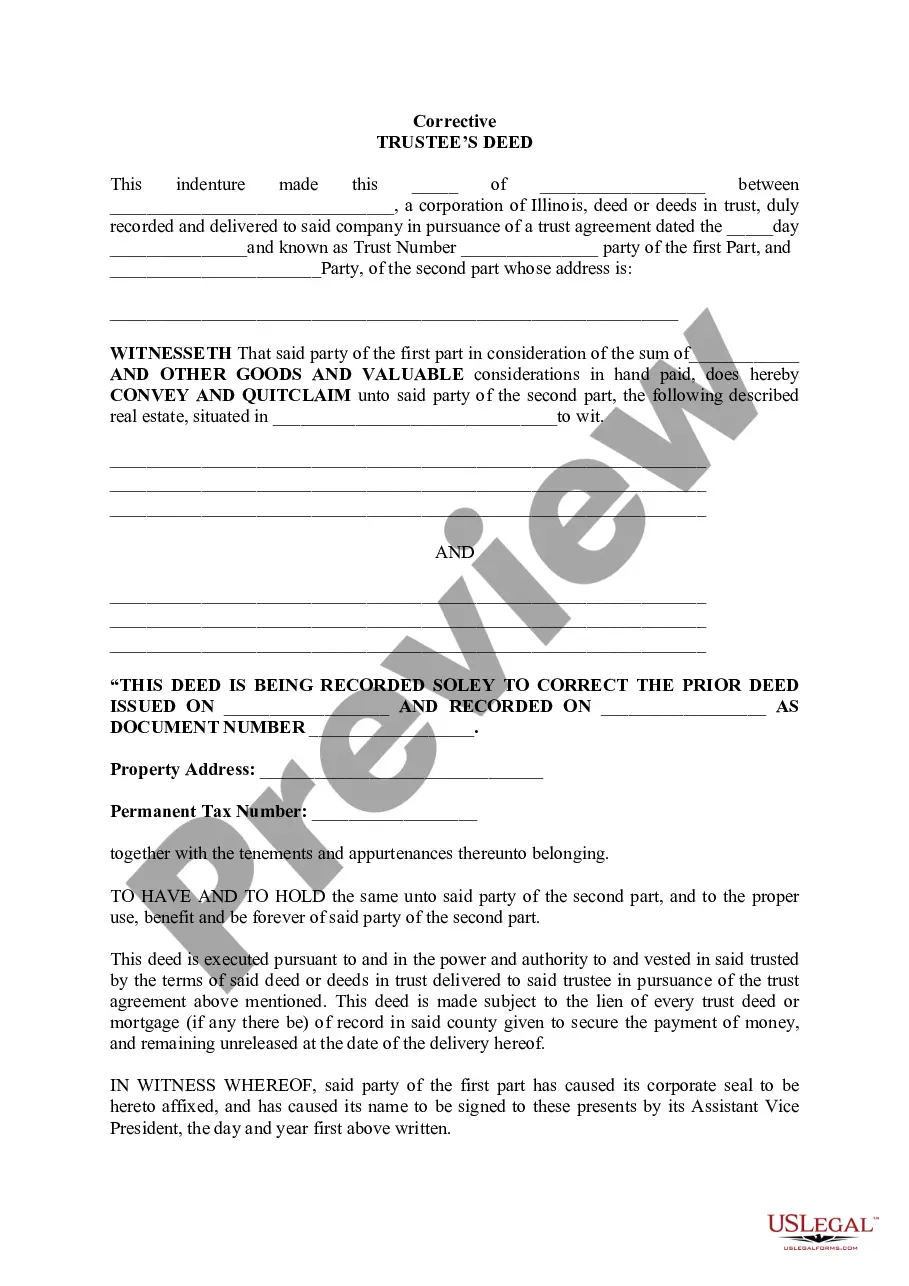

Illinois Corrective Trustee's Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Corrective Trustee's Deed?

Utilize US Legal Forms to obtain a downloadable printable Illinois Corrective Trustee’s Deed.

