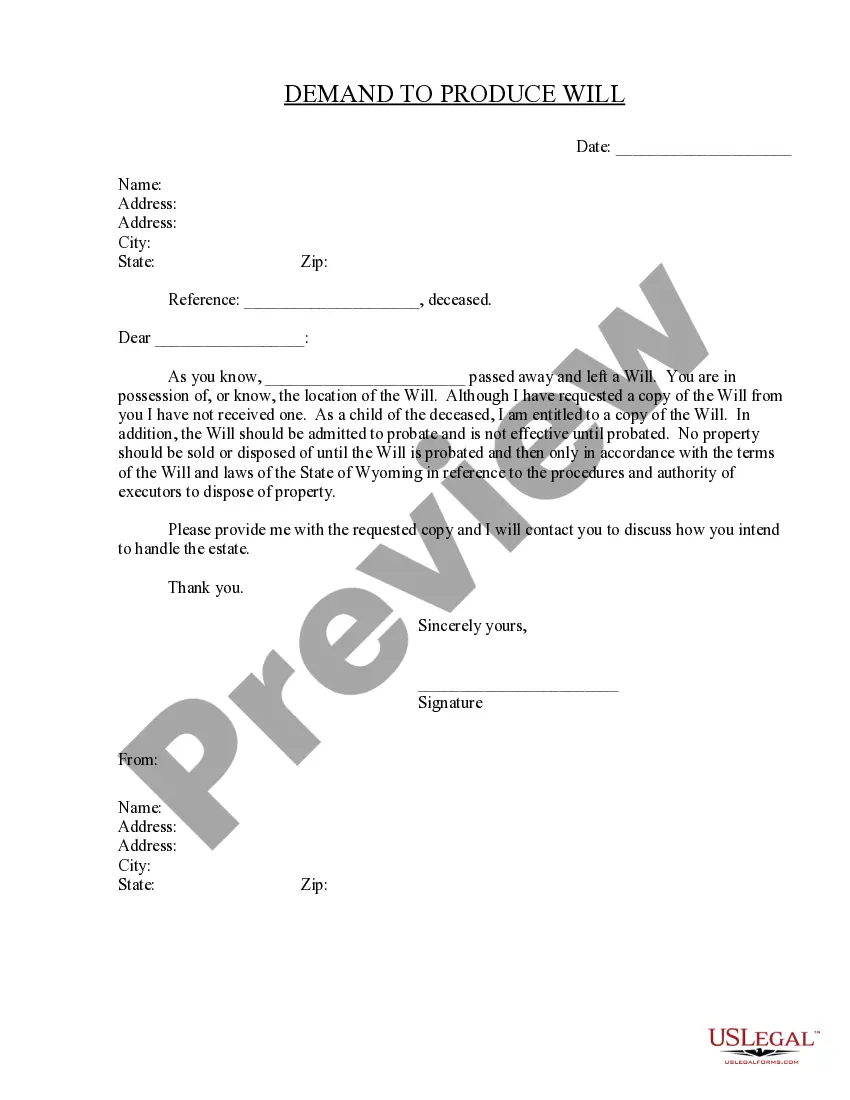

The Illinois Bond of Distributee-Summary Administration is a bond required by the state of Illinois for individuals appointed to administer the estate of a deceased individual. It is an assurance of faithfulness and fidelity to the duties of the office. The bond guarantees that the distributed will correctly distribute the assets of the estate according to the laws of the state and that they will not commit any breach of trust or misapply any of the funds. There are two types of Illinois Bond of Distributee-Summary Administration: the Individual Bond and the Blanket Bond. The Individual Bond is for a single estate and is tailored to the specific estate, while the Blanket Bond covers multiple estates. The bond must provide coverage for a minimum of $25,000 and the applicant must provide a surety bond, signed by a surety company or individual surety with a minimum net worth of $250,000.

Illinois Bond of Distributee-Summary adminstration

Description

How to fill out Illinois Bond Of Distributee-Summary Adminstration?

Completing official documentation can be quite a hassle unless you have accessible fillable templates at your disposal.

