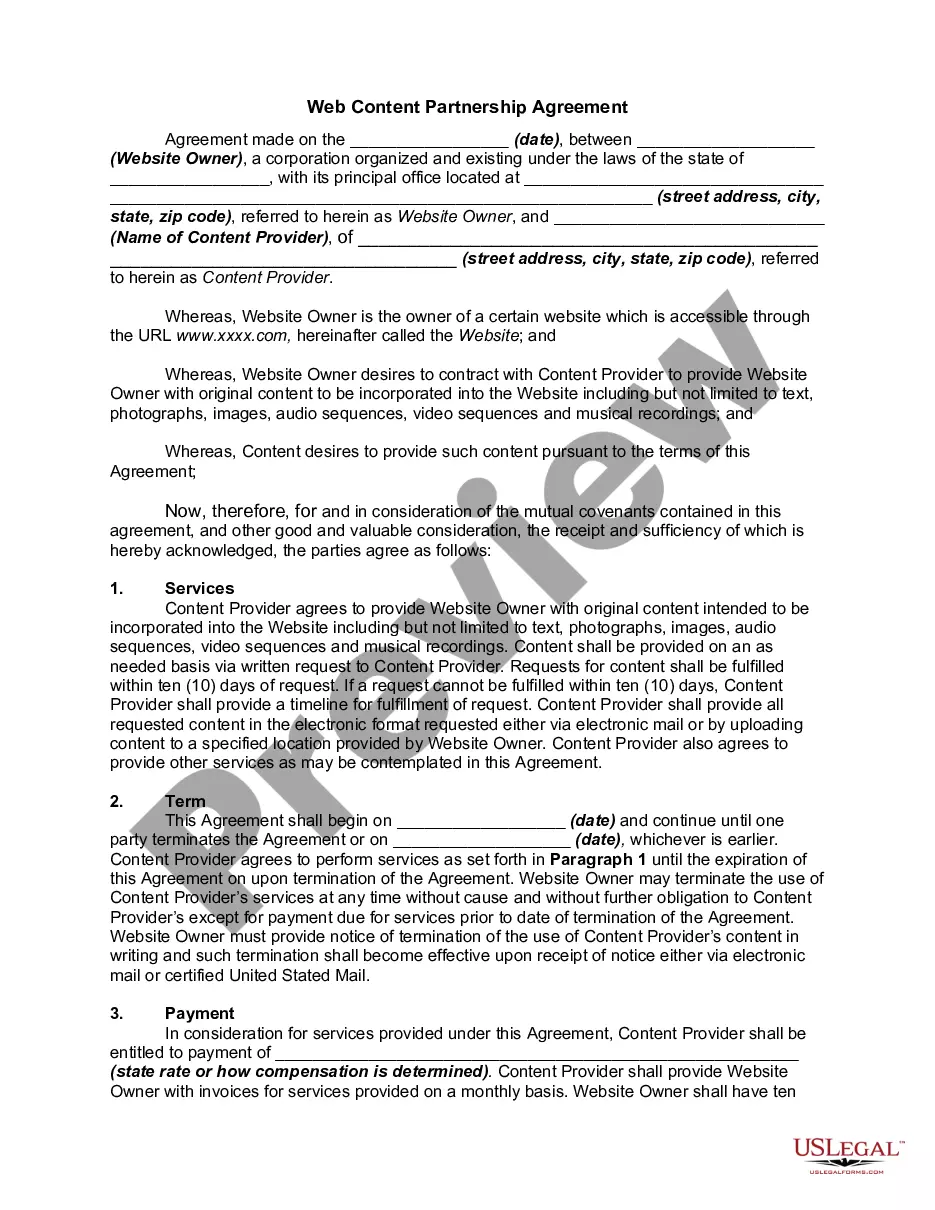

A sales representative contract, sometimes known as a sales representative agreement, is a contract between a company and the contractor performing sales and marketing services on behalf of the company.

Sales EmployeesIf the person earning sales commission is an employee of your company, you have no choice but to pay the commission through your employer payroll system.

Sec. 2. All commissions due at the time of termination of a contract between a sales representative and principal shall be paid within 13 days of termination, and commissions that become due after termination shall be paid within 13 days of the date on which such commissions become due.

All commissions due at the time of termination of a contract between a sales representative and principal shall be paid within 13 days of termination, and commissions that become due after termination shall be paid within 13 days of the date on which such commissions become due.

The law says that all commissions that are due must be paid within 13 days of the termination of your contract. Or, if the commission isn't yet due (because the sale hasn't closed), commission must be paid within 13 days of when it is due. Basically, if the sale hasn't closed, the company doesn't have to pay yet.

820 ILCS 120/1. In sum, it generally covers independent contractors (not employees) who solicits sales for a person or company and who gets paid in whole or in part by commission. It will not cover you if you solicit sales and then resell the product to someone else.