Our court-effective forms are created and frequently refreshed by skilled attorneys.

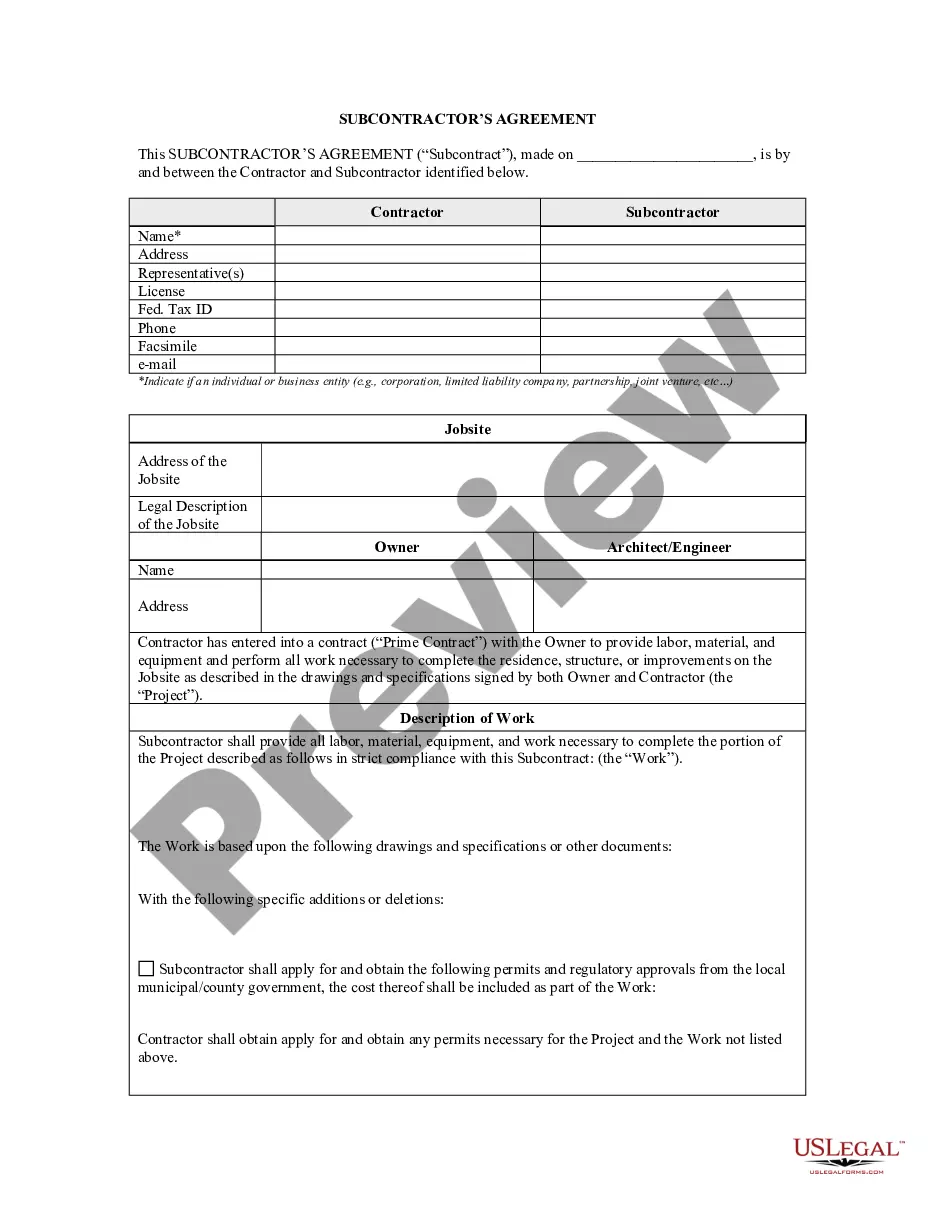

Ours is the most comprehensive Forms collection available online and offers reasonably priced and precise samples for consumers, lawyers, and small to medium-sized businesses.

