Illinois Assignment to Living Trust

What this document covers

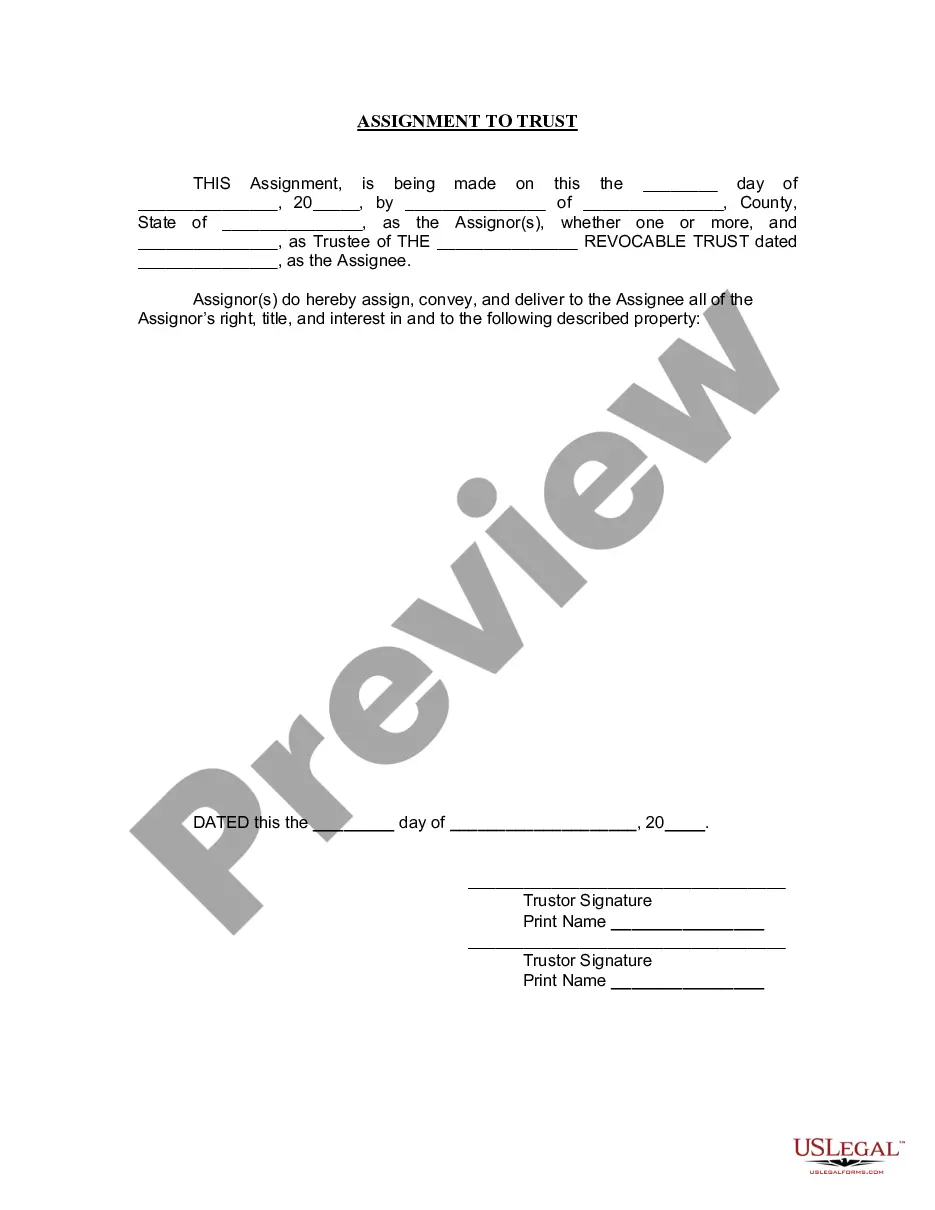

The Assignment to Living Trust form is a legal document used to transfer ownership of specific property to a living trust. A living trust is created during a person's lifetime to manage their assets and facilitate estate planning. This form is essential for ensuring that your property is properly assigned to your trust, which helps avoid probate and simplifies the distribution of assets after your passing.

