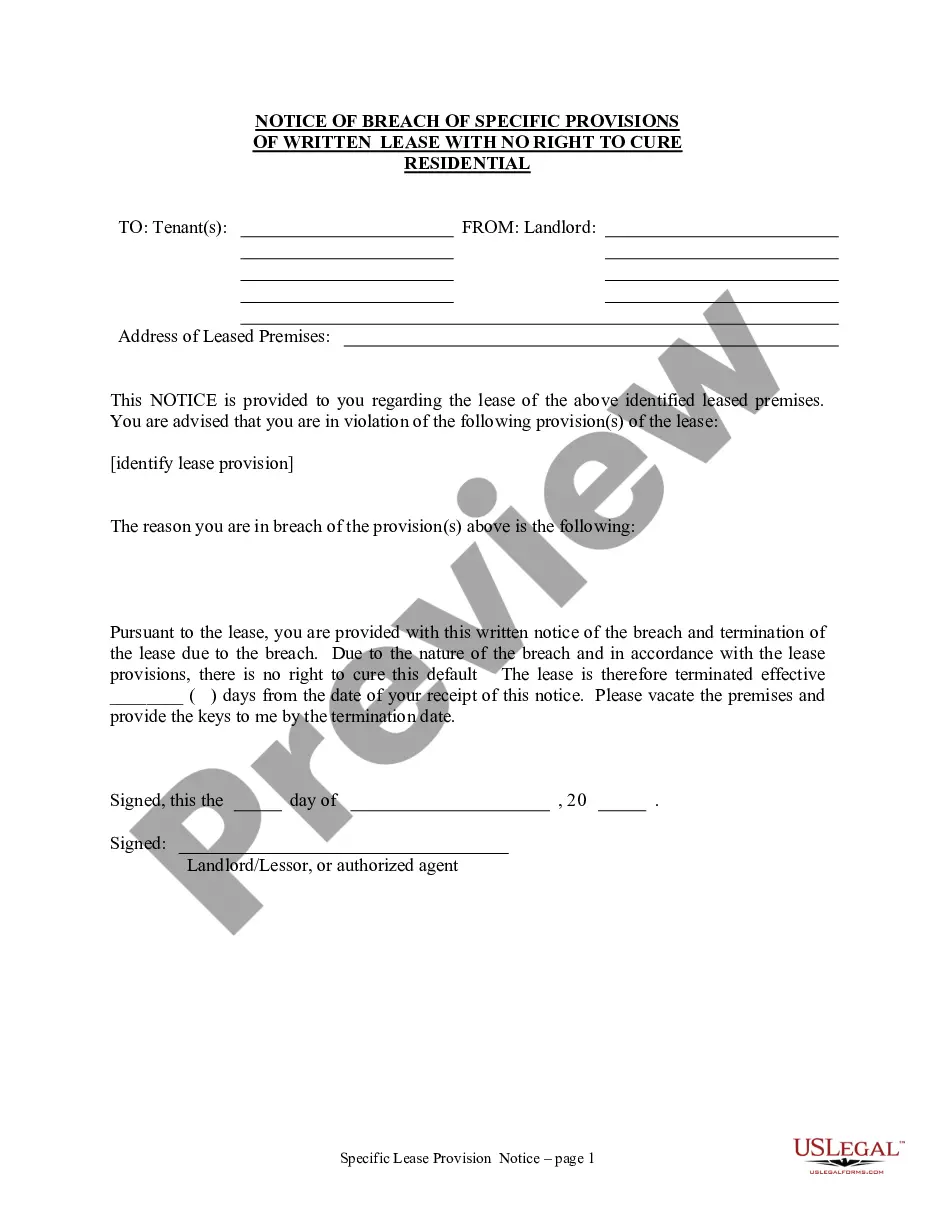

Illinois Mailed Notice To Creditors is a notice sent by the estate of a deceased individual, or a fiduciary in charge of the estate, to creditors of the deceased or the estate. The notice informs creditors of the date of death or the date of the estate filing, and provides the creditor with information regarding how to make a claim against the estate. This notice is typically sent via certified mail to all known creditors of the decedent or the estate. There are two types of Illinois Mailed Notice To Creditors: 1. Reprobate Notice — This type of notice is sent to all known creditors prior to the estate being probated. It informs creditors of the decedent's passing and provides details on how to file a claim against the estate. 2. Post-Probate Notice — This type of notice is sent to all known creditors after the estate has been probated. It provides details on how to file a claim against the estate, and serves as a reminder to creditors that the estate is now in probate.