Hit Buy Now if it’s the form you need. Create your account and make payments through PayPal or by credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search tool if you need to find another document template. US Legal Forms provides countless legal and tax templates and packages for both business and personal requirements, including the Illinois Corrective Trustee’s Deed. More than three million users have successfully utilized our service. Choose your subscription plan and acquire high-quality documents in a mere few clicks.

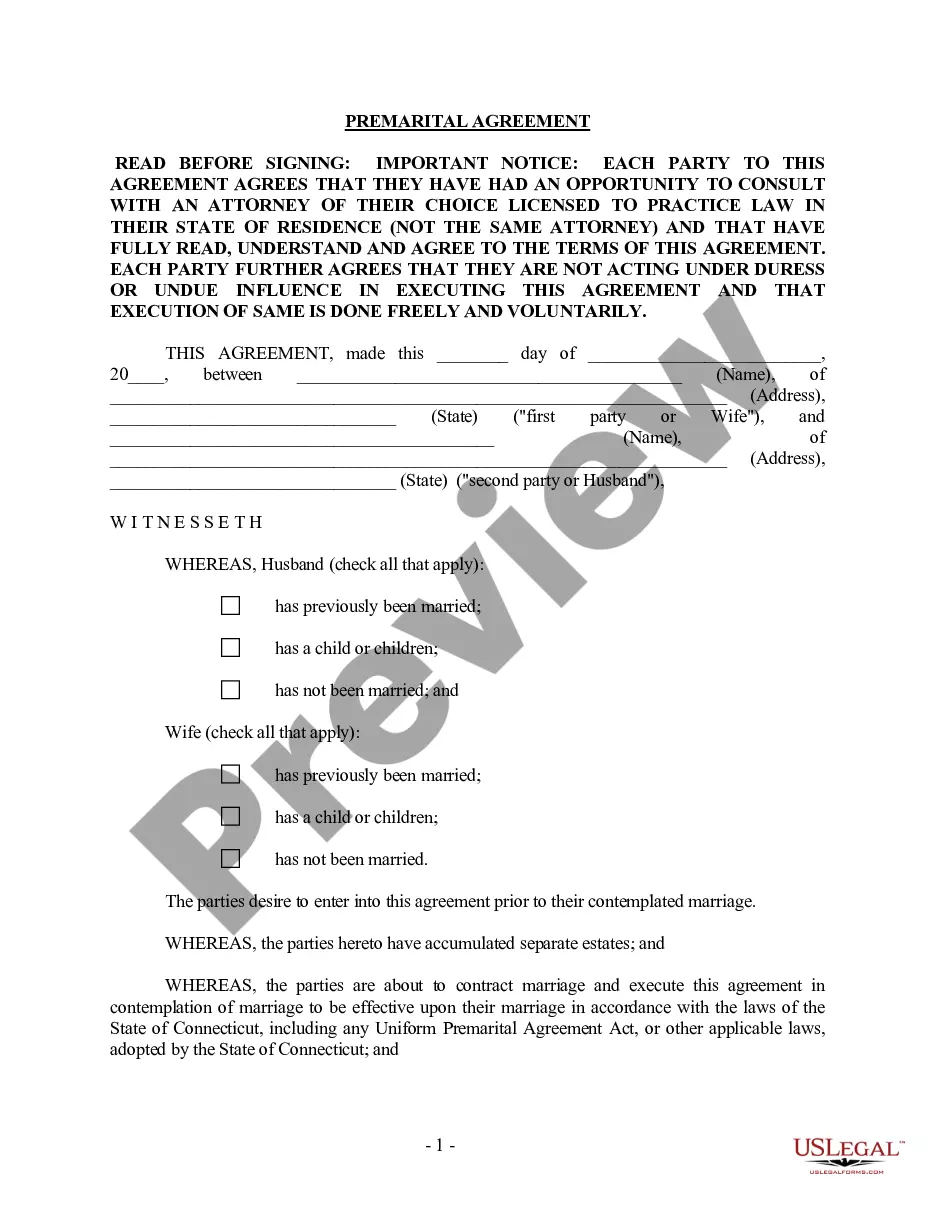

- The documents are categorized based on state and many can be previewed prior to downloading.