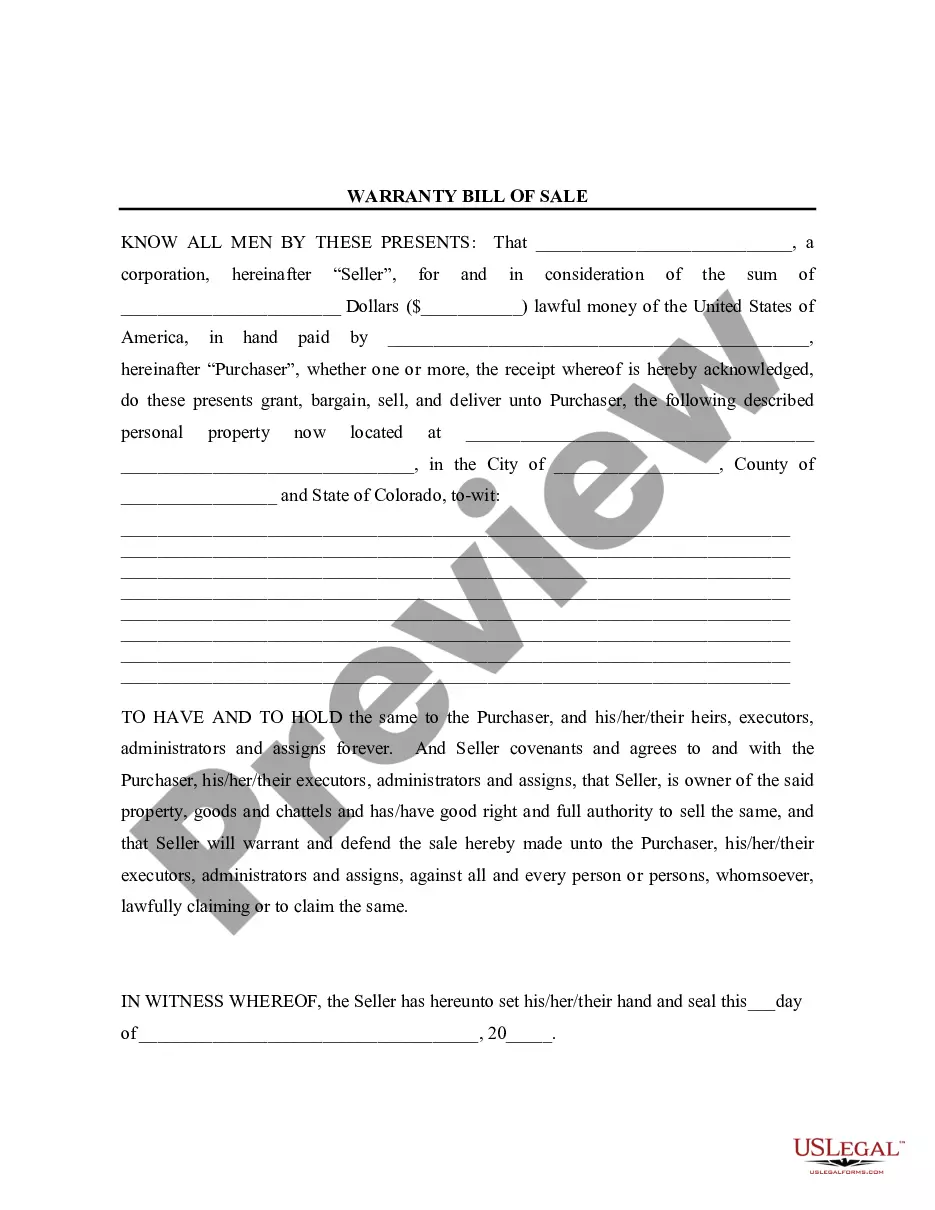

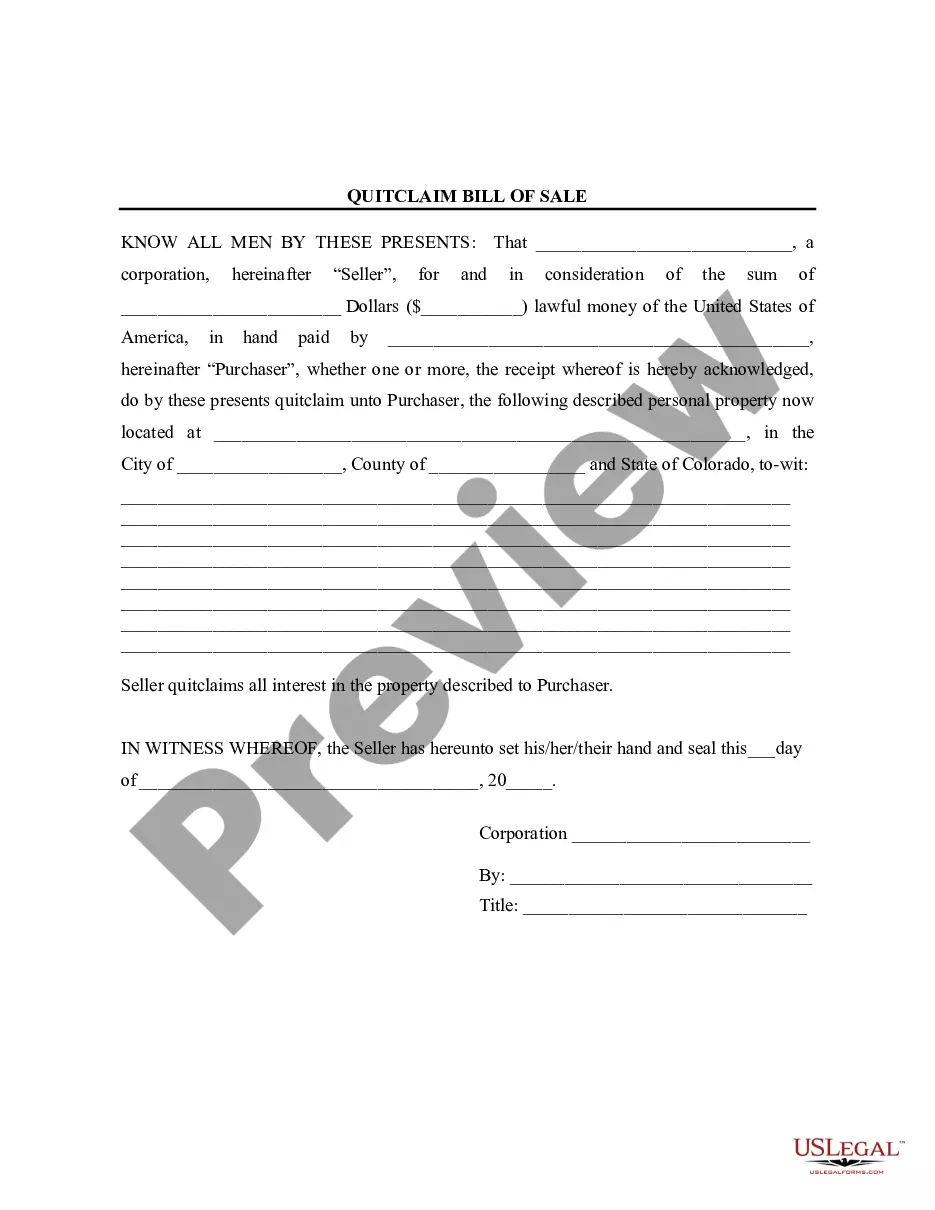

Form components explained

- Assignor's details: Name and address of the person transferring the property.

- Trustee's details: Name of the individual serving as the trustee of the living trust.

- Property description: A clear description of the property being transferred to the trust.

- Date of assignment: The date when the transfer is made.

- Notary section: Space for the notary public to verify the signatures.

