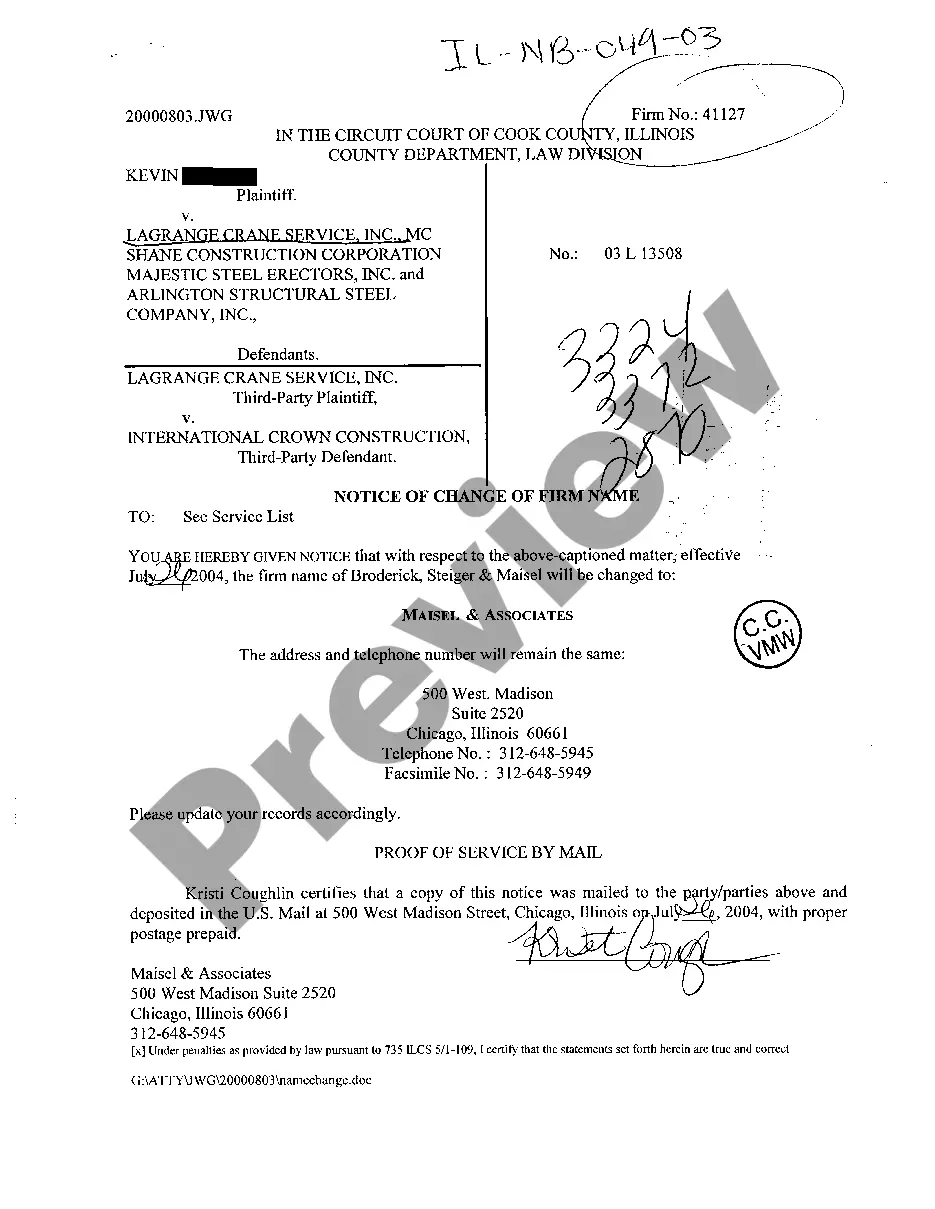

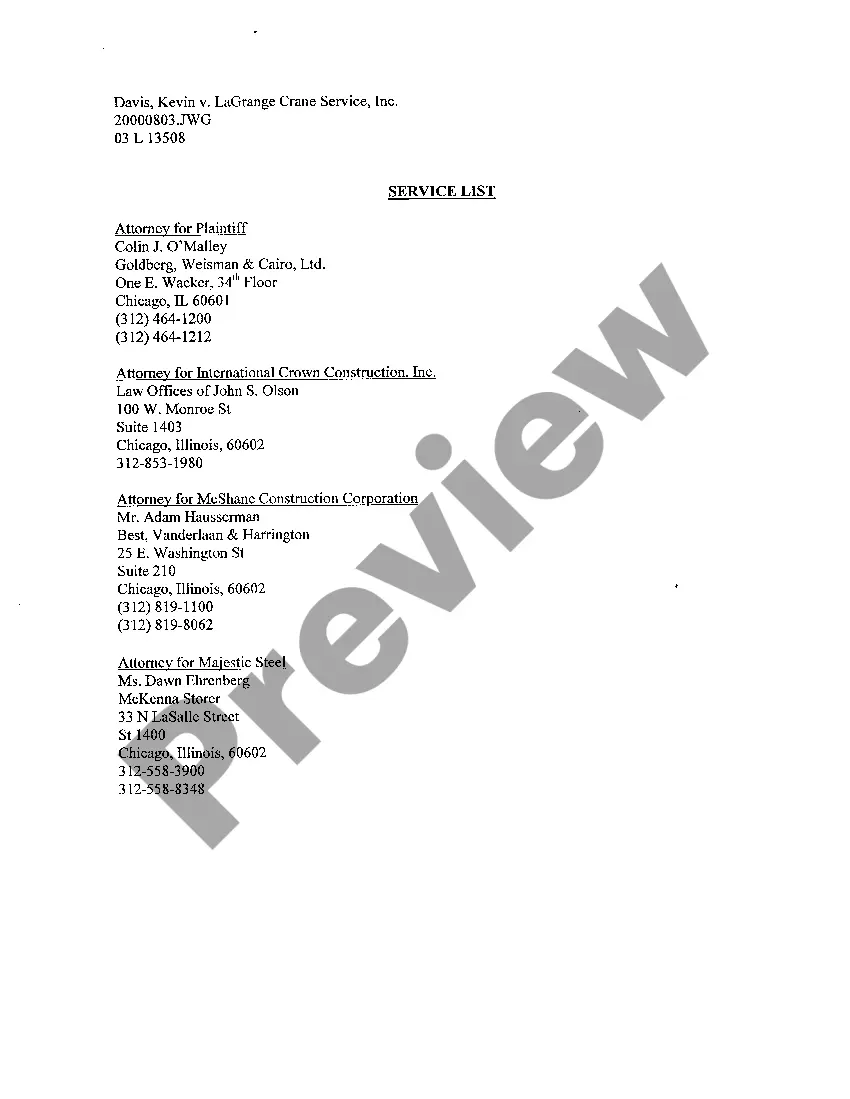

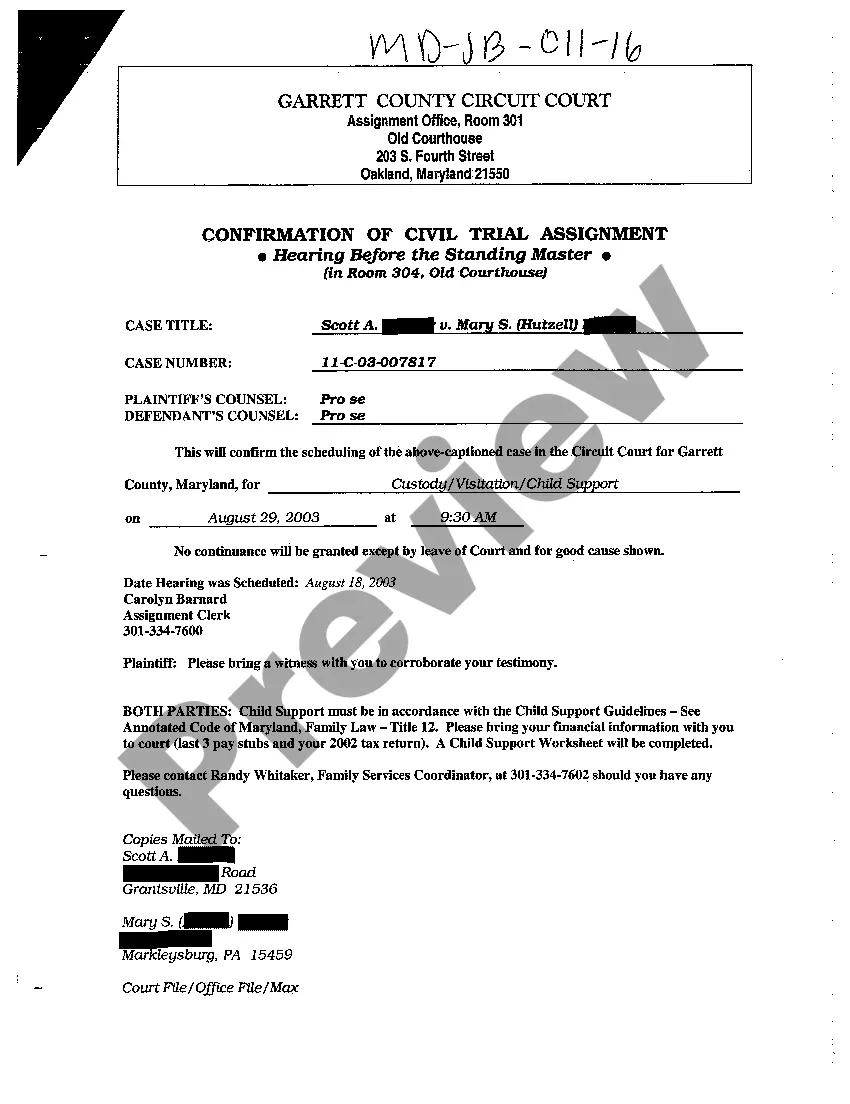

Illinois Notice Of Charge Of Firm Name

Description

How to fill out Illinois Notice Of Charge Of Firm Name?

Locating Illinois Notice Of Charge Of Firm Name forms and completing them might be a daunting task.

To conserve time, expenses, and effort, utilize US Legal Forms to discover the suitable template specifically for your state in just a few clicks.

Our lawyers draft every document, so all you need to do is fill them out. It's really that simple.

You have the option to print the Illinois Notice Of Charge Of Firm Name template or complete it using any online editor. There's no need to worry about errors since your template can be utilized and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to nearly 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's section to download the sample.

- All of your saved templates are stored in My documents and available at any time for future reference.

- If you haven’t subscribed yet, you need to register.

- Check out our detailed instructions on how to obtain your Illinois Notice Of Charge Of Firm Name form in minutes.

- To get a valid form, verify its relevance for your state.

- View the form using the Preview option (if available).

- If there’s a description, read it to understand the key points.