- To access templates, users are required to have a subscription and to Log In to their account.

- Click Download next to any template you desire and locate it in My documents.

- For individuals who lack a subscription, follow the guidelines below to easily find and download the Illinois Corrective Trustee’s Deed.

- Ensure you have the correct form for the respective state it is required in.

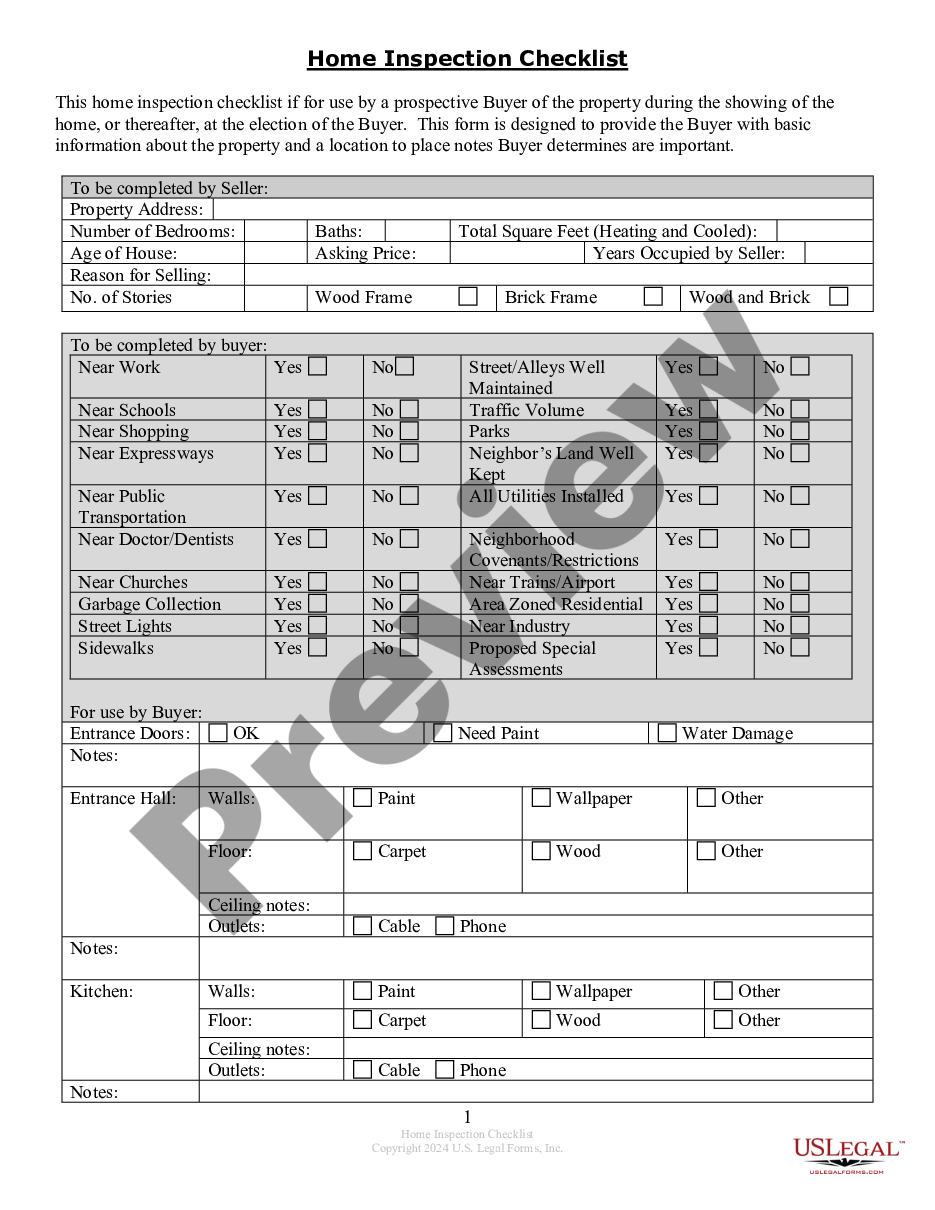

- Examine the form by reviewing the description and utilizing the Preview option.

