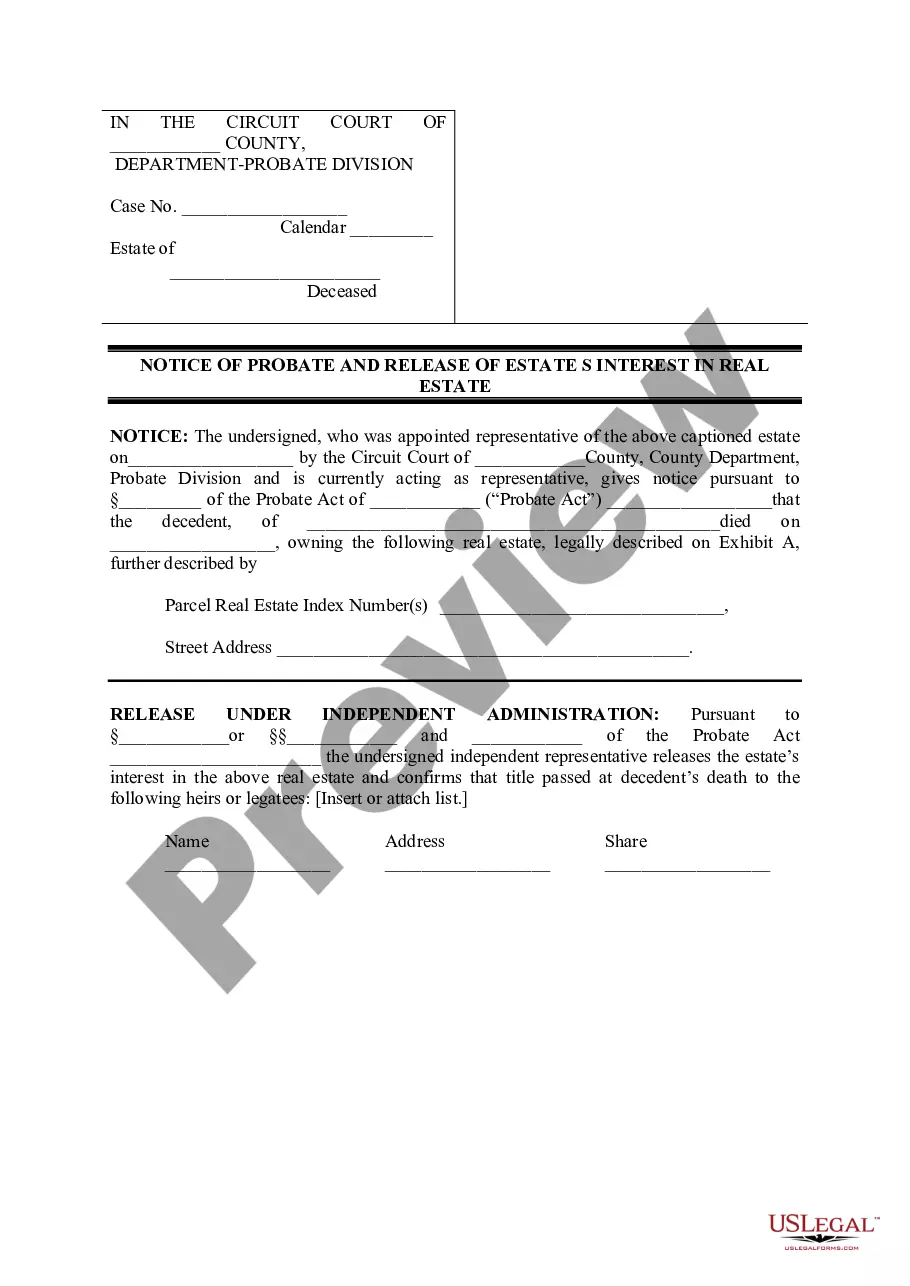

Illinois Notice of Probate and Release of Estate Interest in Real Estate

Description

This form is used to provide notice to interested parties in an

estate that a petition has been filed requesting that an estate be

opened, and a foreign administrator appointed.

Key Concepts & Definitions

Notice of Probate: A legal document formally announcing the submission of a will to the local probate court. Release of Estate Interest: A declaration issued by an individual relinquishing any claims to an estate, typically after a beneficiary's or heir's interest has been satisfied or nullified.

Step-by-Step Guide on Handling the Notice of Probate and Release of Estate Interest

- Receive Notification: The executor of the will typically sends out a notice of probate to all interested parties once the will has been submitted to probate court.

- Review the Will: Beneficiaries should review the will to understand the contents and their implications thoroughly.

- Attend Probate Court Hearings: Interested parties may need to attend hearings to observe or participate in the proceedings.

- Issue of Release: Once the estate is ready to be disbursed, beneficiaries may need to issue a release of estate interest, confirming they have received their share and have no further claims.

Risk Analysis

- Legal Disputes: Failing to handle these documents properly can lead to disputes among beneficiaries.

- Financial Implications: Improper management of the estate could result in financial loss for beneficiaries.

- Delays: Any errors in the documents or failure in attending necessary hearings can cause significant delays in the distribution of the estate.

Key Takeaways

Understanding and managing the notice of probate and release of estate interest are crucial for beneficiaries to ensure they receive their rightful share of an estate without unnecessary disputes or delays.

