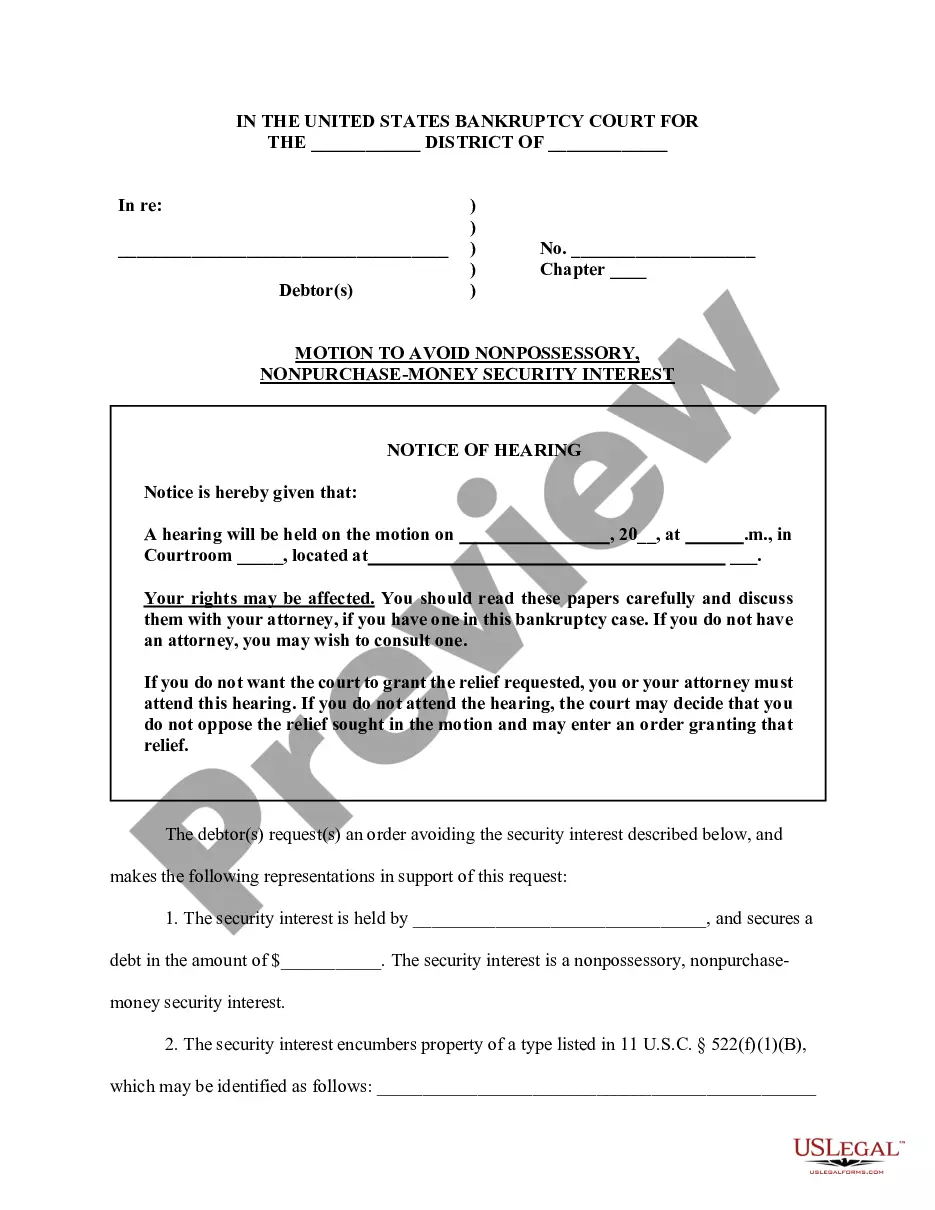

Illinois Getting Started Mortgage Foreclosure Appearance & Answer is a court document that debtors must fill out and file with the court if they are facing foreclosure. The document must be completed and filed with the court prior to the hearing. It is a detailed form that notifies the court of the debtors’ status and allows them to state their case. The form includes information such as the debtor’s current financial situation, payments made, assets, liabilities, and other related information. There are two types of Illinois Getting Started Mortgage Foreclosure Appearance & Answer: 1. Appearance & Answer: This document is used by debtors when requesting a hearing or when filing an answer to a complaint for foreclosure. 2. Answer & Motion: This document is used by debtors when filing an answer to a complaint for foreclosure and also includes a motion to the court. This motion could include a request for a loan modification or other relief.

