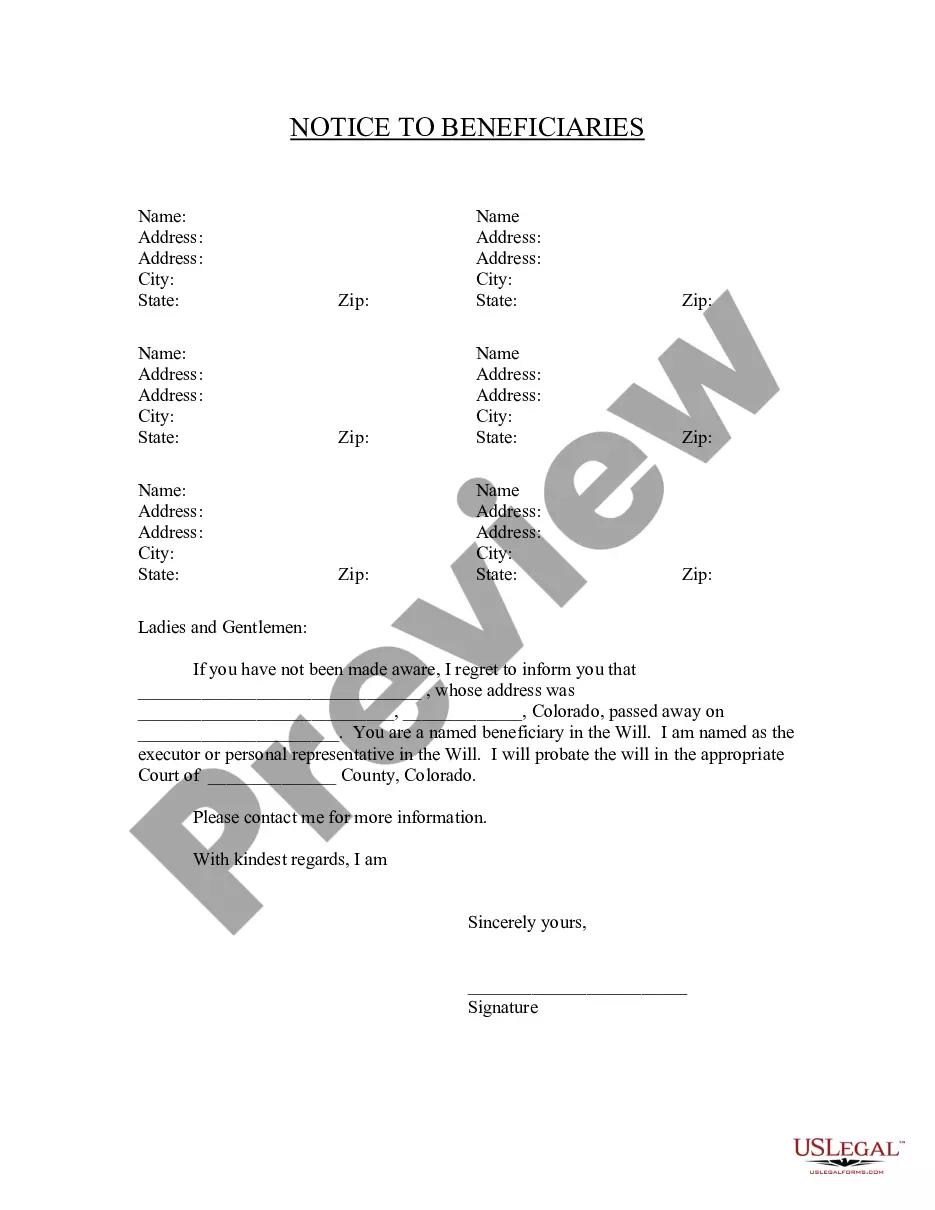

Colorado Notice to Beneficiaries of being Named in Will

Description

How to fill out Colorado Notice To Beneficiaries Of Being Named In Will?

The greater the documentation you must compile - the more anxious you become.

You can locate a vast array of Colorado Notice to Beneficiaries of being Named in Will templates online, yet, you are uncertain which ones to trust.

Eliminate the frustration to simplify obtaining templates with US Legal Forms. Obtain expertly crafted documents that are designed to meet state standards.