Form popularity

FAQ

A Trustee's Deed Upon Sale, also known as a Trustee's Deed Under Sale or a Trustee's Deed is a deed of foreclosure. This deed is prepared after a property's foreclosure sale and recorded in the county were the property is located.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

Trust deeds can be a valuable aid to financial stability, but they are not right for everybody. They are best suited to people who have a regular income and can commit to regular payments.

The trustee is a neutral third-party who holds the legal title to a property until the borrower pays off the loan in full. They're called a trustee because they hold the property in trust for the lender.

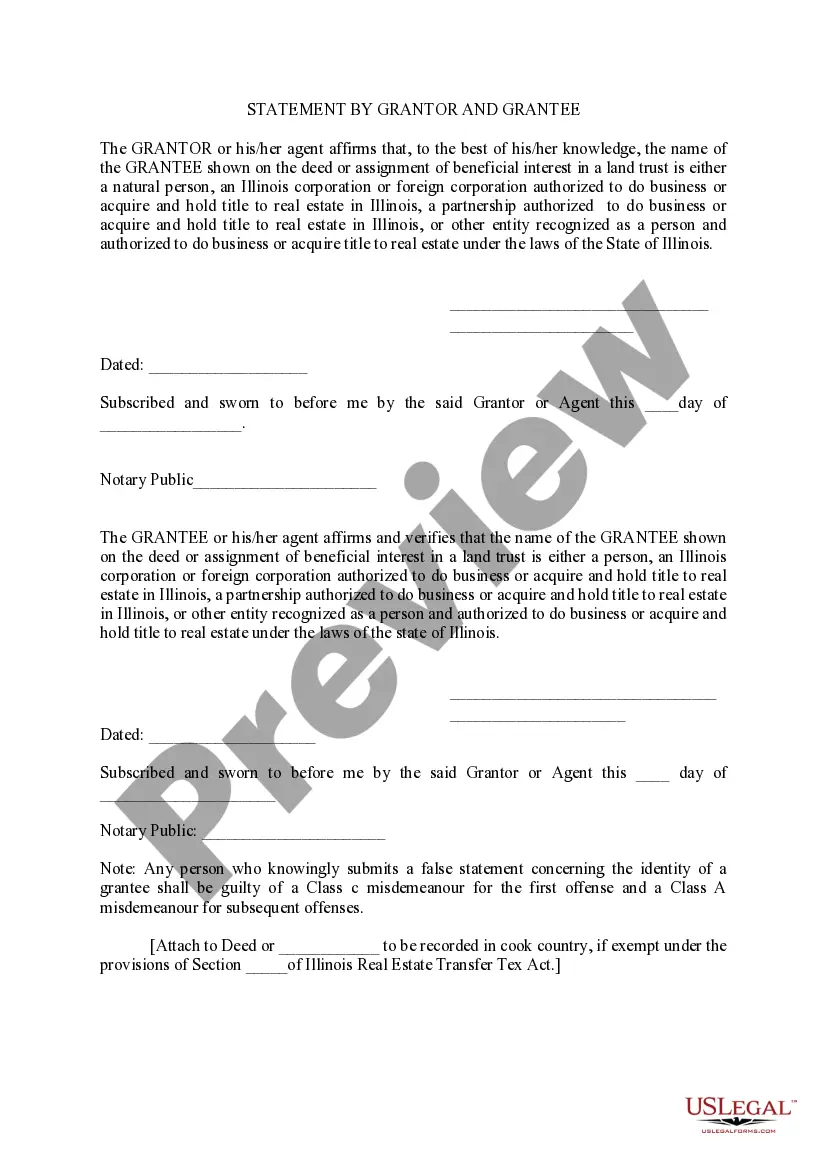

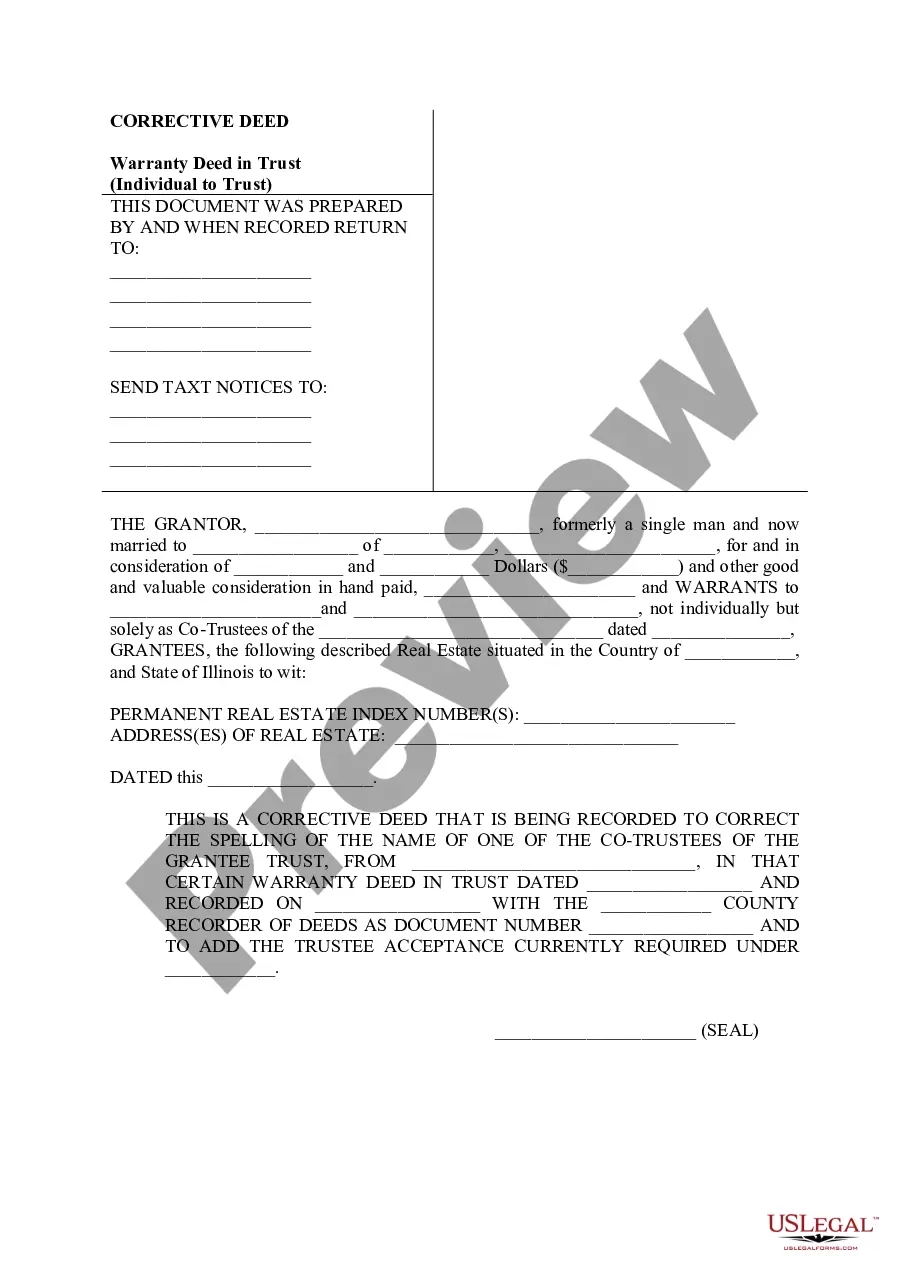

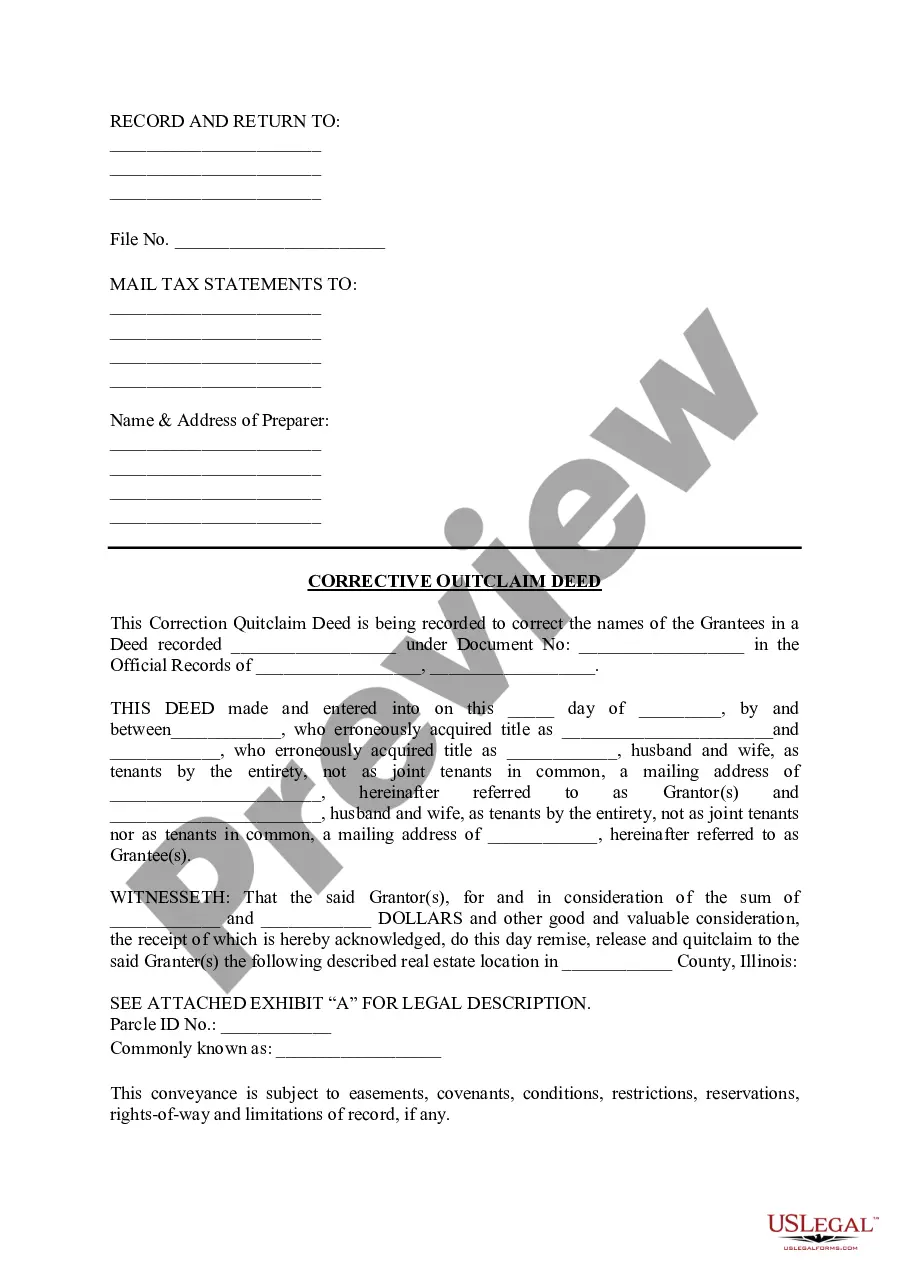

When correcting an error in a deed in Illinois, there are two basic options: 1) re-record the original deed with corrections made on the face of it by striking out the wrong item; or 2) record a correction or corrective deed.