- Click the Buy Now button if you found what you're looking for.

Form popularity

FAQ

The Illinois state Comptroller may send you a check for a variety of reasons, including tax refunds or overpayments related to your business. If you receive a check, verify that the amount and details align with your financial records. This helps ensure that you fully understand the nature of the transaction and its impact on your business.

An identity verification letter from the Illinois Department of Revenue may be sent if they detect discrepancies in your tax filings or business information. This verification process ensures that your records are accurate and legitimate. Promptly responding to these letters is vital to maintaining your credibility as a business owner.

Press Releases A well-written press release is the easiest way to announce your new firm to the largest audience. Wire services such as PR Newswire will send your release to newsrooms in your state or nationally, in addition to posting the release online where it will show up in search engines indefinitely.

: a group of lawyers who work together as a business.

After time demands, toxic culture was the most common reason people cited for leaving their law jobs. Nearly 19% cited it as the primary reason they left.For many attorneys, the stress and time demands of the job weren't the primary problem; more respect, collegiality and kindness may be the keys for them.

Generally speaking, the states' rules of professional conduct permit an attorney to dump a client if the breakup won't hurt him, such at the very beginning of the case, or if there's a suitable replacement waiting in the wings.In non-litigation matters, no special permission is required.

Once a lawyer decides to leave a firm, the lawyer should contemporaneously inform both the firm and his or her clients.The clients must be given the option of remaining with the firm, going with the departing attorney, or choosing another attorney. It is important to understand that clients are not property.

A law firm is an association of lawyers who practice law. It is a business entity formed by one or more lawyers to engage in the practice of law. Usually, the members of a law firm share clients and profits. Traditionally, the law firms were partnerships.

When a lawyer is departing a firm, all the lawyers involved have an ethical obligation to protect clients' interests and honour clients' rights to choose their own counsel. Lawyers within a firm also have obligations to one another, both contractual and fiduciary in nature.

If you fire a lawyer to whom you have paid a retainer, you are entitled to a refund of whatever money remains of the retainer after the lawyer is paid for his services up through the time you fired him. Once you fire him, he must prepare and give you a written accounting of the funds and a refund check.