Illinois Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Have you ever been in a situation where you require documentation for either a business or particular activities almost daily? There are numerous official document templates accessible on the internet, but finding forms you can trust is challenging.

US Legal Forms offers thousands of document templates, such as the Illinois Minimum Checking Account Balance - Corporate Resolutions Form, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Illinois Minimum Checking Account Balance - Corporate Resolutions Form template.

- Identify the form you need and verify it is for your specific city/region.

- Use the Preview button to examine the document.

- Review the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, utilize the Search field to find a template that suits your requirements.

- Once you locate the appropriate form, click Purchase now.

- Choose the pricing plan you desire, complete the requested information to process your payment, and finalize your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

US form 1120 is the federal income tax return that C corporations file to report their income to the Internal Revenue Service (IRS). This form includes information on the corporation’s revenue, deductions, and tax due. While it operates on a federal level, understanding the implications of US form 1120 can also affect how your corporation interacts with state forms like the Illinois Minimum Checking Account Balance - Corporate Resolutions Form. Timely and accurate filing is essential for tax compliance.

IL business income tax refers to the taxes imposed on the income generated by businesses operating in Illinois. This tax applies to various business structures and is based on the net income reported on forms like IL-1120. Understanding IL business income tax is vital for managing your financial obligations, particularly in the context of the Illinois Minimum Checking Account Balance - Corporate Resolutions Form. Adequate knowledge of this tax can help you strategize effectively.