Illinois Mailed Notice To Creditors

Description

How to fill out Illinois Mailed Notice To Creditors?

If you are seeking a method to properly prepare the Illinois Mailed Notice To Creditors without employing a legal expert, then you have arrived at the perfect place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for various personal and business situations. Every document available on our online platform is crafted in alignment with federal and state regulations, ensuring that your papers are accurate.

Another excellent feature of US Legal Forms is that you will never lose the documents you have purchased - you can access any of your downloaded templates in the My documents section of your profile whenever you need them.

- Ensure the document displayed on the page suits your legal circumstances and state regulations by reviewing its text description or browsing through the Preview mode.

- Type the form name in the Search tab at the top of the page and choose your state from the list to find an alternative template in case of any discrepancies.

- Go through the content confirmation again and click Buy now when you are assured of the document's compliance with all necessary standards.

- Log in to your account and select Download. If you do not have an account, create one and choose a subscription plan.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Choose the format in which you wish to save your Illinois Mailed Notice To Creditors and download it by clicking the designated button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare your hard copy manually.

Form popularity

FAQ

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.

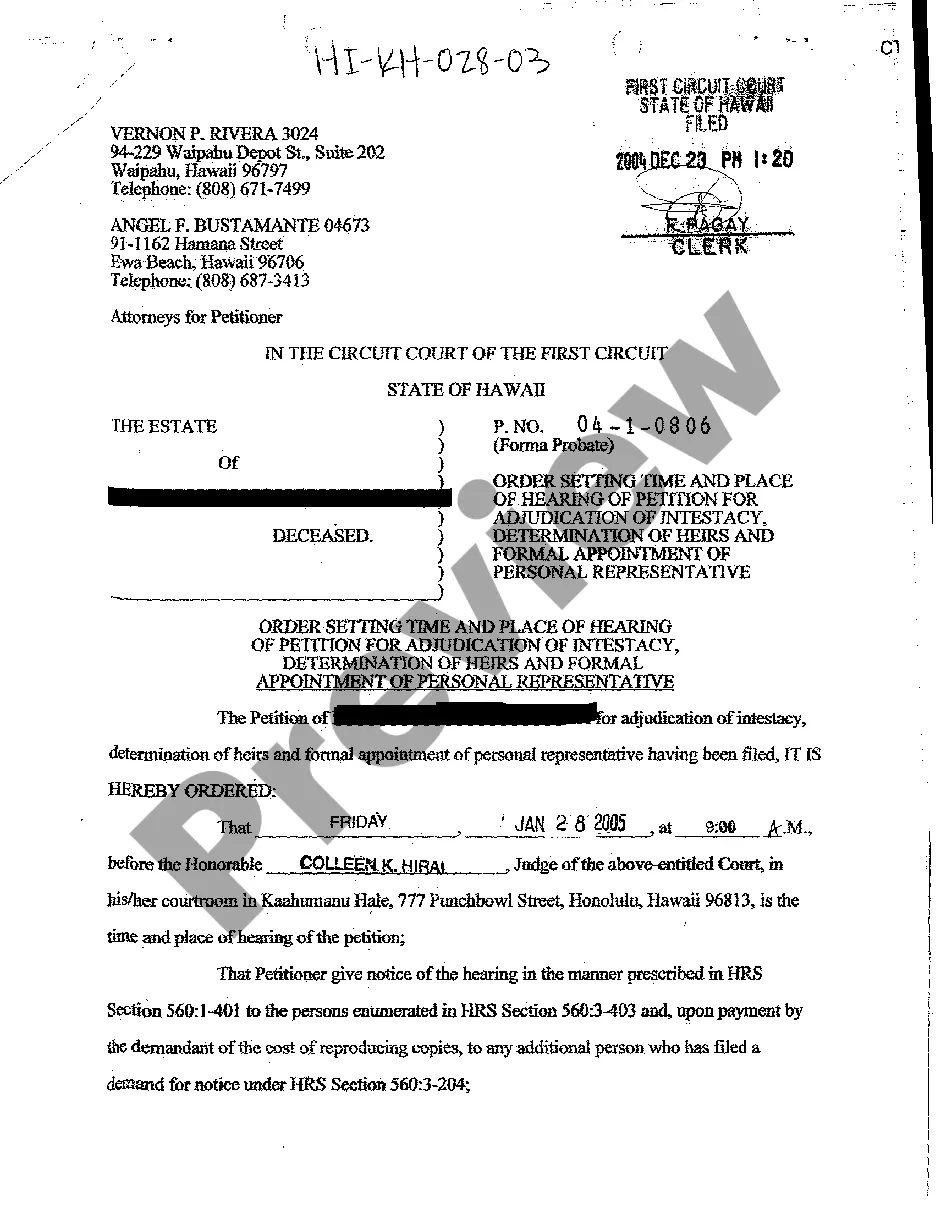

?Within 14 days of the will being admitted to probate, the executor's attorney must mail to the heirs and legatees: (1) the petition for probate; (2) the order admitting the will to probate and appointing the executor; (3) a notice regarding the rights of the heirs and legatees.

