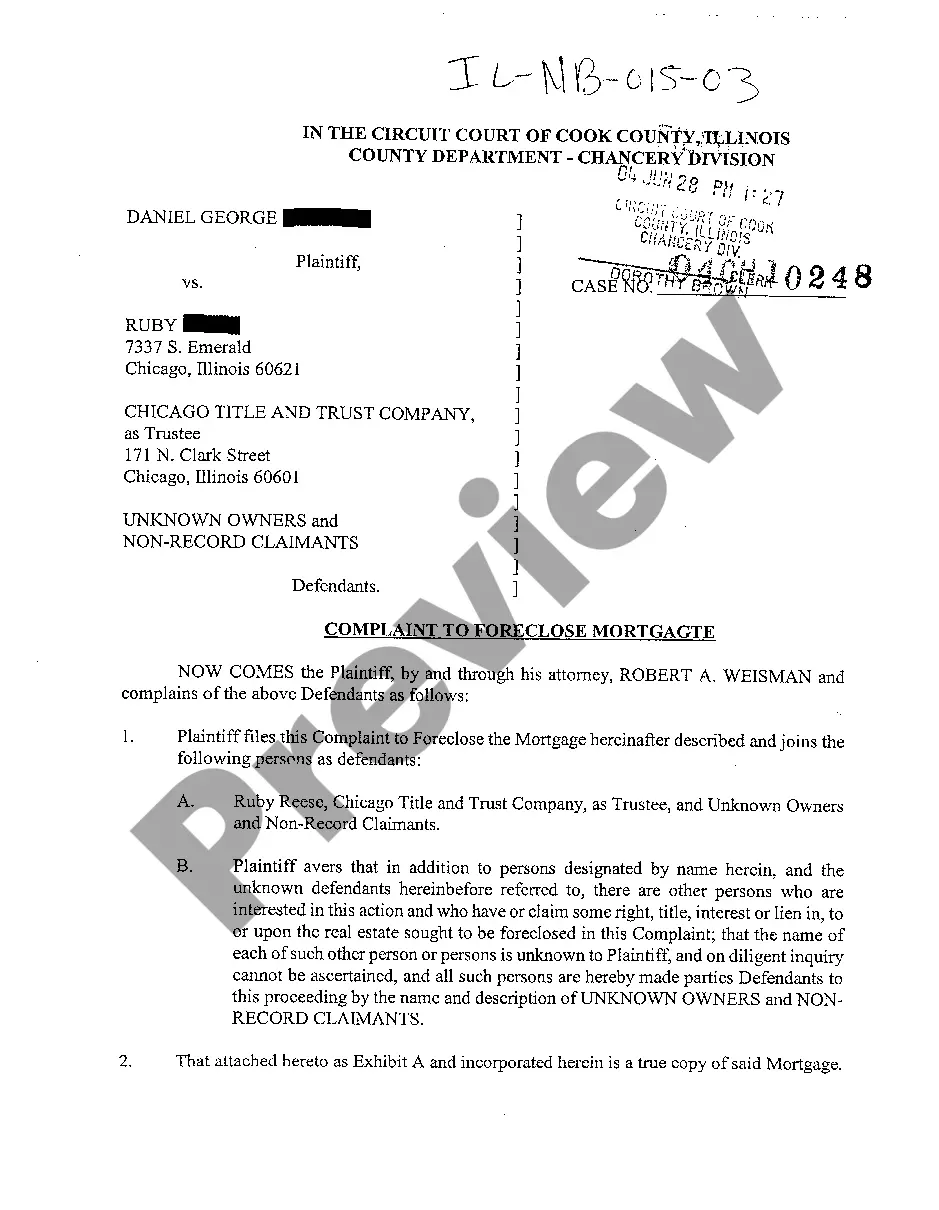

Illinois Complaint To Foreclose Mortgage

Description

How to fill out Illinois Complaint To Foreclose Mortgage?

Seeking to locate Illinois Complaint To Foreclose Mortgage documents and filling them out may pose a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms to quickly discover the appropriate example tailored for your state with just a few clicks.

Our attorneys prepare each document, so all you need to do is complete them. It's truly that easy.

