Illinois Memorandum of Option

Description

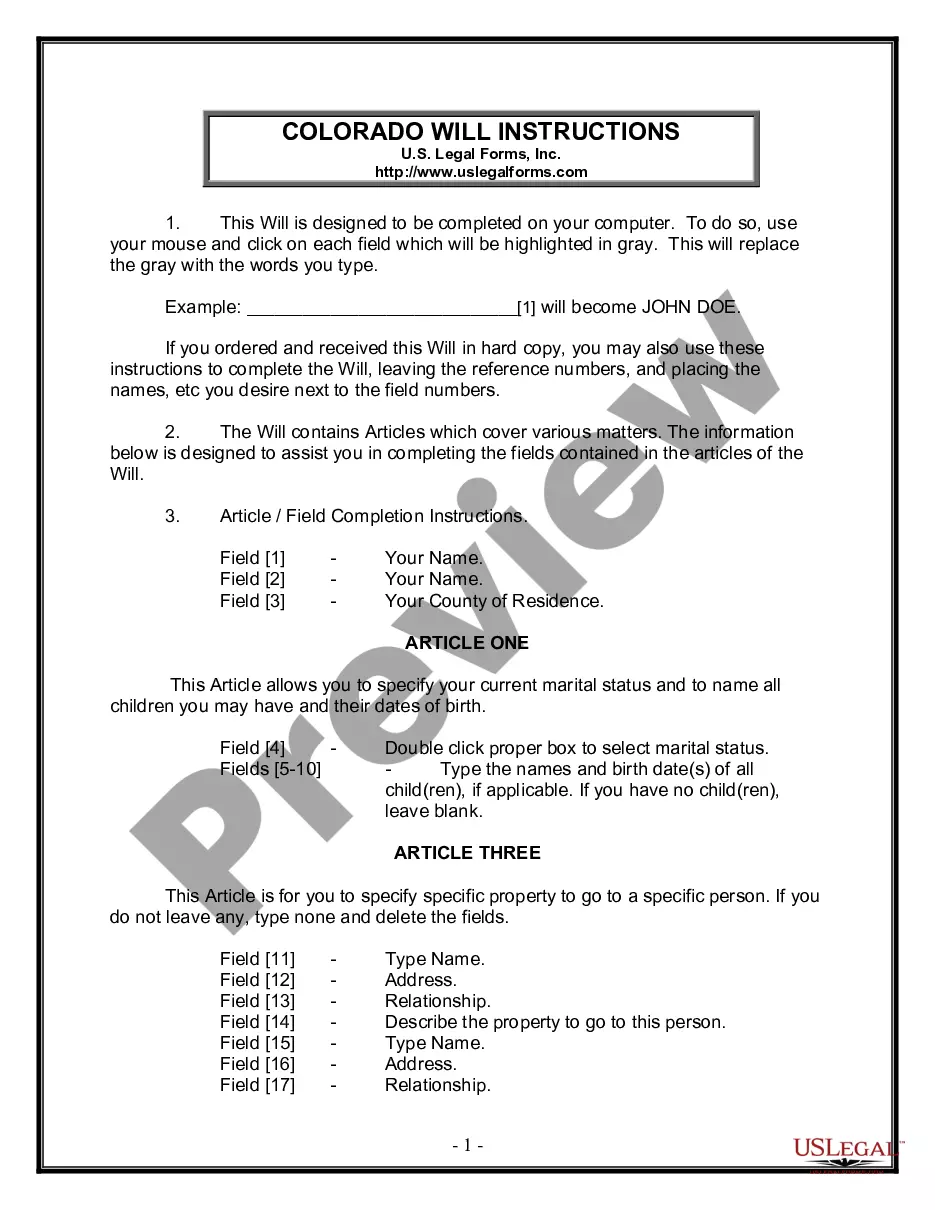

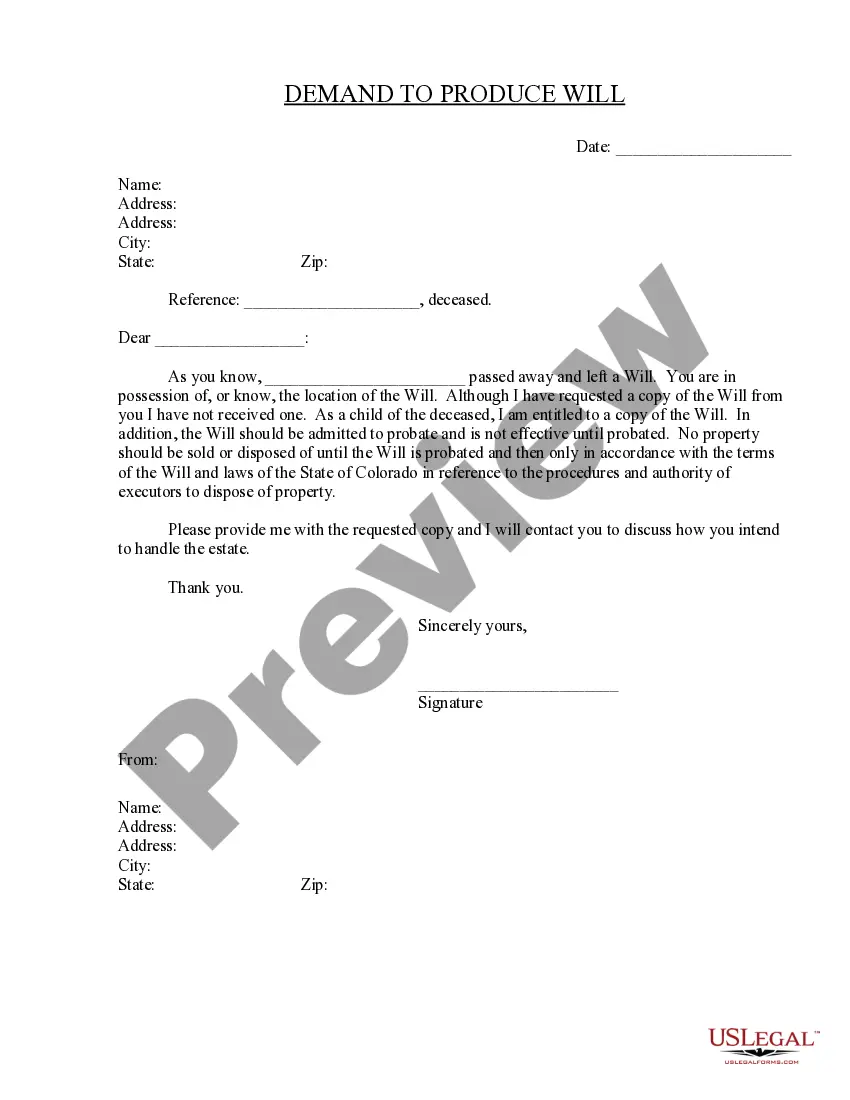

How to fill out Illinois Memorandum Of Option?

Utilize US Legal Forms to acquire a printable Illinois Memorandum of Option.

Our legally acceptable forms are crafted and frequently refreshed by experienced attorneys.

Ours is the most comprehensive Forms repository online and provides economical and precise templates for clients, legal experts, and small to medium-sized businesses.

Click Buy Now if it’s the document required. Create your account and pay via PayPal or credit card. Download the template to your device and feel free to reuse it multiple times. Employ the Search box if you need to find another document template. US Legal Forms offers thousands of legal and tax templates and packages for both business and personal requirements, including the Illinois Memorandum of Option. Over three million users have successfully used our platform. Choose your subscription plan and obtain high-quality forms in just a few clicks.

- The templates are categorized based on state and some can be previewed before downloading.

- To access templates, clients must possess a subscription and Log In to their account.

- Click Download next to any needed form and locate it in My documents.

- For those without a subscription, adhere to the following instructions to easily locate and download the Illinois Memorandum of Option.

- Ensure you have the correct template pertaining to the necessary state.

- Examine the form by reviewing the description and utilizing the Preview function.

Form popularity

FAQ

The Difference Between Renting to Own and a Contract for Deed. Renting to own usually means renting now, with an option to buy later. When you make this kind of deal, you are still a tenant, and the seller is still a landlord, until the final purchase. A contract for deed is very different.

This Standard Document is a recordable instrument used to provide third parties with constructive notice of a purchase option encumbering California commercial real property.

A contract for deed, also called a land contract or contract for sale, is a financing option for buyers who do not qualify for a mortgage loan to purchase property. In a contract for deed, the seller finances the purchase of the property, much like a mortgage company in a more traditional mortgage situation.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

A Contract for Deed is a way to buy a house that doesn't involve a bank. The seller finances the property for the buyer. The buyer moves in when the contract is signed. The buyer pays the seller monthly payments that go towards payment for the home.