Generally, a formal probate court proceeding is necessary in Illinois only if: there are assets that the deceased person owned solely (not jointly), and. all of the probate assets, together, are worth more than $100,000.

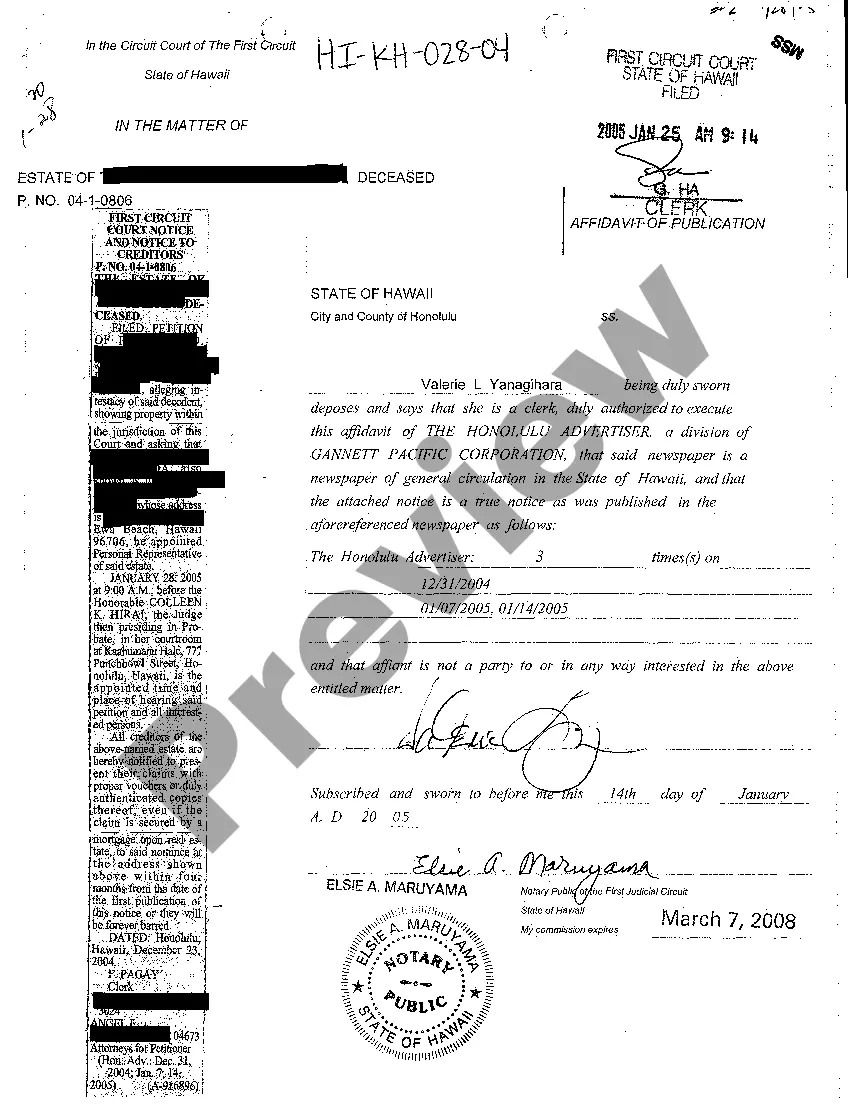

Notice by Publication to All Creditors The publication of notice must be made once a week for three consecutive weeks and must appear in a newspaper published in the county where the estate is being administered.

18-11. Allowance and disallowance of claims by representative. (a) The representative may at any time pay or consent in writing to all or any part of any claim that is not barred under Section 18-12, if and to the extent the claim has not been disallowed by the court and the representative determines it to be valid.

Every estate does not have to go through probate. Probate is the legal process to make sure that a deceased person's debts and taxes are paid. In Illinois, a lawyer is required for probate unless the estate is valued at or less than $100,000 and does not have real estate.

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.