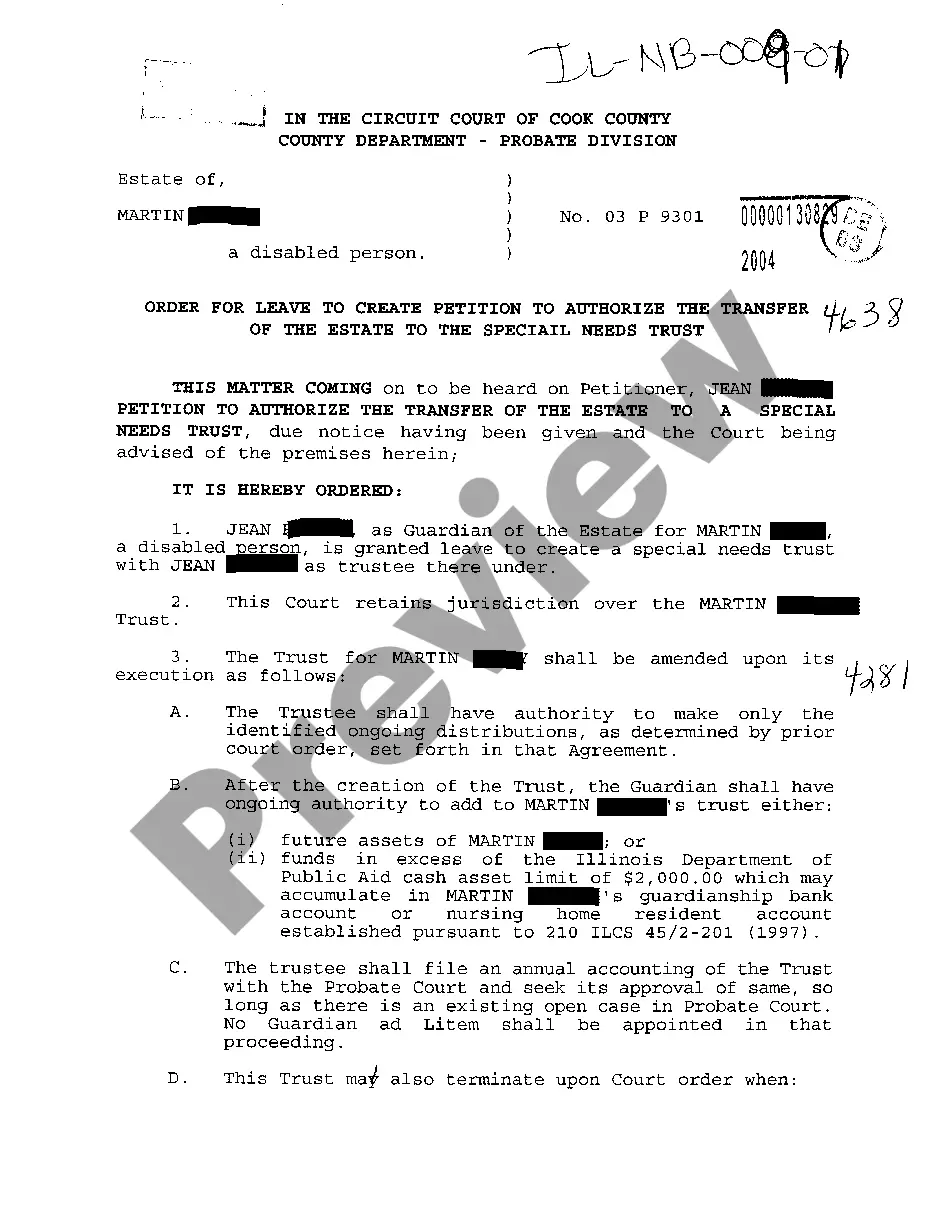

Illinois Petition To Authorize The Transfer Of The Estate To The Special Needs Trust with Draft of Trust Attached

Description

How to fill out Illinois Petition To Authorize The Transfer Of The Estate To The Special Needs Trust With Draft Of Trust Attached?

Searching for the Illinois Request to Approve the Transfer of the Estate to the Special Needs Trust with Trust Draft Included can be challenging.

To save time, expenses, and effort, utilize US Legal Forms and select the appropriate sample specifically for your state in just a few clicks.

Our lawyers create every document, so you only need to complete them. It's really that straightforward.

You can print the Illinois Request to Approve the Transfer of the Estate to the Special Needs Trust with Trust Draft Included template or fill it out using any online editor. No need to worry about typos because your template can be utilized and sent, and printed as often as you like. Visit US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your downloaded samples are stored in My documents and are readily accessible for future use.

- If you haven’t subscribed yet, you will need to sign up.

- Review our detailed instructions on how to obtain your Illinois Request to Approve the Transfer of the Estate to the Special Needs Trust with Trust Draft Included template in minutes.

- Check the form's eligibility for your state.

- View the sample using the Preview feature (if available).

- Read through any provided description to understand the details.

- Click on the Buy Now button if you found what you need.

Form popularity

FAQ

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.

Can a Beneficiary be a trustee. The simple answer is yes, a Trustee can also be a Trust beneficiary. In fact, a majority of Trusts have a Trustee who is also a Trust beneficiary.

The person serving as trustee of the special needs trust can usually pay for anything for the person with special needs, as long as the purchase is not against public policy or illegal and does not violate the terms of the trust.

In some states, the beneficiary of a third-party special needs trust must also be a person with a disability. Remainder beneficiary When the trust ends (usually upon the beneficiary's death), the remainder beneficiaries are the individuals who will receive any remaining trust assets.

Does the trustee of a special needs trust have to file an income tax return? Trusts generally are considered separate taxable entities for income tax purposes, and the trustee must file an income tax return for the trust.

Depending on the type of trust you are creating, the trustee will be in charge of overseeing your assets and the assets of your loved ones. Most people choose either a friend or family member, a professional trustee such as a lawyer or an accountant, or a trust company or corporate trustee for this key role.

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

To establish a Third Party Special Needs Trust, the family member needs to sign the trust document and then transfer the assets to the Trustee. The trust document is provided by an attorney who provides legal representation and writes all the necessary documents.

The beneficiary of a special needs trust will usually (but not always) be disabled. While a beneficiary may also act as trustee in some types of trusts, a special needs trust beneficiary will almost never be able to act as trustee.Incapacity of a beneficiary may sometimes be important as well.