Illinois Getting Started Mortgage Foreclosure appearance & answer

Description

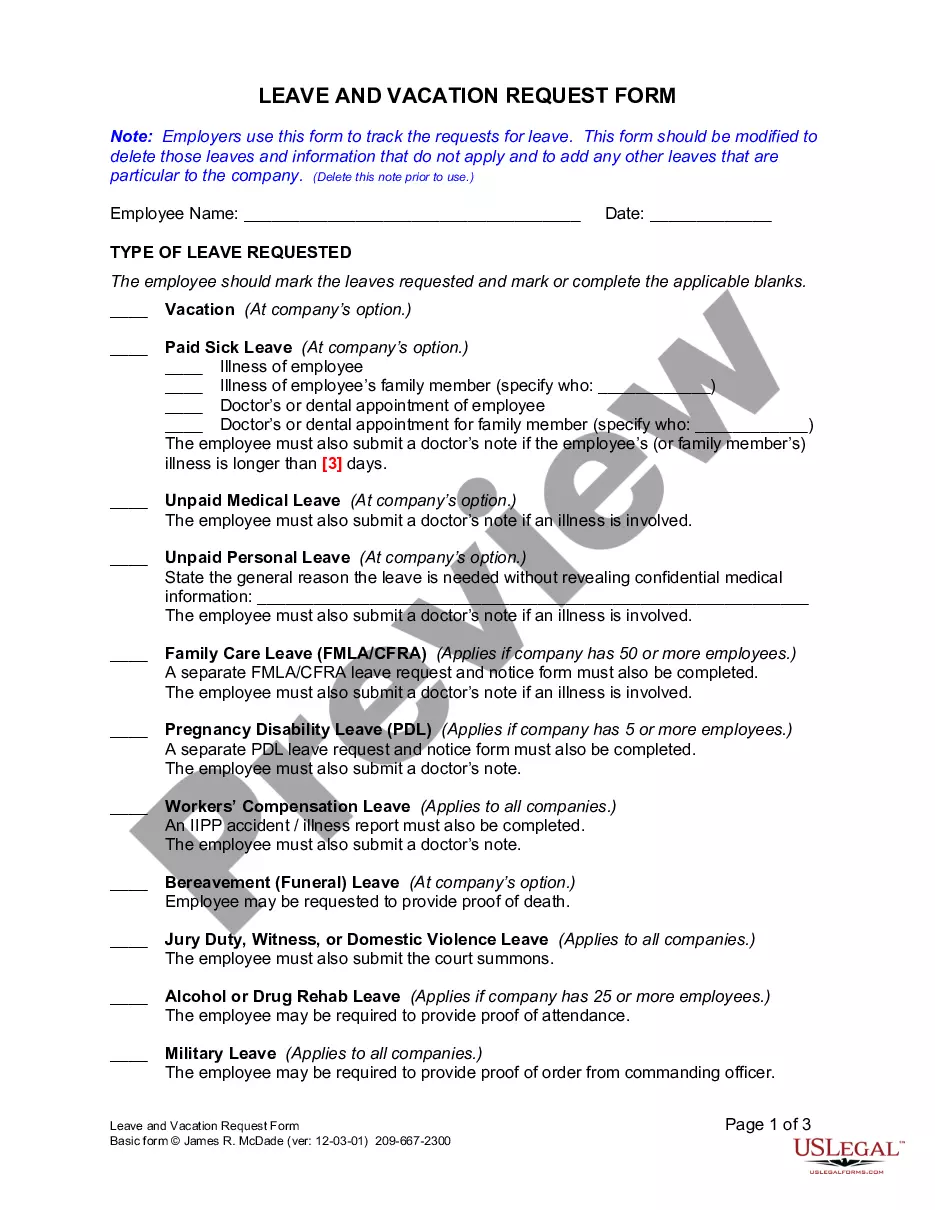

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Getting Started Mortgage Foreclosure Appearance & Answer?

How many hours and resources do you usually allocate for creating formal documentation.

There’s a better alternative to obtaining such forms than employing legal professionals or dedicating hours to hunt for a suitable template.

Establish an account and pay for your subscription. You can complete a transaction using your credit card or through PayPal - our service is entirely safe for this.

Download your Illinois Getting Started Mortgage Foreclosure appearance & answer onto your device and fill it out on a printed hard copy or electronically.

- US Legal Forms is the foremost online repository that provides expertly crafted and validated state-specific legal documents for any objective, including the Illinois Getting Started Mortgage Foreclosure appearance & answer.

- To obtain and prepare an appropriate Illinois Getting Started Mortgage Foreclosure appearance & answer template, adhere to these straightforward guidelines.

- Examine the form content to ensure it aligns with your state requirements. For this, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate another one via the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Illinois Getting Started Mortgage Foreclosure appearance & answer. If not, follow the next steps.

- Click Buy now after identifying the right document. Choose the subscription plan that best fits you to unlock our library’s complete features.

Form popularity

FAQ

In Illinois, your mortgage loan will automatically default after 90 days without payment. At this point, your lender will send a Notice of Default (NOD), which serves the purpose of informing you of their intent to foreclose on your property due to lack of payment.

Foreclosure of mortgage. No person shall commence an action or make a sale to foreclose any mortgage or deed of trust in the nature of a mortgage, unless within 10 years after the right of action or right to make such sale accrues.

Redemption period shall end on the date 30 days after the date the judgment of foreclosure is entered if the court finds that the mortgaged real estate has been abandoned.

In Illinois, you can redeem your home until the later of: seven months after you receive the summons of the foreclosure action (or are served by publication if the lender is unable to serve you the foreclosure papers personally) or. three months after the date that the court enters the judgment of foreclosure.

Once you are delinquent by 120 days or more, your lender can initiate foreclosure proceedings in court. Illinois is a state in which all foreclosures are judicial foreclosures, which means the court system has jurisdiction over the matter.

In Illinois, there is a redemption period during which you have the legal right to pay off the total debt plus certain costs and interest and reclaim your property, even after a judgment of foreclosure. The property cannot be sold during the redemption period.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

The redemption period also runs for 3 months after a foreclosure judgment is entered, so, depending on when a judgment is entered, the redemption period can run longer than 7 months from service.