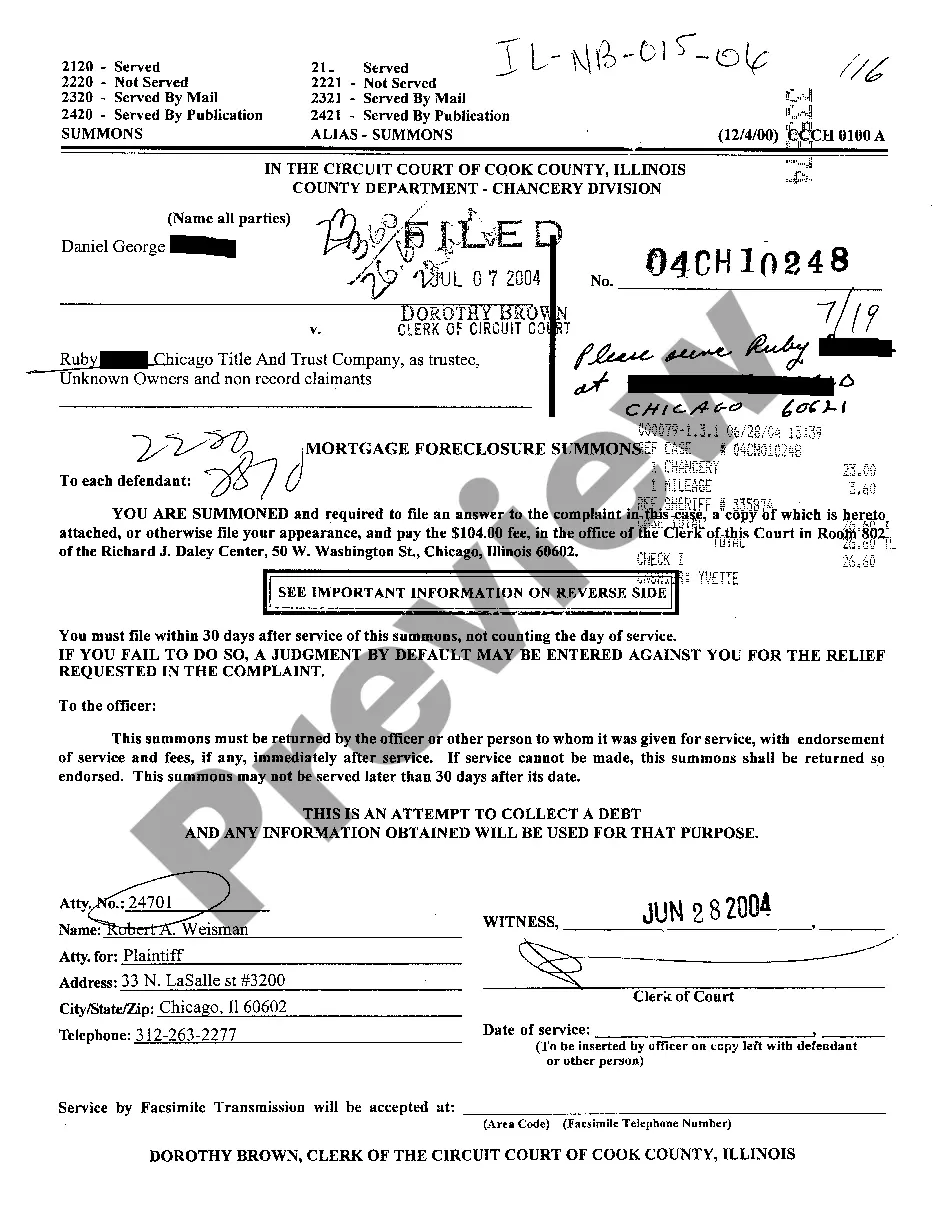

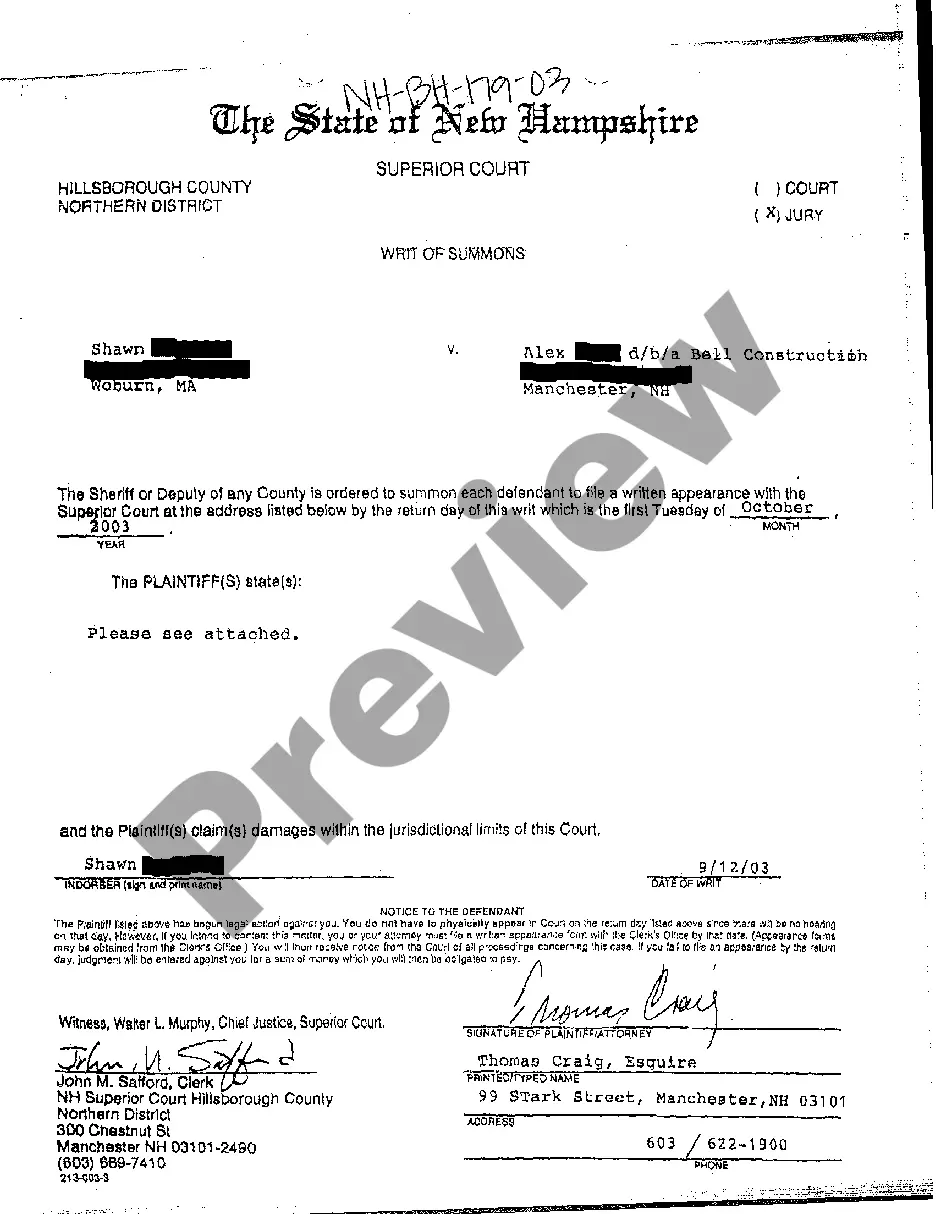

Illinois Mortgage Foreclosure Summons

Description

How to fill out Illinois Mortgage Foreclosure Summons?

Searching for an Illinois Mortgage Foreclosure Summons template and completing it might pose a challenge. To conserve a significant amount of time, expenses, and energy, utilize US Legal Forms and locate the appropriate template specifically for your state with just a few clicks. Our legal professionals prepare every document, allowing you to simply fill them in. It's that straightforward.

Click Log In to access your account and return to the form's page to save the document. Your downloaded forms are kept in My documents and are perpetually available for later use. If you haven't registered yet, you need to sign up.

Review our comprehensive instructions on how to obtain the Illinois Mortgage Foreclosure Summons template in a few minutes.

Now you have the option to print the Illinois Mortgage Foreclosure Summons form or complete it using any online editor. There’s no need to fret about errors, as your template can be utilized, sent, and published as often as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To acquire an eligible template, verify its relevance for your state.