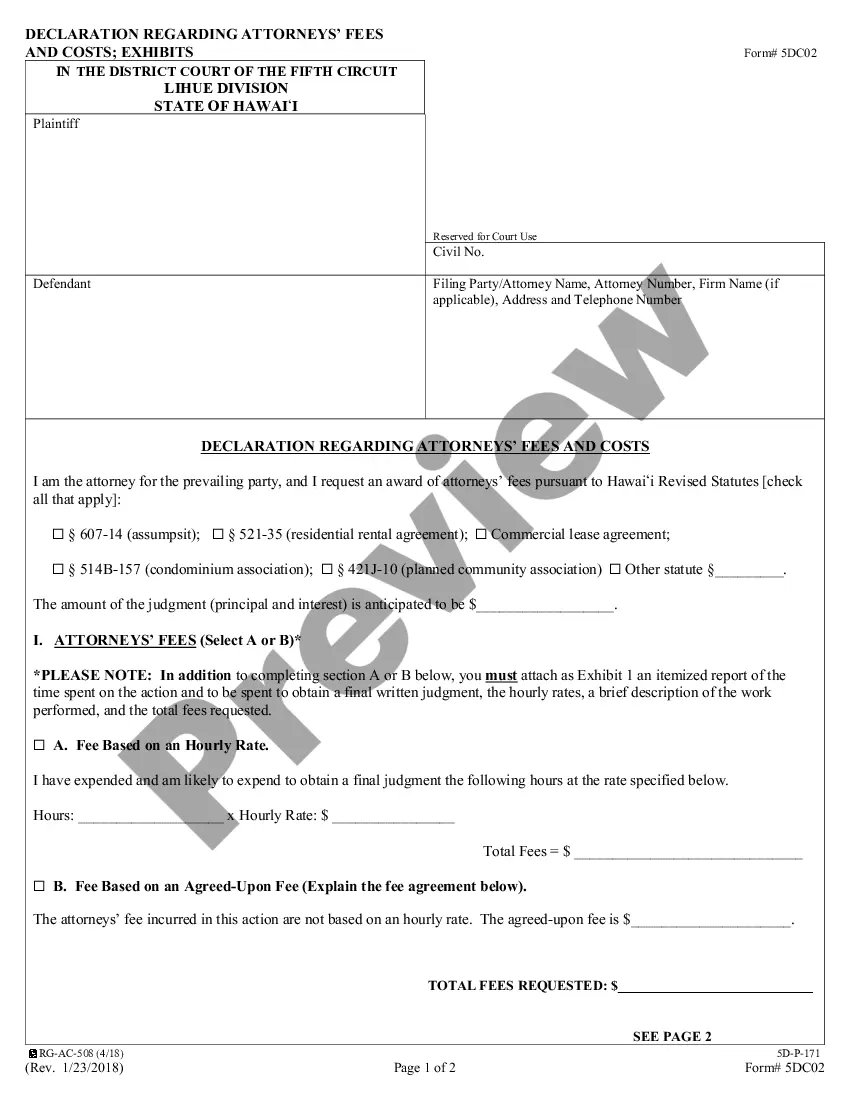

With the US Legal Forms online library of formal documents, you can be assured of the fields you encounter, as they all comply with federal and state laws and have been vetted by our experts.

Nonetheless, even if you are not familiar with our service, registering with a valid subscription will only take a few minutes. Here’s a quick overview for you.

- If you need to finalize the Illinois Bond of Distributee-Summary administration, our platform is the ideal location to obtain it.

- Acquiring your Illinois Bond of Distributee-Summary administration from our service is as simple as one-two-three.

- Existing users with a valid subscription simply need to Log In and click the Download button after locating the suitable template.

- Later, if necessary, users can retrieve the same document from the My documents section of their profile.