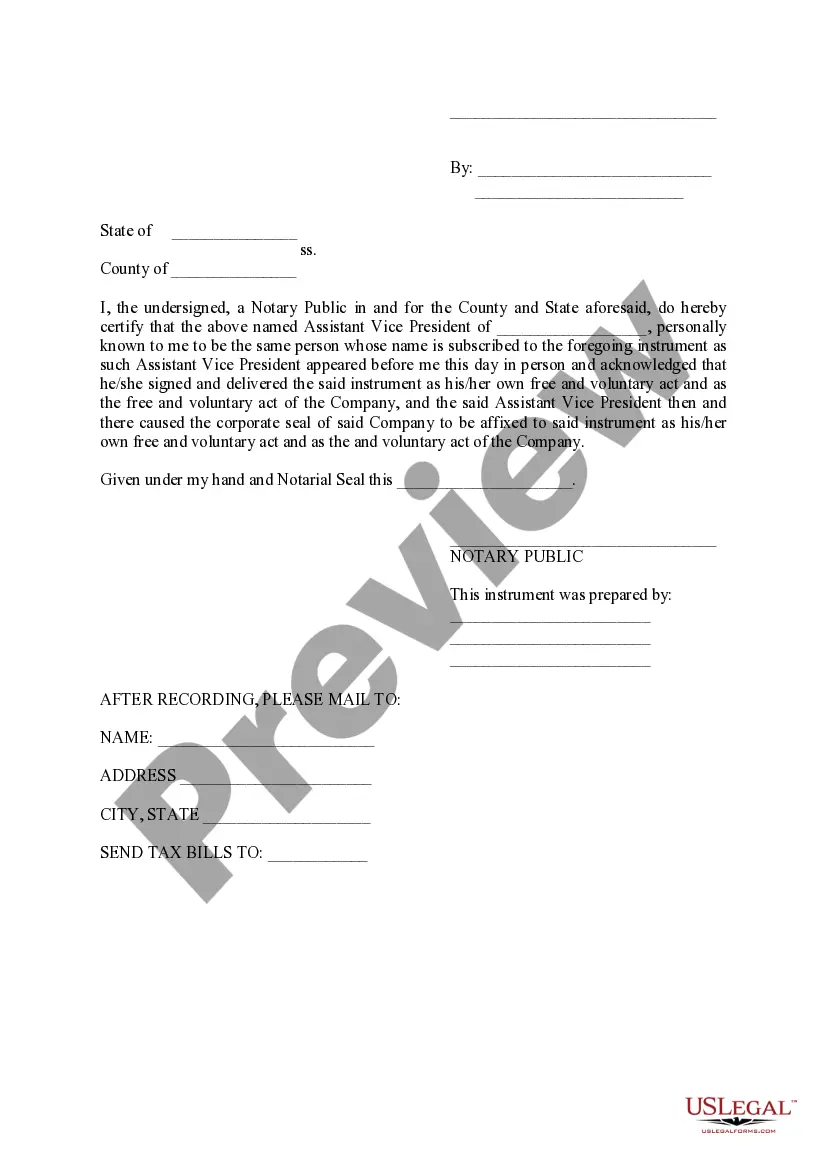

Determine if the error is harmless or fatal to the transfer of title. Decide what instrument is best suited to the error. Draft a corrective deed, affidavit, or new deed. Obtain the original signature(s) of the Grantor(s). Re-execute the deed with proper notarization and witnessing.

Like all deeds, these two legal documents are both used to transfer titles from one owner to another. A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Like all deeds, these two legal documents are both used to transfer titles from one owner to another. A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

If a deed is to have any validity, it must be made voluntarily.If FRAUD is committed by either the grantor or grantee, a deed can be declared invalid. For example, a deed that is a forgery is completely ineffective. The exercise of UNDUE INFLUENCE also ordinarily serves to invalidate a deed.