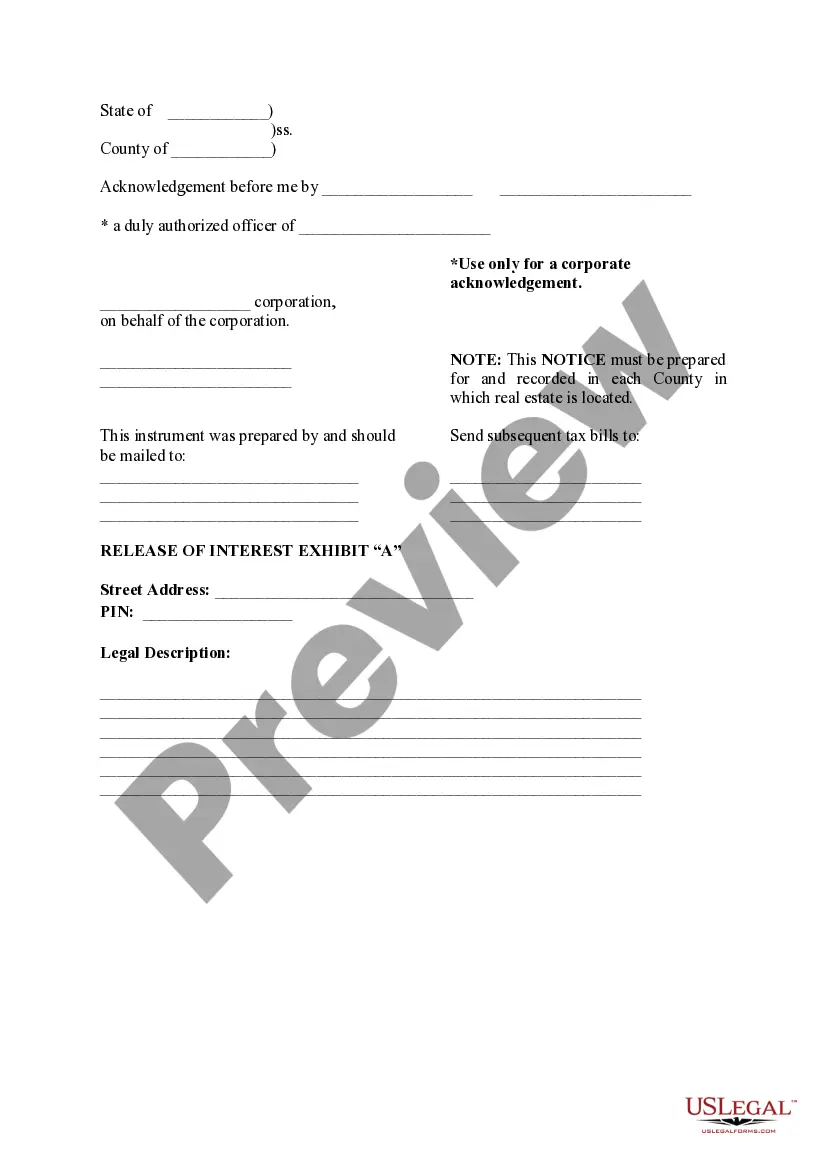

How to fill out Illinois Notice Of Probate And Release Of Estate Interest In Real Estate?

Utilize US Legal Forms to acquire a printable Illinois Notice of Probate and Release of Estate Interest in Real Estate.

Our court-acceptable forms are crafted and consistently refreshed by experienced attorneys.

Ours is the most extensive form library available online and offers economical and precise templates for clients, lawyers, and small to medium-sized businesses.

US Legal Forms provides a vast array of legal and tax templates and packages for both business and personal requirements, including the Illinois Notice of Probate and Release of Estate Interest in Real Estate. Over three million users have effectively utilized our service. Choose your subscription plan and gain access to high-quality forms in just a few clicks.

- Documents are categorized by state and some can be previewed before downloading.

- To access samples, users must possess a subscription and Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For those without a subscription, adhere to the following guidelines to effortlessly find and download the Illinois Notice of Probate and Release of Estate Interest in Real Estate.

- Ensure you select the correct template relevant to the desired state.

- Examine the document by reading the description and utilizing the Preview feature.

- Click Buy Now if it is the template you require.

- Create your account and make a payment via PayPal or credit card.

- Download the form to your device and feel free to use it multiple times.

- Employ the Search feature if you seek to find another document template.

Form popularity

FAQ

Ultimately, what happens to a home in probate varies from state-to-state but generally one of two things will happen: survivors of the estate will inherit the property or the house will need to be sold through probate court.Beneficiaries may be responsible for capital gains tax if the home in probate goes up in value.

A probate bond is a type of court bond that ensures the wishes of a deceased person are carried out ethically and honestly. If an error does occur, the bond promises you will compensate the beneficiaries for any money lost. Probate Bonds are also called Fiduciary Bonds.

The law in Illinois provides such creditors six months to file those claims. The executor is required to protect or preserve the assets, to pay any valid claims, and eventually to distribute the remainder of the estate to those individuals specifically listed in the Will.

Estate bonds are also called executor bonds, fiduciary bonds, or probate bonds.An estate bond is a safeguard to ensure that the executor faithfully complies with the written wishes of the deceased. The estate bond acts like an insurance policy.

If new assets are found during Probate or after the process has completed, this can impact on the Estate's tax liability. It can also mean that some of the Probate steps that have already been taken will need to be repeated.

Beneficiaries of the estate will be required to receive a copy of the final report and to either receive formal notice of the executor's petition for discharge and to close the estate, or alternatively, they must waive formal notice and confirm each beneficiary has received the share to which he or she is entitled.

A personal representative of an estate (either an executor or an administrator) purchases a probate bond from a surety company. They pay a portion of the value of the estate usually around 0.5%.

Fiduciary bonds are required by a court when an individual is named as fiduciary or executor for an estate. The bond protects the rightful heirs of an estate in a decedent's estate, and protects the ward in a guardianship or conservatorship estate.

Deposit in lieu of bond. A. In a civil or criminal matter or proceeding when a bond is required of a party, he may, instead of giving the bond, deposit with the court lawful money of the United States in the sum required in the bond, which shall be accepted in lieu of the bond.