Form popularity

FAQ

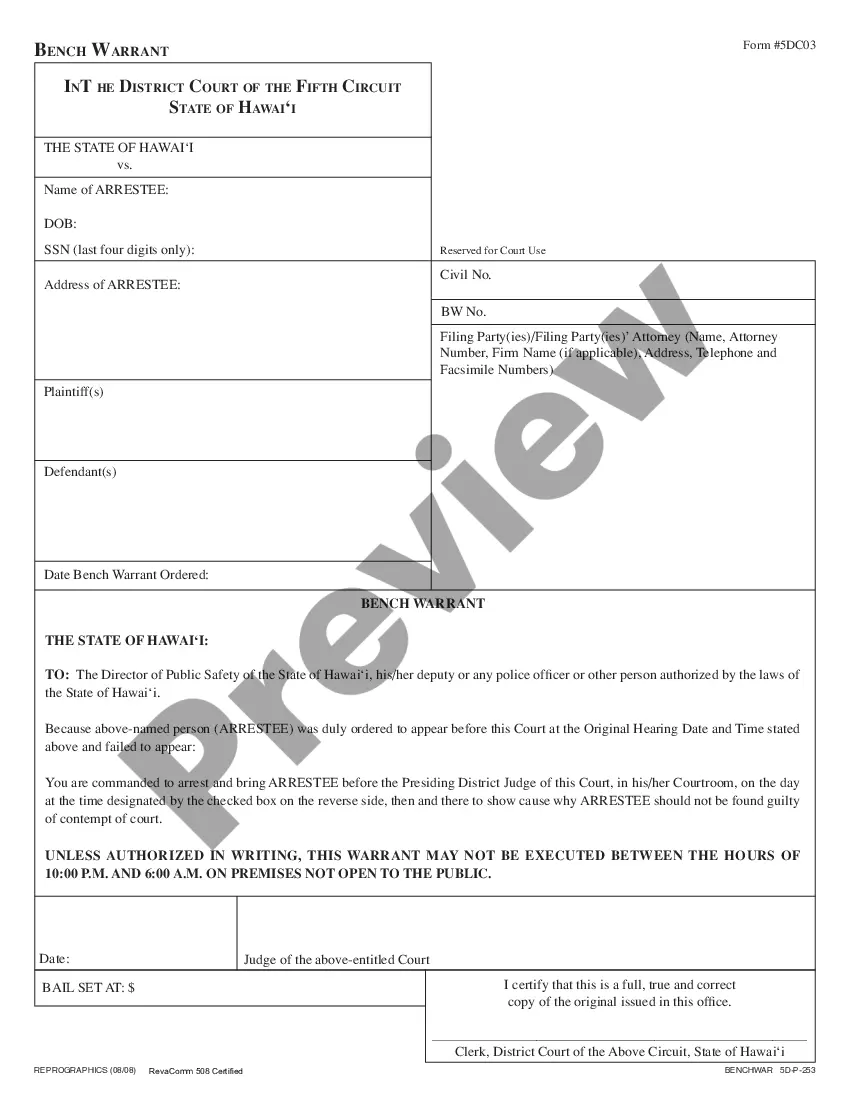

Sec. 9-1. Who may act as administrator. A person who has attained the age of 18 years, is a resident of the United States, is not of unsound mind, is not an adjudged person with a disability as defined in this Act and has not been convicted of a felony, is qualified to act as administrator.

Illinois Bond in Lieu of Probate Explained When using this technique, the personal representative purchases a bond from an insurance company. This acts as insurance against the personal representative distributing the estate incorrectly.

An administrator to collect is a representative who has been named by the probate court after that person has put forward a petition for serving in the probate action. That administrator is then charged with preventing waste, embezzlement or loss of probate estate property.

Simplified Probate in Illinois: Summary Administration To request summary administration, you file a written request or "petition" with the local probate court. If approved, you can then immediately distribute the assets without having to jump through the hoops of regular probate.

What is the Difference Between an Executor and an Administrator in Illinois? An Executor is the individual named in a Will to serve as the representative of the Estate. An Administrator is an interested party to an estate who petitions the Probate Court to serve as the Estate representative in the absence of a Will.

Gottlieb, LLC, generally serves as resident agent for its non-resident estate representative clients. The qualifications to serve as an executor or administrator are: 1) individual is 18 years or older; 2) a United States resident; 3) not a convicted felon; and 4) not under a legal disability.

An administrator to collect is a representative who has been named by the probate court after that person has put forward a petition for serving in the probate action. That administrator is then charged with preventing waste, embezzlement or loss of probate estate property.

If a person dies leaving a valid will, and the will names a person who is to execute the will and administer the estate, this person is called an executor. However, when the person in charge of administering the estate is not named in a will, that person is called an administrator.