Provide the required information to create your profile and settle the order with PayPal or credit card. Opt for a convenient document format and obtain your copy. Access every file you download in the My documents section. Simply navigate there to fill in a new version of the Colorado Notice to Beneficiaries of being Named in Will. Even when utilizing professionally created templates, it’s still crucial that you consider consulting a local attorney to verify the completed document to ensure it is accurately filled out. Achieve more while spending less with US Legal Forms!

- If you possess a US Legal Forms subscription, sign in to your account, and you will find the Download option on the Colorado Notice to Beneficiaries of being Named in Will’s page.

- If you are new to our service, complete the registration process with the following steps.

- Verify whether the Colorado Notice to Beneficiaries of being Named in Will is applicable in your state.

- Re-confirm your choice by reviewing the description or by using the Preview mode if available for the selected document.

- Click Buy Now to commence the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

What are my rights as a beneficiary?A beneficiary is entitled to be told if they are named in a person's will. They are also entitled to be told what, if any, property/possessions have been left to them, and the full amount of inheritance they will receive.

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.

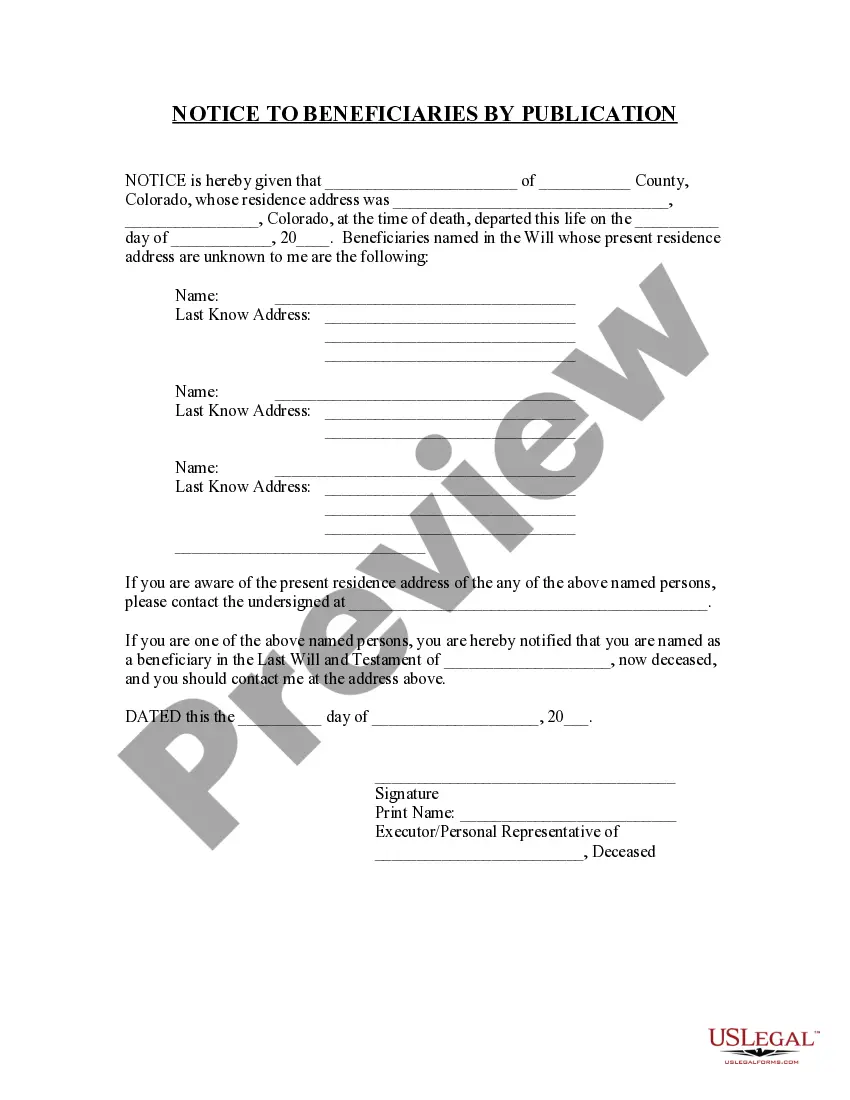

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.