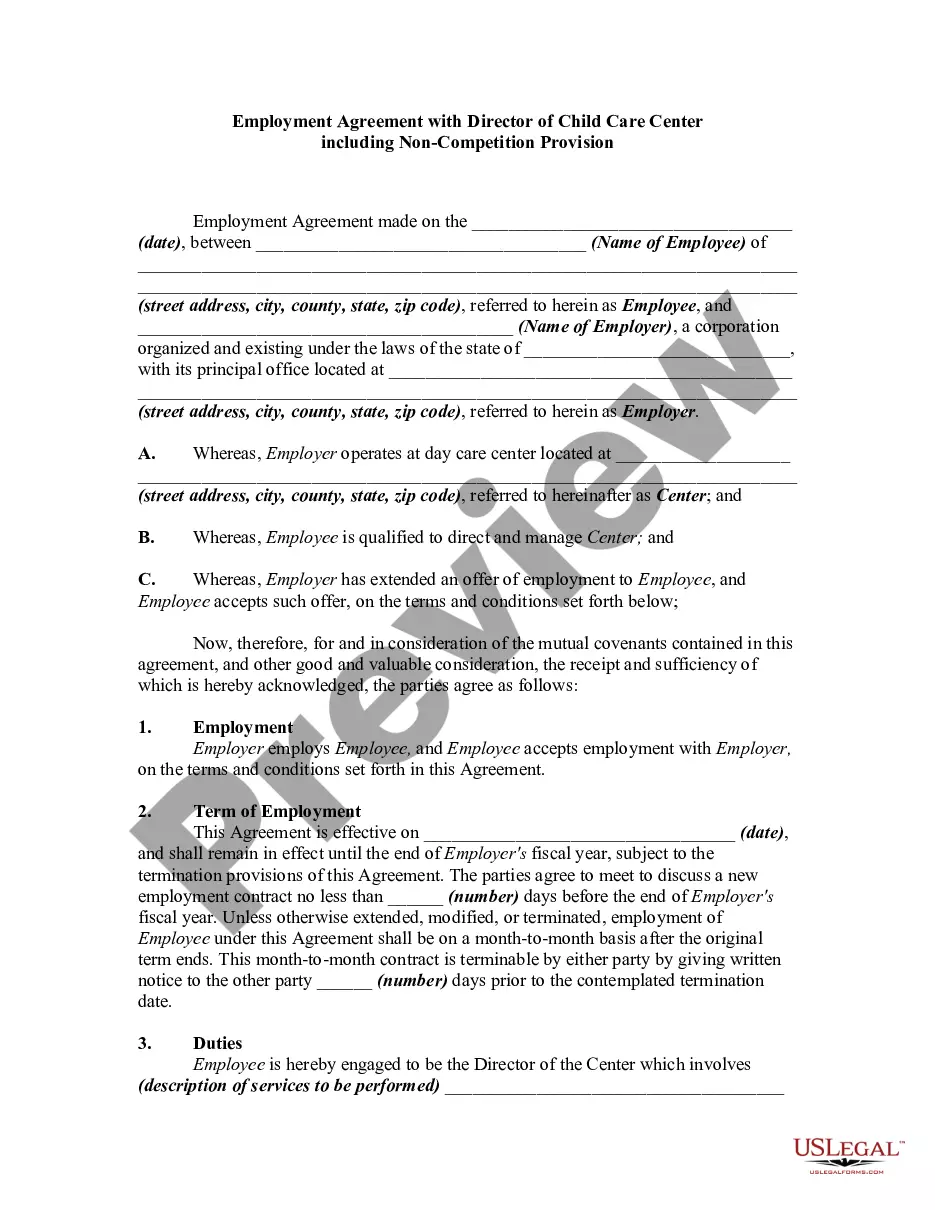

A corporate resolution to open an account is a formal document that authorizes specific individuals to act on behalf of the corporation in financial matters. This document is essential for establishing a business bank account, ensuring that all actions align with corporate governance. When dealing with the Illinois Minimum Checking Account Balance - Corporate Resolutions Form, having a corporate resolution in place helps streamline the process of opening and managing your business bank accounts.

The IL-1120 ST form is a streamlined version of the IL-1120 for corporations that meet certain criteria, typically those with a simpler financial structure. This form allows for a more straightforward filing process and less documentation. Utilizing the IL-1120 ST can be advantageous for eligible businesses, particularly in relation to the Illinois Minimum Checking Account Balance - Corporate Resolutions Form. It simplifies tax compliance while ensuring you fulfill your obligations.

Form IL 1120 is a tax return specifically for corporations operating in Illinois. It reports the corporation’s income, deductions, and tax liability to the Illinois Department of Revenue. Understanding this form is essential for businesses aiming to comply fully with state tax laws, especially regarding the Illinois Minimum Checking Account Balance - Corporate Resolutions Form. Proper filing can help you avoid potential fines.

Any corporation that operates within Illinois and has a tax liability must file the IL-1120 form. This includes various types of corporations, such as C corporations and S corporations. Filing is crucial to ensure compliance with Illinois tax regulations, particularly concerning the Illinois Minimum Checking Account Balance - Corporate Resolutions Form. By filing correctly, you can keep your business in good standing.

Filling out a corporate authorization resolution form like the Illinois Minimum Checking Account Balance - Corporate Resolutions Form involves providing essential details about your corporation and the authorized individuals. Start by entering the corporation's name, address, and other identification information, followed by the names and roles of individuals being authorized. Be sure to check that all names are accurate and clearly stated, as this helps prevent any misunderstandings with the bank. Finally, have all authorized parties sign the document to validate it.

You can easily get a banking resolution through resources like uslegalforms, which offers templates specifically designed for Illinois corporations. The Illinois Minimum Checking Account Balance - Corporate Resolutions Form is available for download and customization to fit your corporate needs. Additionally, your bank may provide its own template, but using a standardized form can simplify the process and ensure consistency across banks. Don’t hesitate to explore various options for obtaining this important document.

You can obtain a banking resolution by drafting your own using the Illinois Minimum Checking Account Balance - Corporate Resolutions Form available on platforms like uslegalforms. This user-friendly form guides you in providing all necessary information to ensure compliance with banking regulations. Additionally, consulting a legal professional can help clarify any complex issues related to your corporation's specific needs. Once completed, present this document to your bank to finalize the resolution.

A banking resolution is a formal document authorizing specific individuals to carry out banking transactions on behalf of a corporation. This document details who has the authority to open, manage, and close bank accounts while complying with the Illinois Minimum Checking Account Balance - Corporate Resolutions Form requirements. Without a banking resolution, your bank might restrict access to corporate accounts. This is essential for protecting your company's financial interests.