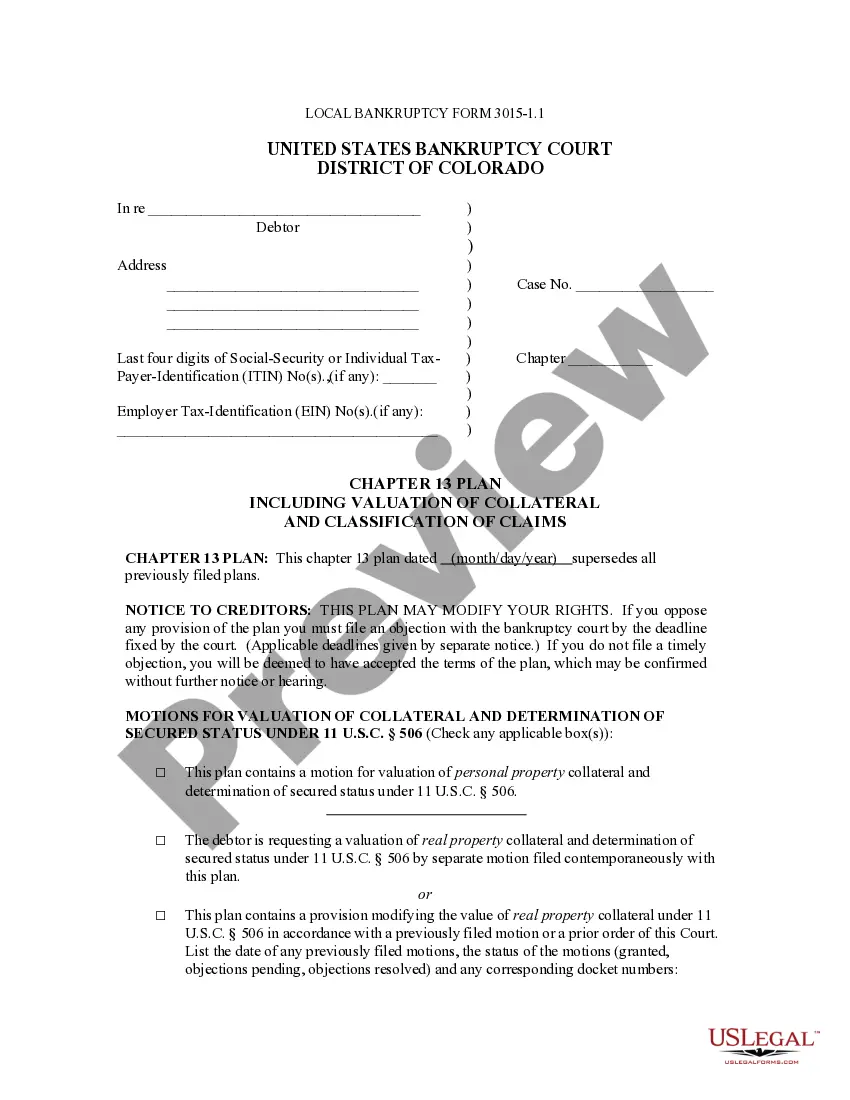

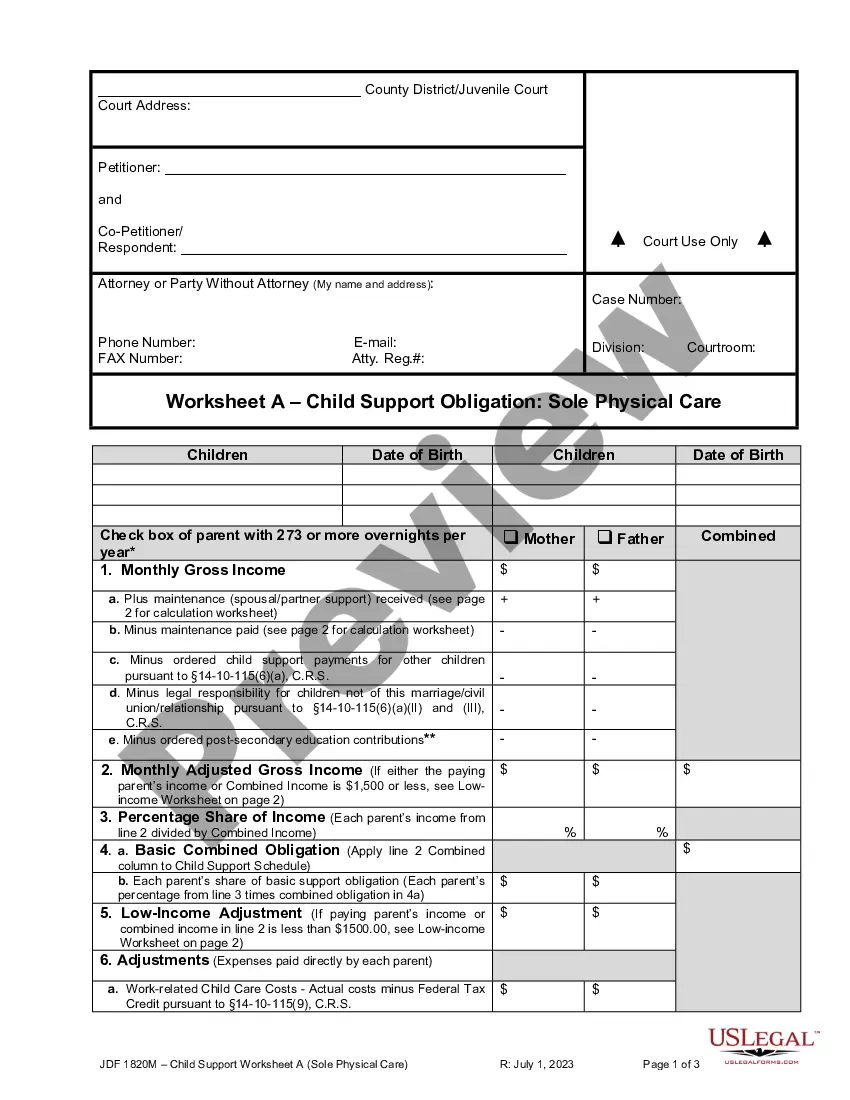

Situations where this form applies

This form should be used when you want to place specific assets into your living trust, thereby enabling more efficient management and distribution of your property. Scenarios for its use include assigning real estate, bank accounts, or other valuable assets to the trust as part of your estate planning process.

Who needs this form

- Individuals looking to establish a living trust for estate planning.

- Trustors who want to transfer specific property into their trust.

- Anyone who has assets that they wish to manage through a living trust.

How to complete this form

- Identify the parties: Enter the name and address of the Assignor and Trustee.

- Specify the property: Describe the specific property being transferred.

- Enter the date: Fill in the date when the assignment is made.

- Obtain signatures: Ensure both the Assignor and Trustee sign the document.

- Have the document notarized: Schedule an appointment with a notary public to validate the signatures.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide a clear description of the property being assigned.

- Not obtaining a notary signature, when required.

- Leaving sections blank or omitting signatures from the Assignor or Trustee.

Why complete this form online

- Convenience: Download it anytime, from anywhere.

- Editability: Fill in your specific details easily.

- Reliability: The forms are drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

Trust agreement. The legal document that sets up a trust. It is sometimes called a Declaration of Trust; however, the title on the document may simply read "The Jones Family Trust," or something similar. It sets forth the names of the grantor, the trustee, and the beneficiaries.

This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust. Having this information available will make it easier to prepare your trust distribution provisions.

Figure out which type of trust you need. Single people only have the option of a single trust. Take stock of your property. Pick a trustee. Create a trust document. Sign the trust document in the presence of a notary. Lastly, you'll need to fund your trust by moving your property into it.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Unlike a will, the contents of a living trust are not a matter of public record. Like most court records, probate files are open to the public.

A trust can be fairly easy to set up, so a lawyer is not always necessary. However, a person with a large or complex estate or a unique situation may want to consult with an estate planning attorney for help with setting up a trust.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.