An Illinois Small Estate Affidavit ($100,000 and Under) is a legal document that allows for the transfer of a person's estate without the need for probate court proceedings. The affidavit is most commonly used when an individual has died and left an estate with assets valued at or below $100,000. This type of affidavit is typically used to transfer assets such as real estate, bank accounts, and personal property. There are two types of Illinois Small Estate Affidavit ($100,000 and Under): an affidavit for real estate and an affidavit for personal property. The affidavit for real estate is used to transfer a deceased person's real estate or interests in real estate. This affidavit must be completed and signed by the deceased's heirs, and the appropriate documentation must be filed with the court. The affidavit for personal property is used to transfer the deceased's personal property, such as bank accounts, investments, and vehicles. This affidavit must also be completed and signed by the deceased's heirs, and the appropriate documentation must be filed with the court. In order to be eligible to use an Illinois Small Estate Affidavit ($100,000 and Under), the deceased must have passed away within the past three years and the estate must consist solely of assets with a value of $100,000 or less. Additionally, all heirs listed on the affidavit must be legally competent and must have agreed to the distribution of the assets. Once the appropriate documentation and affidavits have been completed and filed with the court, the court will issue an order that allows the assets to be transferred without the need for probate court proceedings. This can be a convenient and cost-effective way to transfer an estate with assets valued at or below $100,000.

Illinois Small Estate affidavit ($100,000 and Under)

Description

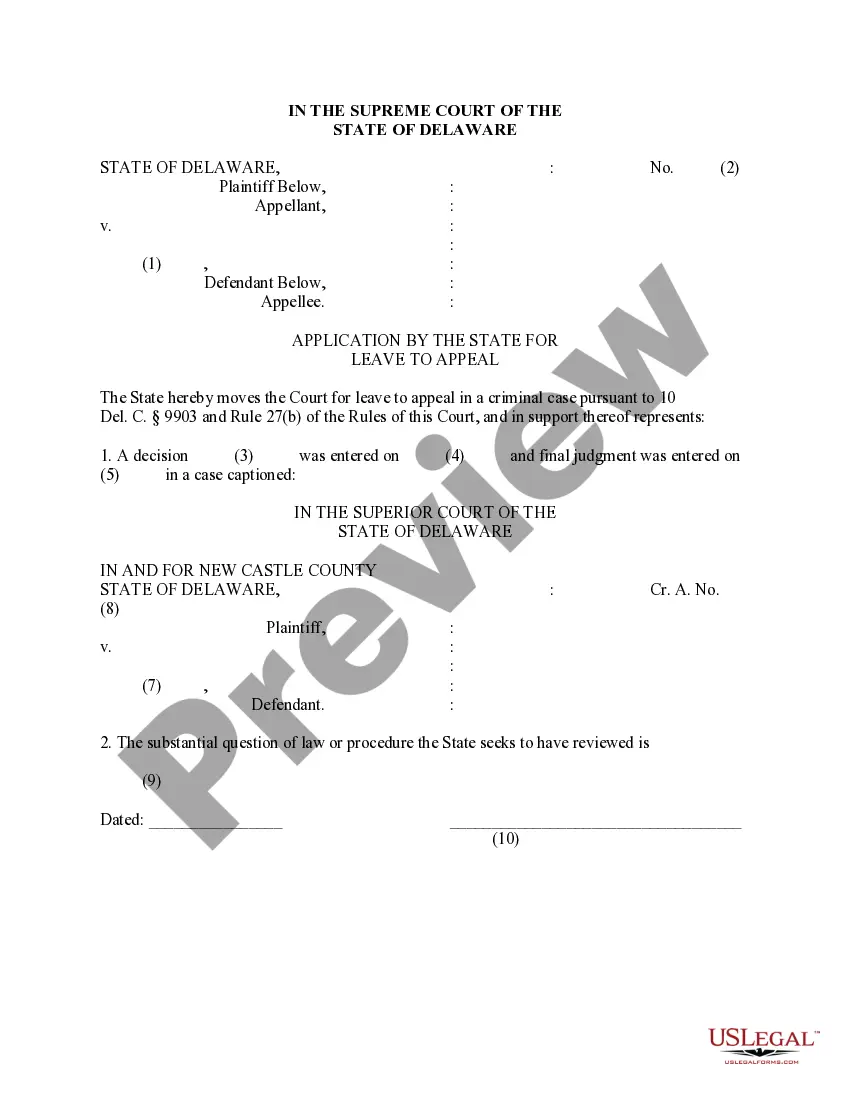

How to fill out Illinois Small Estate Affidavit ($100,000 And Under)?

US Legal Forms is the easiest and most lucrative method to find appropriate legal templates.

It’s the most comprehensive online collection of business and personal legal paperwork prepared and validated by legal experts.

Here, you can discover printable and fillable forms that adhere to national and local regulations - just like your Illinois Small Estate affidavit ($100,000 and Under).

Review the form description or preview the document to ensure you’ve selected the one that meets your needs, or find another one using the search function above.

Click Buy now when you’re confident of its suitability with all the specifications, and choose the subscription plan you prefer.

- Obtaining your template requires just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the website and download the document onto their device.

- Afterward, they can access it in their profile under the My documents section.

- And here’s how to obtain a properly formulated Illinois Small Estate affidavit ($100,000 and Under) if you are using US Legal Forms for the first time.

Form popularity

FAQ

To use a small estate affidavit, all of the following must be true: The total amount of property in the estate is worth $100,000 or less; The person who died did not own any real estate, or they owned real estate that went to someone else when they died.

You can only use a small estate affidavit if the estate has no more than $100,000 in it. You cannot use a small estate affidavit to transfer real property, such as a house. However, the decedent's real property may have already been transferred to someone else.

In Illinois, a will must be filed within thirty (30) days of a person's death. Failure to file a will in your possession is a felony under Illinois law.

Does a small estate affidavit need to be filed with the court in Illinois? A small affidavit does not need to be filed with a court. You can find the small estate affidavit form from the Illinois Secretary of State online or in person at your local circuit county clerk's office.

This statement of the decedent's intent is commonly known as that person's "Will." Under Illinois law, it is required that any person who possesses the Will of a decedent file it with the Clerk of the Circuit Court of the county in which that individual resided within 30 days after the death of the testator is known to

Probate is typically necessary in Illinois when the decedent owns any real estate or more than $100,000.00 of non-real-estate assets outside of a trust.

Probating a will can be both expensive and time-consuming. Because of this, Illinois law allows estates that are valued at $100,000 or less to be transferred to heirs through what is called a small estate affidavit process.

If estate personal assets are $100,000 or less, then you can pass the asset on using a small estate affidavit. This affidavit cannot be used for real estate. If there is a will, file the will with the Circuit Clerk, obtain a certified copy of the will, and attach it to the small estate affidavit.