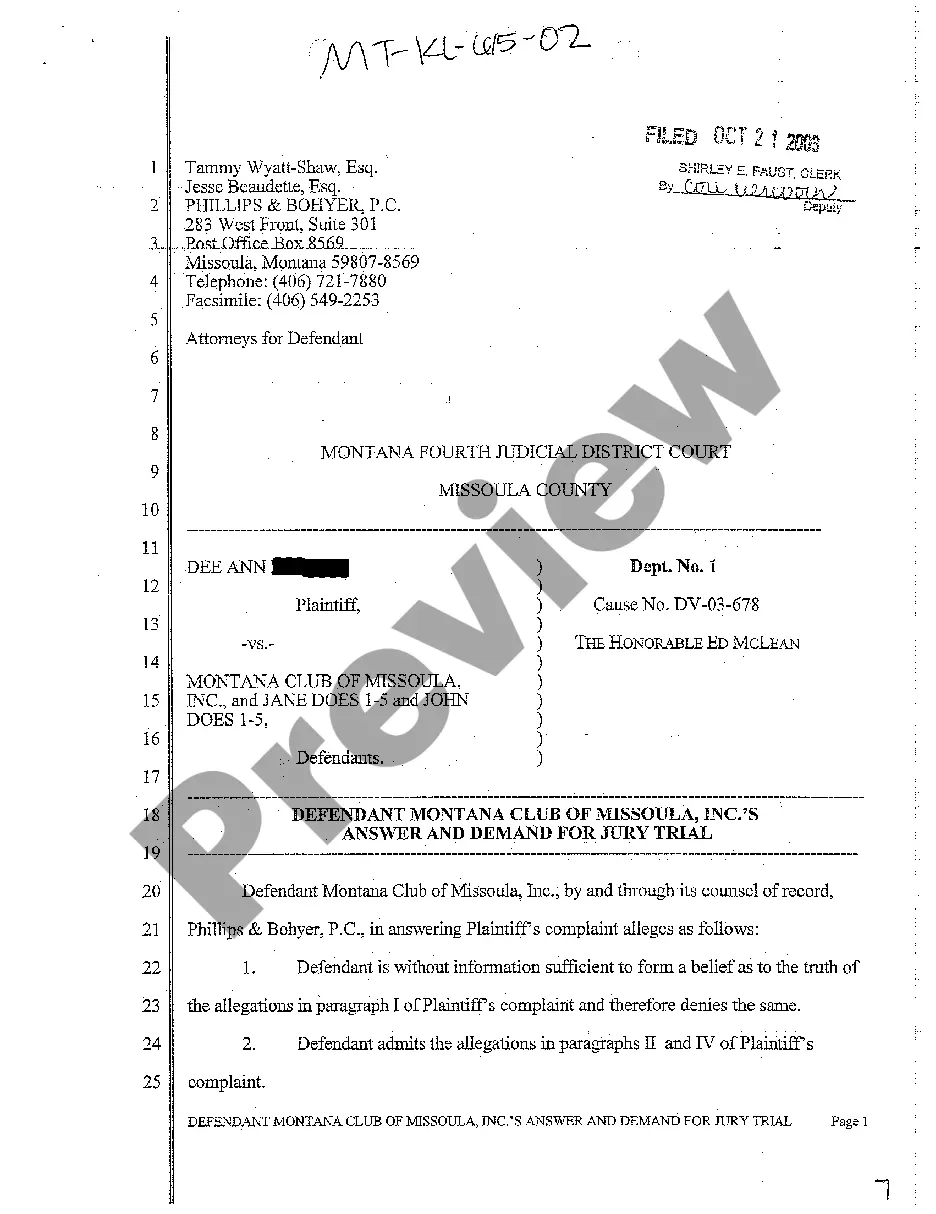

- Examine the form using the Preview feature (if available).

- If available, read the description to grasp the key aspects.

- Hit the Buy Now button if you found what you're looking for.

- Select your plan on the pricing page and set up your account.

- Decide whether you'd like to pay with a credit card or via PayPal.

- Download the template in your preferred format.

Form popularity

FAQ

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

Generally, homeowners have to be more than 120 days delinquent before a foreclosure can begin. If you're behind in mortgage payments, you might be wondering how soon a foreclosure will start. Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure.

When You Have to Leave After an Illinois Foreclosure Sale The foreclosed homeowner can remain in the home for 30 days after the court confirms the sale.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding. Written proof of money owed under the mortgage.

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

The Notice of Default starts the official foreclosure process. This notice is issued 30 days after the fourth missed monthly payment. From this point onwards, the borrower will have 2 to 3 months, depending on state law, to reinstate the loan and stop the foreclosure process.