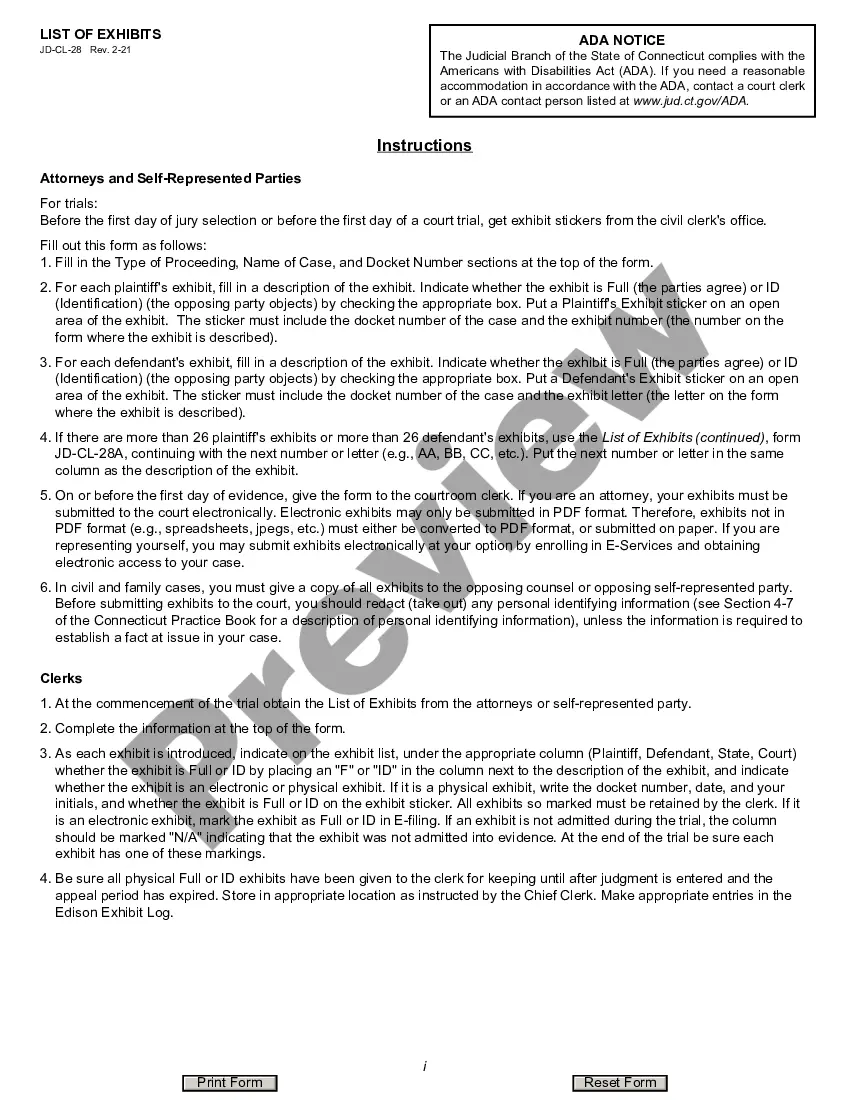

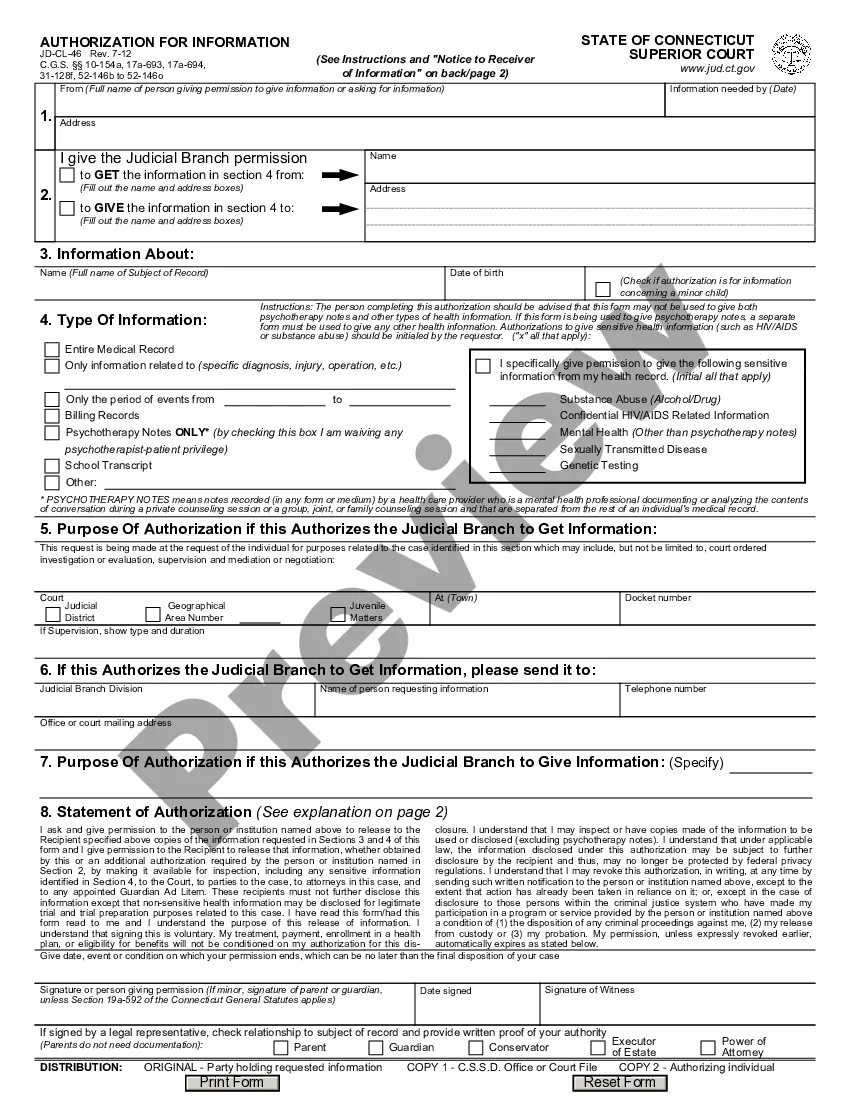

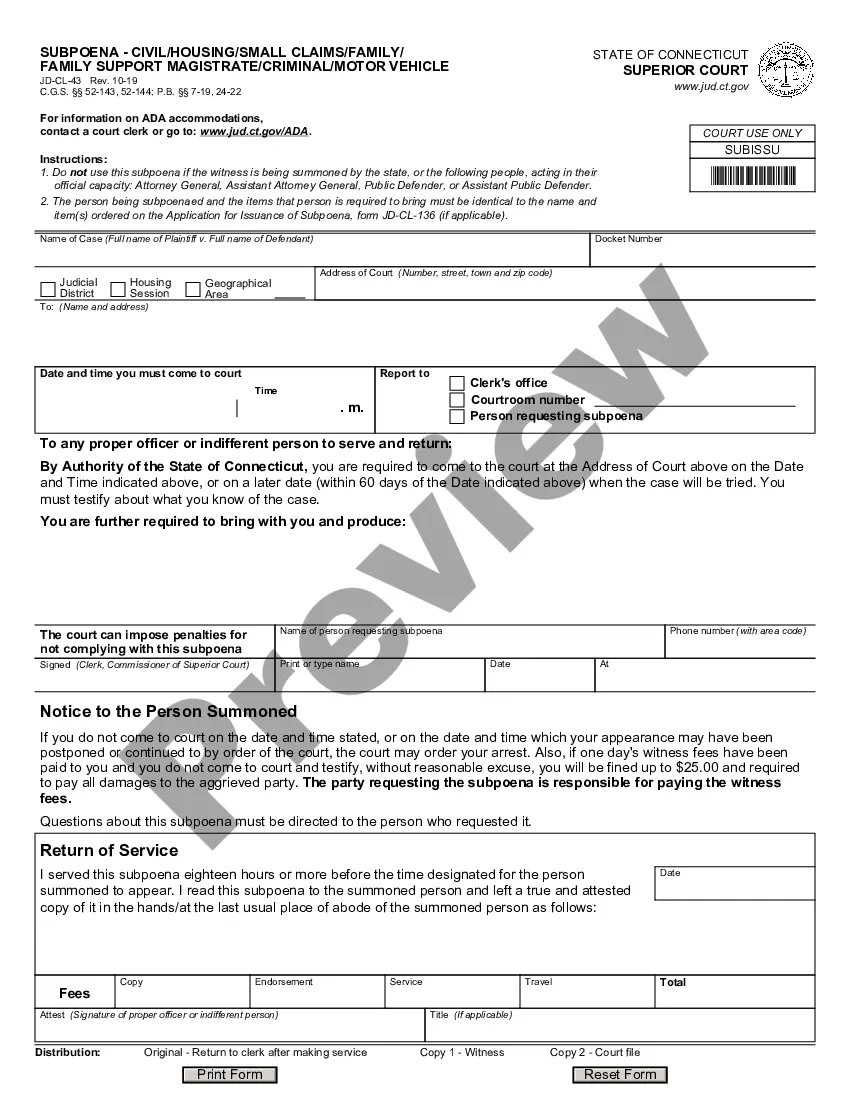

You can print the Illinois Complaint To Foreclose Mortgage template or complete it using any online editor. Don’t worry about errors since your template can be reused and submitted multiple times. Experience US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the template.

- All your saved samples are stored in My documents and are always available for future use.

- If you haven't subscribed yet, you should register.

- Review our comprehensive instructions on how to obtain your Illinois Complaint To Foreclose Mortgage form in a matter of minutes.

- To secure a relevant example, verify its suitability for your state.

- Examine the sample using the Preview feature (if available).

- If there’s a description, read it to grasp the key details.

- Click the Buy Now button if you’ve identified what you need.

Form popularity

FAQ

When You Have to Leave After an Illinois Foreclosure Sale The foreclosed homeowner can remain in the home for 30 days after the court confirms the sale.

Lenders will seize the home, which is typically used as collateral for the loan and will put the property up for sale to try and recoup losses. The foreclosure process from beginning to end typically takes a lender about 18 months to foreclose on a property during normal times.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.

A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale (or for a short period after the sale, in some cases), or filing for bankruptcy. Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding. Written proof of money owed under the mortgage.

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.